Stefano Spica

The data in the article below comes from Lipper’s Global Fund Flows app. GFF can be found on LSEG Workspace (“FundFlows”).

During LSEG Lipper’s fund flow week ending May 1, 2024, investors were overall net buyers of funds. assets (including conventional funds and ETFs) for the second consecutive week, adding a net $22.0 billion.

Last week, money market funds (+$26.2 billion), municipal bond funds (+$515 million) and commodities funds (+$214 million) saw inflows.

Equity funds (-$4.2 billion), mixed asset funds (-$444 million), taxable bond funds (-$253 million) and alternative investment funds (- 20 million dollars) suffered capital outflows.

After recording their third largest weekly outflow on record (-$118.5 billion), money markets have recorded consecutive weeks of inflows.

Actively managed stocks (-$4.4 billion) saw capital outflows for the sixth consecutive week, while passive equity funds (+$216 million) attracted new capital in nine of the the last 10 weeks. Actively managed fixed income funds (+$2.6 billion) recorded their sixteenth weekly entry over the past 18 weeks, while passive fixed income funds (-$2.4 billion) saw losses. releases in two of the last three weeks.

Spot Bitcoin ETFs reported their first weekly outflow as a group, ending a streak of 15 consecutive entries since their launch.

Index performance

As the LSEG Lipper Fund Flows Week closed, US stock indices reported negative returns for the fourth week out of five: DJIA (-1.45%), Nasdaq (-0.68%), Russell 2000 (-0.76%), and the S&P 500 (-1.05%) were all in the red.

The FTSE US Broad Investment Grade Bond Total Return Index (+0.17%) and the FTSE High Yield Market Total Return Index (+0.05%) recorded gains for the week. The FTSE US Municipal Tax-Exempt Investment Grade Bond Index suffered its seventh consecutive weekly loss.

Foreign broad indices delivered mixed returns: the FTSE 100 (+1.49%) and the Shanghai Composite (+2.06%) recorded positive returns, while the Dax (-0.91%), the Nikkei 225 (-2.15%) and the S&P/TSX Composite (-1.04%) recorded losses.

Prices/Yields

The two-year Treasury yield (+0.67%) increased, while the 10-year Treasury yield (-0.26%) fell during the week. At the close of trading on Wednesday, the yield spread of 10 to 2 reversed slightly from last week.

According to Freddie Mac, the 30-year fixed rate average (FRM) increased for the fifth consecutive week, with the weekly average currently at 7.22%, the highest level since November. The US dollar index (DXY-0.10%) and the VIX (-3.77%) decreased during the week.

The CME FedWatch tool estimates that the Federal Reserve should cut interest rates by 25 basis points (BPS) to 14.2%. This tool predicted a month ago a possible reduction of 25 basis points of 62.5%. The next meeting is scheduled for June 12, 2024.

Exchange Traded Equity Funds

Exchange-traded equity funds recorded a weekly inflow of $912 million, the ninth inflow in the past 10 weeks. The macro group recorded a loss of 0.97% over the week, the fourth negative return in five weeks.

Large-Cap ETFs (+$2.3 billion), Multi-Cap ETFs (+$904 million) and International Developed Markets ETFs (+$771 million) were the largest groups of investors. Equity ETFs to record inflows. Large-cap ETFs saw their eighth inflow in 10 weeks, led by the Lipper Large-Cap Growth classification (+$1.4 billion).

Equity sector ETFs (-$1.9 billion), small-cap ETFs (-$1.3 billion) and mid-cap ETFs (-$334 million) suffered the largest weekly outflows within equity ETFs. Healthcare/Biotech ETFs (-$724 million) and Consumer Services ETFs (-$684 million) led the sector’s stocks to experience their second weekly outing in three.

During the last week of fund flows, the top two attractors of equity ETF flows were the iShares Core S&P 500 ETF (IVV+$1.7 billion) and Invesco QQQ Trust Series 1 (QQQ+$928 million).

Meanwhile, the two worst-performing stock ETFs in terms of weekly outflows were the SPDR S&P 500 ETF Trust (TO SPY-$1.4 billion) and iShares Russell 2000 ETF (IWM-$1.0 billion).

Exchange Traded Fixed Income Funds

Exchange-traded taxable fixed income funds saw a weekly outflow of $2.1 billion – the macro group’s second outflow in three weeks. Fixed income ETFs saw a loss of 0.41% on average, the fifth weekly loss out of seven.

