Dragon Claws/iStock via Getty Images

TLT, inflation and fiscal sustainability

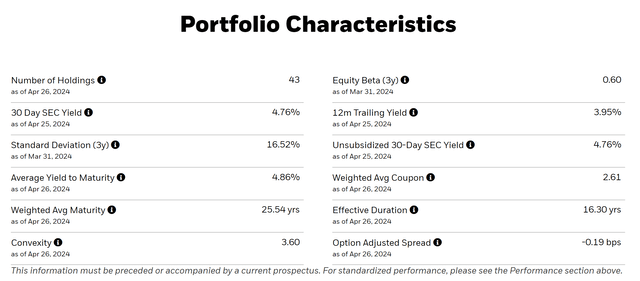

The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) provides investors with exposure to extended duration Treasury bonds. As pointed out by Description of the TLT ETF (the accents were added by me), it’s “seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities more than twenty years. » As a result, the effective duration of the TLT is greater than 16 years as shown in the graph below and its weighted average maturity is greater than 25 years.

Changes in the price of a bond can be approximated by the product of its rates and its duration. As such, with the combination of TLT’s long duration and the interest rate uncertainties we face, TLT investors may face enormous price volatilities ahead, and I do not Would probably not recommend to investors with a closer or more conservative investment timeline. risk profile (we will come back to this later).

Description of the TLT fund

However, for investors with a longer investment framework (say at least 3-5 years or more) and who are more risk tolerant, the thesis of this article is to explain why I see more upside potential than downside risks. There are several reasons, including our inverted yield curve, the possibility of a hard landing, etc. But today I will focus on a more macroscopic factor: the balance between inflation and fiscal sustainability. I do not believe that current long-term rates can be sustained over the long term. Ultimately, long-term rates cannot exceed the growth rate of real GDP (around 2% per year on average) plus inflation (also around 2% on average).

In recent years, due to the rapid rise in debt and interest rates in the United States, I believe we are approaching a point where fiscal sustainability needs to be seriously examined as well as our inflation target before until the Fed decides to raise rates again.

Next, I will analyze the Japanese debt cycle and explain why the United States is likely to adopt the same strategy and capitalization rates.

TLT and Japanese bond cycle

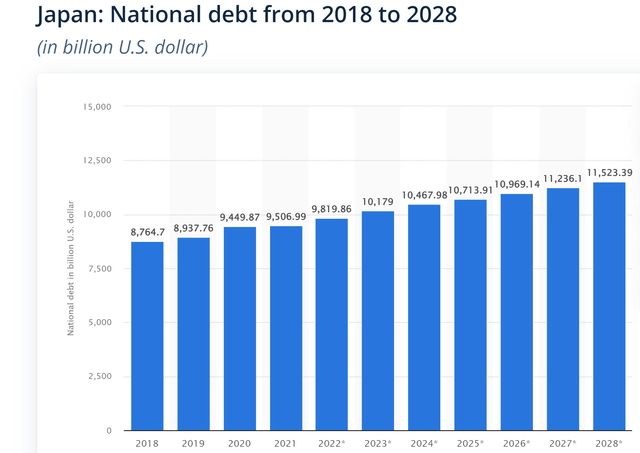

Japan’s public debt exceeds US$9 trillion since 2020, as shown in the chart below. This figure is expected to exceed $10,000 billion from 2023.

Statistical

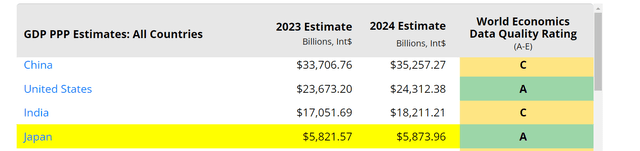

To anchor this in terms of GDP, the table below shows that the World Economy Estimates Japan’s GDP $5.822 trillion for 2023 and about the same for 2024, as shown in the chart below. Thus, Japan’s public debt currently stands at around 175% of its GDP, based on these projections.

Mondial economy

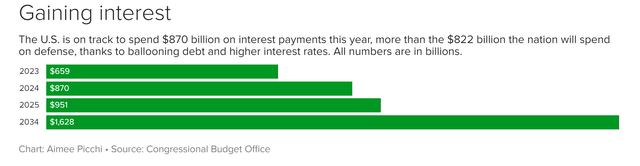

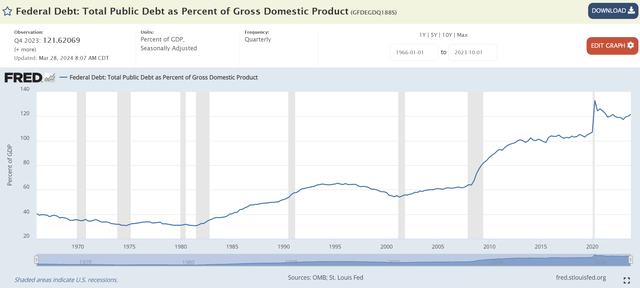

The US public debt is not as high as Japan’s, but it also exceeds GDP by a considerable amount and is growing rapidly. As the chart below shows, total U.S. government debt now exceeds 120% of GDP. The simultaneous combination of growing debt and rising interest rates has caused an inflating effect on interest spending.

