da-kuk

While Zscaler (NASDAQ:ZS) offers a critical solution and has a reasonably strong competitive position, the company’s activity continues to slow. This is likely largely due to the demand environment, but competition in the SASE market is intensifying.

THE Last time I wrote about Zscaler I had suggested that its valuation was attractive, given its market leadership and financial profile. However, I felt that the company’s growth would likely have to level off before this became material. I continue to think that is the case, especially as the evidence points to a continued slowdown through 2024, which is unlikely to be well received by investors.

Market conditions

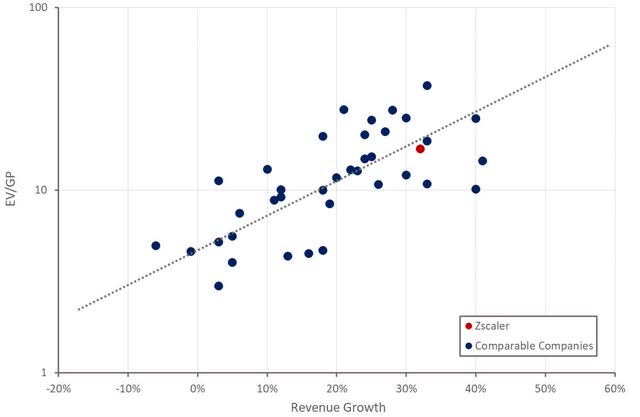

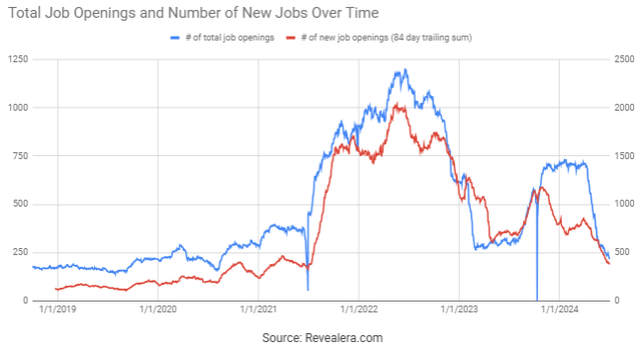

Despite a shift in investor focus, high interest rates and uncertainty continue to weigh on demand for most software companies. Zscaler does not expect This is likely to change in the short term. This is evident by the number of job postings that mention Zscaler in the job requirements, which remains at a fairly low level.

Figure 1: Job postings mentioning Zscaler in the job requirements (source: Revealera.com)

Although the macroeconomic environment is currently weak, Zscaler has a huge opportunity as the Zero Trust network security market is still nascent. Zscaler estimates that its core target customer group is only about 20% penetrated. The company also estimates that there is an upsell opportunity of at least 6x to existing customers.

Beyond that, Zscaler is expanding into adjacent markets, such as vulnerability management, security operations, and branch security. Recent acquisitions and product innovations have broadened Zscaler’s reach A $72 billion market opportunity of several billion dollars.

Longer term, competition is a much bigger concern than macroeconomic headwinds or market size. Zscaler is relatively well positioned, but competition has intensified significantly in recent years. It is unclear, however, whether this will have a significant impact at this point. Zscaler’s win rates remain very high, although the company is under some pricing pressure. Zscaler is trying to minimize the impact of this by focusing on selling value.

The federal government is currently an interesting battleground for SASE vendors. Palo Alto Networks (PANW) thought it was well positioned for several major federal government projects in early 2024, but those deals did not closewhich resulted in a significant miss during the quarter. Palo Alto has been working on the Thunderdome project for the past 1.5 to 2 years, trying to sell SASE to the federal government. Thunderdome refers to the Defense Information System Agency’s zero-trust network architecture. While this remains a big opportunity that Palo Alto is optimistic about, the company now believes it will happen over a period of time rather than all at once. Versa Networks has been selected by DISA to deliver SD-WAN, Zero Trust Access and Customer Edge Security Stack capabilities for Thunderdome.

Zscaler serves 12 of the 15 federal cabinet-level agencies and continues to pursue new upsell opportunities within the federal sector. The DoD is also implementing Zero Trust, with Zscaler signing a seven-figure ACV contract in the third quarter.

