Jacek_Sopotnicki

Discovery of Warner Brothers (NASDAQ:WBD) released first quarter results last week. The media giant has been under scrutiny for its profits and high leverage since its merger. In February, I took a bullish stance on Warner Brothers Discovery through the sale of puts guaranteed in cash. Although the first quarter earnings report disappointed due to the lack of revenue and earnings estimates, I believe there are current and upcoming catalysts to remain bullish on WBD stock.

Warner Brothers Discovery Earnings Results

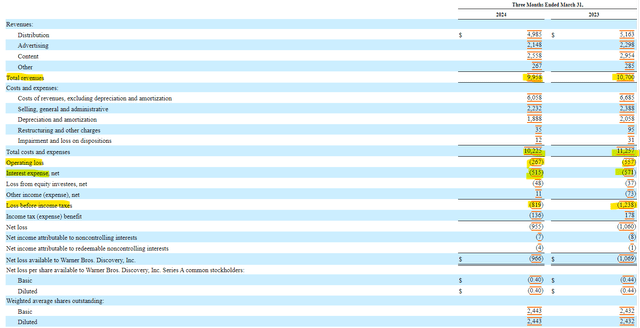

Warner Brothers Discovery saw a sharp decline in revenue across all segments of its business in the first quarter. Fortunately, the $700 million drop in revenue was offset by a $1 billion drop in expenses as the company completed a well containing variable costs. Despite the positive variance, there was still an operating loss of $267 million and a pre-tax loss of $819 million.

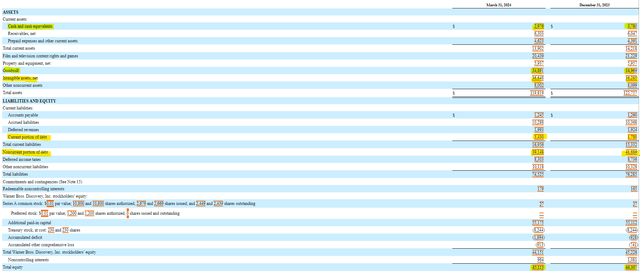

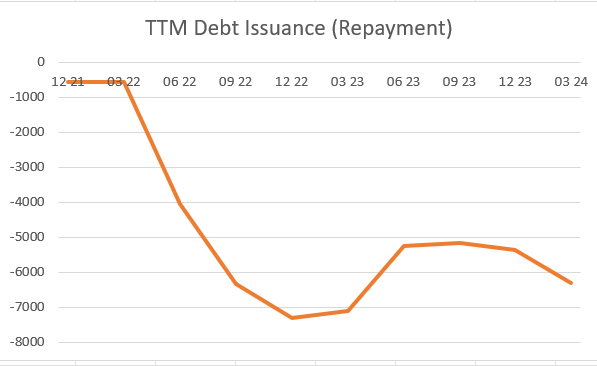

On the balance sheet, Warner Brothers Discovery repaid $1 billion in debt despite an operating loss. Part of the debt repayment came from cash, with the balance decreasing by $800 million. Equity is down $1 billion, and while many investors may view the discount between market cap and equity as an opportunity, it’s important to note that Warner Brothers Discovery’s balance sheet is full of intangible assets which must be amortized.

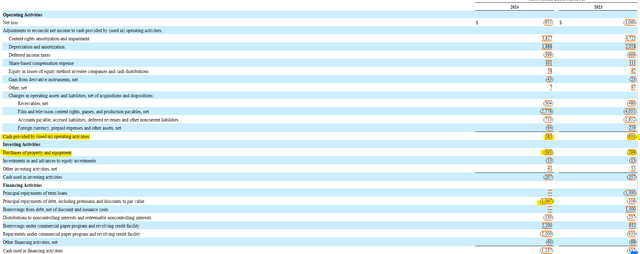

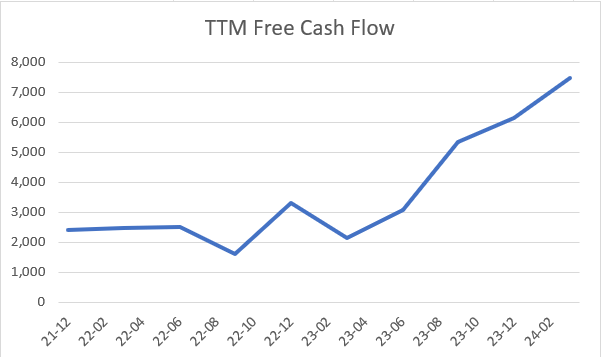

Warner Brothers Discovery’s bread and butter comes from its cash flow statement. Since a large portion of the company’s expenses are related to depreciation and amortization, the company generates healthy cash flow. In the first quarter, Warner Brothers Discover generated $585 million in operating cash flow and $390 million in free cash flow, compared to burns of $631 million and $930 million in the same quarter. last year, respectively. Free cash flow and $600 million of liquidity were used to pay down debt of more than $1 billion in the first quarter.

