pingingz

Introduction

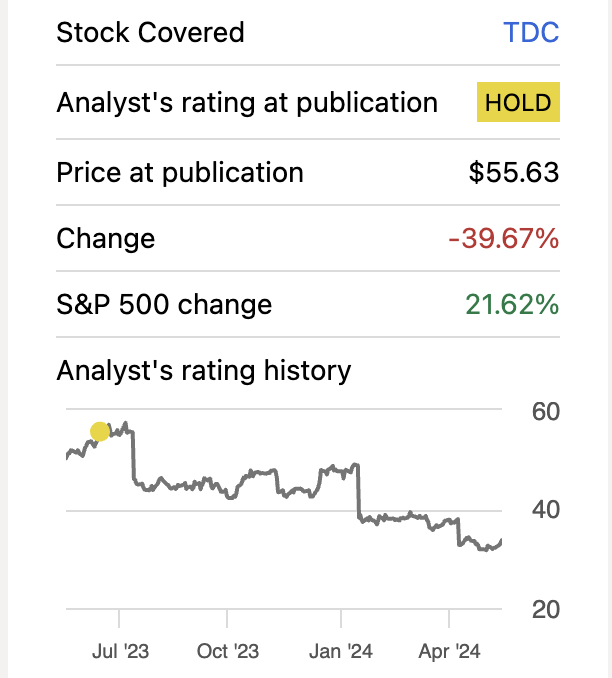

About a month ago, I received a price alert that one of my watchlist stocks had hit the target. This company was Teradata (NYSE:PMH). Since the last the time I covered the company, its stock price fell 40%, so I thought it might be a good time to look back at it and see how it performs throughout 2023 and whether it would be a good time to start a position now that it is much more attractive. The cloud performed well overall, while others lagged behind. However, I would like to see cloud growth reaccelerate before pulling the trigger at these price points. Therefore, I am reiterating the hold rating until I get more information on earnings progression.

In search of Alpha

Briefly about finances

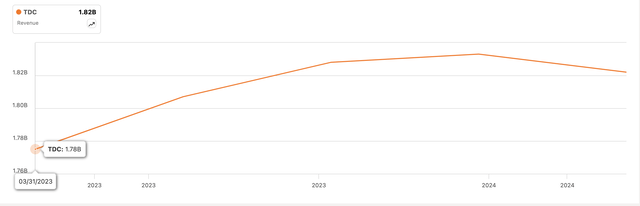

Looking at revenue performance over the last Over the past year, growth has been quite slow and appears to have peaked in late 2023. The only reason the company has seen some growth is because its public cloud segment has far outperformed the rest revenues. However, it appears this wasn’t enough to support the company in the most recent quarter, as it saw an overall decline of 2% year-over-year.

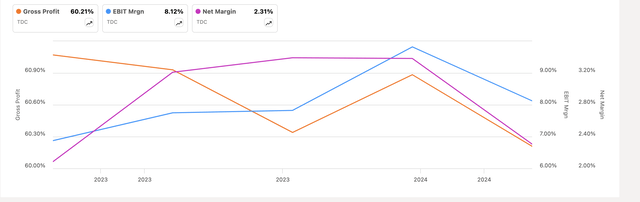

In terms of GAAP margins, these have seen some volatility over the past year, with no apparent trend in sight in the last quarter. The downside I can see is that it has seen a downward trend in Q1 24. GAAP margins are well below what the company reports on an adjusted basis due to excessive profit-based compensation. actions, and I’m not a big fan of that.

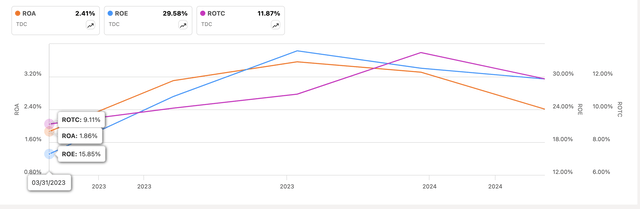

Still in terms of efficiency and profitability, the company’s ROA is slightly on the lower range, which indicates to me that management is not using the company’s assets as efficiently as possible. I would like to see at least double the current yield. On the other hand, the company’s ROE is fantastic and well above my minimum requirement of 10%, which tells me that management is good at using shareholder capital. Additionally, the company’s return on total capital is higher than I consider investment-worthy, and I pay a premium to own the company, which is over 10%. Overall, I’m happy with these metrics and how they’ve changed over time, with the exception of GAAP margins which still show no direction.

