filo

WP Carey Inc. (NYSE:WPC) is a leading net lease REIT that continues to represent great value for passive income investors eager to capture recurring dividend income, but also has an eye on capital appreciation potential.

The net lease commercial real estate investment trust recently sold its office portfolio to shareholders and has, in my opinion, a good chance of returning funds from growing its operations in 2025.

While short-term interest rates could also be reduced, debt-financed acquisitions in the trust’s core business of industrial and warehouse real estate could make a difference and allow WP Carey to regain growth.

My grade history

A few months ago I wrote an article about WP Carey with the title WP Carey: Don’t hold grudges, buy the dip and enjoy a 6% return In for which I presented an investment case for the commercial real estate investment trust as its portfolio reorganization continued.

Looking ahead, I see a net lease trust that is poised to increase its adjusted funds from operations. With a clearer strategic outlook and cash from its rental business continuing to flow in, I think WP Carey may soon return its focus to increasing its cash flow through acquisitions.

WP Carey: portfolio reorganization and return to growth

WP Carey partially sold and partially spun off its office properties after the real estate investment trust surprised investors in September last year with its desire to change the composition of its portfolio.

Due to well-documented problems in the office sector, WP Carey presented a new vision for the net lease trust by returning to its industrial real estate foundations.

As of March 31, 2024, WP Carey owned a total of 1,282 real estate properties, including 168.4 million square feet. This real estate position is poised to generate $1.28 billion in annualized sales for WP Carey in 2024. The future should prove brighter for the trust, however, as WP Carey uses its cash flow (and rates of potentially lower interest) to go on the offensive. .

Large diversified portfolio (WP Carey)

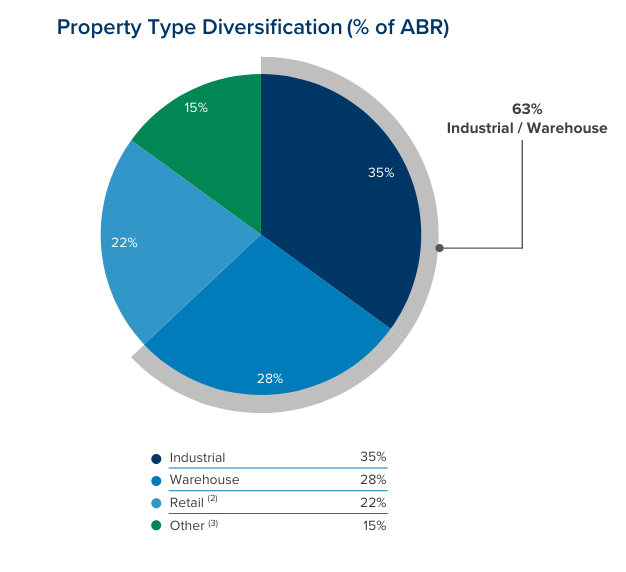

WP Carey is now, following the spin-off and sale of its office properties (of which the trust retains a small percentage, but is set to divest in 2Q24), primarily focused on industrial properties, warehouses and retail.

The trust said it expects to complete its proposed office sale in the first half of the year and expects to raise between $550 million and $600 million from the sales.

Diversification of property types (WP Carey)

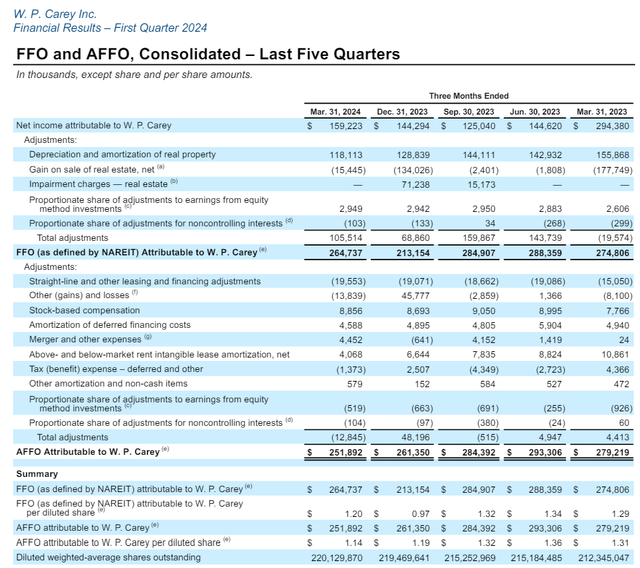

Going forward, WP Carey is, in my opinion, an interesting play for growth through acquisition. The real estate investment trust produced $251.9 million in adjusted funds from operations in 1Q24, down 10%. Year. The decrease in AFFO is due to the sale of offices by WP Carey and the transfer of office buildings to NLOP.