In addition to strong first-quarter cash flow, Warner Brothers Discovery’s trailing-twelve-month free cash flow jumped to more than $7 billion. More than $6 billion of that free cash flow was used to pay down debt as the company commits to deleveraging. Continued debt reduction is expected to lead to lower interest costs and higher profits in the future.

TIKR TIKR

The World Bank’s commitment to debt reduction

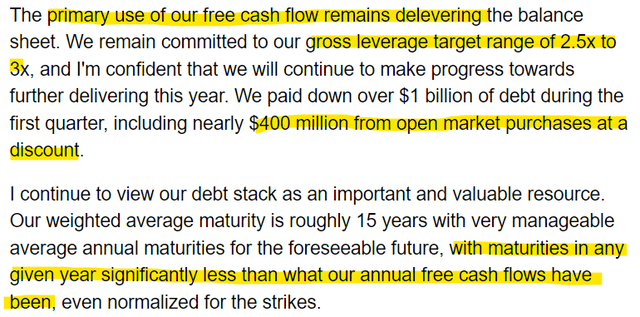

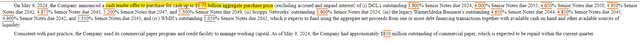

Warner Brothers Discovery’s high level of debt has been scrutinized by many analysts. Not only is the company using its free cash flow to pay down debt, but management has also publicly committed to further deleveraging. Management mentioned during the earnings conference call that it was using discounted open market purchases as part of its debt reduction strategy to achieve its 3x gross leverage target. On the same day as its earnings report, Warner Brothers Discovery announced a cash tender offer to purchase up to $1.75 billion of long-term bonds with cash on hand.

Transcript of the results call SEC10-Q

Can Warner Brothers Discovery reach profitability?

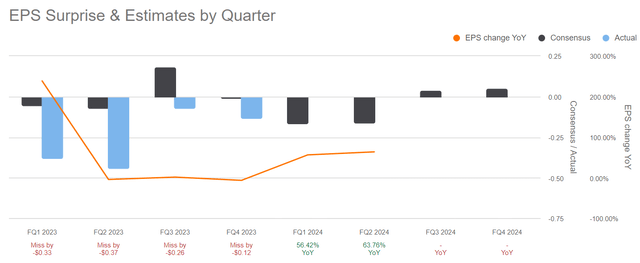

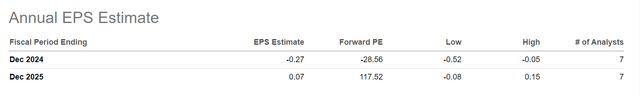

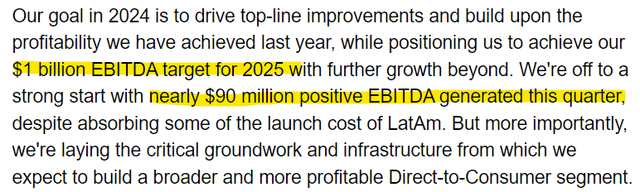

Even though the free cash flow and debt reduction numbers are great, Warner Brothers Discovery will serve its investors well by generating profits. Despite a lower-than-estimate profit loss in the first quarter, analysts believe the company will begin generating small profits in the second half, with full-year profitability achieved in 2025. Management said also set an EBITDA target of $1 billion for 2025.

In search of Alpha In search of Alpha Earnings Transcription

Which trade is best for the Warner Brothers Discovery Bulls?

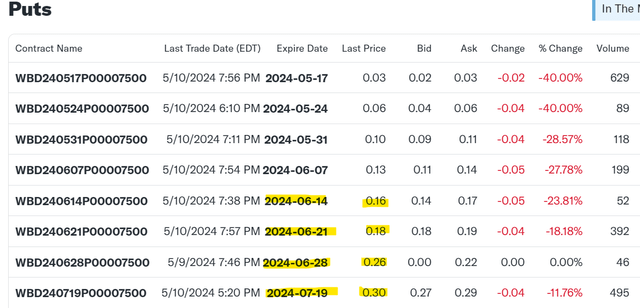

While outright purchasing shares may be the best solution for some, I continue to roll over cash-secured puts. My last option contract expires this week and I will be looking to initiate a new contract which expires between mid-June and mid-July. Earnings from these contracts are currently valued at an annualized return in excess of 20% and bring the cost of entry down from $7.50 to between $7.20 and $7.34 per share. If shares are awarded in a sale, investors can generate additional income by selling covered calls.

Conclusion

Warner Brothers Discovery continues its recovery efforts. The media company is still struggling to achieve profitability under the weight of high debt following its merger. Despite these challenges, free cash flow is increasing and management has prioritized deleveraging. Analysts are confident that profitability will return in the coming quarters and shareholders should start to see the share price rise accordingly.