yangna/E+ via Getty Images

Please note that all $ figures are in $USD (the reporting currency), not $CAD, unless otherwise stated.

Introduction

I last covered Polaris Renewable Energy (Toronto Stock Exchange:PIF:CA) six months ago, in January. At the time, I had issued a buy rating on the company, noting that Polaris was a great way to play the renewables sector, especially given that capital expenditures were about to start tapering off and new projects were about to come online. As a small cap with little analyst coverage, the company has flown under the radar at a cheap valuation, while offering investors a yield of over 6% while waiting for a rapid EBITDA recovery. In this article, I will discuss and analyze the company’s progress on various initiatives and explain why I am still bullish on the stock, despite shares being essentially flat since initial coverage.

Company presentation

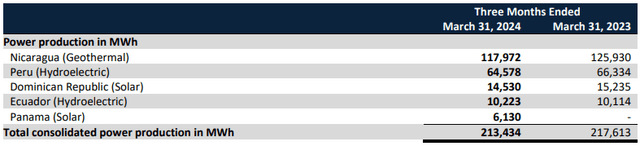

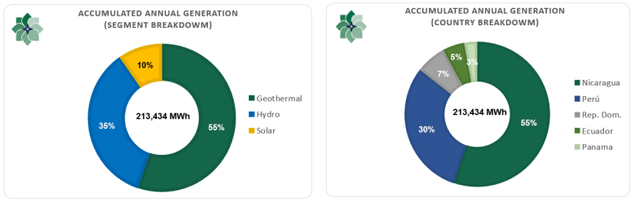

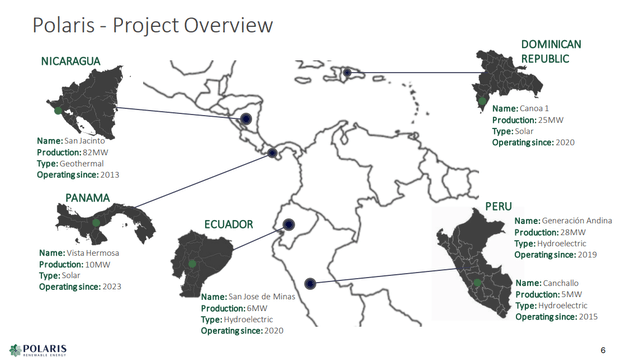

To recap, Polaris Renewable energies have renewable energy projects across Latin America, with projects in the Dominican Republic, Ecuador, Nicaragua, Panama and Peru. ongoing operations include one geothermal plant, four run-of-river hydroelectric plants and three solar photovoltaic projects, with many more under development. By segment, Nicaragua’s geothermal plant represents 55% of electricity production, hydraulics represents 35% and solar 10%.

Company management report Presentation to investors

The current asset base is solid

While these projects carry additional risks due to their geographic profile (which comes with political risks), they have the potential to generate higher returns. Latin America is a faster growing market, with grids continuing to grow at around 3-6% per year. Unlike North America, where renewable energy projects tend to be well established and capitalized with an entire industrial ecosystem around them, the market in Latin America is much less developed with around one-fifth to one-tenth of North America’s per capita consumption.

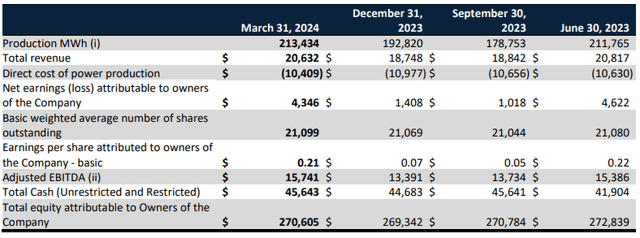

Because of this, Polaris knows rapid growthThe stock price might tell you otherwise, but under the hood, the company’s business performance is pretty good. quarterly resultsThe company generated 213,000 MWh for the quarter, up from 129,000 MWh the last time I valued the company.

