Nikada

ETF Shares of Vanguard International High Dividend Yield Index Fund (NASDAQ:VYMI) invests primarily in large-cap foreign stocks that offer a high-yielding dividend. Since many European stocks outperform their U.S. counterparts, this fund has strong European exposure. and an impressive yield of around 4.8%. There’s a lot to love about this fund, including the fact that it has a low expense ratio of 0.22% and has generated solid returns of just over 8.5% per year since its inception in 2016. Let’s take a closer look:

Table

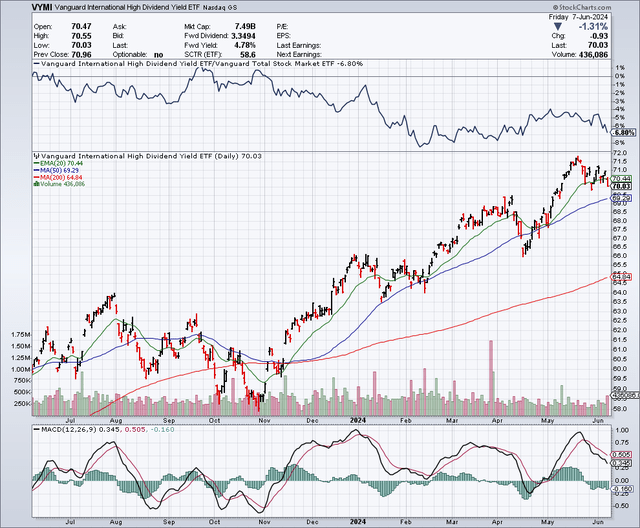

As the chart below shows, this fund has been in a strong uptrend since November 2023 and is now trading near all-time highs. There has been a slight pullback recently, and I would wait for additional pullbacks to use as buying opportunities. The 50 day moving average is $69.29 and the 200 day moving average is $69.29 the average is $64.84. For new funds to be invested here, I would buy on the pullbacks of either of these moving averages, and especially more aggressively on the lower 200 day moving average.

Top ten titles

The top ten holdings in this fund reveal a number of well-known stocks. Below you will find a list of some of the titles:

What I like about this fund is that there are no oversized positions that create excess risk; indeed, no position equates to much more than 2%. This broad diversification provides investors with peace of mind and allows the fund to invest in many companies and across multiple sectors. This fund is invested in pharmaceuticals, financials, automobile manufacturers, consumer staples, energy, industrial products and much more. Here’s a closer look at some of my favorite stocks in VYMI’s portfolio:

Nestlé (OTCPK:NSRGY) is one of the largest food companies in the world. It has a wide range of many popular brands, including Buitoni (pasta), Coffee Mate, Carnation, Digiornio, Contrex, Fancy Feast, Gerber, KitKat, Nescafe, Perrier, Purina and many others. Food inflation and the growing popularity of weight-loss drugs have caused some investors to worry about this stock, but in the long run, it’s pretty hard to go wrong investing in a high-quality, high-quality food producer. especially as the population increases globally and more and more consumers in third countries. Countries around the world are joining the middle class. This security represents a little more than 2% of the securities in the portfolio.

TotalEnergies (TTE) is one of my favorite oil stocks because it offers a high-yielding dividend and trades at a significant discount to its U.S. peers, which include Exxon (XOM) and Chevrons (CLC). TotalEnergies trades at around 8 times earnings and offers a yield of around 4.6%. AI data centers are expected to consume massive amounts of energy in the coming years, particularly solar power, which is also beneficial for this company since it has a large solar division. This security represents a little more than 1% of the securities in the portfolio.

Toyota engine (TM) is one of the largest and most popular automobile manufacturers in the world. It also owns the Lexus brand and offers a wide range of hybrid vehicles, which have been popular with consumers who don’t want to have range anxiety. This company would not have provided precise data security information on some of the cars it makes and that has caused the stock to drop recently, but I think it’s probably a buying opportunity. This security represents a little more than 2% of the securities in the portfolio.

ECB and US Federal Reserve policy changes could create upside potential

The European Central Bank or “ECB” recently lower interest rates for the first time since 2019, and further rate cuts could follow in the coming months. The US Federal Reserve is expected to follow suit and cut rates perhaps later this year or next. If interest rates fall globally over the next couple of years, it could make high-yielding dividend stocks more attractive to investors. The amount of cash placed in money market funds recently reached record levels of more than 6 trillion dollars. When interest rates are reduced, money market fund rates will fall, which could drive many investors into high-dividend stocks and drive up the prices of stocks like those VYMI has in its portfolio.

The dividend

This fund pays a quarterly dividend of approximately $0.8644 per share. This offers a yield of around 4.80%. This return is very attractive because it is close to that of current money market funds, with returns of just over 5%. However, the big difference is that when you invest in this fund, you can essentially lock in that return over the long term and potentially get an attractive upside in capital gains. On the other hand, investors who have parked their cash in money market funds could see a sharp decline in returns after the Federal Reserve cuts rates.

Potential Downside Risks

Of course, this fund has potential downside risks associated with investing in the stock market, and I believe that is the main risk. However, this fund is very well diversified and does not hold positions significantly exceeding 2% of the total portfolio holdings. This gives investors diversification and minimizes the downsides of investing in single stocks or ETFs with oversized positions. I think the other potential risk is actually opportunity cost. This fund isn’t going to rise like an AI stock, and it hasn’t performed as well as many tech ETFs or growth stocks. So while the annual returns of around 8.5% it has delivered are very solid, you may be missing out on a larger total. Back.

In summary

I consider VYMI an ideal ETF to add to my portfolio because it has delivered solid total returns of around 8.5% since its inception and with a yield of around 4.8%, it returns almost as much as most money market funds. However, money market yields are likely to fall over the next couple of years, and this fund could benefit from falling yields, as this will make high dividend stocks more attractive to investors. I believe this will lead to capital gains which, together with the dividend yield, could lead to above-average overall returns in the years to come. I plan to add more shares of this ETF in the event of a downturn and hold it for the long term.

No warranties or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is provided for informational purposes only. You should always consult a financial advisor.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.