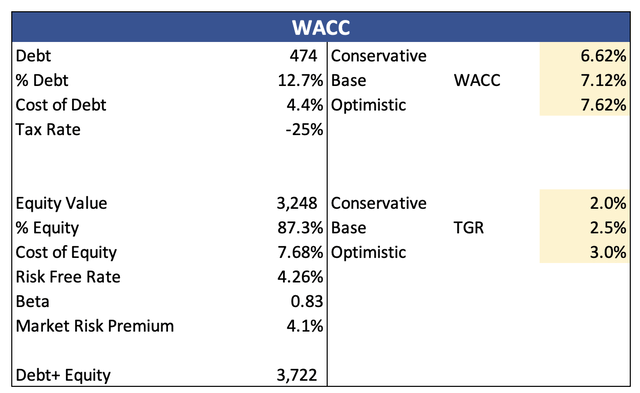

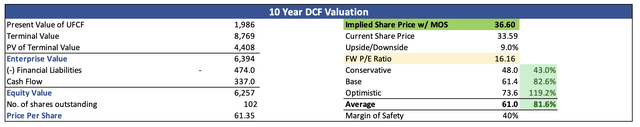

In terms of the company’s financial position, TDC had approximately $337 million in cash and equivalents, compared to $474 million in long-term debt as of Q1 24, filed on May 7.th ’24. The company’s interest coverage ratio was around 6x, so the amount of debt it has on its books is not a problem in my opinion, however, it would be good to see the company continue to pay it back over time, so all available resources can be used to promote business growth and reward loyal shareholders.

Overall, I’m not too impressed with the company’s performance throughout 23. Margins have shown no positive trends and revenue growth has been minimal throughout the year. year, with the only performing segment being public cloud, while other revenue segments performed poorly. Unsurprisingly, the company’s stock price has fallen since I last wrote about it.

Outlook feedback

Subscription-based revenue

The company has moved from perpetual purchase options to subscription purchase options. This is a smart move in my opinion because it makes it easier to predict what kind of cash flow it will receive throughout the year. However, this segment has not seen much growth. The perpetual revenue migration is almost complete, so the company needs to find a way to grow subscriptions at a much healthier rate than currently. It appears that once the migration is complete, the company will see low single-digit growth for the segment and will contribute to overall cloud growth. I think it’s pretty unexciting in terms of growth here. I would like to see some sort of additional innovation for this model. Perhaps develop cloud-native versions of their products that would be specifically designed for subscription models. I’m sure there will be customers who appreciate this kind of flexibility and scalability. For now, I don’t expect miracles from this revenue segment until we hear about new initiatives to drive growth.

Public cloud

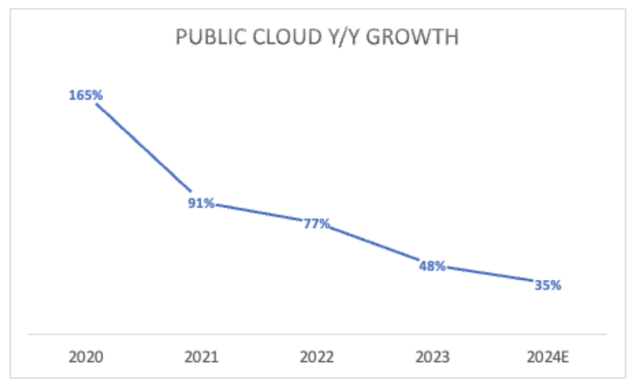

This segment continued to perform very well throughout the year; however, the growth rate is steadily declining, which is a bit worrying. This segment is expected to continue to perform well over the next decade, but the slowdown has been significant. I would like to see it reaccelerate going forward or at least stabilize to where the company expects the segment to end in FY24, which is between 35% and 41% growth. Cloud adoption is still alive and well for many businesses that are still in transition, so there should be plenty of opportunity for growth in this segment. Public cloud is expected to become the largest contributor to total revenue over the next two years, so even if it slows down slightly more, it should perform much better overall than it has over the past two years. The question now remains whether management can capitalize on such prospects. In my opinion, doubling down on Public Cloud should be the main priority because it seems to be the best in terms of growth and I would like to see it accelerate again.