On a comparable quarterly basis, although MWh power generation declined slightly, Polaris still has considerable room to grow its power generation. Given that most of its contracts are long-term (weighted average of 13.6 years) and fixed-price (98% of contracts are fully fulfilled), the company has some certainty regarding the predictability of cash flows. With stable cash flows on the current asset base as a profitable business, Polaris’ 6.2% dividend is well supported by ongoing operations, with approximately half of the earnings going to the dividend and the other half being reinvested in new projects.

The importance of these fixed-price contracts is fundamental. While most investors would shy away from investing in renewable energy projects in Latin America, these fixed-price contracts and indexations provide Polaris with utility-like cash flows, reducing the risks associated with the investment profile.

For example, for Polaris’s largest project by far, the San Jacinto Tizate geothermal plant in Nicaragua, the company gets a fixed price of $111.20. For the Canoa I solar farm in the Dominican Republic’s Barahona province, Polaris gets an initial price of $125 per MWh, but that price increases by 1.22% until a cap of $143 per MWh is reached, and then it stays fixed through 2040. Sure, Polaris could miss out on an increase in the MWh price over time, but for risk-averse investors, it makes a lot of sense. Governments like this because they have certainty of power generation, and Polaris likes it because it gives it long-term visibility into its future cash flows. It’s a win-win situation.

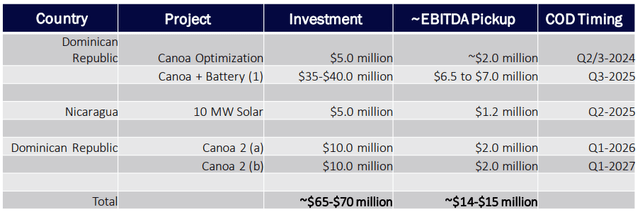

Future developments are a source of growth

I find Polaris and its current valuation compelling enough on the current asset base, but the cherry on top is the additional projects and developments underway. Across the portfolio, Polaris has made organic growth investments that should result in fairly solid IRRs of over 20%, even under the most conservative forecasts. In total, these capacity expansions and optimizations (a significant portion of which is in the Dominican Republic via Canoa) should total approximately $65 million to $70 million in capital expenditures and should generate EBITDA accretion of between $14 million and $15 million over the next three years.

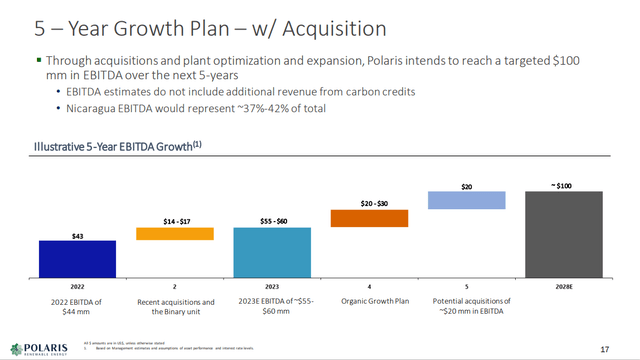

With EBITDA of $58.3 million generated over the last twelve months, EBITDA is expected to grow by at least 25% over the next three years, assuming Polaris is able to hit the lower end of the guidance range. Compared to the last time I looked at Polaris, the company was expecting organic growth capex of $75 million, so with capex already being made by the company, there is room for further dividend increases.

Another area of potential growth is mergers and acquisitions. Historically, this has been part of Polaris’ strategy, with deals in the $15 million to $30 million range. This has included acquisitions such as Emerald Solar Energy SRL for $20.3 million and Hidroelectric San Jose de Minas SA for $16.3 millionamong others.

Polaris is targeting $100 million in EBITDA by 2028. With current EBITDA of $58.3 million plus $14.5 million in EBITDA recovery from organic projects (the midpoint of guidance), Polaris will be about $27.2 million short of its target. To fill this gap, the company sees M&A opportunities where it can acquire projects in addition to organic growth initiatives.

