The day President Biden announced the repurposing of the site that was to belong to Foxconn, I am reprinting this 2017 review.

Of Legislative Tax Officethe memorandum of understanding between Wisconsin and Foxconn states:

… Foxconn commits to investing $10 billion to build a factory in Wisconsin over six years and create up to 13,000 jobs, with a reported average salary of $53,875 over a period of up to six years. The state’s agreement, under the memorandum of understanding, among other things, is to provide up to $3 billion in an economic package that would include refundable tax credits and a corporate tax holiday. construction sales for Foxconn.

What is the calculation of benefits and costs to state taxpayers? To undertake the analysis, a set of hypotheses would need to be formulated; these included:

- The project will require the average annual employment of approximately 10,200 construction workers and equipment suppliers earning an average total compensation of approximately $59,600 (including benefits) per year during the four-year construction period (from 2018 to 2021). The total income of these people is estimated at $2.4 billion.

- Nearly 6,000 indirect and induced jobs will be created during the construction period, for an average total compensation of $48,900.

- Additional jobs during the construction period would generate an increase in state tax revenue (primarily income and sales taxes) equal to approximately 6.3 percent of additional gross wages. The total state tax increase associated with the construction period is estimated at $186.9 million.

- Foxconn’s permanent factory staff is estimated to increase from around 1,000 in the second half of 2017 to 13,000 starting in calendar year 2021. The average annual salary of these employees is estimated at $53,875… Mass The company’s total salary is expected to be $13.8. million for the rest of this year and increase to around $700 million per year starting in 2021.

- All employees are Wisconsin taxpayers (i.e., no Illinois residents).

- State tax revenue associated with additional employees and wages is estimated to increase from about $900,000 this year to $44 million annually starting in 2021.

- Indirect and induced jobs associated with the project are estimated at 22,000 from 2021, based on a multiplier of 2.7. The average annual salary for these people is estimated at around $51,000.

- Total permanent salaries are $1.12 billion per year and associated state taxes are $71 million per year. Lower impacts are estimated for calendar years 2017 to 2020.

The conclusion:

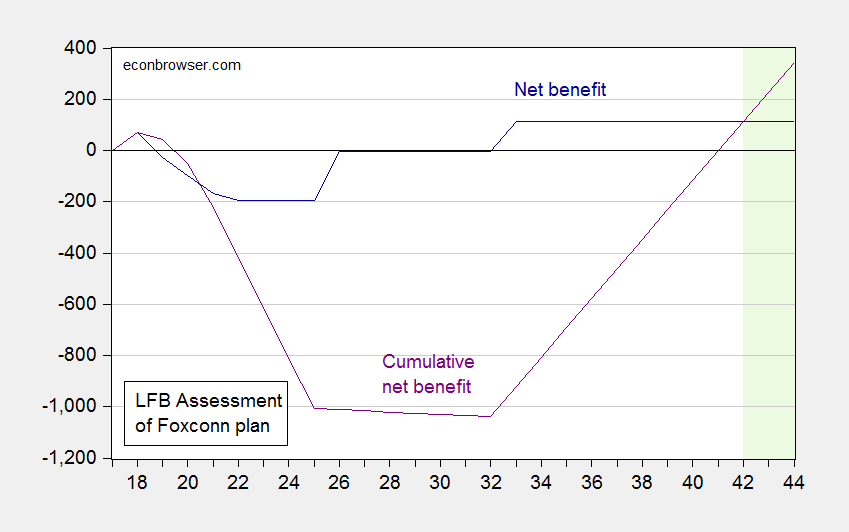

(Wisconsin Department of Administration) projects that the cost of the state’s refundable tax credits under the bill will exceed the potential increase in tax revenue until the final payroll credit of the ‘EITM be paid during the 2032-33 financial year. At the end of this year, the cumulative net cost of the incentive program is estimated at $1.04 billion. Starting in 2033-34, payments to the company would cease and the increase in state tax revenue is estimated at $115 million per year. The DOA estimates that the project would break even during the financial year 2042-43.

