J Studios/DigitalVision via Getty Images

The United States faces a persistent housing shortage, with no clear end in sight. One of the beneficiaries of this favorable wind is UMH Properties, Inc. (NYSE:UMH), a leading manufacturer and distributor of prefabricated homes.

“The demand for affordable products housing in our markets and across the country remains incredibly strong. Our communities continue to fill sites with homes for rent and sale.

Our improvements have transformed disadvantaged communities into first-class communities, creating waiting lists for our housing. This business plan has allowed us to profitably increase the supply of quality affordable housing in the markets we serve. Over the next five years, our community is expected to be full and there will be limited land available to build homes. The housing crisis and the inability of conventional builders to provide affordable housing highlights the tailwinds supporting UMH in our sector. (First quarter 2024 earnings call.)

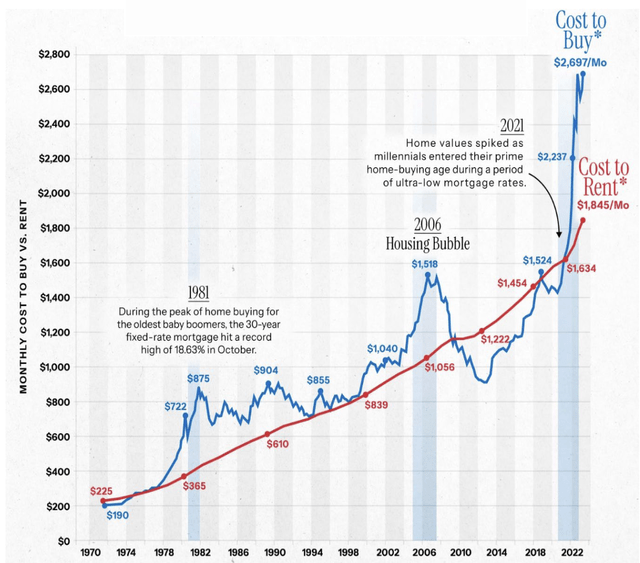

The shortage has driven up the cost of purchasing and the cost of renting over the past decade:

Performance:

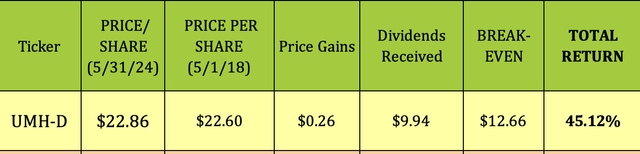

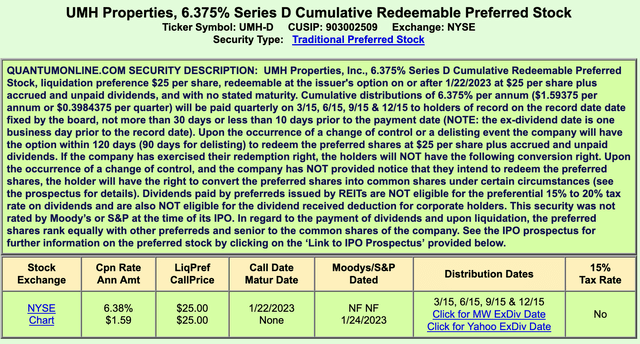

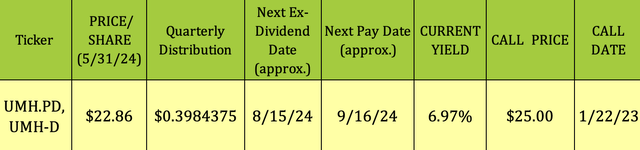

We added the 6.375% Series D Cumulative Redeemable Preferred Stock of UMH Properties (NYSE:UMH.PR.D) to the HDS+ portfolio on 05/01/18. Since then, it has generated a solid total return of around 45%, consisting mainly of its quarterly dividends:

Company Profile:

