pechkov

Real Estate Income Company (New York stock market :O) the three largest tenants are:

And what do these three companies have in common?

All three of them suffered terrible pain. news lately, and it’s not good news for Realty Income.

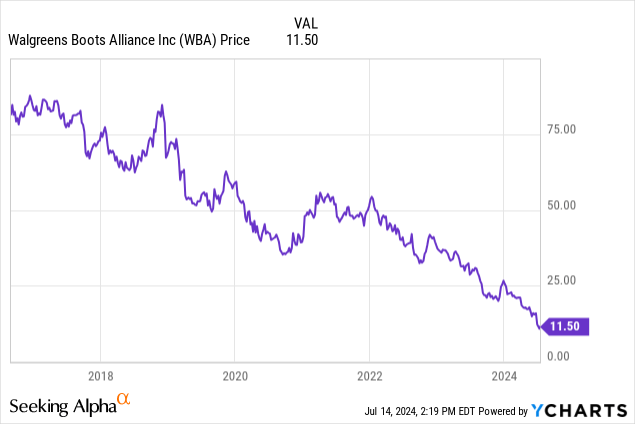

Walgreens recently announcement that it would close up to a quarter of its stores as part of a “company-wide strategic review” and that this caused its share price to fall to its lowest level in several years. Some analysts now believe claim that the company could face bankruptcy in the future, just like its counterpart, Rite Aid, which deposit for Chapter 11 last October. This reminds me that VICI Properties (VICI) The CEO told me this in 2021 in an exclusive interview:

“If you look at pharmacies, you have to ask yourself The question: Once Amazon really decides to become an online pharmacy, what will the impact be on Walgreens or CVS (CVS)?”

Net Lease Advisor

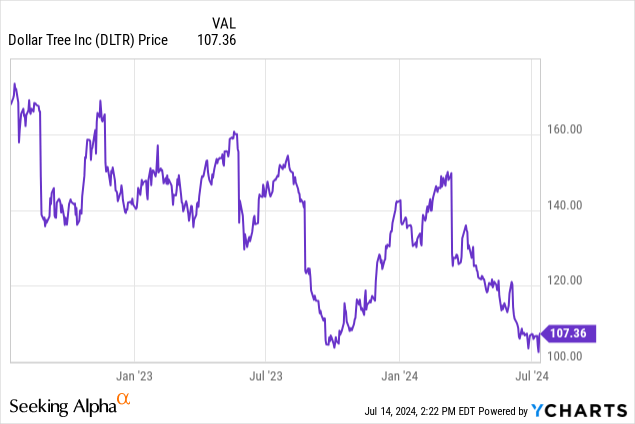

Similarly, Dollar Tree/Family Dollar plans to close 1,000 stores in the short term. Specifically, they plan to close 600 Family Dollar stores this year and 400 more under both banners in the coming years as their leases gradually expire. interviewed Agree with Realty (ADC) CEO, and we asked him what he thought about Dollar Tree’s plan to sell Family Dollar. His answer was simple: “Hah. Good luck,” and it really epitomizes the challenges the company is facing. Many of these stores are losing money, they’re often stuck in long-term leases, they’ve been underinvested, and competition from Amazon is only getting tougher (AMZN) and other offline discount stores. Their rival, 99 Cents Only, deposit for bankruptcy earlier this year, citing changing consumer demand, inflation and theft as the main reasons for its demise:

Net Lease Advisor

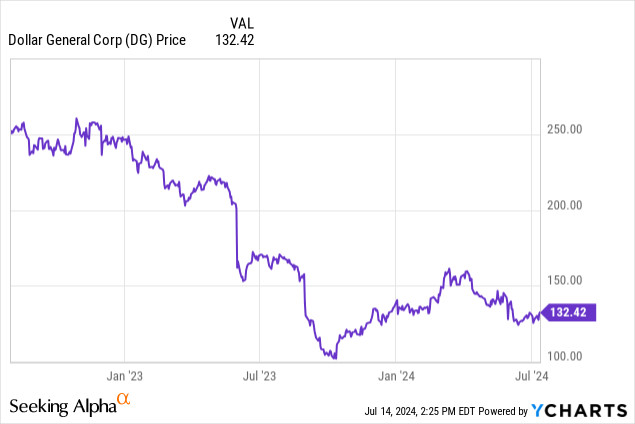

Today, Dollar General is doing much better than its rival, but concerns are also growing right now, and its stock price has collapsed by more than 50% in the last two years. Its profitability has been to crash because of the high inflation that is weighing on the consumer. But the bigger long-term concern for me is that Walmart (WMT) could take on Dollar General. Historically, Dollar General has done well because it opened smaller stores in less competitive areas. interview with the CEO of Agree Realty, he explains that:

“Dollar General is the grocery provider for rural America. They are literally the only general store in areas where there is no competition from other retailers. They are built at least 15 to 20 miles from the nearest Walmart and are a provider of essential goods to rural Americans.”

