Olena_T

We have seen some market widening in 2024 compared to 2023. Hopefully this is a sign of an upward shift with greater participation from sectors other than technology.

If inflation eventually declines, the Fed will likely cut rates, which should help businesses grow their profits. As a result, cyclical stocks, particularly industrial, financial and energy stocks, should benefit.

Of course, inflation has remained stubborn, and it could push back rate cut expectations until later this year. However, the doves arrive; It’s a question of when, not if, in my opinion.

This article examines whether enlargement will take place in 2024 or 2023. We’ll also look at what’s needed to expand stock growth and lead to higher overall returns in the market. Hopefully this analysis of key sectors and stocks will help you diversify and increase your earnings. in 2024, whatever the noises from the Fed.

Performance 2023 – Mainly technological

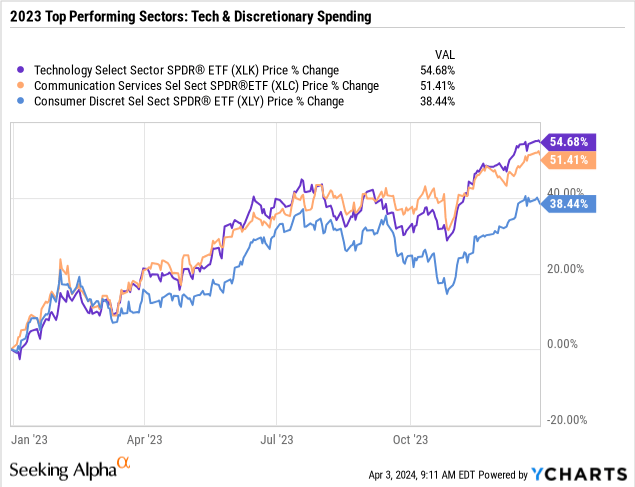

In 2023, it is technology and consumer discretionary stocks that have pushed the market higher. In the chart below we can see that the three best performing sectors of the S&P 500 were:

+54%: Technology Selected Sector SPDR® Fund ETF (XLK)

+51%: Communication Services Selected Sector SPDR® Fund ETF (XLC)

+38%: Discretionary consumption Select SPDR® Fund Sector ETF (XLY)

The Magnificent 7

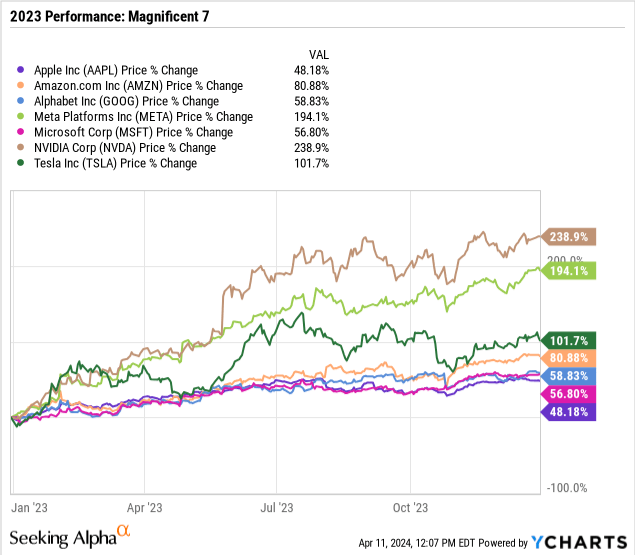

The Magnificent Seven surged in 2023, with Apple’s stock price hitting the lowest of the seven with a return of 48%. You know it’s a good year when the worst performer in the group makes a gain of almost 50%.