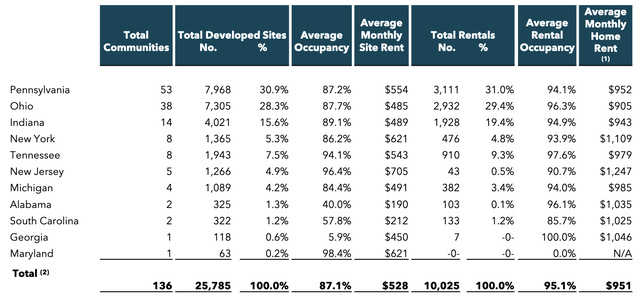

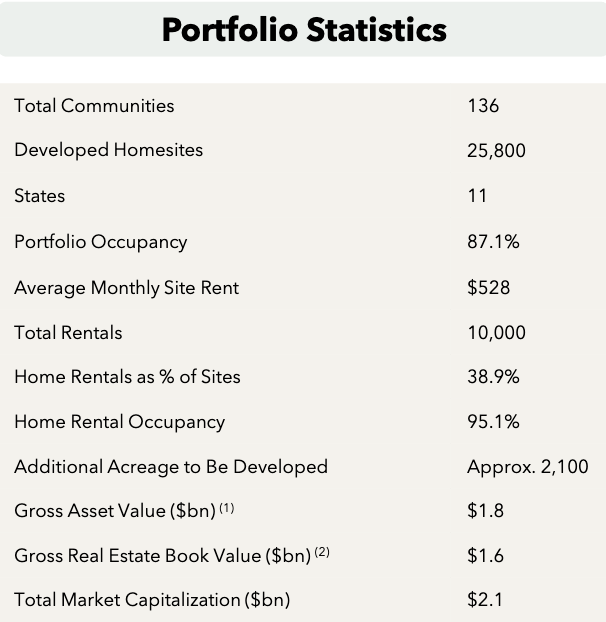

UMH Properties, Inc. is a public REIT (real estate investment trust) headquartered in Freehold, New Jersey. The Company owns and operates a portfolio of 136 manufactured home communities with 25,800 manufactured home sites.

In 2023, occupancy averaged around 87%, with rental occupancy around 95%, representing 39% of sites.

UMH website

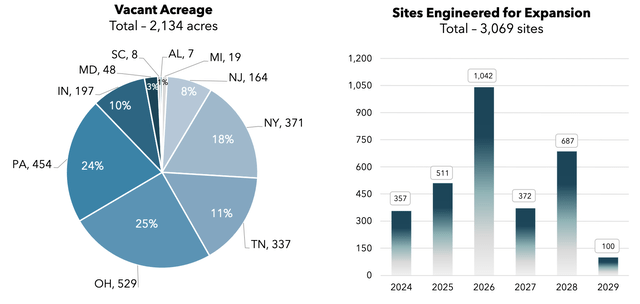

UMH also has room for expansion, with approximately 2,100 acres to develop. It can typically build 4 houses on one acre, at a cost of around $75,000/house.

Pennsylvania and Ohio are its largest areas, with 31% and 28% of its sites developed, followed by Indiana, at 15.6%, Tennessee, at 7.5%, and New York, at 5 .3%. It also has locations in 6 other states. New Jersey has the highest average monthly rent, at $1,247, followed by New York, at $1,109.

One of the interesting notes about UMH’s portfolio is that it is concentrated in the Marcellus and Utica Shale regions, which are large natural gas deposits located beneath much of Pennsylvania, Ohio , West Virginia and New York. The UMH has 78 municipalities and 12,300 sites in this territory.

UMH’s Sales and Finance unit, which serves both functions, has sold 5,700 homes since 1996. Its portfolio of approximately 1,600 homes is spread across 109 communities. It has a loan portfolio of $80.5 million, which generates approximately $11 million in principal and interest per year. Most loans require a 10% down payment, with an amortization of 15 to 25 years.

