motomotosc/iStock via Getty Images

Introduction

This title, Silvercorp Metals Inc (NYSE:SVM)(Toronto Stock Exchange:SVM:CA) is China’s leading silver producer and also mines gold, lead and zinc. I have been trading this stock for many years and am currently as long as this is a company that will benefit from the ongoing bull market in precious metals. Like many operators in this small sector of the market, it once traded at much higher price levels. As was the case in 2011, when it briefly flirted with a price of $14.00. Fast forward to today and it can be purchased for around $3.53, seeing a 75% price drop from its peak. I am not saying that there is now “blood in the streets”, but that its unpopularity has gone too far and that a significant readjustment of prices towards a higher level the level is on the cards.

Fundamentals

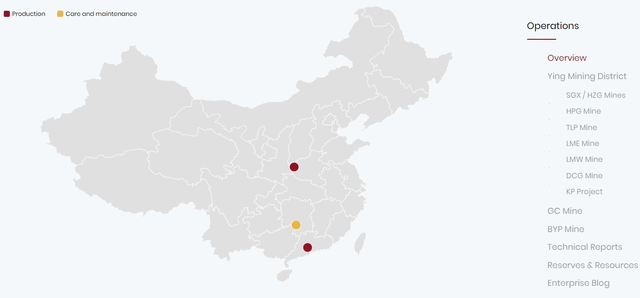

Silvercorp Metals Inc. was established 18 years ago and is headquartered in Vancouver, Canada. The mining activities of the companies are in China on two sites in production and one under care and maintenance, as shown in the map below.

Silvercorp Mines in China (Silvercorp website)

In terms of geopolitical risk, this operator derives most of its revenue from its mining activities in China. If you are not comfortable investing in it, then maybe this stock is not for you. For disclosure purposes, I am long Silvercorp and am comfortable holding this stock.

Financial datas

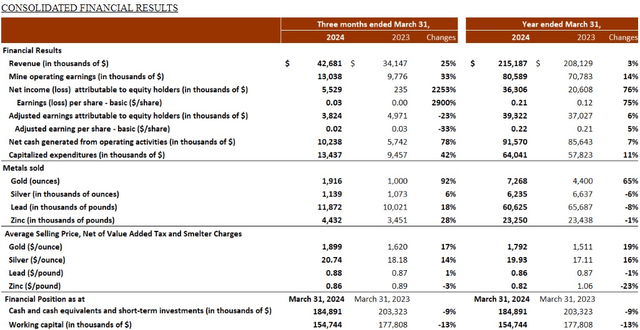

A few weeks ago, Silvercorp announced a semi-annual meeting Dividend of US$0.0125 per share, which isn’t anything out of the ordinary and it raises the question of what they intend to do with their current cash position. For clues about their intentions, we turn to their recently released financial and operating statements. results which were published on May 23, 2024 and are summarized in the table below, the title being that the ‘Adjusted net income was $39.3 million, or $0.22 per share, and operating cash flow was $91.6 million for fiscal 2024..’

Silvercorp Financial Reports (Silvercorp website)

I would like to draw your attention to the far right column of the table above and note that net income increased by 76% on an annual basis and earnings per share by 75%. Gold ounces sold increased by 65%, but silver, lead and zine all declined slightly. Silvercorp’s cash and cash equivalents are $184,891.00. There were therefore funds available to support their stated intention to seek projects with high margins and a long life of mine. Mergers and Acquisitions activity. In line with this expansion intention, they announced that they would acquire Adventus Mining Corp. (OTCQX:ADVZF) (TSXV: ADZN) in a transaction worth approximately C$200 million. Adventus’ crown jewel is an already permitted copper-gold project called El Domo, which is in Ecuador. In the April 26, 2024 announcement, they state the following:

The existing flow of US$175.5 million with Wheaton Precious Metals International Ltd, combined with that of Silvercorp existing cash flow and cash equivalents of approximately US$200 million are more than sufficient to fully finance El Domo through construction.

Acquisitions like this generally take time to digest, but the next two quarters should shed some light on the success of this approach. To make sure you don’t miss their progress reports, you may want to join their mailing list, although I’m sure you already know that.