- Apple Inc. (AAPL) +48%

- Amazon.com Inc. (AMZN) +81%

- Alphabet Inc. (GOOGLE) +59%

- Meta Platforms Inc. (META) +194%

- Microsoft Corp.MSFT) + 57%

- Nvidia Corp.NVDA) + 240%

- Tesla Inc. (TSLA) +102%

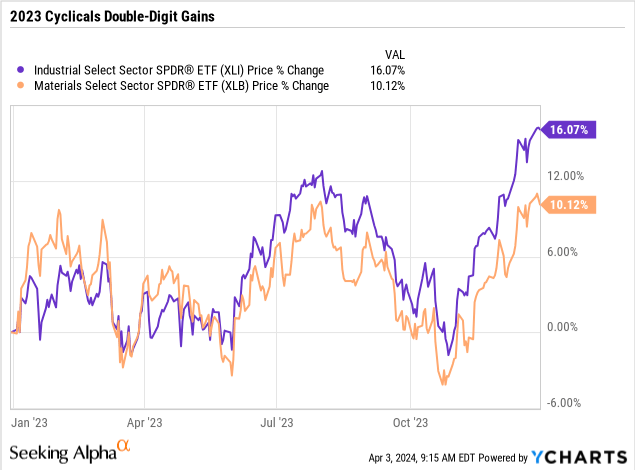

Cyclical sectors 2023

THE cyclical sectors didn’t get much press, but got in on the action, as shown below.

- Industries jumped 16% as measured by the SPDR® ETF for Select Industry Sectors (XLII).

- Materials saved by more than 10% for the year, as measured by Select sector SPDR® fund ETFs for materials (XLB).

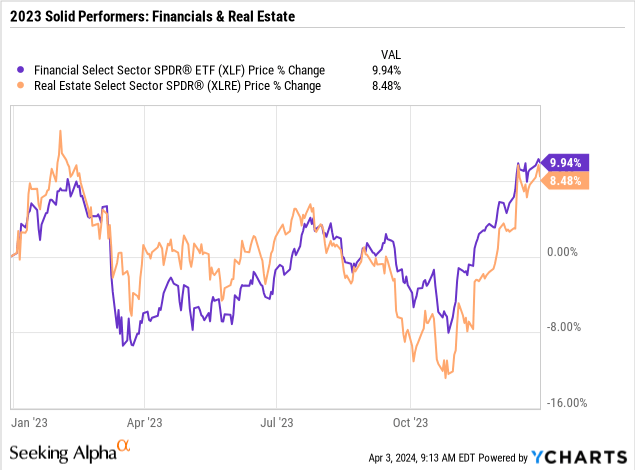

We recorded solid performance in the financial and real estate sectors:

- Close to a 10% gain for financials as measured by the SPDR® ETFs for Selected Financial Sectors (XLF).

- Real estate increased by 8%, according to the Real Estate Select Sector SPDR Fund ETF (XLRE).

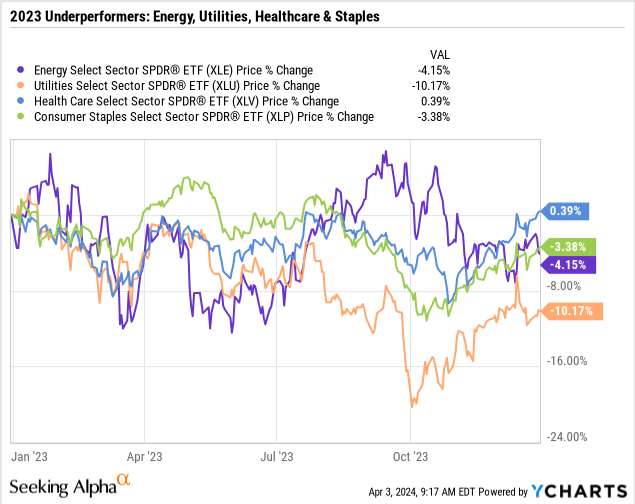

Underperformers sectors were not a surprise in a growth environment, with utilities, healthcare and consumer staples generate negative returns.

However, a surprise was that the the energy sector was down 4% for the yearas measured by the Energy Select Sector SPDR® Fund ETF (XLE).

However, it’s been a volatile year and the XLE’s annual performance doesn’t reflect what’s been happening in the industry.

2024 enlargement story

So far in 2024, we are seeing broadening growth across several S&P 500 sectors.

So far so good: S&P up like last year

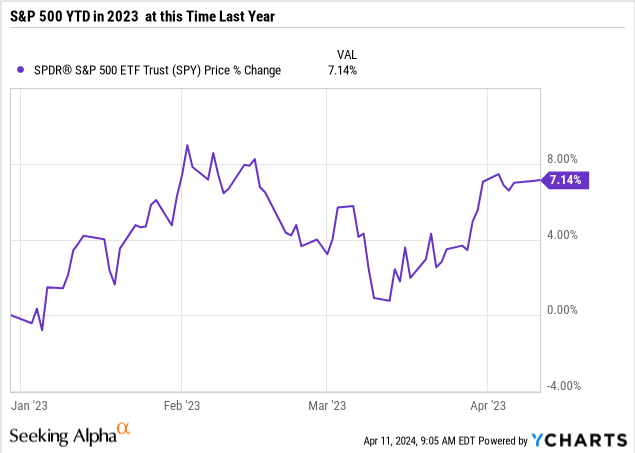

With all the news surrounding the Fed and the AI rally, it may come as a surprise that the The S&P 500 is higher than it was this time last year.

