Dragon Claws

Rithm Capital Corp.NYSE:RITM) is a well-managed mortgage real estate investment trust with strong first quarter distributable results and a low dividend payout ratio.

Additionally, Rithm Capital holds significant investments in mortgage servicing rights, the values of which benefit from higher exchange rates. interest rate.

As inflation sees a slight resurgence in early 2024, I believe the market is primed for a higher and longer interest rate environment, which would benefit Rithm Capital.

Given that Rithm Capital shares also sell for less than book value, I believe the mortgage trust is one of the most compelling value propositions in the high-yield market.

My grade history

A low dividend payout ratio combined with Rithm Capital’s strategic move into the asset management sector (via the acquisition of Sculptor Capital) last year was the reason I issued a Strong Buy in February.

Resurgent inflation is tipping the scales toward a higher, longer rate environment, which is poised to favor investment in Rithm Capital’s mortgage servicing rights.

With a consistently low dividend payout ratio and MSR investments favoring distributable earnings growth, I believe the risk/reward relationship for Rithm Capital remains extraordinarily attractive.

Broadly diversified mortgage investment portfolio

Rithm Capital is a diversified mortgage real estate investment trust that makes money by servicing mortgage loans, investing in real estate securities, consumer loans, single-family rentals and other assets such as mortgage loans.

Mortgage servicing rights are a key source of revenue for Rithm Capital in the trust origination and servicing segment and are unique in that they generate higher revenue during periods of rising rates.

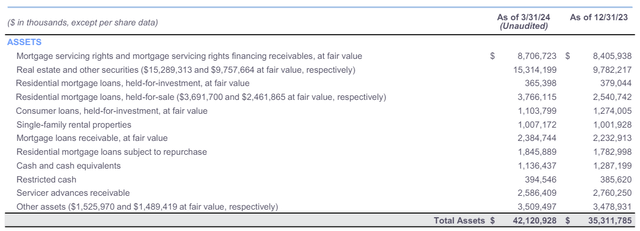

Mortgage servicing rights are a key investment pillar of Rithm Capital and represent $8.7 billion in assets (making MSRs the second largest investment category as of March 31, 2024). The mortgage real estate investment trust had a portfolio consisting of more than $42 billion in assets as of March 31, 2024.

Asset Overview (Rithm Capital Company)

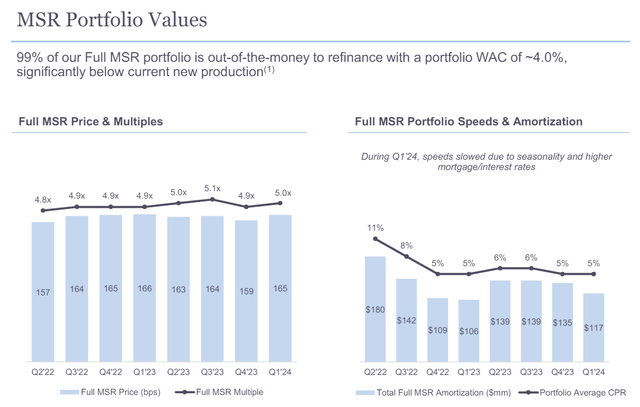

Mortgage servicing rights increase in value during periods of rising rates, making them the most attractive investments at the start of a rising rate cycle.

The central bank appears unwilling to cut short-term interest rates, in part because inflation remains above 3% (inflation was 3.4% in April, down slightly compared to the previous month). A higher and longer rate environment would certainly benefit Rithm Capital’s mortgage servicing rights exposure and associated revenue.

MSR Portfolio Values (Rithm Capital Company)

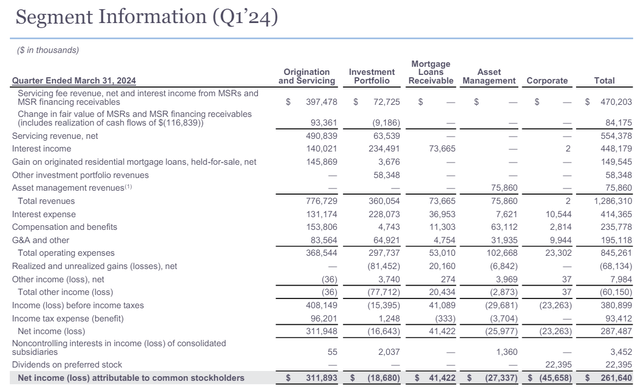

The majority of the trust’s income comes from its investments in mortgage servicing rights, as I just mentioned. In 1Q24, Rithm Capital earned $311.9 million in origination and servicing revenue. Rithm Capital’s distributable profits, which represent realized and unrealized gains and losses, deferred taxes and transaction-related expenses, are much larger than the industry’s bottom line.