In Q4 highlights we can see investment in stocks wallet valued at approximately $112.3 million as of March 31, 2024, which could be useful for acquisition purposes but may not be readily available.

The all-in sustaining cost per ounce of silver, net of by-product credits, was $11.38/ounce, but for the fourth quarter it is higher at $14.36/ounce. Given that silver is now trading north of $30.00/ounce, the second half of 2024 financial reports should be very interesting in terms of increasing profitability. This also applies to other operators in the precious metals sector who have managed to control their production costs well.

I encourage you to read these financial reports, as I tend to look for the metrics that I consider important and you will be able to spot other metrics that impact your own decision-making process.

If we now take a quick look at the Seeking Alpha As to In the section, this stock has an Industry rating of 144 out of 281 and an Industry rating of 9 out of 9, which is the lowest, and it has been rated as a Hold.

Silvercorp has a market capitalization of $659.693 million, a 52-week trading range of $2.08 to $4.39, a P/E ratio (TTM) of 16.00, and an EPS (TTM) of 0.22. For speculators looking to enter and exit this stock, liquidity is quite good.

Silvercorp trades on the TSX and NYSE American under the symbol SVM.

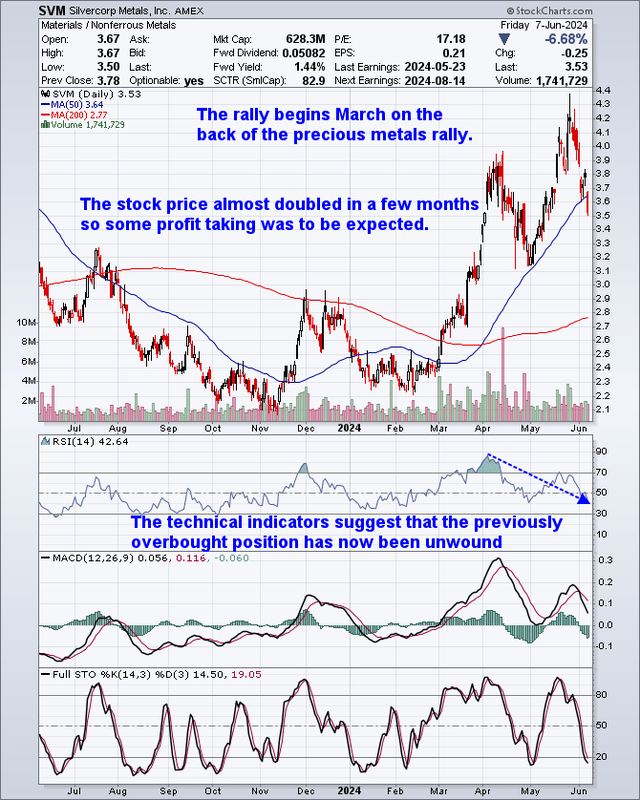

A quick look at the Silvercorp Metals Inc chart

The share price almost doubled in a few months, so profit taking was to be expected. The rally began in March following the precious metals rally.

Silvercorp One-Year Progress Chart (TA Stockcharts by Bob KIrtley)

Technical indicators suggest that the previous overbought position has now been unwound.