- In 2023, THE The S&P 500 is up +7% this time last year (January to April).

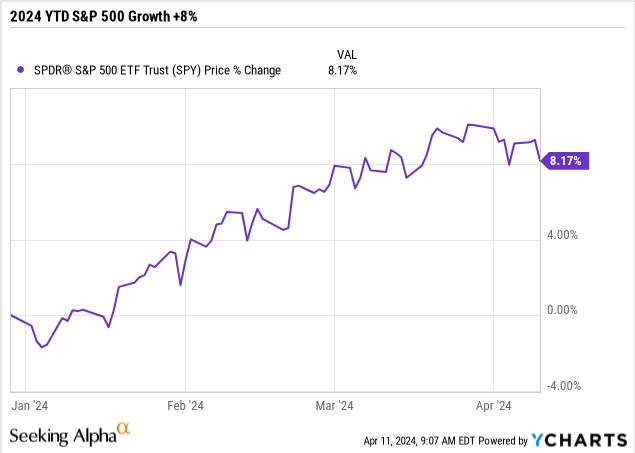

- In 2024, THE The S&P is up +8% Since the beginning of the year (see the following two graphs).

Cumulative 2024: The growth of the S&P 500 is +8%.

Year 2024: Magnificent Seven (now The Fab Five)

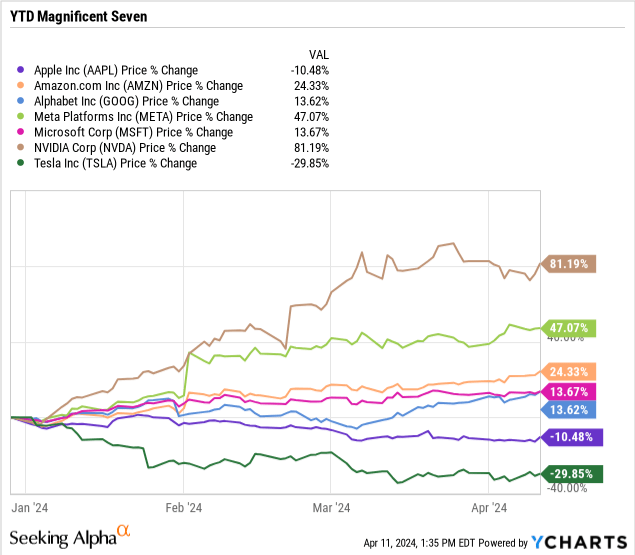

We’ve seen strong gains from mega-cap technology year-to-date, which has helped keep stocks higher for longer.

However, two of the Magnificent Seven have temporarily fallen from elite performance status: Apple Inc. (AAPL) is down -10%while Tesla Inc. (TSLA) is down -30%. The other five are much higher:

- Amazon.com Inc. (AMZN) +24%

- Alphabet Inc. (GOOGLE) +14%

- Meta Platforms Inc. (META) +47%

- Microsoft Corp (MSFT) +14%

- Nvidia Corp.NVDA) +81%

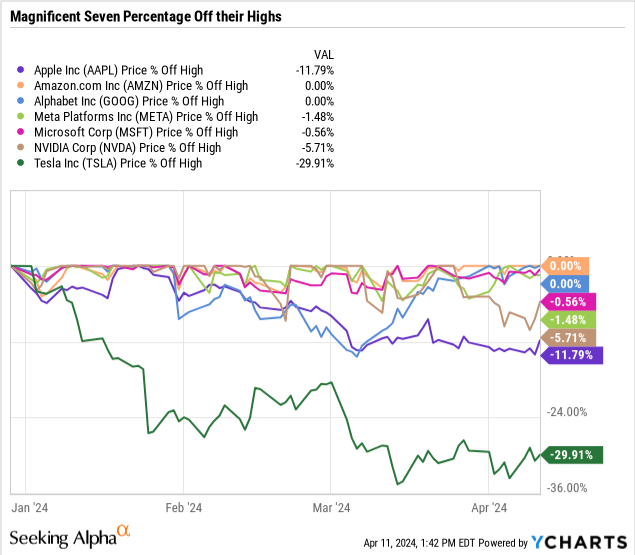

Magnificent 7: stuck at their peaks

The year-to-date numbers don’t tell the whole story, as most of the Magnificent Seven have remained stalled at their current highs, but at least they haven’t declined much.