Zscaler Activity Updates

Zscaler’s sales organization is in the midst of a transition, including the addition of a new chief revenue officer, executive replacements, increased quota rep hiring, and a shift from opportunity-centric to account-centric selling. Attrition has also increased during this process, which is likely to create headwinds in the coming quarters.

Zscaler sees strong growth in SD-WAN and sees its Zero Trust approach as an advantage. SD-WAN expands the attack surface and allows threats to move laterally. Zscaler uses a direct-to-cloud architecture and avoids VPNs, eliminating these issues.

Zscaler is also extending the Zero Trust concept to the LAN with the acquisition of Airgap Networks. Zscaler will combine its Zero Trust SD-WAN with Airgap to extend the Zero Trust Exchange to east-west traffic across customer branches, campuses, and factories. This eliminates the need for legacy segmentation solutions for east-west traffic, such as firewalls.

Data protection is currently a major focus for Zscaler. The company has launched a range of products (DLP, CASB, endpoint, email) to support this approach. Zscaler also recently announced a Data Security Posture Management solution, which strengthens its cloud security offering. DSPM is used to assess the data environment and proactively reduce the risk of data loss. From a competitive perspective, there are companies that are approaching the cloud security market from a workload, DevOps, and network perspective, and I’m not sure which one is best positioned.

Zscaler also introduced GenAI App Security to provide granular visibility and controls for GenAI applications. GenAI App Security offers:

- Visibility into AI services used by employees

- Policy control, which allows granular control over user access to AI services

- Enforcing data protection policies to prevent leakage of sensitive information

Zscaler recently acquired Avalor to support its AI ambitions by breaking down data silos. Avalor’s Data Fabric aggregates data from across the enterprise to identify and prioritize vulnerabilities based on a holistic risk assessment.

Financial analysis

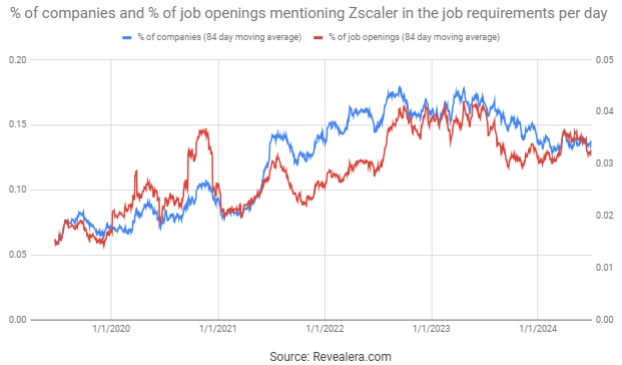

Zscaler generated revenue of $553 million in the third quarter, a 32% increase year-over-year, while billings increased 30% to $628 million.

Zscaler expects fourth-quarter revenue of $565 million to $567 million, representing 24% to 25% growth from the prior year. It should be noted that the fourth quarter of fiscal 2023 included a $20 million contract, which created a challenging comparable period from a billing perspective. Attrition is also expected to impact the fourth quarter.

I expect revenue growth of around 28% year-over-year in the fourth quarter, but that may not be enough to satisfy investors. With growth below 30% and continued deceleration quite rapidly, Zscaler may struggle to maintain its current revenue multiple.

Figure 2: Zscaler Revenue Growth (source: Created by the author from Zscaler data)

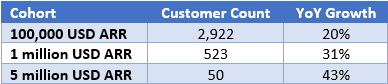

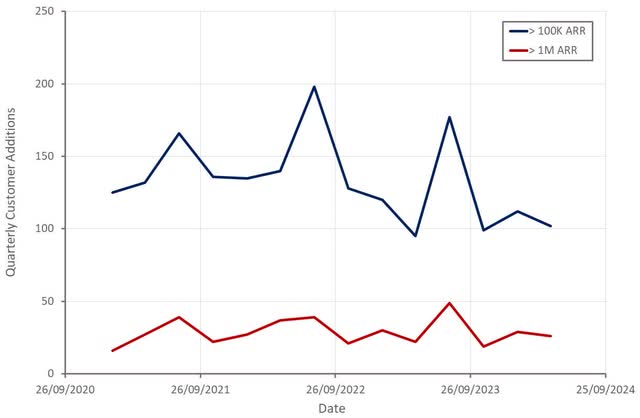

Growth continues to be driven by larger customers, which is not surprising given Zscaler’s focus on this segment. The number of new customers remains well below the 2022 peak, highlighting the challenging demand environment in which Zscaler operates.