But that could change in the future. Walmart and others are working hard on grocery delivery and are also developing smaller store concepts to compete with Dollar General. I fear Walmart will win this battle because they have much greater scale, more power with suppliers, and that allows them to offer even lower prices. prices.

To be clear, I still expect Dollar General to do well over time. However, I wouldn’t be surprised if the company ran into growing pains that forced it to close some stores in the future, and from a real estate perspective, there’s not much to like about these properties. They’re in rural markets with often declining populations, and the construction quality is also poor.

Here’s what VICI CEO told me in a previous interview interview comparing the quality of their casinos to Dollar General’s net lease properties:

“Palace of the Caesars (CZR) in Las Vegas was built in 1966 and it’s as vital a building as ever. The Venetian was built like the fucking pyramids in Egypt. I mean this asset is going to be there forever. You know, the Chinese use the term 1,000-year assets. Who knows if it’s really going to be there in a thousand years, but that’s what the Chinese mean by 1,000 years.

Not to disparage Dollar General, but these models are designed to last 15 or 20 years. And guess what? You have to take them apart and start over. They were cheap to begin with.

Simply put, Dollar General properties are poorly located and cheaply built, and their value is therefore heavily dependent on the lease with Dollar General. If you lose that lease, your property value plummets, making these properties very risky net lease investments. This explains why they typically trade at relatively high cap rates:

All of this is a bad look for Realty Income.

Historically, it has been viewed as a “high quality” net lease REIT, but today its three largest tenants are struggling and its largest investments are in drugstores and dollar stores, which most people would consider “low quality” net lease investments.

But is that alone reason enough to sell Realty Income?

The answer is no.

Realty Income is well diversified, benefits from long-term leases, and generally owns higher-quality properties than average, which are less likely to close.

But it’s not something to ignore either. Together, these three tenants account for about 10% of the company’s rental income. In addition, Realty Income also has other struggling companies like AMC Entertainment (AMC), Red Lobster and CVS (CVS) in its top 20 tenants.

I think this confirms my earlier point that Realty Income’s portfolio quality has deteriorated over the years as a result of its numerous M&A activities, with the acquisition of lower quality companies in terms of net rents, such as Vereit and Spirit Realty Capital. This is also evident when comparing Realty Income’s occupancy rate to its close peers. It is now among the lowest in the peer group in terms of net rents and could decline further in the years ahead if the company faces more tenant challenges:

| Occupancy rate | |

| Real estate income (O) | 98.6% |

| VICI Properties (VICI) | 100% |

| Okay Real Estate (ADC) | 99.8% |

| FPI NNN (NNN) | 99.5% |

| Essential Properties Real Estate Trust (EPRT) | 99.9% |

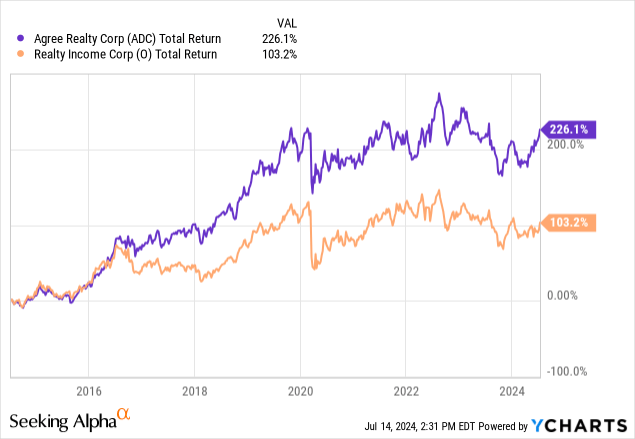

Therefore, Realty Income should no longer be compared to Agree Realty and other high-quality net lease REITs, and deserves to trade at a discounted valuation relative to them.

This is the case today, as Realty Income is trading at a valuation 2 turns lower than that of Agree Realty.

But do I buy Realty Income stock?

I’m not.

I have owned it in the past and would be willing to own it again, but the discount over Agree Realty should be greater than that.

Agree Realty has many advantages that in my opinion justify an even larger premium and therefore I would rather buy more shares of Agree Realty instead:

| Multiple FFO | |

| Real estate income (O) | 13.6x |

| Okay Real Estate (ADC) | 15.8x |

These advantages have driven significant outperformance over the past decade and I expect this outperformance to continue as these advantages are still not properly factored into the company’s valuation:

But it’s fair to say that Realty Income isn’t particularly expensive right now either, and I expect it to do relatively well over time.

I just think some of his peers will do even better.

I rate Realty Income as a Buy and Agree Realty as a Strong Buy.