Most are only below their peaks by a single-digit percentage, with the exception of Apple (-12%) and Tesla (-30%).

Of course, consolidation makes sense after the huge gains made over the last year. However, the Magnificent Seven might be tired.

On the other hand, it could be good news if the blocking of the Magnificent Seven means that capital shifts to other sectors, thus promoting the enlargement narrative.

S&P 500 Sectors for 2024

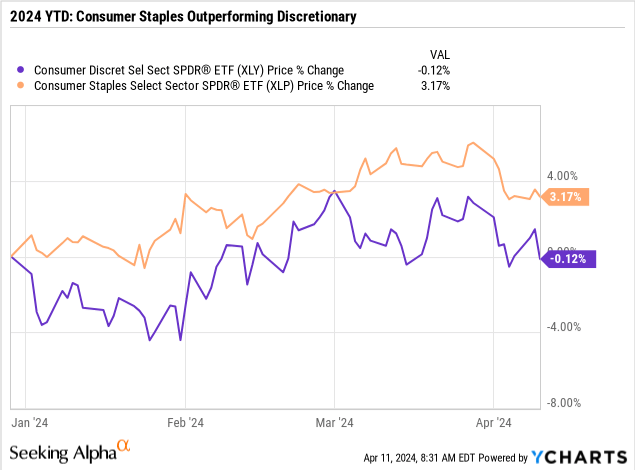

- Commodities are up 3% after declines in 2023 and are currently beating consumer discretionary stocks (XLY).

Good news: If this is the result of diversification, watch out for significant increases in commodities, as this could mean investors are becoming defensive.

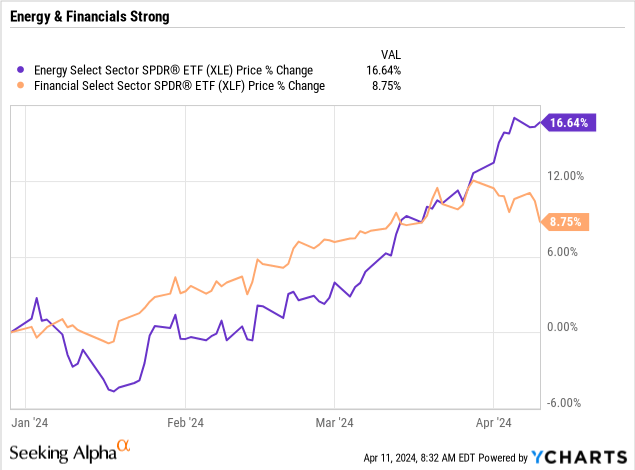

- Financial stocks remain strong because insurance companies get returns on their premiums invested at higher interest rates. Meanwhile, investment companies are still doing well.

- The energy bounces back, which could be a favorable story for economic growth. However, this could lead to inflation and delay Fed rate cuts, which would be negative for the S&P 500.

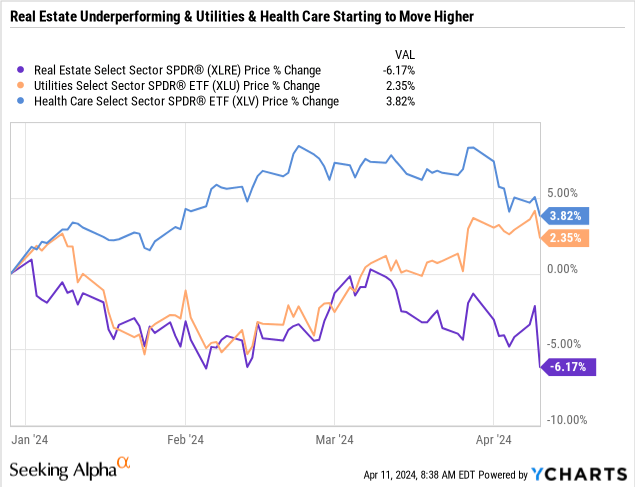

- Real estate is down 6% via the ETF Real Estate Select Sector SPDR Fund (XLRE) after increasing by 8% in 2023.

