piranka/E+ via Getty Images

Preview

I believe we are currently living in one of the best times in history for high dividend investors. There are so many high-yielding asset classes and funds today that it can be a little difficult to know which one is best for you. Defiance has launched a relatively new covered call ETF, Defiance Nasdaq 100 Enhanced Options Income ETF (NASDAQ:QQQY) with creation dating back to September 2023. However, at first glance at the price chart, QQQY looks a bit scary with a steady price decline.

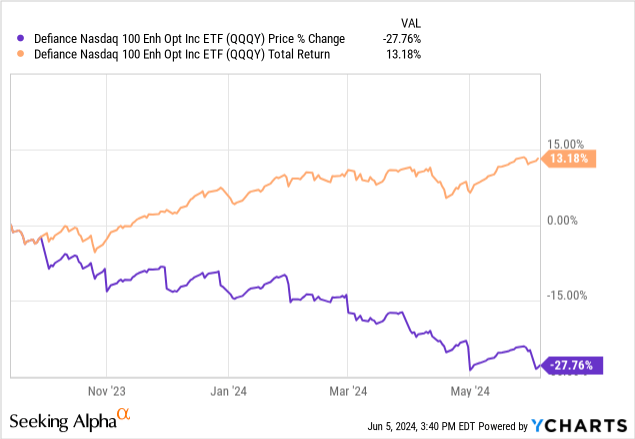

We see that the price has fallen by almost 30% since the launch of the fund. Despite this price drop, QQQY managed to maintain a positive total return of over 13%. This can be attributed to absolutely massive distribution yield of over 63%. This dividend yield is abnormal due to the option writing strategy used by QQQY. The advantage of a high yield like this is that distributions are issued on a monthly basis, making it a very useful resource for generating income. This income can be used to fund lifestyle expenses or simply be reinvested in other areas of your portfolio.

Just for a little context, QQQY is a put-write ETF that implements daily options in order to generate these significant returns. The ETF maintains exposure to stocks in the Nasdaq-100 Index while having net assets of approximately $250 million. The ETF is actively managed and has an expense ratio of 0.99%. Although the dividend yield is huge, it is very difficult for me to recommend, as much of the performance is wiped out by constant price deterioration. Unfortunately, I do not believe that price action will see any improvement in the long term due to the flawed underlying option strategy of using at-the-money puts.

Strategy and vulnerabilities

Part of QQQY’s strategy is to use an options strategy that helps the fund generate the income needed to support the high distribution yield. They do this by selling puts daily that are priced at or up to 5% in price. This strategy allows for slight upward price recognition if the fund sells an option priced above the current market price. However, this 5% spread may not always be used and even if it was, price history shows us that QQQY’s strategy doesn’t really capture much upward movement, the price having a constant downward trend since its creation.

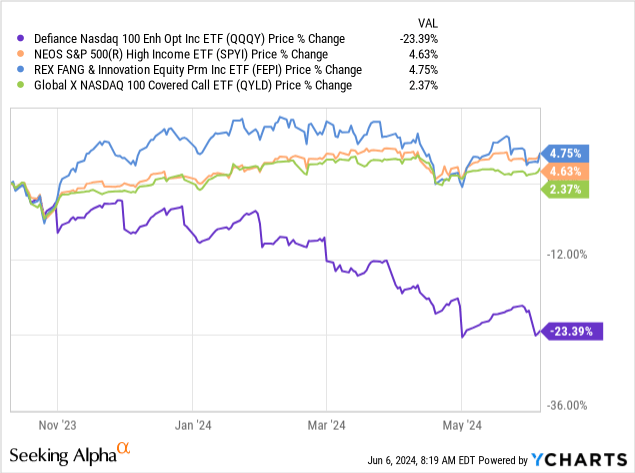

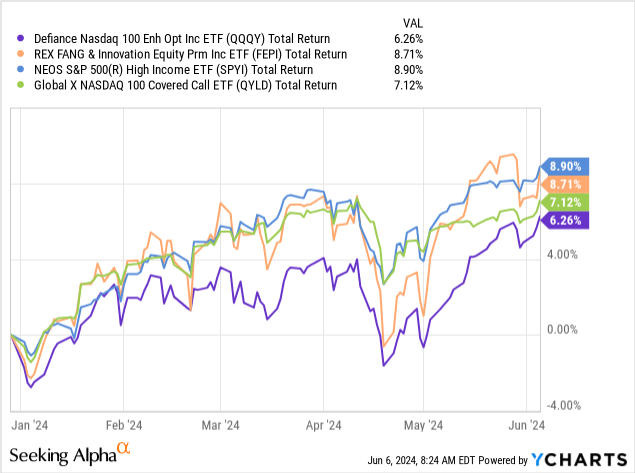

I think this at-the-money strategy is a bit inferior, as it fails to capture price rises from the gains of the underlying assets. For comparison, covered call ETFs that use an out-of-the-money strategy may have lower returns, but they do not destroy invested capital because this strategy captured additional upside potential. We can see the difference in performance by comparing QQQY to something like NEOS S&P High Income ETF (SPY) or REX FANG & Innovation Equity Premium Income ETF (FEPI), both of which use an out-of-the-money options strategy. For added context, I’ve also included the Global X Nasdaq 100 Covered Call ETF (QYLD) since this fund also uses an at-the-money strategy.