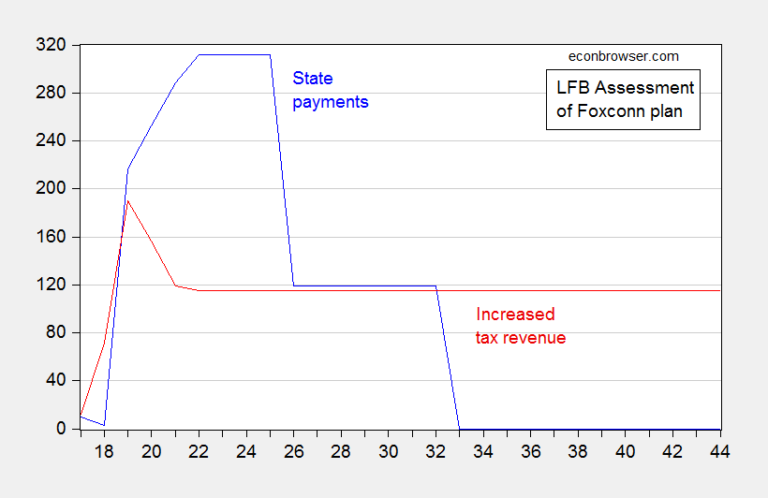

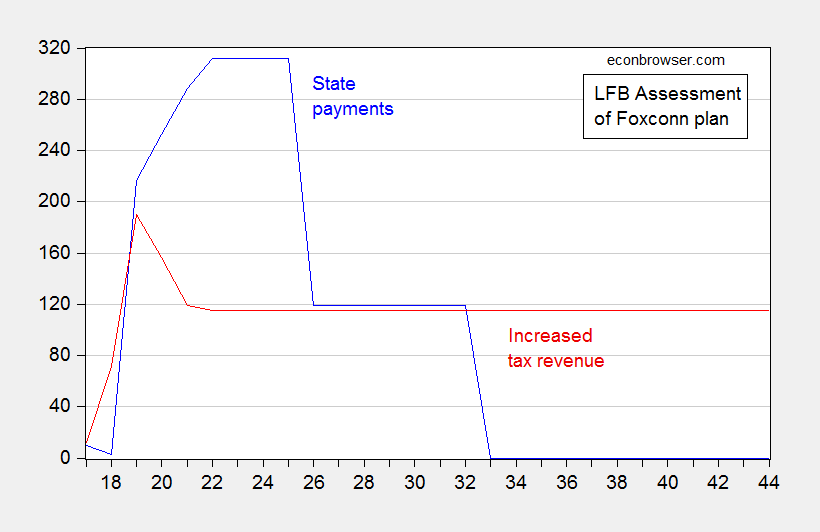

In Figures 1 and 2 below, I summarize state payments and revenue increases, respectively, as well as the flow and accumulation of net benefits. The more astute will note that state payments are concentrated in the first 15 years (after which Foxconn could withdraw), and that even under the fairly optimistic assumption of 13,000 additional jobs, financial equilibrium occurs over the course of some exercice. 2042-43.

Figure 1: State payments (blue) and increased tax revenue (red) under Bill 1 of the August 2017 Special Assembly, in millions of dollars, by fiscal year (2018 indicates fiscal year 2018-19 ). Source: Legislative Tax OfficeTable 4.

Figure 2: Net benefits calculated as increased tax revenue less state payments under August 2017 Special Assembly Bill 1 (dark blue) and cumulative (purple), in millions of dollars, per fiscal year financial year (2018 indicates financial year 2018-19). Source: Legislative Tax OfficeTable 4.

As we have indicated, there is great uncertainty about the increase in employment. The LFB quietly observes:

Some news reports suggest employment at the proposed facility would be closer to 3,000 instead of 13,000 permanent positions. If this were the case, using the other assumptions described above, EITM payroll tax credit payments would be reduced from just under $1.5 billion to approximately $345 million over the 15-year life of the EITM zone, but the capital expenditure credit would still be estimated at $1.35 billion. The project’s estimated ongoing tax benefits would decline from $115 million to $27 million per year, and the break-even point would be well beyond 2044-45.

The serious question arises as to whether Foxconn will respect its commitments. Hiltzik at the LA Times points to the 2013 agreement in Pennsylvania.

Foxconn itself has a reputation for making lavish promises and then dropping them, as appears to have been the case with a project the company touted for Harrisburg, Pennsylvania, in 2013. That deal was for a 30 million dollars employing 500 workers. But the factory did not materialize.

And of Wisconsin Gazette:

Amid all the jubilation and hype, it’s important to remember that Foxconn has earned a reputation for failing to deliver on its commitments. Business publication Crain’s warns: “Foxconn Technology Group…has a history of big promises with little or no results in the United States.” »

Foxconn abandoned commitments it made in Harrisburg, Pennsylvania, where CEO Terry Gou promised his small 50-person company would expand to a 500-worker manufacturing plant. His announcement generated “intense buzz” that was “created by a chief executive known for promising projects around the world that never really came to fruition,” the Washington Post reported.

Foxconn’s promises of new or increased investments have also been broken in Brazil, China, India, Indonesia and Vietnam.

“There is a trend here,” observed Alberto Moel, senior analyst at Bernstein Research in Hong Kong.

Bloomberg News noted that Foxconn’s total commitments now stand at $27.5 billion, more than Hon Hai has spent over the past 23 years.

The fact that this business does not appear to be a big benefit to Wisconsin seems consistent with the literature that state tax incentives for business relocation generally do not yield big profits. According to a survey conducted by Bus (2001):

The tax literature, now numbering hundreds of publications, provides little guidance to policymakers trying to fine-tune economic development. Taxes should be important to states, but researchers can’t say with certainty how, when and where. Businesses may need tax incentives to increase their viability in certain locations, but researchers cannot say with certainty which businesses or which locations.

Perhaps more relevant for this specific case:

… Declining firms tended to benefit from programs targeted to distressed areas, while growing firms tended to locate in non-distressed countries. Tax incentives made distressed areas worse or no better, while non-distressed areas always got better.

Summary of a roughly contemporary analysis of Noah Williamsformerly of UW Madison.

In this article, I assess the potential economic impact of the Foxconn factory on Wisconsin’s economy. I consider factors affecting both the direct impact of the Foxconn factory, as well as additional, broader impacts it could have. If implemented as planned, the direct impact of the plant will be substantial and the broader impacts could go well beyond traditional fiscal policies. In particular, the opening of a large-scale high-tech manufacturing plant by a multinational company has the potential to generate significant spinoffs. Drawing on the economic literature on factory openings and foreign direct investment, I analyze the magnitude of these potential gains. While direct employment multipliers in the literature vary from 1.7 to over 3, the most relevant in this case are in the range 2.5 to 3.0. So if Foxconn represents 13,000 direct jobs, it could generate a total of 32,000 to 39,000 jobs directly and through its supply chain, employee suppliers, spinoffs to existing businesses, and new investments. I also review the economic evaluations that have been previously completed and assess some of the concerns that have been raised about the proposal. In the overall assessment of the Foxconn program, the uncertain but potentially significant gains in jobs, wages, production and income must be weighed against certain fiscal costs.