Morsa Images

For almost a year and a half, I have devoted a good part of my time to analyzing and better understanding financial institutions. For the vast majority of the 16 years I spent investing, I largely avoided these companies. But Due to the banking crisis that occurred last year, I could not resist their attraction any longer. Two banks that I have analyzed previously and on which I adopted rather neutral positions were Independent banking group (NASDAQ:IBTX) And Southern State Corporation (NYSE:SSB). In the case of Independent Bank Group, the company’s shares are up just 4.5% since I wrote about this in February of this year. That’s less than the 7.2% increase seen by the S&P 500 over the same period. And as I had initially written about In September 2023, SouthState Corporation shares were up just 4.2% while the S&P 500 was up 20.9%.

This underperformance is obviously disconcerting, but not really surprising given the rating I have assigned to both companies. In May of this year, however, the management teams of both companies agreed to a transaction that would see SouthState Corporation acquire Independent Bank Group in an all-stock deal, initially valued at about $2 billion. The hope here is that through the combination of the companies, additional opportunities can be captured and value created. But looking at the bigger picture, I don’t have much hope that this will come to fruition.

While it is entirely possible that this maneuver will result in cost savings, the downside for SouthState Corporation is that it is purchasing a bank that, fundamentally speaking, is quite inferior to itself. This may seem like a blessing to Independent Bank Group shareholders. Ultimately, I maintain that SouthState Corporation still deserves a “hold” rating. Currently, Independent Bank Group is only offering a 1% spread between its current price and its implied buyout price, which may seem to some to be a reason to warrant a “sell” rating. But given that its fortunes are tied to those of SouthState Corporation, it also makes sense to keep the company in check.

A big bet on the south

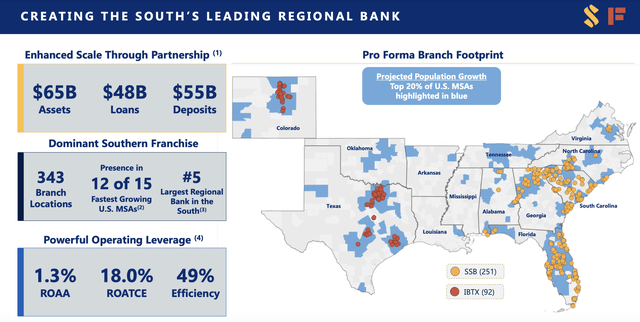

On May 20, the management teams of Independent Bank Group and SouthState Corporation announced that the two companies would merge in an all-stock transaction valued at nearly $2 billion. In short, for every share of Independent Bank Group held by an investor, the investor will receive 0.60 shares of SouthState Corporation upon closing. All combined, the institution will be quite large. The combined company’s total assets, as of the announcement date, were $65 billion. This included $48 billion in loans. These are backed by $55 billion in deposits.

Southern State Society

Operationally, the combined company will be considerable in size, with 343 branches and a physical presence in 12 of the 15 fastest-growing metropolitan areas in the United States. In fact, the combined company will be the 5th largest regional bank in the south of the country. SouthState Corporation primarily operated in Florida, Georgia and South Carolina. However, it also has operations in other locations like Virginia, North Carolina, and Alabama. In comparison, Independent Bank Group operates primarily in Texas, although it has locations elsewhere, such as Colorado.

Southern State Society

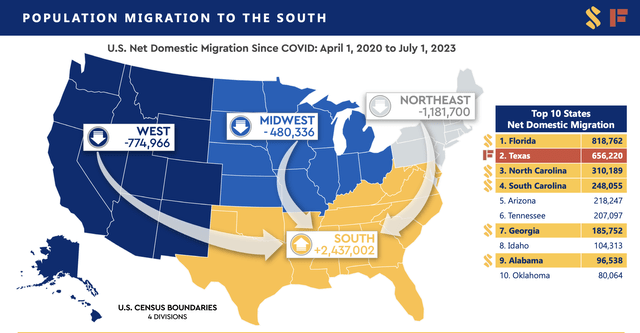

This deal represents a big bet on the South. And there are good reasons to be optimistic about it in general. According to the management teams of both companies, between April 1, 2020 and July 1, 2023, 2.44 million people migrated to the South. Most of them came from the Northeast, but some came from the Midwest and the West. The biggest beneficiary was Florida, with a net inward migration of 818,762 people. However, Texas, where Independent Bank Group has a significant presence, was the second-largest beneficiary of this migration, with a net inward migration of 656,220 people.