State and Treasury Short/Mid ETFs (-$2.6 billion), Alternative Bond ETFs (-$908 million), and Nationally Taxable Fixed Income ETFs (-$365 million dollars) were the largest subgroup of taxable fixed income ETFs to experience outflows during the week. Short/Mid Government and Treasury ETFs saw their first outflow in four weeks as they suffered the largest outflow since the week ended January 31, 2024.

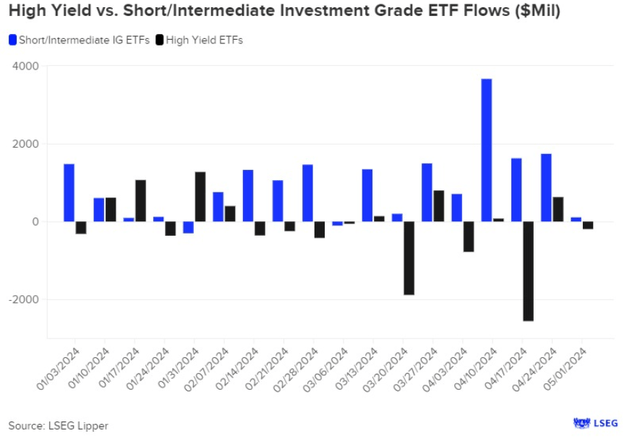

Government and Treasury ETFs (+$2.0 billion), short/mid-tier investment grade ETFs (+$108 million), and global income ETFs (+$51 million) were the largest subgroups of taxable bond ETFs to observe inflows. Government and Treasury ETFs recorded their sixth inflow in the past seven weeks, led by US Mortgage ETFs (+$2.0 billion) which celebrated their largest weekly inflow since October 2022. After an influx weekly record three weeks ago, short/intermediate investment grade ETFs achieve their eighth consecutive week of net new capital.

Municipal bond ETFs reported an inflow of $89 million during the week, marking the group’s third weekly inflow of four. Municipal bond ETFs experienced their sixth weekly loss (-0.04%) in seven weeks.

iShares MBS ETF (MBB+$1.4 billion) and iShares 20+ Year Treasury Bond ETF (TLT+$645 million) attracted the largest amounts of weekly net new capital in fixed income ETFs.

On the other hand, the SPDR Portfolio Short Term Treasury ETF (TSPS-$1.2 billion) and iShares iBoxx $Investment Grade Corporate Bond ETF (LQD-824 million dollars) suffered the largest weekly outflows.

Conventional Equity Funds

Conventional equity funds (ex-ETFs) experienced weekly outflows (-$5.1 billion) for the one hundred and sixteenth consecutive week. Conventional stock funds posted a negative weekly return of 0.92%, the fourth week of losses in five.

Multi-cap funds (-$1.3 billion), small-cap funds (-$671 million) and large-cap funds (-$657 million) were the largest subgroups of funds conventional actions to carry out weekly outings. Conventional multi-cap mutual funds recorded their sixth consecutive week of outflows, led by core multi-cap funds (-$681 million).

No subgroup of conventional equity mutual funds saw inflows for the week.

Conventional Fixed Income Funds

Conventional taxable fixed income funds had a weekly inflow of $1.8 billion, the first inflow in four weeks. The macro group recorded a gain of 0.16% on average, its second consecutive week of appreciation.

Domestic taxable general fixed income funds (+$753 million), short/mid-tier investment grade funds (+$704 million) and high yield funds (+$256 million) were the largest groups of Taxable fixed income mutual funds to record inflows during the week. . The country’s taxable general fixed income funds were dominated by Lipper’s Loan Participation funds (+$268 million) and multi-sector income funds (+$256 million). Domestic taxable general fixed income funds have reported 18 inflows over the past 19 weeks.

Government and Treasury Funds (-$112 million) and Government and Treasury Funds Short/Mid (-$77 million) were the only two subgroups of taxable fixed income mutual funds to display weekly net outflows. Government and Treasury funds have seen four consecutive weekly outflows.

Conventional municipal bond funds (ex-ETFs) returned a negative 0.10% during the fund flow week, giving the subgroup its sixth loss in seven weeks. Tax-exempt fixed income mutual funds saw an inflow of $426 million, marking the first influx in the last four weeks.

*The Lipper weekly fund flow period runs from the previous Thursday to Wednesday.

Editor’s Note: The summary bullet points in this article were chosen by the Seeking Alpha editors.