As a notable example, the following data from the Congressional Budget Office The table below shows a 32% increase in interest expense in 2024 alone compared to 2023. To further contextualize things, the 2024 interest expense is:

…. is on track to spend $870 billion in interest this year, more than the $822 billion the country will spend on defense, thanks to growing debt and higher interest rates. All numbers are in billions. To be sure, rising interest rates are not the only factor increasing the cost of servicing the country’s debt. Over the past decade, outstanding U.S. debt has nearly doubled, jumping to $33 trillion last year from $17 trillion in 2014, according to Treasury data.

Congressional Budget Office

FRED

I just don’t think this situation can continue for too long from a budgetary point of view. So I see a good possibility for the United States to follow the Japanese strategy and implement some form of bond rate cap. For example, the Bank of Japan (“BOJ”) implemented a policy called Yield Curve Control (“YCC”) in 2016. This policy aimed to stimulate the economy by keeping long-term interest rates artificially low . Specifically, the BOJ targeted the 10-year Japanese Government Bond (“JGB”) yield and committed to purchasing unlimited quantities of bonds if necessary to keep the yield around a specific target, typically around 0%. This essentially capped the rates on these bonds. In October 2023, the BOJ announced a policy change. They have moved away from a hard cap and now aim to keep the 10-year JGB yield as a “reference point” around 1%. This allows for some yield flexibility, but nevertheless signals the BoJ’s intention to influence bond yields.

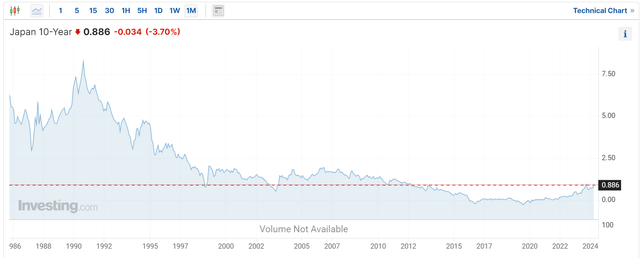

In total, as the chart below shows, Japanese 10-year Treasury yields have fallen drastically, from a high of around 8% in the 1990s to less than 1% as of around 2013 (and even in negative diets for a while). creating a remarkable bull market in long bonds.

Source: Investing.com

Risks and final thoughts

As mentioned above, a bond’s price changes can be approximated by the product of its rates and its duration. In the case of TLT, its effective duration is around 16%, so a 1% drop in yield can create an upside potential of around 16% (plus coupons).

However, downside risks are also amplified. In particular, the following ICE BofAML MOVE Index (^MOVE) shows that bond volatility is currently relatively high. I took the data from Yahoo finance. The MOVE Index is a financial benchmark that tracks volatility in the U.S. Treasury bond market. In simpler terms, it reflects the extent to which investors expect bond prices to fluctuate. As seen before the COVID-19 pandemic (i.e. before the epic QE of 2022 and subsequent inflation), the MOVE index has been below 75 most of the time and spent a considerable amount of time hovering around 50 only. The index has remained above 100 most of the time since 2022, reflecting the anticipation of significant price swings in the bond market. With the extended duration of TLT, this increased volatility could be further amplified.

Yahoo

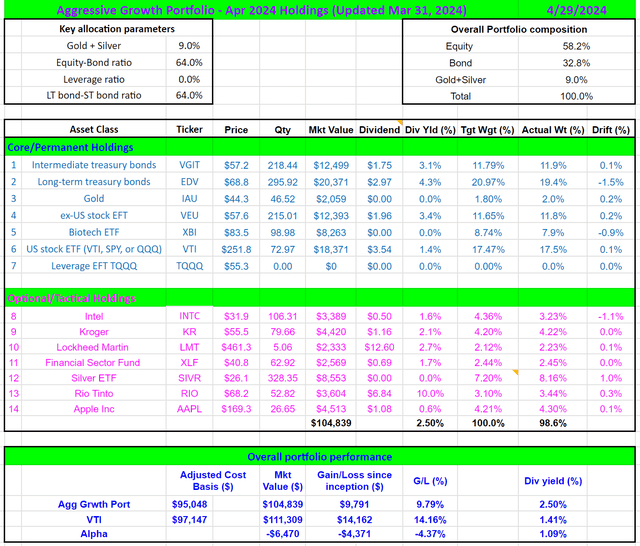

Given these considerations, I probably won’t recommend TLT to everyone. But my overall conclusion is that the upside risks outweigh the downside risks in the long term (say 3-5 years or more). For these investors, I think this is a good time to add TLT (or other similar funds such as EDV’s VGLT) to the mix of high quality equity and/or equity funds. Our own portfolio follows our analysis. The chart below shows the current holdings in our real money portfolio. As seen, he holds a substantial amount of Vanguard Extended Duration Treasury Index Fund ETF (EDV). EDV has essentially the same features as TLT and the main reason we choose EDV over TLD is its lower fees (0.06% versus 0.15% for TLT).

Author