To fund these acquisitions, Polaris is generating strong free cash flow and has a decent balance sheet. From a balance sheet perspective, the company had $56 million at the end of the quarter, with $232 million in long-term debt (source: S&P Capital IQ). With net debt of $176 million, the company has a net debt-to-EBITDA ratio of 3.0x, which should organically reduce its debt to 2.4x by 2028, even without any debt payments.

While the debt level is higher than when I last reviewed the company, I maintain that the leverage is appropriate, given that its peers in this sector are significantly more leveraged. While interest rates on debt are high (in the 5% to 10% range), I don’t think Polaris will take on new debt unless it finds a very attractive M&A target.

Evaluation and conclusion

According to Bloomberg, 6 sellside analysts are covering Polaris stock. The average price target is $20.50 with a low of $19.00 and a high of $32.00. From the current price to the average target price in a year, that implies an upside of about 58%, not including the 6% dividend.

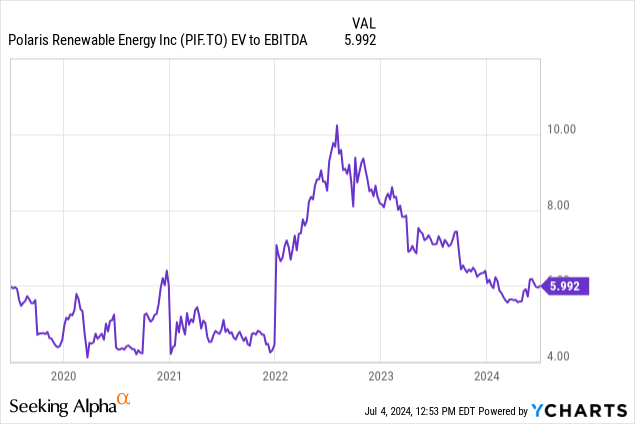

While these targets may seem aggressive, I don’t think they are unreasonable. In terms of EV/EBITDA, the company trades at just 6.0x EV/EBITDA. And while this is in line with the 5-year historical average multiple, I think Polaris could trade much higher.

Comparing Polaris to its peers listed below, there is a huge valuation gap. At 6.0x EV/EBITDA, the company is trading at a discount of over 50% to the average of 15.7x EV/EBITDA. The last time I valued Polaris, I compared it to Canadian publicly traded peers like Boralex (OTCPK:BRLXF) (BLX:CA), Northland Power (OTCPK:NPIFF) (NPI:CA) and Innergex Renewable Energy (OTCPK:INGXF) (INE:CA). Due to Polaris’ more international operations (Latin America), this time I have also included several global companies in the renewable energy field.

Still, the valuation mismatch couldn’t be more obvious. At more than half the valuation, I find Polaris shares to be a compelling value. While there are risks related to geography, it’s hard to argue that Polaris should be traded on a broader scale.

Regarding company-specific risks, investors should be aware of the political risks associated with operating in these geographies. A few years ago, in 2020, the company was forced to make a decision 16% off The $130.72 the company initially received from its Nicaraguan operations. Since then, such events have not occurred, but the unpredictability of governance in these regions is a concern. Another risk would be the balance sheet, but the stability of cash flows and the 98% price lock-in mean that I think the risk of covenant default is low. It is important to note that the majority of the debt is at the asset level, rather than at the corporate level, which gives investors an additional set of protections.

Overall, I believe these risks have been largely priced into the valuation. With a strong position in growth markets, capital expenditures now behind the company, and several projects underway to boost EBITDA, I find Polaris Renewable stock attractive at current prices. With potential for valuation and EBITDA to re-rate through organic growth projects, investors are being paid to wait with a 6.2% dividend yield. As such, I rate Polaris stock as a “buy.”

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Be aware of the risks associated with these securities.