Nikada

Introduction

I followed the American freight forwarder Radiant Logistics, Inc. (NYSE:RLGT) closely, and I have written a total of 7 articles about the company on Seeking Alpha to date. THE The last was released in March 2024 and At the time, I said Radiant Logistics was navigating a challenging US freight market as TTM adjusted EBITDA margin was close to 15% in Q2 FY24.

On May 9, the company published its financial results for the third quarter of FY24 and I think they were disappointing since revenues were down 24.4% year-over-year and operating income was in the red. With the stock price returning above the $5.00 mark in mid-May, I no longer feel comfortable with a strong Buy rating on the stock. My rating on Radiant Logistics is now a speculative buy as the U.S. freight sector’s recovery is underway. it’s taking longer than expected. Let’s review.

Financial results for the third quarter of FY24

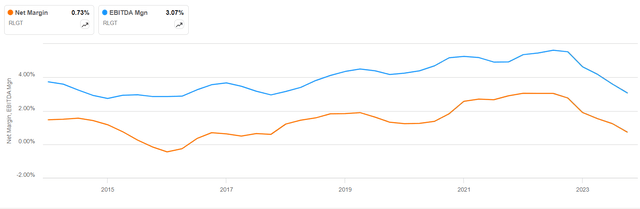

If you are not familiar with Radiant Logistics or my previous coverage, here is a brief description of the company. The company is involved in providing air and ocean freight forwarding, truckload, less-than-truckload and intermodal freight brokerage services and its bread and butter arranges shipments of larger goods than shipments handled by integrated carriers, mainly small parcels. . Radiant Logistics serves the automotive, pharmaceutical and electronics industries among others and has a network of more than 120 company-owned locations and strategic operating partners. It is an asset-light business with low barriers to entry, resulting in low margins. As the chart below shows, the net margin barely exceeds 3%, even during difficult times for freight forwarders, such as during COVID-19 lockdowns. Radiant Logistics benefited from a strong boost at the time through the chartering of test kits.

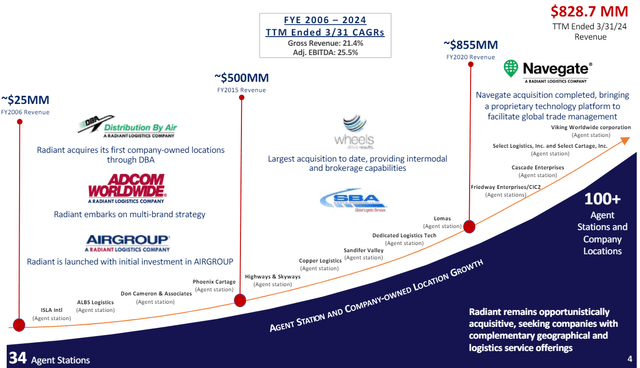

Economies of scale are crucial for this industry and as you can see from the chart below, the compound annual growth rate of gross revenue was 21.4% and the CAGR of adjusted EBITDA s stood at 25.5% between FY06 and Q3FY24. Radiant Logistics has been banking on mergers and acquisitions to fuel its growth and has acquired more than a dozen companies to date. Most of Radiant Logistics’ acquisitions were agent stations and the latest included Vikings around the world in April 2024. The latter has operated within the company’s Service By Air brand since 2012 and this acquisition is expected to result in a slight increase in net margin. You see, when Radiant Logistics transforms an existing agent position into a company-owned location, its revenue and gross margin do not change – the agent position’s commissions are eliminated instead. Gas station purchases typically increase EBITDA by $0.5 million to $2 million on an annual basis.