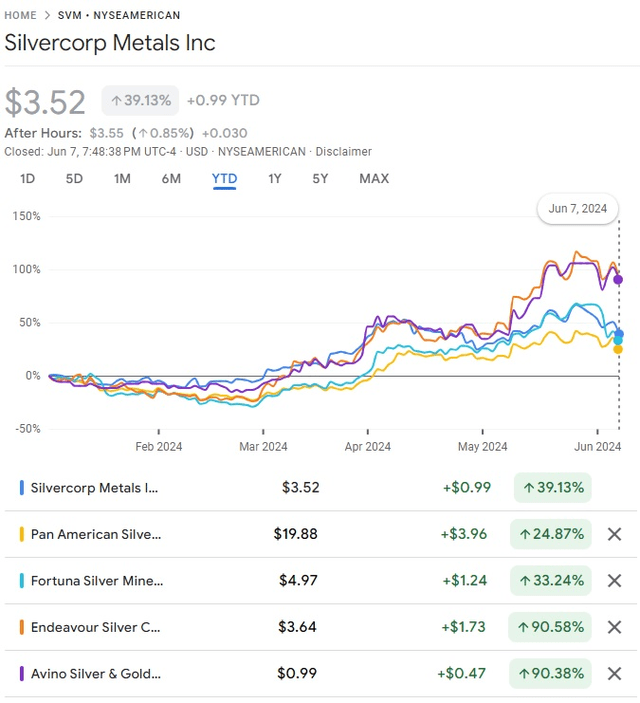

The following table compares Silvercorp to some of its peers

A quick look at the chart below that compares Silvercorp to some of its peers on a year-to-date basis shows that it’s not best in class, but a capital gain of 39 .13% is always nice to achieve. And depending on the time scale used, we may arrive at different results, but I prefer to stick to recent history.

Silvercorp is growing year-to-date compared to similar companies (Google Finance)

A Quick Look at the Silver Price Chart

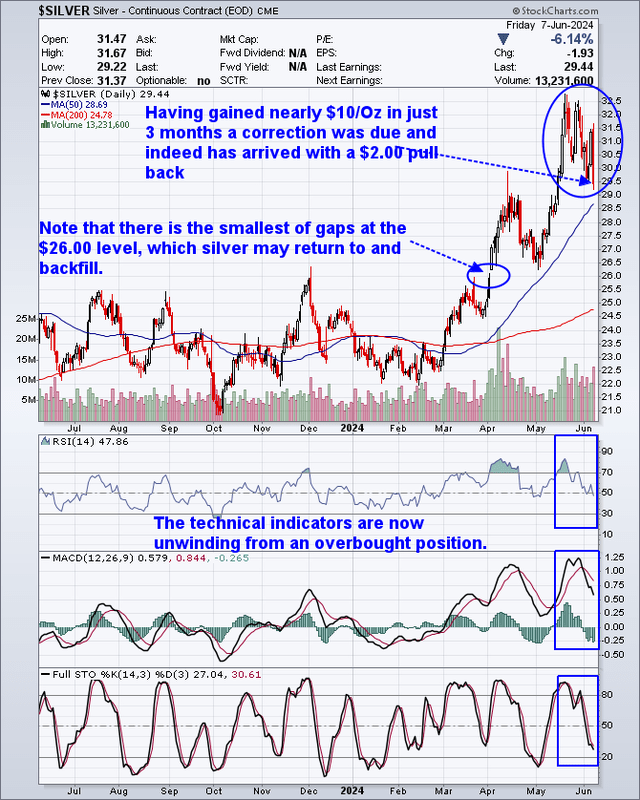

After gaining almost $10/ounce in just 3 months, a correction was expected and actually occurred with a $2.00 pullback. I also draw your attention to the gap at the $26.00 level formed when money rallied hard. It’s just a quirk of mine, but I warned that the money might just come back to fill that space.

A one-year chart of silver prices (TA Stockcharts by Bob Kirtley)

The technical indicators, the RSI, MACD and STO, are now moving out of an overbought position as the fizz dissipates.

Conclusion

In terms of geopolitical risk, this operator derives most of its revenue from its mining activities in China. If you are not comfortable investing in it, then maybe this stock is not for you.

Silvercorp is active on the acquisition trail, which suggests the future could be bright as this bull market accelerates.

I am Long this company and will continue to hold it, you may wish to wait for this correction to complete its move before making a purchase.

My readers know that I am Long both physical silver and gold and that I own a portfolio of stocks in the precious metals space, including but not limited to:

Avino Silver & Gold Mines Ltd (ASM)

Wheaton Precious Metals Corp.. (WPM)

Agnico Eagle Mines Limited (AEM)

Fortuna Silver Mines Inc. (FSM)

First Majestic Silver Corp.AG)

IMPACT Silver Corp.IPT: CA)

Pan American Silver Corp.. (PAAS)

Silvercorp Metals Inc. (SVM)

Now whether you are a precious metals specialist Bug or not, feel free to post your comments and I will try to respond to each one.

Take it easy because this is going to be a White-Knuckle Ride

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.