Segment information (Rithm Capital Company)

The main strength of Rithm Capital: a low distribution rate

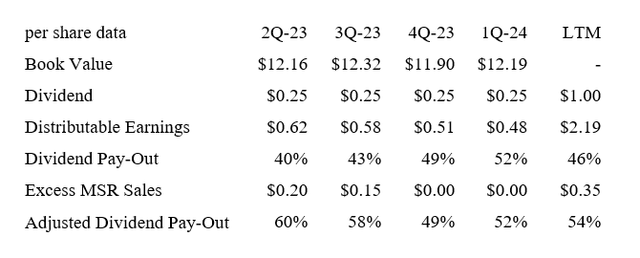

Rithm Capital produced excellent dividend coverage in the first quarter. The trust earned $0.48 per share from its mortgage investments, primarily in the origination segment, equating to a dividend payout ratio of just 52% in 1Q24.

Over the last twelve months, Rithm Capital has paid out even less than that, at 46%, of its distributable profits and when adjusting the dividend payout ratio to account for irregular sales of mortgage servicing rights (which are increasing temporarily distributable profits), Rithm Capital paid out only 54% of the gains.

The distribution rate, considering the 9% yield offered by the stock, is extremely low and is, in my opinion, the main reason why passive income investors should consider investing in a mortgage real estate investment trust .

The payout ratio (Table created by author using trusted information)

Rithm Capital still sells at a discount to book value

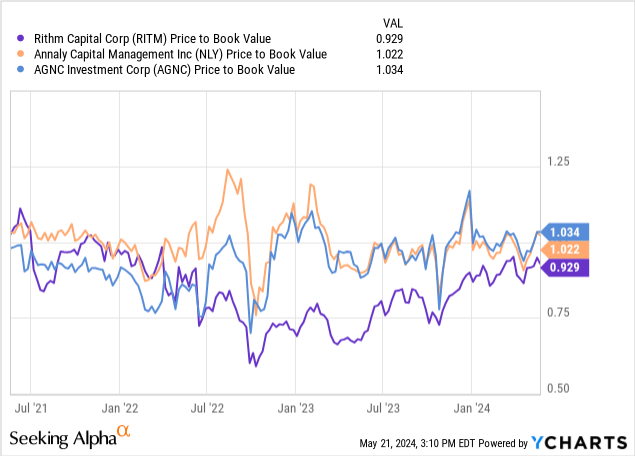

In addition to the diversified exposure to mortgage investments and the low payout ratio based on distributable profits, Rithm Capital shares are still available in the market at a 7% discount to book value, which I have to hard to explain.

Rithm Capital is also increasing its book value, which increased 2.4% quarter-over-quarter in 1Q24 to $12.19 per share, so the lack of growth and concerns over dividend coverage are not reasons to passive income investors to apply significant discounts.

I believe Rithm Capital offers passive income investors much greater profits, diversification and dividend value than mortgage trusts like Annaly Capital Management Inc. (NLY) Or AGNC Investment Corp.AGNC) because Rithm Capital only pays out around half of its distributable profits, leading to a much higher margin of dividend safety than for other less diversified mortgage trusts.

Annaly Capital Management pays out almost 100% of its distributable profits, and the trust is not as diversified as Rithm Capital. In fact, Annaly Capital Management’s significant exposure to mortgage-backed securities makes NLY primarily a bet on falling short-term interest rates.

Why the investment thesis might not pan out

Rithm Capital has a broad allocation of investment funds to mortgage servicing rights, which are non-traditional mortgage investments. This is because the value of MSRs increases as interest rates increase and vice versa. Thus, a faster-than-expected decline in short-term interest rates poses substantial valuation risk for Rithm Capital’s mortgage servicing rights investments.

My conclusion

Rithm Capital is one of the strongest high-yielding investments in the mortgage real estate investment trust industry that I have discovered since I started working as a financial analyst a few years ago.

The Mortgage Trust has a diversified portfolio of high-quality mortgage assets, particularly mortgage servicing rights, which are expected to appreciate in value if short-term interest rates increase.

Based on the current inflation trajectory, it is likely that interest rates will remain higher for longer, which would obviously benefit Rithm Capital’s MSR investment strategy.

The combination of a low distribution rate with a diversified mortgage investment portfolio and a discount to book value is what, in my opinion, makes Rithm Capital a compelling mortgage investment vehicle.

The 9% yield should prove relatively safe and Rithm Capital retains special dividend potential to distribute excess portfolio income.