We can see that all of these alternatives generate more price growth and stability. That’s the trade-off you make when you opt for QQQY’s much higher dividend yield. This out-of-the-money approach means that greater upside potential can be captured because the strike price of options is typically set at a variable rate premium above the current market price. In comparison, QQQY’s at-the-money strategy does not capture the same upside potential before exercising options. I really like the visual provided by QYLD below as I think it does a good job of illustrating the difference in strategies, with the orange line essentially representing QQQY here and the navy line representing peers like SPYI and FEPI.

So while you’re earning a huge dividend yield from QQQY, you need to take price deterioration into account. For now, the high yield has been able to offset the price decline while providing a positive total return. However, is it really the best option for high-yield income? We can see that on a year-over-year basis, QQQY has underperformed its peers in terms of total return while simultaneously posting the largest price decline.

When it comes to holdings, QQQY’s exposure is a bit unique because it holds U.S. Treasuries. Unlike some other covered call ETFs, QQQY does not hold individual stocks as part of its securities portfolio. This makes it even more likely that fewer upward price movements will be captured.

Distribution

The last monthly distribution was confirmed at $0.8013 per share. This brings the current yield above 63%, which has the capacity to produce high levels of cash flow. To help support this massive return, the fund aims to generate a consistent income stream on a daily basis. They do this through the previously mentioned in-the-money put options and are looking for a daily amount of 0.25%. This higher yield can be achieved through a higher frequency of deployed options. These short-term options typically last less than a week, generating a higher income than long-term options.

Plus, I wouldn’t expect much growth, since you’re already reaping a massive yield in the first place. The distribution has actually had a slight downward trend since its inception. Distribution income here is directly linked to the fund’s performance of its options strategy. It is important to note that distributions received from QQQY are primarily classified as return of capital, depending on the 19a-opinion.

Year to date, we can see that net investment income has funded approximately 47.4% of distributions. However, the largest portfolio of 52.5% of the distribution is made up of return of capital. This can be considered a little more tax efficient, since return of capital distributions are generally not taxed at the same rate as ordinary dividends.

While I’m sure some investors might find a good use case for a fund like QQQY, I struggle to see any long-term value. I really enjoy collecting high levels of income from different asset classes such as REITs, business development companies, and closed-end funds, but there seems to be a lot more risk here with QQQY than benefit. The massive yield would make for a nice addition to the portfolio, but I personally don’t agree with the tradeoff between a big drop in price and a massive drop in the fund’s net asset value. I would, however, consider exposure to a covered call ETF that instead used out-of-the-money options strategies and held a better set of securities, as this allows for greater upside appreciation alongside the dividend.

Outlook

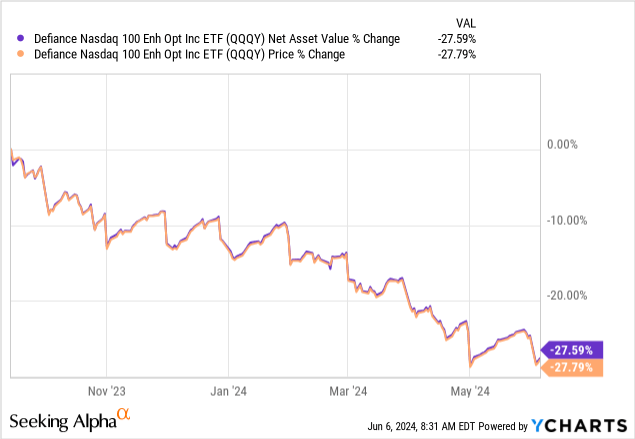

Erosion of net asset value remains my biggest concern here. The fund has not yet been in existence for a year but the net asset value has decreased considerably. We have already explained that the at-the-money strategy does not allow for upside, but this deterioration in NAV would also indicate that QQQY is directly distributing more than it earns through generated options income.

Going forward, this options strategy does not provide any protection against market downside risks. This means you limit your upside potential while remaining vulnerable to the full brunt of downturns. So while your distribution income may be high, your capital would likely be destroyed in a stock market crash. Since the underlying exposure is to the Nasdaq 100 Index, which primarily includes technology stocks, volatility can be high as the sector trades at premium valuations. If the Nasdaq were to fall, you could benefit from high distributions to offset the risk, but you would ultimately face massive downside risk. Please note that the Invesco QQQ Trust (QQQ) has performed strongly year-to-date, while QQQY has suffered a decline in its net asset value and price.

In the shorter term, the income side of QQQY could actually improve as volatility increases. We will likely have market uncertainty caused by the US presidential elections on the horizon. This would also be accompanied by ongoing discussions about interest rate cuts that could be implemented by the Fed. As interest rates remain high and inflation begins to slow, we could see an increased possibility of rate cuts this year, alongside the election. Higher volatility generally means that covered call ETFs like QQQY can charge a higher premium for writing the options.

Take away

In conclusion, QQQY’s massive yield comes with downside risk that I am not comfortable recommending. Additionally, the fund aims to gain exposure to the Nasdaq-100 Index, but does not actually hold any of the underlying stocks as part of the portfolio. NAV and price declines have negatively impacted total return potential as the fund does not earn enough from its options strategy to fully support payouts. In addition, the parity strategy does not allow much upside while still presenting all the downside risks. This is why I would prefer to find a covered call ETF that uses an out-of-the-money strategy, like FEPI or SPYI. As a result, I consider QQQY a sell.