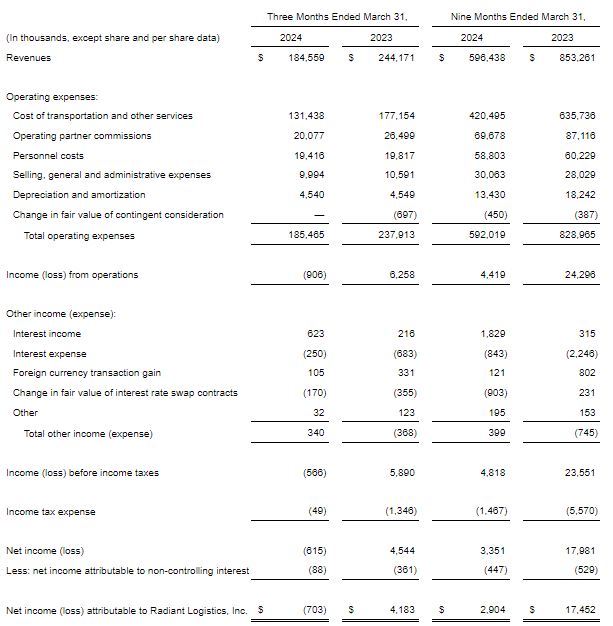

Turning to the Q3 FY24 financial results, we can see that this is another challenging quarter for Radiant Logistics, as revenue declined 24.4% YoY to 184 .6 million dollars, while operating profit was negative due to fixed costs such as salaries and depreciation. remained almost unchanged. EBITDA fell 66% to just $3.6 million. U.S. freight demand remained weak and excess capacity reduced operating margins across the industry. Last March, I said we were past the worst or close to the worst, but that assessment now seems too optimistic. In my opinion, it may be another quarter before Radiant Logistics’ revenue starts growing sequentially. On a positive note, interest income almost tripled to $0.6 million thanks to rising interest rates and the company’s strong balance sheet.

Radiant Logistics

Looking at the balance sheet, the net cash balance was $29.2 million in March, which is a slight decrease from $29.8 million in the previous quarter. The main reason appears to be the acquisition of Select Logistics and Select Cartage, specializing in South Florida, which had been part of the company’s Adcom Worldwide brand since 2007 – payments for the acquisition of companies amounted to $1.9 million in Q3 FY24. Given that the purchase of Viking Worldwide took effect on April 1, I expect Radiant Logistics’ net cash balance to fall below of $29 million in Q4FY24. The company is expected to release its quarterly results around mid-September.

Future of the company and valuation

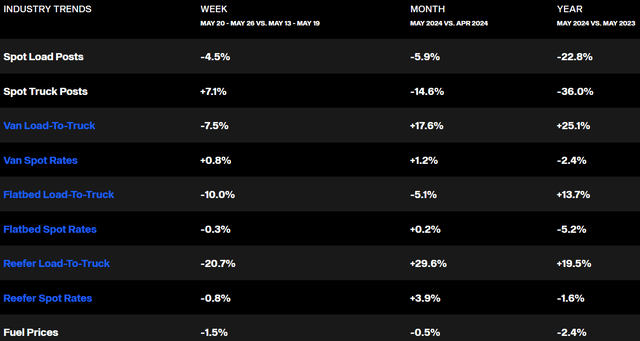

Bohn Crain, CEO of Radiant Logistics, said during the Q3 FY24 results presentation that the company expects to report sequential quarterly improvement going forward. While this is positive news, I worry that the company is overly optimistic about a return to normalized market conditions. According to data from DAT Freight & Analytics, spot loading posts and spot truck posts decreased significantly in May 2024.

In my opinion, it may take another quarter before the US freight market bottoms out and I expect revenue to decline sequentially in Q4FY24. Against this backdrop, margins are expected to remain under pressure and I would not be surprised if Radiant Logistics’ operating profit remains in the red in the current fiscal quarter.

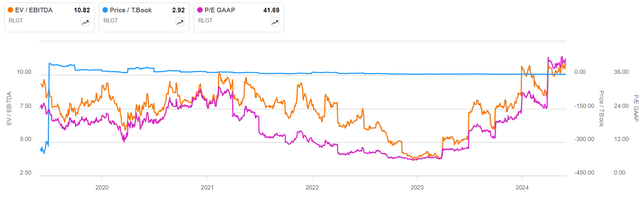

Looking at the valuation, the company looks more expensive compared to my March article as the EV/EBITDA ratio approaches 11x. However, the stock still trades at an all-time low, with a tangible book value multiple of 2.9x.

Although Radiant Logistics may appear expensive based on key financial metrics, it is important to note that the company is operating in a challenging market environment. Its adjusted EBITDA margin under normalized market conditions is approximately 18%. If the US market returns to growth in the near term, I believe Radiant Logistics could report EBITDA of around $44 million by FY26. This translates to a forward EV/EBITDA ratio of just 6 .3x, which is below where the company has traded for the better part of the last five years.

As for downside risks, I think the main one is that I might still be too optimistic about the timeline for recovery in the US freight market. Geopolitical tensions and high interest rates could lead to a slowdown in economic growth in the second half of 2024, which would likely negatively impact the local freight sector.

Takeaways for investors

Radiant Logistics had a tough quarter and I think Q4FY24 could also be tough given that the US freight market is still on shaky ground. While I still think the company has a strong balance sheet and looks cheap based on its valuation under normalized market conditions, it could take some time before the company returns to growth.