The combination of these two activities should generate quite significant cost savings. If all goes as planned, the total annualized savings should represent approximately 25% of the non-interest expenses generated by Independent Bank Group. This is based on projected non-interest expenses for the year 2025. Management assumed, in this case, that annual non-interest expenses would increase by approximately 3% per year. If we remove some one-time costs incurred by Independent Bank Group in 2023 and apply this 3% annual growth rate for two years, we get potential annualized savings of approximately $77.3 million before taxes. About half of these savings are expected to be realized in 2025, with the rest expected afterward.

This will not happen without significant costs. To begin, SouthState Corporation expects to incur approximately $175 million in pre-tax merger expenses. Additionally, it expects impairments of certain assets, such as loans, securities and debt, of approximately $438.8 million before taxes. If we assume a tax rate of 21%, the net cost will be approximately $346.7 million.

Author – SEC EDGAR Data

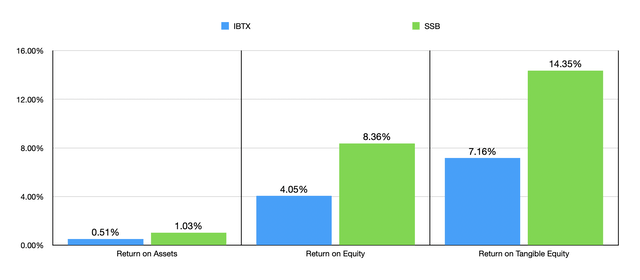

To be very clear, this transaction is not a transaction between equals. For starters, SouthState Corporation is currently a bit larger than Independent Bank Group. This is why Independent Bank Group shareholders will only receive 24.7% of the combined business. The remaining 75.3% will be retained by existing SouthState Corporation shareholders. Companies are unequal not only because of their size, but also because of their overall quality. In the table above you can see the most recent calculations for their return on assets, return on equity and return on tangible equity. In the vast majority of cases, SouthState Corporation is the superior company.

Southern State Society

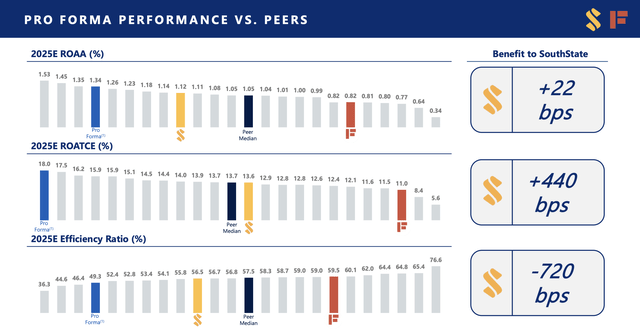

Now it’s important to keep in mind that when it comes to two of these metrics, return on assets and return on tangible equity, companies have provided alternative estimates. These estimates, as shown in the image above, take into account certain adjustments and project out to 2025 instead of using the most recent data provided by management. But even then there is a clear difference in quality. Overwhelmingly, SouthState Corporation remains significantly superior to Independent Bank Group on this front.