A catalyst for further acquisitions could come from falling interest rates. As the central bank begins to lower short-term interest rates, debt-financed acquisitions would become more affordable and allow REITs like WP Carey to leverage their existing FFO strength.

AFFO (WP Carey)

The payout ratio allows for sustained dividend growth

WP Carey set its dividend at $0.865 per share in 1Q24 and this was the first quarter the net lease real estate investment trust increased its dividend (up from $0.86 per share in the previous quarter) after the trust finalized most of its office transactions. The first quarter dividend increase sends a strong signal to passive investors that WP Carey will revive its history of dividend growth going forward.

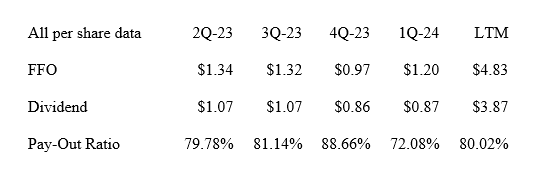

In the first quarter, WP Carey earned $1.20 per share in funds from operations, which brought the dividend payout ratio to just 72%, down from 89% in 4Q23. Over the past twelve months, WP Carey has paid out 80% of its funds from operations, but the trust’s payout metrics are poised to improve in the coming quarters as WP Carey realigned its dividend with its lower AFFO potential.

From a dividend safety perspective, I think the low payout ratio of 72% plus the fact that WP Carey has started increasing its quarterly dividend again makes an investment in the trust’s stock reasonably safe.

Dividend (Table created by author using trusted information)

Moderate AFFO Multiple

WP Carey reaffirmed its 2024 guidance of $4.65 to $4.75 per share in 1Q24 adjusted funds from operations, which equates to an AFFO multiple of 12.0x. The forecast reflects the expectation that the net lease trust will spend between $1.5 billion and $2.0 billion on acquisitions this year, while forecasting divestiture volume of between $1.2 billion and $1.4 billion. Net acquisition volume of up to $800 million could be a catalyst for AFFO growth.

With a possible path to AFFO growth, I think WP Carey could rerate to a 14-15x AFFO multiple (implied intrinsic value between $65 and $70) that the trust had easily achieved prior to the AFFO announcement. office exit.

Real estate income company (Oh)which focuses primarily on commercial properties, but also has some industrial exposure, currently sells at an adjusted funds from operations multiple of 12.8x.

Why WP Carey Could See a Lower Valuation Multiple

WP Carey, as I mentioned, is increasing its dividend payout again, which I think will attract more passive income investors to the stock. There are, however, a number of ways WP Carey could make mistakes, including failing to grow its funds from operations through organic means (increasing rental income) or through acquisitions.

Higher interest rates for a longer period of time could also delay WP Carey’s ability to use credit to stem acquisitions to drive growth in its AFFO.

My conclusion

WP Carey is going through a transition period, but the net lease commercial real estate trust is poised to see its AFFO stabilize after office deals and the dividend payout ratio has also improved.

Additionally, the dividend has started to grow again and the trust is focused on completing a limited number of AFFO-boosting real estate transactions that could help investors conceptualize WP Carey as a growing real estate investment trust with potential attractive and acquisition-driven AFFO hike.

I think WP Carey’s valuation multiple has decompression potential if it announces more acquisitions and promotes AFFO growth. Although 2024 is a transition year for WP Carey, the dividend is not at risk as far as I know and growth will resume soon, in my opinion.

My belief in WPC is so high that I made this trust my second largest REIT investment in my passive income portfolio.