Andrei Yalanskyi/iStock via Getty Images

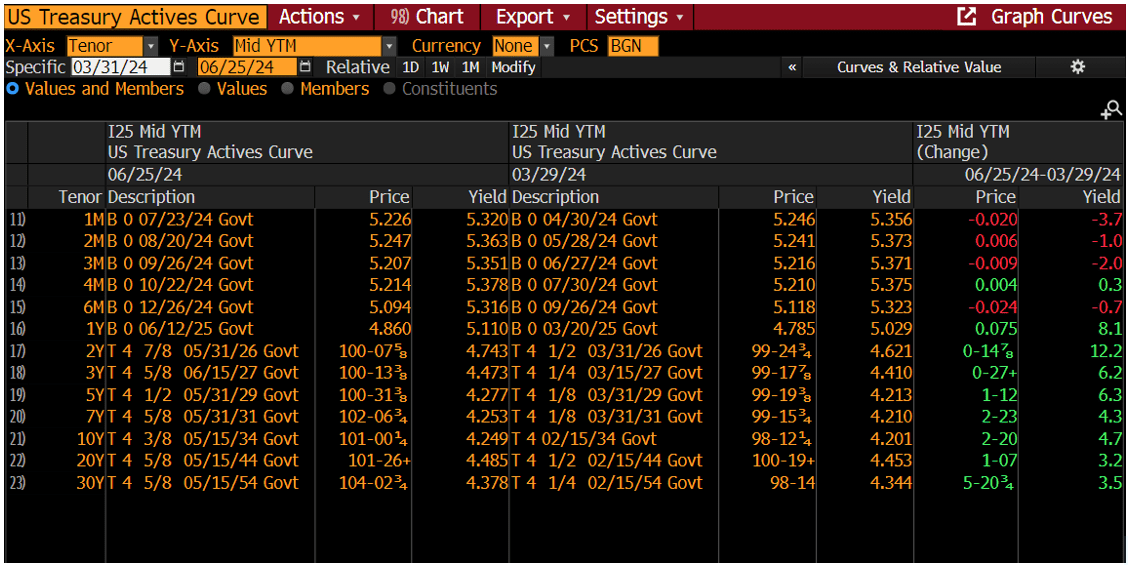

During the second quarter of 2024, the Treasury market experienced increased volatility as market participants attempted to predict when the Federal Reserve would begin cutting interest rates. The 10-year Treasury yield (US10Y) fluctuated Treasury yields ranged from a high of 4.705% to a low of 4.222% during the quarter. Despite this volatility, the net result was only a slight increase in yields from the start of the quarter. The most significant move was in the 2-year Treasury note, which rose 12.2 basis points to 4.743% as of June 25, 2024. The 10- and 30-year Treasury notes entered the quarter up just 4.7 basis points to 4.249% and 3.5 basis points to 4.378%, respectively. The full Treasury yield curve moves for the quarter are detailed below.

Source: Bloomberg

After declining steadily for Over the past two years, investment grade corporate and municipal taxable bond spreads have interrupted their downward trend. As of June 25, 2024, the Bloomberg US Corporate Bond Index spread has increased 1 basis point to +93, and the Bloomberg Taxable Muni US AGG Index spread has increased 4 basis points to +82. As noted in our previous quarterly report, we believe the upside potential of these spread products has been largely realized. As a result, we have begun to reduce our overweight in these securities and increase our allocation to Treasuries. We expect these spreads to widen further, which would provide an opportunity to reinvest in these spread securities later in the year. As we approach the third quarter of 2024, we will be closely monitoring economic data, with a particular focus on inflation. Our long-term outlook anticipates lower interest rates as we expect the Federal Reserve to begin cutting rates later in the second half of the year. As a result, you can expect us to gradually increase our exposure to Treasuries over time, as long as spreads remain at or near multi-year lows. Our goal is to maintain higher levels of liquidity, which will provide us with more flexibility as we make strategic adjustments in the future. While taking a conservative approach to credit, we will also seek to be opportunistic in seeking out attractive investment opportunities as they arise.

Editor’s note: The summary bullet points in this article were chosen by the Seeking Alpha editors.