Data shows that Bitcoin’s selling pressure on crypto exchange Coinbase is decreasing, which could support a near-term rebound.

Bitcoin Coinbase Premium Gap Nears Neutral Mark Again

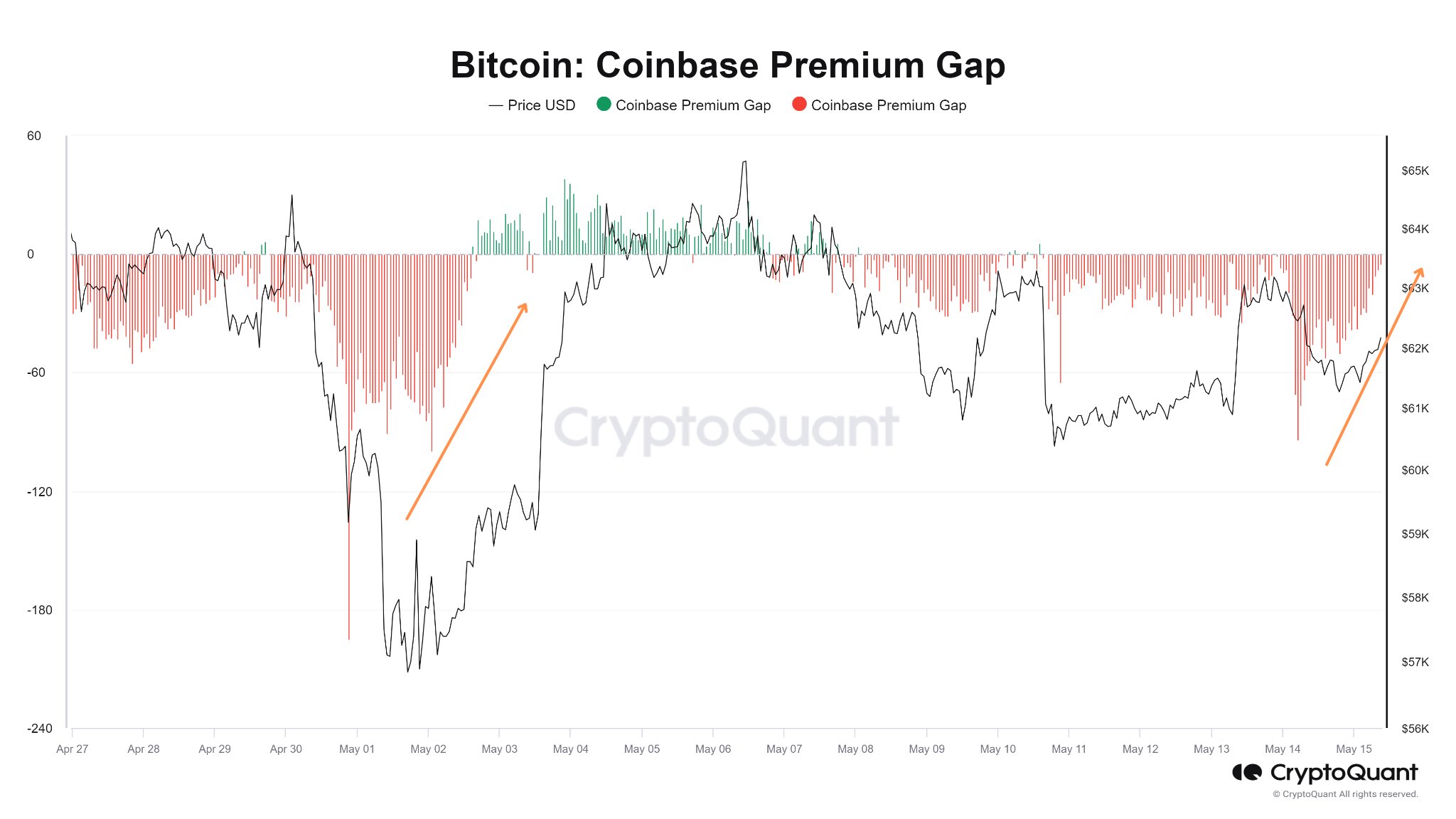

As analyst Maartunn explains in a job on X, the Coinbase Premium Gap has increased since dipping into negative territory yesterday. “Coinbase Premium Gap” here refers to a metric that tracks the difference between Bitcoin prices listed on Coinbase (USD pair) and Binance (USDT pair).

When the value of this indicator is positive, it means that the price of the cryptocurrency indicated on Coinbase is currently higher than that of Binance. Such a trend implies that buying pressure is higher (or selling pressure is lower) on the former than on the latter.

On the other hand, a negative value would suggest that the selling pressure on Coinbase could be higher than on Binance, as the asset is trading at a lower value on the exchange.

Now here is a chart that shows the Bitcoin Coinbase Premium Gap trend over the past few weeks:

The value of the metric seems to have been going up over the past day | Source: @JA_Maartun on X

As the chart above shows, the Bitcoin Coinbase Premium Gap has been negative in recent days, suggesting that Coinbase users have been selling more than those on Binance.

Coinbase is generally known to be the preferred platform for US-based companies. institutional investors, while Binance hosts global traffic. Thus, the value of the bounty can tell us about the behavior of American whales.

The recent negative values of the indicator would naturally imply that these large entities participated in some sales. The chart shows that these investors also showed similar behavior earlier.

When sales finally fell and the Coinbase Premium Gap reversed, the price of the cryptocurrency rebounded in the short term. Over the past day, the indicator has shown a similar trend, as its value is now approaching the neutral mark.

This may imply that institutional traders may be done with their selling for the time being. “This could potentially create upside opportunities in the short term,” notes the analyst.

Furthermore, Bitcoin Open interesta measure of the total amount of derivatives-related positions currently open for the asset, has seen an alarming spike over the past few hours, as Maartunn highlighted in another X. job.

Looks like the value of the indicator has seen a sharp jump recently | Source: @JA_Maartun on X

Generally, an increase in open interest can lead to greater volatility in Bitcoin prices. This 9% rise came so suddenly that a violent liquidation event could occur for the cryptocurrency.

BTC Price

Bitcoin has recovered over the past day as its price has now crossed the $64,800 mark.

The price of the coin appears to have shot up over the last 24 hours | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, CryptoQuant.com, chart from TradingView.com