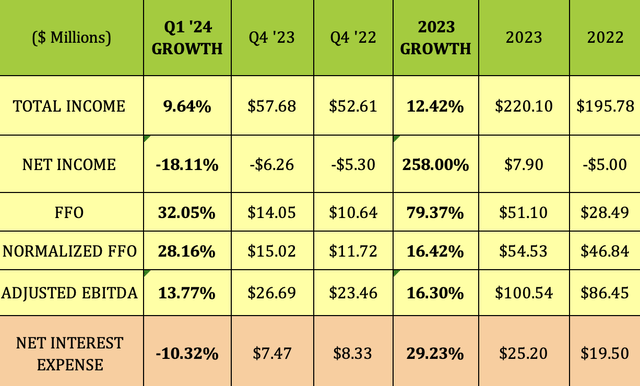

Earnings:

Q1 ’24: Normalized FFO, which excludes depreciation and amortization and one-time items, was $15 million, compared to $11.7 million in the first quarter of 2023, up 28%. Total revenue increased 9.6%, primarily due to an increase in occupancy of the same properties, the addition of rental units and an increase in rental rates. EBITDA increased by 13.77%.

Net income was -$6.26 million, down 18%, primarily due to an increase of approximately $2 million in non-cash reductions in marketable securities. Net interest expense actually decreased by 10% in Q1 24.

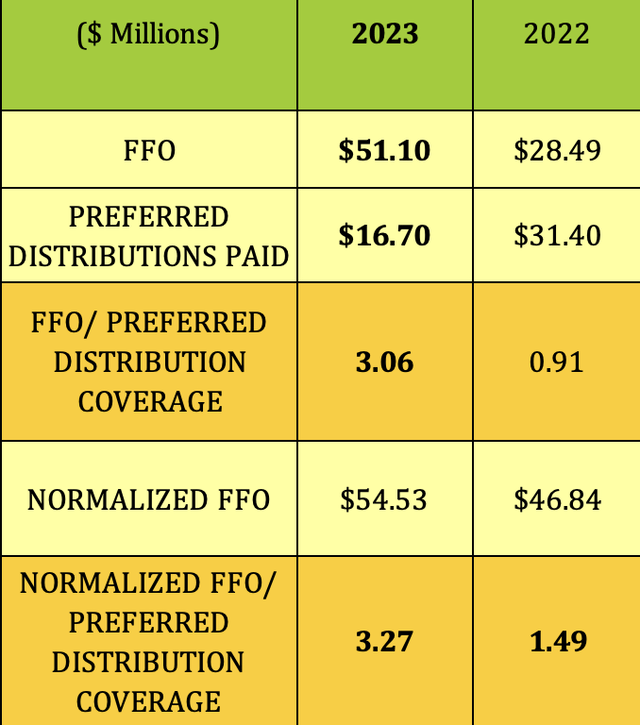

2023: It was a good year for UMH, with revenue up more than 12% and net income going from a loss of -$5M to a gain of $7.9M. FFO jumped 79%, while normalized FFO increased 16.4%. EBITDA increased by approximately 16%. Net interest expense increased to $5.7 million, up 29%.

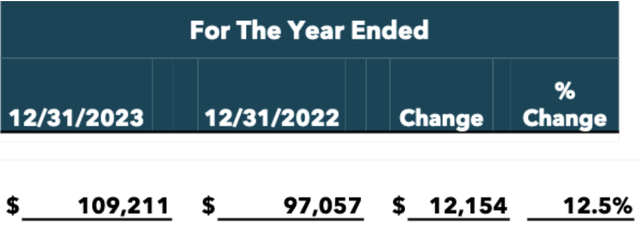

A key real estate number, the net operating income of the same properties, NOI, increased by 12.5% in 2023, reaching $109.2 million:

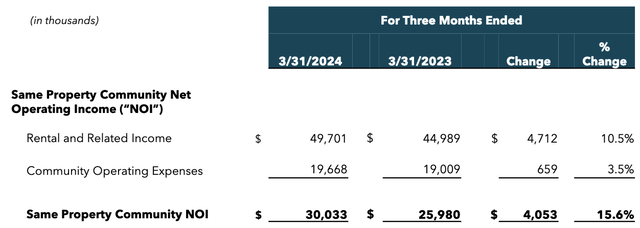

In the first quarter of 2024, NOI increased by 15.6%, continuing this upward trend:

Preferred dividends:

These are cumulative shares, which means that UMH must pay preferred shareholders any skipped dividends BEFORE paying common shareholders. They also have priority over UMH’s ordinary shares in the event of liquidation.

