Don Boudreaux writing:

Unlike you who finds May 6 by Duncan Braidth harangue against free trade supporters “devastating”, I find that tendentious. Braid writes triumphantly as if he has caught us free traders in another of our Keystone Kops antics—most notably here, our effort to blame inflation on tariffs. Yet no competent economist or free trade advocate is guilty of this ridiculous accusation. If that were the case, Braid’s proof of free traders’ belief that tariffs cause inflation would consist of more than just a connection with a piece, of all places, Voice.

If inflation means an increase in the money supply, then no, tariffs do not cause inflation.

If inflation means a persistently higher rate of growth in the price level, then no, tariffs do not cause inflation.

But if inflation means an increase in the price level, then yes, tariffs TO DO cause inflation.

One of the equations that I have found most useful for understanding macroeconomics is MV = Py. (M is the quantity of money, whether it is M1, M2 or another M; V is the velocity of money; P is the price level; y is real income.)

Adding a tariff makes the economy less efficient, making real income lower than otherwise. Imagine that many tariffs are added and, as a result, real income is 0.5 percentage points lower than it would otherwise be. That’s a lot, actually. Then, if M and V are unaffected, the price level, P, will be 0.5 percentage points higher than it would otherwise be. QED.

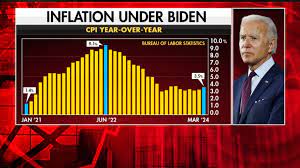

Does this mean that the addition of customs duties is a major cause of inflation? Of course not. 0.5 percentage points in a given year (the year the tariffs are added) is a small fraction of the inflation rate of 3 or 4 percent. 0.5 percentage points, plus 3 years of average inflation above 4 percent per year, constitutes a rounding error.