- Utilities are up nearly 4% via the Utilities Select Sector SPDR® Fund ETF (XLU).

- Health care is up 2.35%, according to the Health Care Select Sector SPDR® Fund ETF (XLIV).

If you remember, utilities and health care were negative last year.

Maybe some good news: There could be signs of a broadening, but watch for unusual gains in the utilities and healthcare sectors, as this often indicates the market is becoming defensive.

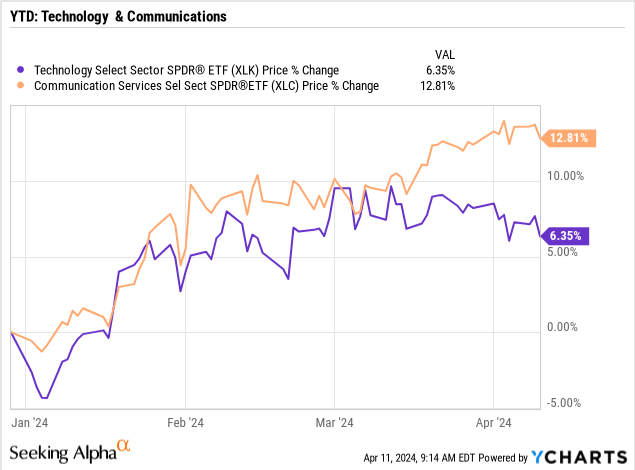

- Communications Services: Up 12% since the beginning of the year via THE ETF of SPDR® select sector communications services funds (XLC).

- Technology: up 6% via the Select Technology Sector SPDR® Fund ETFs (XLK).

Good news: The S&P 500 will need strong performance from the technology sector, but will not rely too heavily on these sectors to rise in 2024.

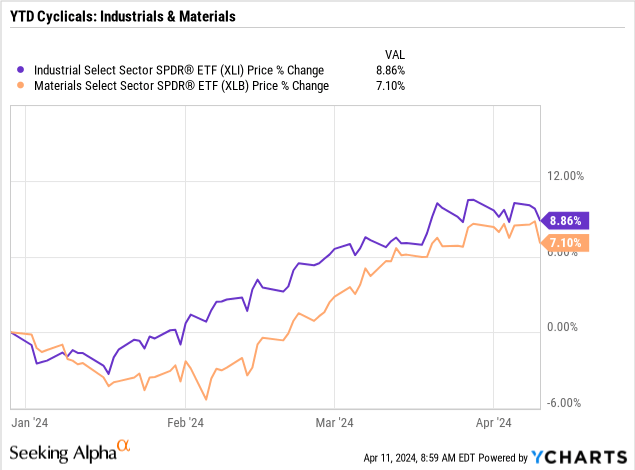

- Industrial products since the start of the year are up almost 9% via the Industrial Select Sector SPDR® Fund ETF (XLII).

- Materials are up 7% Select sector SPDR® fund ETFs for materials (XLB).

Good news: Whether a strong economy leads to strong cyclical earnings.

Points to remember:

The expanded narrative could take shape. The S&P has basically performed the same year to date as it did this time last year. However, the Magnificent Seven have plateaued near their peaks (for the moment).

Other sectors need to step up their efforts and replace the massive growth in tech last year, as the sector is unlikely to post another +50% gain. Consumer discretionary and cyclicals need to perform well, otherwise a broader sector-wide rally will be necessary.

Monitor the commodities, utilities and defensive sectors. Broadening is a good thing, but big gains could pull money out of growing sectors like technology, which would be negative for the S&P 500.

Profit growth from Fed cuts is needed to support the narrative that lower rates and overall economic growth can offset remaining inflationary pressures.

Unresolved Inflation, Fed Data-Dependent Policy, and its verbal rhetoric of whether to cut or not to cut will continue to confuse markets, causing volatility. If the Fed does not reduce its cuts before the end of the year, we are likely to expect a 5-10% correction, as noted in my previous article: How the Fed could push the S&P 500 into correction.

In the future, the profits of industrialists and banks will be important to monitor.

The question remains whether all of these factors will be enough to drive year-over-year growth in stocks and the S&P 500 or whether we will see a more sector- and stock-specific market of winners and losers. losers in 2024.

More soon. Good luck there.