Author – SEC EDGAR Data

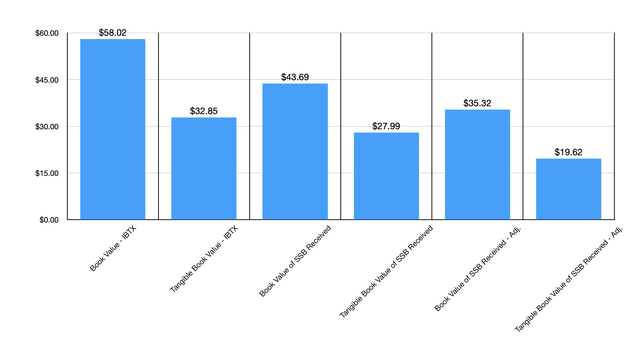

There is another way to determine whether this transaction makes sense or not. That is to look at the amount of equity and tangible equity contributed by Independent Bank Group compared to the price paid by SouthState Corporation. For example, at the end of last quarter, Independent Bank Group had a book value per share of $58.02. However, SouthState Corporation shareholders are only giving $43.69 in book value for that. Even if we remove the estimated $346.7 million in after-tax impairments from the equation, Independent Bank Group would have a book value per share of about $49.65. This means that shareholders are still receiving a discount on a book value per share basis of 12%. In the chart above, you can also see how this works out on a tangible book value basis. The end result, however, is that SouthState Corporation is getting a discount on the net assets contributed by Independent Bank Group. And this is almost certainly due to the lower asset quality we’ve already talked about.

Southern State Corporation

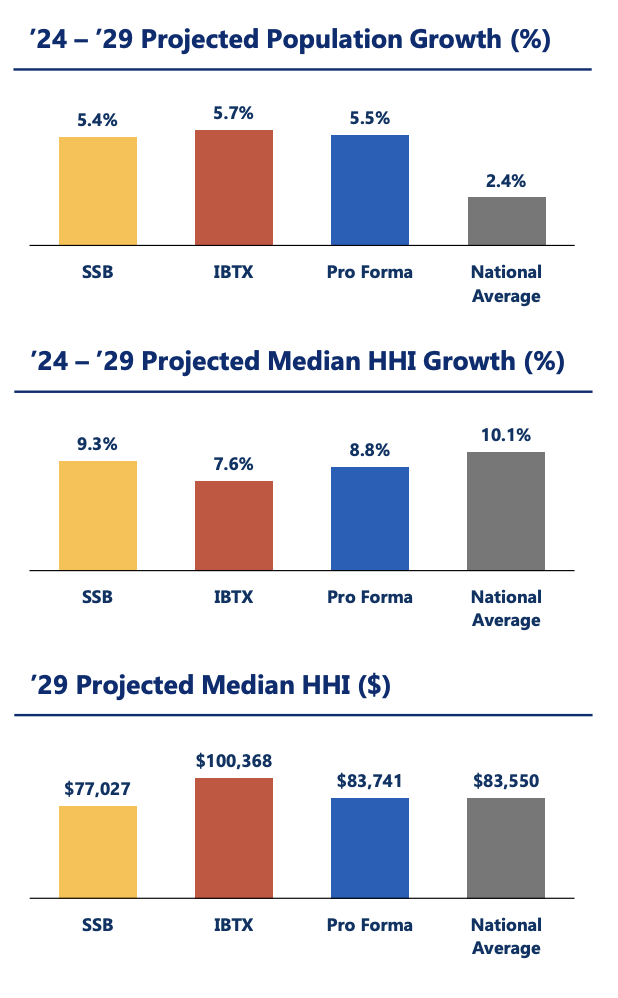

That’s not to say that everything about this deal is bad. For starters, the discount SouthState is getting is a positive. In addition, Independent Bank Group has some positives. For example, median household income in the areas where Independent Bank Group operates is projected to grow by about 7.6% per year between 2024 and 2029. That’s less than the 9.3% projected for SouthState Corporation. However, even by the end of that forecast period, Independent Bank Group will be operating in areas where the median household income of $100,368 is significantly higher than the $77,027 that SouthState Corporation is exposed to. With higher median household incomes, that should, by definition, become a bigger opportunity.

Take away

In my opinion, while this is an attractive acquisition, it puts all the risk on SouthState Corporation. Fortunately, the company is getting net assets at a discount due to this risk and the lower quality of those assets. Ultimately, this is not enough to change my own opinion on SouthState Corporation. Given the lower quality that Independent Bank Group brings, it may seem odd that I do not rate the company as a “sell.” However, since it now appears to be tied to SouthState Corporation’s performance and offers a 1% spread between its price and the buyout price, it also makes sense to hold on to it.