Zscaler’s trailing 12-month net dollar retention rate was 116% in the third quarter. While that figure may be considered low, it reflects Zscaler’s business, where it tends to grow over time rather than at the expense of small business growth.

Table 1: Zscaler Customers (source: Created by the author from Zscaler data) Figure 3: Zscaler Quarterly Customer Additions (source: Created by the author from Zscaler data)

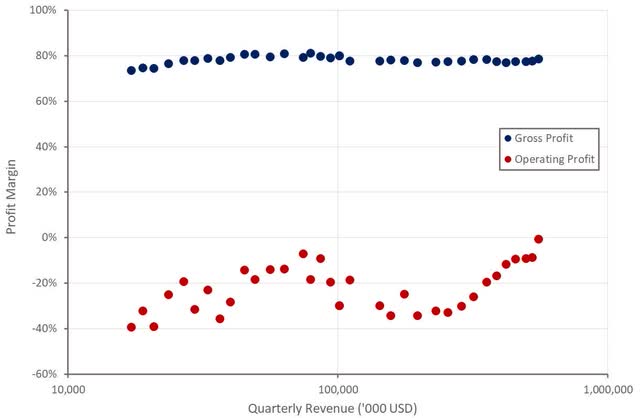

Zscaler’s gross margins expanded in the third quarter, driven in part by the longer useful life of its cloud infrastructure. Zscaler’s operating margin also expanded significantly, driven in large part by a relatively modest increase in sales and marketing spending in recent quarters. Recent hiring, however, could put pressure on margins in the coming quarters, especially if growth continues to slow.

Figure 4: Zscaler Profit Margins (source: Created by the author from Zscaler data)

After a surge in hiring in late 2023 and early 2024, Zscaler’s job postings have been rapidly declining in recent weeks. I tend to view these types of changes in job postings as a sign of an unexpected deterioration in business.

Figure 5: Job openings at Zscaler (source: Revealera.com)

Conclusion

There are several signs that Zscaler’s growth will continue to slow in the coming quarters, putting pressure on the company’s stock price. While Zscaler remains a market leader, the company faces pricing pressure, and go-to-market changes could suggest that competition is also becoming an issue. This must be balanced against the fact that Zscaler is a leader in a large and growing market. Generative AI is also likely a long-term tailwind, even if it is currently putting pressure on IT spending in other areas.

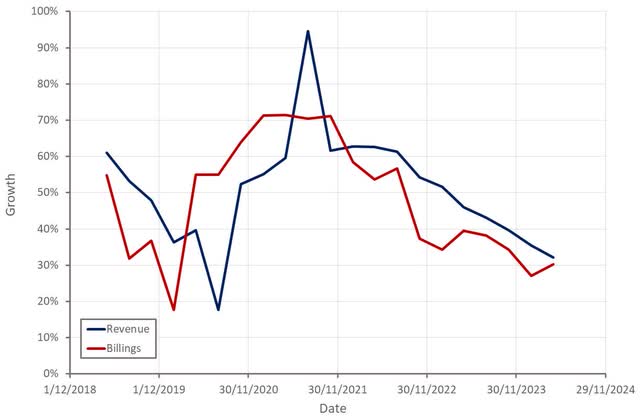

Demand headwinds and a changing competitive landscape mean that volatility is likely to be elevated in the near term. However, Zscaler is very likely to outperform the market over a longer period, given its growth prospects and current valuation. Zscaler trades at an earnings multiple of around 55x using a mature normalized profit margin, a low number for a company that is expected to grow at a CAGR of around 20% over the next decade.

Figure 6: Zscaler Relative Evaluation (source: Created by the author from data from Seeking Alpha)