Morsa Images/DigitalVision via Getty Images

Investment stocks

I recommended a buy a note for Progyny, Inc. (NASDAQ:PGNY) when I spoke about it in mid-March this year, as I continued to view the long-term growth prospects as attractive. Based on my current perspectives and analysis, I recommend a buy a note. The main update to my thesis is that I don’t think the 1Q24 revenue weakness is a sign of a long-term structural slowdown in growth. ART’s historical cycles in the US suggest a strong long-term growth trend, and any downturn usually results in a strong rebound afterwards, which gives me confidence that we will eventually see a rebound. Additionally, some leading indicators suggest that the utilization rate is already on track.

Goodbye

Briefly addressing the latest results, PGNY reported earnings in early May, with revenue growth of 7.6% to $278 million, missing expectations of $290 million. Decomposition In terms of growth, fertility benefits services grew 8.1% to $169.8 million and pharmacies grew 6.9% to $108.3 million. Gross margin decreased 18 basis points to 25.7%, while EBITDA margin increased 14 basis points to 18.1%, or $50.3 million in absolute terms. Overall, 1Q24 results were disappointing, with revenue underperforming due to low utilization essentially sending the stock down, from ~$32 to ~$26 today. Below, I’ve explained why I think this failure is just a one-time issue and why I still think the stock is trading at very attractive levels.

Regarding the failure, I think it is not due to anything structural. The year started off well, with usage rates in January and February in line with 2023. However, usage saw a sharp decline in mid-March, resulting in a loss of revenue. What I believe has happened is that many patients are adjusting their expectations for access to maternal health care as a result of the crisis. Alabama Supreme Court Decision, especially in states with the most restrictive laws regarding women’s reproductive rights. In other words, I believe utilization rates are delayed and not permanently affected. Once there is more clarity (the recent Senate bill should help clear up any confusion). In fact, management has already noted that in April, utilization rates were stable and improved from low levels. It is also important to note that while utilization has declined in states with more restrictive laws on women’s reproductive rights, there has been no decline in demand for PGNY fertility benefits among employers in the regions concerned. This is crucial because it means employees can continue to have access to affordable IVF (increased potential demand and future use).

I expect PGNY’s growth to accelerate in the coming quarters as several indicators suggest demand remains strong. First, the year-to-date pipeline remains very strong, based on early indications. It was specifically pointed out that the pipeline was more active than last year. Notably, the pace of industry adoption appears to have accelerated as: (1) PGNY is seeing earlier commitments from a strong pipeline of not-nows mentioned last November; and (2) PGNY has seen strong engagements in healthcare, automotive, manufacturing, etc. My view on increasing adoption rate is supported by the fact that 45% of large employers offered IVF coverage to their employees, up from 23% in 2019. On an overall basis, statistics show a 10-point improvement in IVF treatment coverage in 2023 compared to 2020.

Under certain conditions, non-immediate projects represent the majority of early commitments we have received, and 2024 will be no different with strong early commitments from major brands in the healthcare, auto manufacturing, travel and entertainment, and media, as well as several state and local government populations. Call for 1Q24 results

Another indicator that also suggests that demand remains healthy is that engagement has persisted at levels above 2022. This suggests that the current increase in adoption and pipeline growth is not an outlier, one-off event.

What reassures me about focusing on the long term is that demand for IVF has always been resilient, and I don’t see any major catalysts that would change this trend in the future. THE CDC has historical data on ART cycles, and based on this data, ART cycles have continued to increase over the past 20 years, and the only periods where growth has turned negative have been during COVID and the subprimes, but growth bounced back immediately after the end of each crisis. During the subprime period, the growth of the ART cycle became negative in 2009 and 2010, but immediately rebounded to 3.2% in 2010, a growth rate similar to that observed before the crisis (the average growth from 2005 to 2008 was 3.7%). The same was true for the COVID period, which saw negative growth of -1% in 2010, but rebounded to ~27% growth in 2021.

Assessment

The author’s work

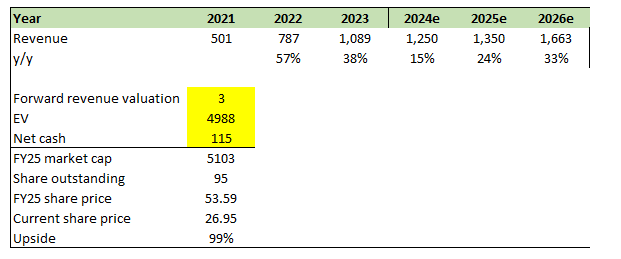

My view has not changed for PGNY. I continue to believe that this can accelerate growth back to over 30% eventually, as any short-term problems disappear and the economy recovers. The problem is knowing when growth will reaccelerate. Previously, I expected growth above 30% in FY25, but in order to be more conservative today, given the current situation and the still weak economic outlook, I pushed back my one-year estimates. Using the revised FY24 revenue forecast of $1.25 billion at the midpoint (implying 15% year-over-year revenue growth), I projected a linear expansion in growth rates YoY to 33% in FY26, implying PGNY will generate $1.66 billion in revenue in FY26. I don’t think it’s a big hurdle, as this is a business that grew 38% last year.

The market should respond positively to accelerating growth over the years, and I believe PGNY should trade up to at least 3x forward earnings, which was the level it was trading at at during FY23 when growth was >30%.

Based on these assumptions, I have a target price of around $54 for FY25.

Risk

Given the volatility in usage, I think investors are going to be much more conservative in their estimates, especially with the guidance incorporating a recovery in 2H24. Until PGNY shows usage improving on a reported basis, the stock could range in the near term. Additionally, based on historical cycles, if the economy continues to slow or falls into a recession, PGNY will be directly impacted.

Final Thoughts

My recommendation is a Buy rating despite a lack of revenue in 1Q24. I believe demand is simply delayed due to recent legal uncertainties, not due to structural factors. I still believe in the company’s long-term prospects, as historical trends show that IVF demand is resilient, with strong rebounds following economic downturns. Additionally, some leading indicators suggest that a rebound in usage is already underway.