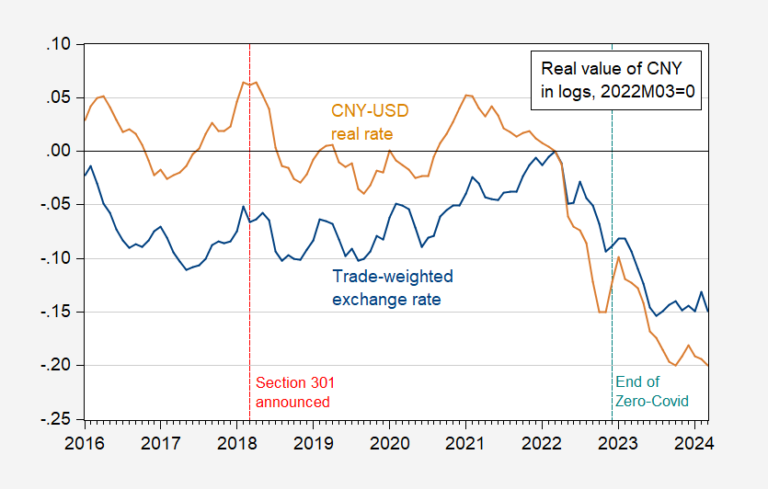

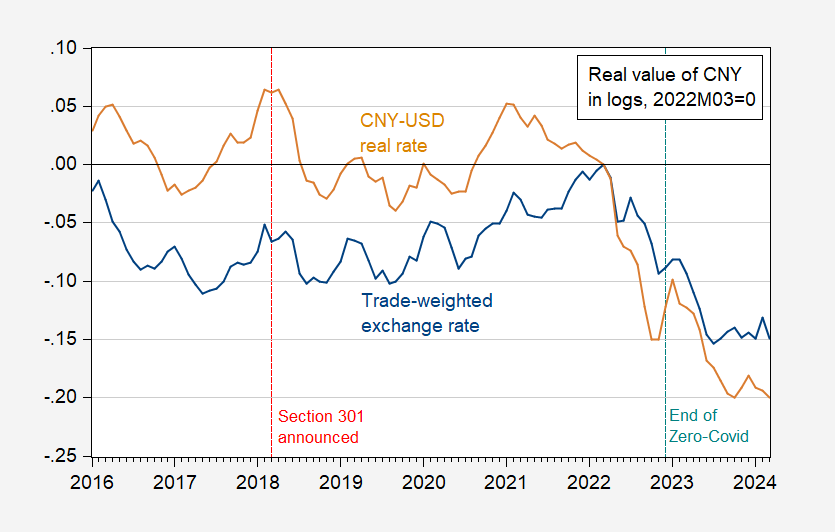

Much has been made of Chinese production overcapacity and the resulting pressures in the United States and other markets. Here is a picture of Chinese real exchange rates.

Figure 1: Real exchange rate deflated by Chinese trade-weighted CPI (blue) and real exchange rate deflated by US-China bilateral CPI (tan), in log. Up indicates an increase in the value of the Chinese currency. Author-adjusted Chinese CPI using X-13. Source: BIS, FRB, BLS via FRED.

In principle, I would prefer to use PPI deflated real rates, or even deflated unit labor cost (see this paper), but these are harder to find. The weighted value of the Chinese CNY is down 15% in log terms since its recent peak in 2022M03. On the other hand, the decline in the bilateral real exchange rate is 20%. As of 2021M02, it’s 25%. Interestingly, imports of goods from China (as reported in trade statistics) are not significantly different from 2022M03:

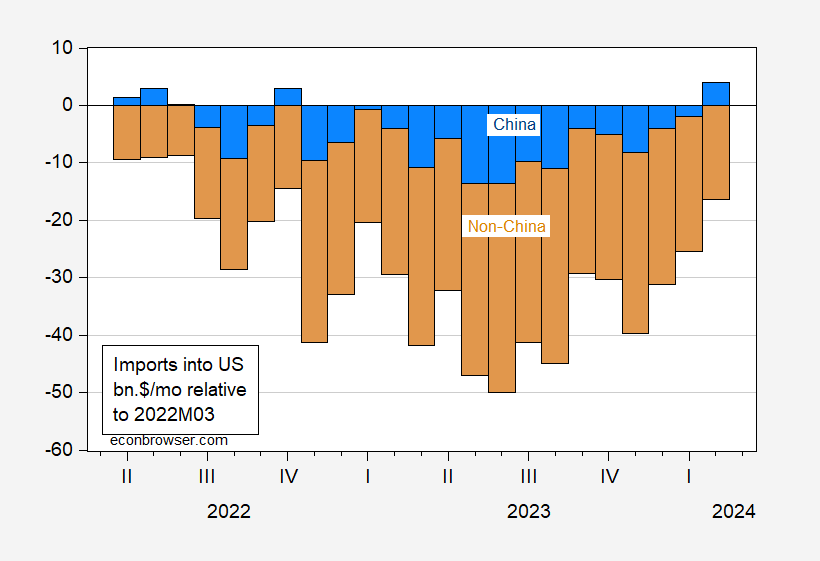

Figure 2: Evolution of imports from China compared to 2022M03 (blue bar), from non-China (beige bar), in $bn/month. Imports from China are goods, customs basis; total imports of goods and services, on a balance of payments basis. Imports of Chinese goods seasonally adjusted by the author using X-13. Source: Census, BEA via FRED.

That being said, it is clear that a large number of Chinese products arrive in the United States via third countries (transshipped or displaced production). In reality, what we would like to see more of is added value imported from China; to my knowledge, up-to-date data of this type is not readily available.

Even then, the bilateral flow of value added would not reflect the full pressure on prices of tradable goods, since Chinese imports could depress globally negotiated prices, thereby increasing imports into the United States.

Is the Chinese currency undervalued? We’ll talk about this later (older summary of approaches, see here). The last The Treasury report is from November. THE BigMac Index, using December dataindicates an undervaluation of 26.3% using the Penn effect.

Brad Setser has some thoughts, here.