UMH-D will be ex-dividend in February/May/August/November. calendar – it is expected to go ex-dividend next on 08/15/24, with a payment date of 09/16/24.

At $22.75, the current yield is around 7%:

UMH preferred coverage improved significantly in 2023, with preferred FFO/dividend coverage jumping more than 3X, to 3.06X, while normalized FFO coverage increased from 1.49X in 2022 to 3.27X in 2023:

Potential buyout:

With 11,801 million UMH-D shares outstanding as of 3/31/24, it would cost UMH ~$295 million to repurchase these shares. UMH’s current cost of debt is 6.79%, which is higher than the 6.375% rate on these stocks, so we don’t expect them to repurchase these shares until interest rates do not drop much further.

Taxes:

These are non-qualified dividends.

Profitability and leverage:

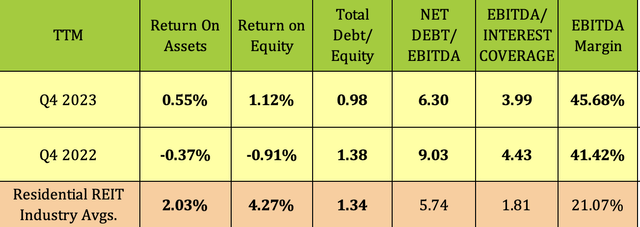

ROA and ROE both improved in 2023, although they remained below industry averages, while UMH’s EBITDA margin is well above its industry average.

UMH’s debt leverage has improved a lot in 2023. It has a slightly higher net debt/EBITDA leverage of 6.3X, compared to the industry average of 5.74X, while its total debt/ Equity improved to 0.98X as of 12/31/23, compared to 1.34X for the industry average.

As with most other companies, UMH’s interest coverage decreased slightly due to rising rates, but remained much higher than average:

Debt and liquidity:

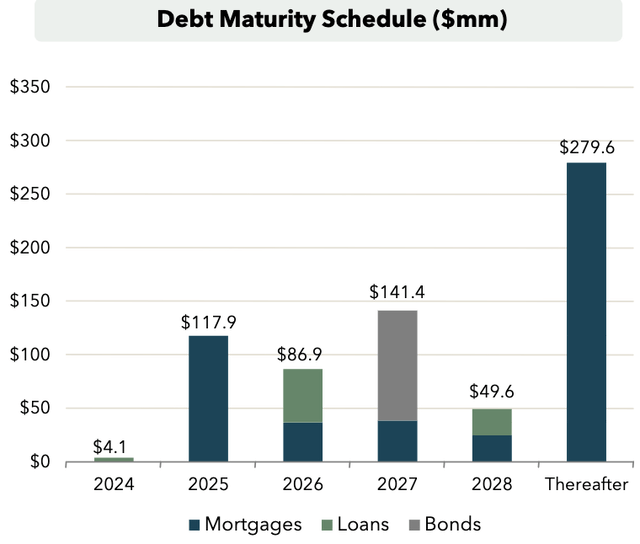

UMH ended the first quarter of 2024 with $39.9 million in cash and cash equivalents and $130 million available under its unsecured revolving credit facility, with an additional $400 million potentially available pursuant to an accordion feature. It also had $194 million available on our other lines of credit for financing home sales and purchasing inventory and rental homes.

In April 2024, management expanded the borrowing capacity of UMH’s unsecured revolving credit facility from $180 million of available borrowings to $260 million of available borrowings.

Total debt was 92% fixed at the end of the quarter, with a weighted average interest rate on short-term borrowings of 6.79% as of 03/31/24.

UMH has minimal debt due in 2024, with around €118 million due in 2025.

UMH issued and sold 194,000 shares of Series D preferred stock during the first quarter of 2024 under the ATM Preferred Program, generating net proceeds of approximately $4.4 million.

Parting thoughts:

We rate UMH-D a Buy, up to $25.00, based on improving dividend coverage and UMH’s strong position in the manufactured housing sector. We believe UMH will follow this secular trend in the coming years.