Here is the whole Document from the Legislative Tax Office on Foxconn (since the links to the original site don’t work in my previous post “Wisconsin FoxConned by Walker et al.”:

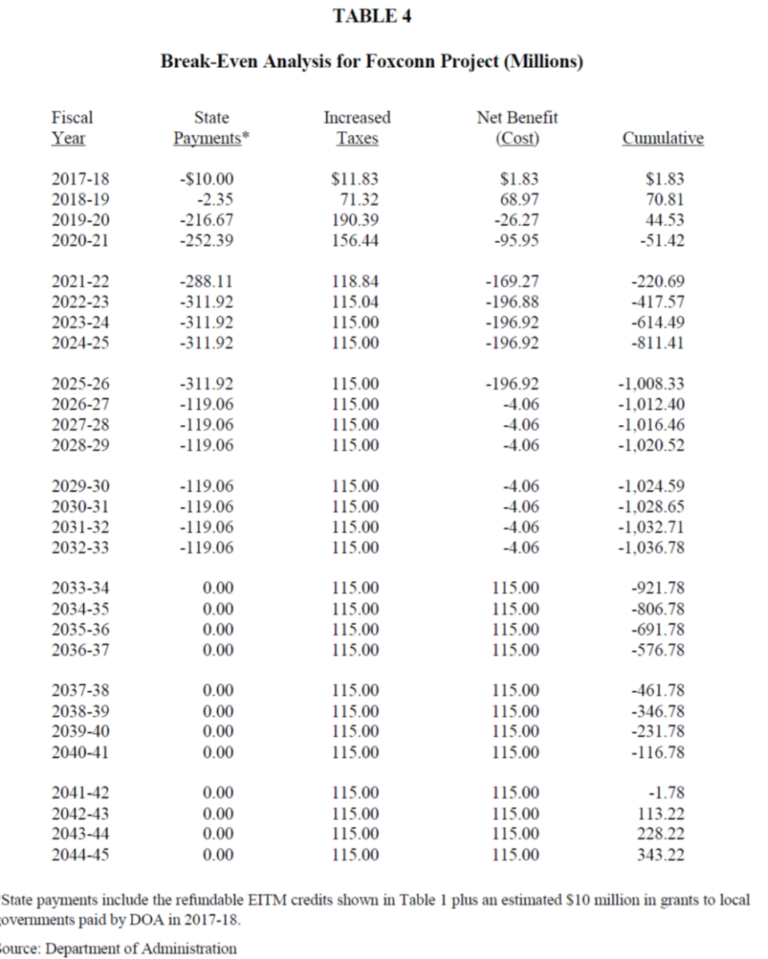

Table 4 (which underlies these graphs) below:

Source: LFB (2017).