AWS (AMZN) is experiencing a slowdown in its cloud adoption, but given the size of the company, that’s expected. Additionally, it faces strong competition from Azure (MSFT) and Google Cloud (GOOG) (GOOGLE) who are looking to take market share from AWS. TDC partners with these data cloud providers, so it doesn’t matter which one wins the largest market share. The company must provide value so that customers will turn to their offerings instead of turning to the competition.

In summary, I would like to see better growth in the subscription segment through the introduction of some initiatives that could lift the low single-digit growth a bit higher. The Public Cloud segment is seeing a downward trend in terms of growth, which is slightly worrying. I would like to see the company continue to build stronger partnerships with major data cloud providers to re-accelerate growth prospects.

Assessment

So let’s see what kind of valuation we get once we introduce updated assumptions about revenue growth and margins.

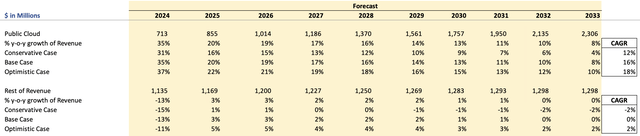

First, I wanted to look at what kind of growth the public cloud could see over the next decade. Considering the chart above, we can see that the trend is downward, so without being too optimistic, I assume that growth will slow down to around 8% by FY33. This way, the segment will grow by approximately 16% CAGR in the base case. I would like to see an acceleration in growth, but I need a few more quarters to decide if I want to change growth or if linear growth downward is the right decision.

For the rest of the revenue, which will be primarily subscription-based revenue, the company said total revenue will be flat at 2% growth in FY24, meaning if we peg the growth of the cloud at 35% as we did. , the rest of the revenues will see a drop of around 13% year-on-year. Long term, the company says it expects low single-digit growth for remaining revenue. So I opted for about 3% in FY25, which will drop linearly to 0% by FY33. I’m not the biggest supporter of such low growth, given that the company is operating in a high-growth cloud sector, but it is better to be safe than sorry and apply overly positive assumptions. Below are these revenue estimates.

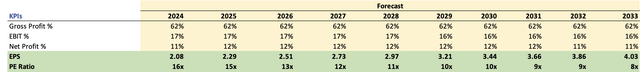

For margins, I decided to use the company’s non-GAAP metrics because that’s what they tend to focus on the most when it comes to results. I also decided to keep them stable throughout the valuation model, precisely because they are already adjusted metrics and inflate the company’s numbers. Below are these estimates.

For the DCF analysis, I use the company’s WACC as the discount rate and 2.5% as the final growth rate, because I would like the company to at least meet the US inflation target at long term.

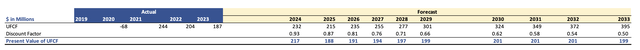

With all the inputs above, we obtain the following cash flows for the DCF model.

Additionally, because the company uses adjusted figures, which are very different from GAAP figures, I will add a 40% discount to the final intrinsic value calculation, which will be an additional margin of safety and give me more margin maneuver. error in my estimates. That said, Teradata’s intrinsic value is around $36.6 per share, meaning it is currently trading at a slight discount.

Closing comments

So, now that the company’s stock price has fallen significantly since I last covered it, it seems like it’s not a bad time to start a position here. Why do I always recommend not acting on it? Well, for me the reason is simple. I would like to see revenue growth be much stronger than what the company has been able to achieve recently. I would like to see the public cloud segment finally become the primary revenue generator, and if it can continue to grow at decent double-digit growth rates, then I could see revenue growth for the company speed up once again. Before committing any capital to this company, I think I’ll wait until the company’s next earnings report is released and see what management has to say about the future outlook and how the cloud segment is performing so far. ‘now.

There are many opportunities ahead in terms of AI/ML applications and I would like to see the company seize them. As I mentioned, the company hit my price alert that I completely forgot I set last year, so I am tempted to start a position, however, I will make that decision over the next couple of quarters. The risk/reward ratio is much more attractive than last year.