zhongguo

The impact of tariffs on solar equipment on global supply chains

The American Alliance for Solar Manufacturing Trade Committee (AASMTC) has filed a petition with the United States International Trade Commission (US ITC) to impose antidumping and countervailing duties on imports of solar panels. from Cambodia, Vietnam, Malaysia and Thailand. The AASMTC claims that manufacturers from these countries sell their products at a loss in the U.S. market and receive subsidies.

This case illustrates the adaptive nature of supply chains and trade protections: buyers will seek cheaper sources after adjusting prices. In turn, this may require governments to continually modify and expand the focus of tariffs. Additional considerations such as operational risk are also factored into company decisions to shift production.

The AASMTC petition

The US Commerce Department had previously found that imports from Cambodia, Vietnam, Malaysia and Thailand were circumventing anti-dumping measures. and countervailing duties on mainland China in 2022, but delayed the implementation of the tariffs for two years. The imposed delay in the implementation of these duties, which expires in June 2024, could increase customs duty rates on imports from the four countries by up to 280.18%, from the current 14.25%. The postponement was intended to support solar projects funded by the Inflation Reduction Act while keeping the cost of panels low. The Biden administration said the exemption would end as scheduled on June 6, 2024.

The AASMTC petition claims that the delay gave “Chinese solar manufacturers in these countries time to modify their supply chains”, which is no longer considered circumvention and therefore requires corrective action direct sales.

Malicious circumvention and other commercial harm cannot be directly seen in published commercial data. Instead, the ITC and the U.S. Department of Commerce use additional formulas and conduct due diligence.

If additional duties are levied, other import sources could be the Netherlands, which accounted for 9.2% of global exports in 2023; Singapore, which accounted for 2.8% of total world exports; or even India, which represented 2.1% of the total.

Drivers relocation

As in other sectors, reshoring of supplies is often driven by a wide range of cost and risk considerations beyond tariffs. In the case of labor costs, moving manufacturing may be beneficial. Labor costs in Vietnam, Thailand, Cambodia and Malaysia all offered cost advantages over mainland China, with Cambodia being the lowest in terms of hourly wages, according to our data.

Operational risk controls are also important when ensuring a consistent flow of product. This is vital for solar panels where large-scale projects depend on on-time delivery.

India could be a potential site to move manufacturing, both for geopolitical and cost reasons. The country has lower manufacturing wages than mainland China, at the cost of additional operational risk, and is itself a large market for goods.

New sources of US solar imports

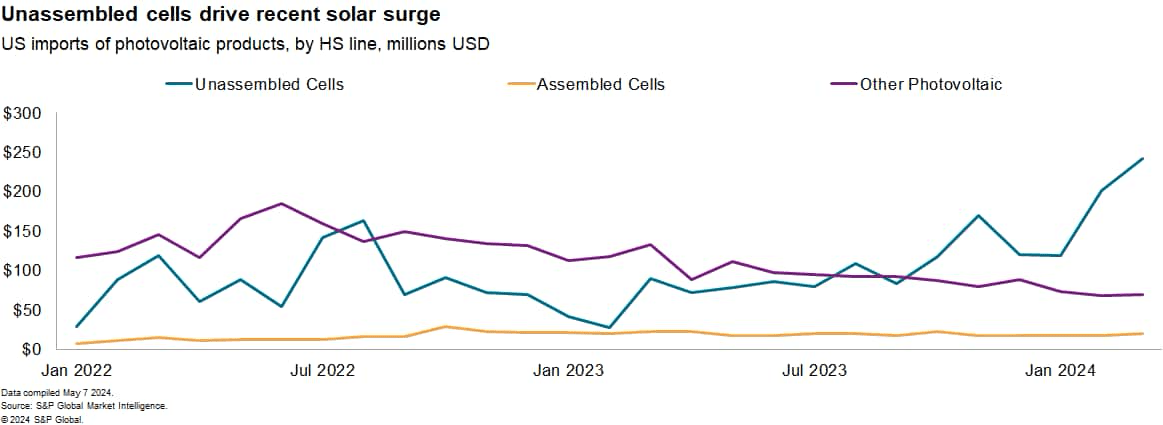

U.S. solar panel imports increased 78.2% year-over-year in 2023, but slowed somewhat in the first quarter of 2024.

Growth was centered on unassembled modules, which accounted for 67.9% of total PV imports in the first quarter. These unassembled modules saw their imports increase by 252.7% year-on-year during the same period, after increasing by 2.7% in 2023.

The growth of unassembled modules may indicate that assembly is growing in the United States – this could allow companies to adjust for tariffs if unassembled modules from different countries are substitutable.

Imports of assembled modules fell 12.4% and accounted for only 6.7% of PV imports by value, while imports of other PV semiconductors fell 41.9% year-on-year in the first quarter. and represented 25.4% of imports.

Imports of solar panels from the countries targeted in the new case have grown much faster than total imports. Shipments from Thailand increased 152.8% year-on-year in 2023 and an additional 17.8% in the first quarter. Imports from Malaysia and Vietnam also increased. Cambodia, the other country cited in the petition, saw a turnaround as its imports fell year-on-year in the first quarter after increasing 209.5% in 2023.

Imports from the four countries combined accounted for 71.1% of total U.S. imports in 2023, up from 60.6% in 2019. Imports from mainland China remained a minor share of U.S. solar energy, representing 0.2% of imports by value in the first quarter of 2024 and in 2023 as a whole.

Company Responses

Businesses can respond to potential tariffs in two ways: by preemptively seeking new sources or by stockpiling additional goods. Another strategy may be to shift the destination of goods to countries without customs duties. Our data shows that more than half of Vietnam’s solar panel exports by value went to the United States in the 12 months to February 29. Other destinations like Singapore and India accounted for 13.5% and 5.6% of exports, respectively.

Even if new antidumping and countervailing duties were enacted, companies that share information with the ITC and the U.S. Department of Commerce could end up paying significantly less than the punitive rates applicable in all countries. Businesses also have many options to offset the impact of rising rates, even outside of changing sourcing. This may include increasing prices for customers – particularly with utility customers who may have cost-passing agreements with their end customers – or negotiating lower prices with suppliers further up the supply chain. ‘supply.

As the solar energy industry continues to evolve, it is essential that companies remain agile and proactive to adapt to the changing landscape of tariffs and trade policies.

Editor’s note: The summary bullet points in this article were chosen by the Seeking Alpha editors.