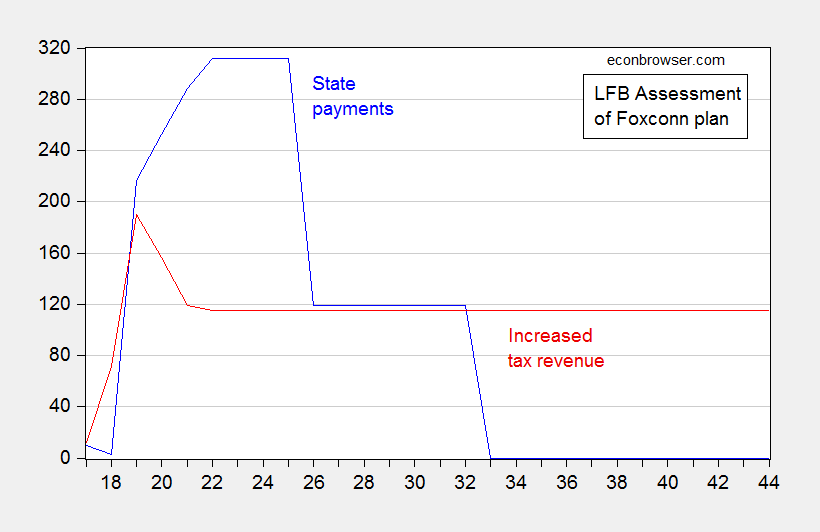

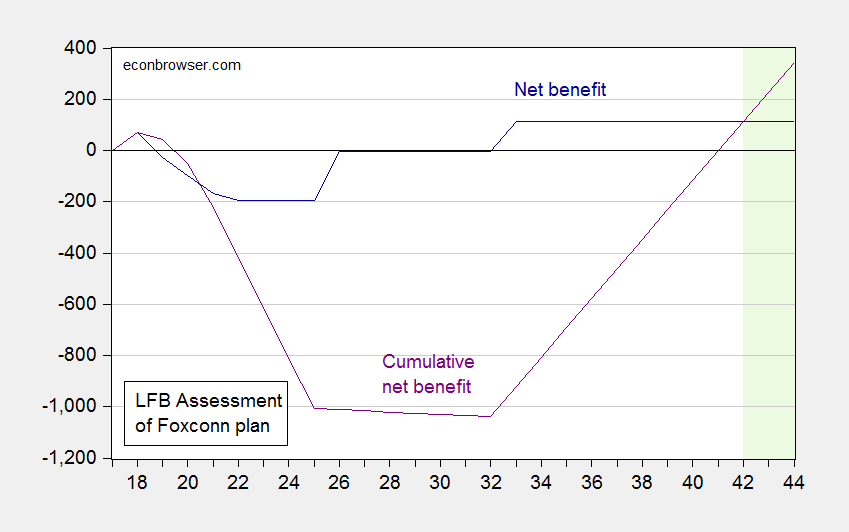

This table forms the basis of these graphs:

Figure 1: State payments (blue) and increased tax revenue (red) under Bill 1 of the August 2017 Special Assembly, in millions of dollars, by fiscal year (2018 indicates fiscal year 2018-19 ). Source: Legislative Tax OfficeTable 4.

Figure 2: Net benefits calculated as increased tax revenue less state payments under August 2017 Special Assembly Bill 1 (dark blue) and cumulative (purple), in millions of dollars, per fiscal year financial year (2018 indicates financial year 2018-19). Source: Legislative Tax OfficeTable 4.

The initial contract has been substantially revised (!), so here are the obligations of the 2021 contract.

Source: Legislative Audit Office (2023).

Wisconsin taxpayers must therefore pay Foxconn to pay employees who are do minimal work. Although this has multiplier effects (in other words, Scott Walker and the Wisconsin GOP are de facto the greatest examples of Keynes’ aphorism “let them dig holes”), they are unlikely to have all the upstream multiplier effects on suppliers etc. which have been envisaged e.g. Williams (2017).

Note that the above does not take into account spending by locality. From Mitchell (2019):

In addition to state grants, localities agreed to a $764 million site development grant (which was later increased to $911 million), funded by tax increment financing. The state has agreed to guarantee 40 percent of these loans if the local government is unable to repay them (but we do not include this potential cost in the state grants listed in Table 1). Beyond these financial incentives, the state also exempted the company from certain wetlands regulations, allowing it to bypass standard environmental impact reporting and dump materials in non-federal wetlands without permits. It also authorized more than $332 million in electric and gas utility infrastructure improvements to serve the plant, the costs of which will be borne by other utility customers. Finally, the village of Mount Pleasant declared 2,800 acres “blighted,” despite the area’s relatively low crime rate, and spent $160 million to acquire property via eminent domain to transfer to Foxconn.

So, even if the state of Wisconsin was somewhat cost-insured, localities were fucked incurred significant uncompensated costs.

So, looking back, it’s hard to see how certain policymakers (the Republican Party of Wisconsin, Scott Walker, Ron Johnson) were so bamboozled. (I’m sure almost everyone now understands how Donald Trump was so fooled). See more here, here.