In May, 51 million retirees receiving benefitsI took home an average Social Security check totaling $1,916.63., which equates to $23,000 on an annualized basis. While that doesn’t seem like a game-changing amount of money, the average retiree would struggle without their guaranteed monthly benefit.

For the past 23 years, the national pollster Gallup has surveyed retirees to assess their dependence on Social Security income. Between 80% and 90% of respondents always considered their remittances a “major” or “minor” source of income. In other words, a majority of retirees might not be able to cover their expenses if Social Security did not exist.

Given the importance of this program for more than eight decades to the financial well-being of our nation’s aging workforce, it is no surprise that the Annual Cost of Living Adjustment (COLA ) is the announcement most awaited by beneficiaries.

What exactly is the Social Security COLA and how is it calculated?

Simply put, the Social Security COLA is the mechanism that accounts for inflation. If you were to build a basket of all the goods and services that older people buy regularly and the purchase price of these collective goods and services increases, benefits would ideally increase by a proportionate amount to ensure that it there is no loss of purchasing power. COLA is the tool that determines how much benefits are expected to increase from year to year.

In the 35 years since the first Social Security retirement benefit was mailed in January 1940, cost-of-living adjustments have been disbursed on an arbitrary basis by special sessions of Congress. Not a single COLA occurred during the entire 1940s, and only 11 total adjustments were made before 1975.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) became the annual inflationary measure of the main U.S. retirement program. Each major spending category and subcategory within the CPI-W has its own respective weighting, helping to reduce the index to a single digit each month. This makes it very easy to determine whether prices are increasing (inflation) or falling (deflation).

Although the CPI-W is released monthly by the U.S. Bureau of Labor Statistics (BLS), the CPI-W figures for the trailing 12 months of the third quarter (July-September) are the only figures used to calculate the Social Security CPI-W. COLA for the coming year.

If the average CPI-W figure for the third quarter (Q3) of the current year is higher than the average CPI-W figure for the same period last year, inflation has occurred and Beneficiaries are about to receive a larger Social Security check. The percentage difference between these third-quarter average CPI-W readings, rounded to the nearest tenth of a percent, determines how much benefits will increase in the coming year.

Social Security’s cost-of-living adjustment hasn’t done this since the late 20th century

For the 51 million retired beneficiaries who currently receive a monthly check, the 2025 Social Security COLA could be very special. Although it is not currently on track to see a dramatic year-over-year increase, it is nonetheless on track to achieve something that was last seen in 1997.

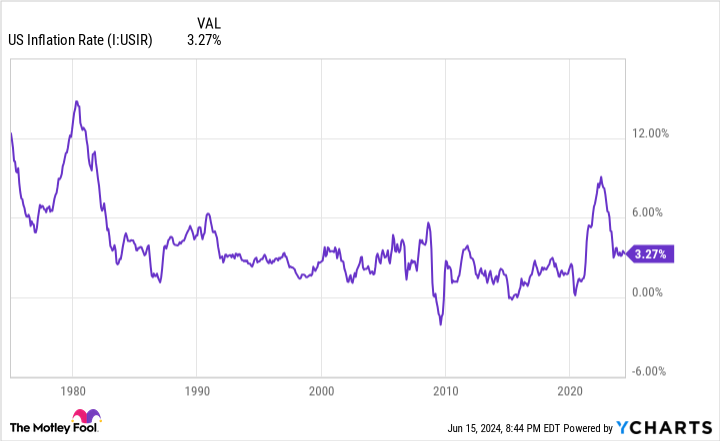

On June 12, the BLS released the much-anticipated May inflation report, which showed that the CPI-W increased 3.3% on a trailing 12-month (TTM) basis. This represents a drop of one-tenth of a percent from the TTM increase in the April inflation report.

Based on this new round of inflation data, Social Security policy analysts at the Senior Citizens League (TSCL), a nonpartisan senior advocacy group, forecast a COLA of 2.57% for 2025 (which would round to 2.6%), which is down from 2025. a previous forecast of 2.66% following the release of the April inflation report. Over the past 20 years, the average cost of living adjustment has been 2.6%.

However, even average COLAs have been difficult to achieve consistently since the start of this century. Deflation resulted in no COLAs in 2010, 2011, and 2016, while the 2017 COLA was the lowest on record (just 0.3%). In total, there have been 11 years with a COLA of 2% or less since 2000.

But over the past three years, recipients have gotten a nice boost to their Social Security check. Cost of living adjustments totaling 5.9%, 8.7% and 3.2% were passed through in 2022, 2023 and 2024 respectively. The COLA of 8.7% in 2023 was the highest in 41 years.

If the TSCL forecast proves correct and Social Security recipients receive an estimated cost of living adjustment of 2.6% in 2025, it will be the first time since 1997 that there have been four consecutive years of COLA totaling at least 2.6% (each COLA between 1988 and 1997 ranged between 2.6% and 5.4%).

What would a 2.6% COLA mean in dollar terms? For the average retired worker, their monthly check would increase by about $50. Meanwhile, the average disabled worker and average surviving beneficiary could expect their monthly payment to increase by $40 and $39, respectively.

Higher COLAs Just Aren’t Enough for Retirees

Although the first four-year period of COLAs totaling at least 2.6% in 28 years would likely be applauded by those receiving a Social Security check, the fact remains that seniors continue to be the first victims when examined over several decades.

In May 2023, TSCL released a study comparing overall Social Security COLAs between January 2000 and February 2023 to price differences in a basket of goods and services regularly purchased by seniors. While the overall COLA has increased by 78% since the start of the 21st century, the price of the basket of commonly purchased goods and services has collectively increased by 141.4% since January 2000.

In other words, the purchasing power of a Social Security dollar has fallen 36 percent since the start of this century. Although COLAs have been somewhat higher in recent years, they often fail to keep pace with the inflation that seniors face.

The culprit for this constant loss of purchasing power is the CPI-W. As its full name suggests, it tracks the spending habits of “urban workers and office workers“These are primarily working-age Americans who currently receive no Social Security benefits. More importantly, they spend their money differently than the 86% of Social Security recipients who are 62 or older.

For example, older adults spend a higher percentage of their monthly budget on housing and medical care than the average American. On a TTM basis, inflation for housing and medical care services stood at 5.4% and 3.1%, respectively, in May 2024, according to the Consumer Price Index for All Urban Consumers (CPI -U).

Housing inflation has remained stubbornly high due to the Federal Reserve’s hawkish monetary policy and rapidly rising mortgage rates. At the same time, inflation in medical care services has accelerated over the past seven months. The purchasing power of Social Security income continues to decline over time because the CPI-W does not properly weight the largest costs for older adults.

I’m sorry to say that a planned 2.6% cost of living adjustment in 2025 is unlikely to reverse this dynamic.

The $22,924 Social Security Bonuses Most Retirees Completely Ignore

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help you boost your retirement income. For example: a simple trick could earn you up to $22,924 more… every year! Once you learn how to maximize your Social Security benefits, we believe you can retire confidently with the peace of mind we all seek. Just click here to find out how to learn more about these strategies.

Consult “Social Security Secrets” ›

The Mad Motley has a disclosure policy.

Social Security’s cost-of-living adjustment (COLA) for 2025 is on track to accomplish something that hasn’t happened in 28 years was originally published by The Motley Fool