allanswart

Platinum Group Metals Ltd.NYSE:PLG) is an interesting PGM play in the development phase that can be evaluated on a NAV basis thanks to Stantec’s technical study, although dating from 2019. By adjusting the assumptions of this study to the current new macroeconomic context, we We are concerned about NPVs, given the decline in palladium prices in particular, especially as the negative narratives around PGMs solidify following the BHP Group Limited affair (BHP) offer for Anglo American plc (OTCQX:NGLOY). Compared to this time, it is not really clear whether the proposal seems less or more attractive. It would appear that the exceptional performance of some of the more marginal commodities, notably gold and nickel, could offset the weakness since the 2019 palladium analysis, particularly in dollar terms, even taking into account inflation assumptions post-2019, discount rate assumptions, etc. ahead. However, we do not think the valuation is better than just based on a rough analysis of a very sensitive model, also considering Lion Battery Technologies. From a directional perspective, we are also not very excited about PGMs due to the commercial rhetoric around the commodity.

Brief PLG

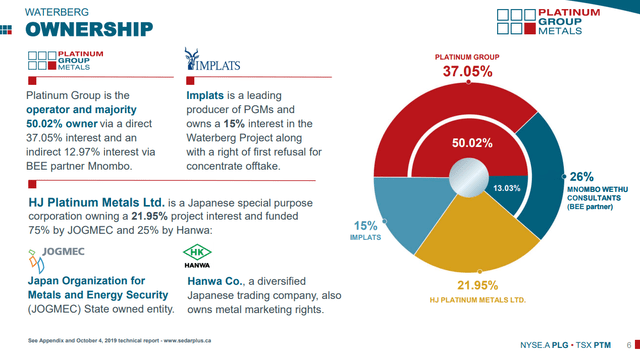

PLG holds majority stake in Waterberg JV, which is their only mining project in the development phase. These are pre-revenues.

Property in Waterberg (Featured Presentation)

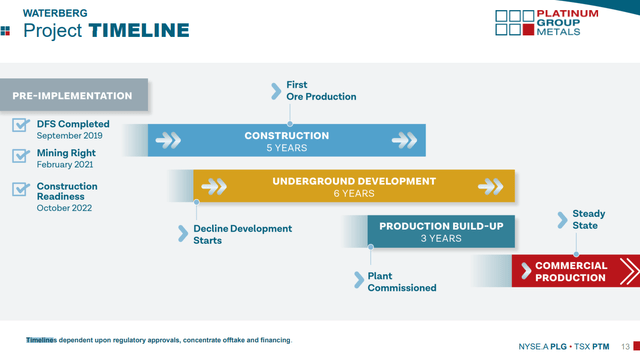

Technical studies are mostly completed, and they are reaching the end of the pre-construction phase, which will then lead to the construction phase which is expected to last five years. It may take about seven years before they reach commercial scale.

Timeline (Featured Presentation)

They are in a low cost region for PGM mining, South Africa, and cash costs are expected to be relatively competitive, well in line with Anglo American Platinum Limited (OTCPK:ANGPY). There are not many major options outstanding in the company, nor by other interests like Impala Platinum Holdings Limited (OTCQX: IMPUY) or as part of executive compensation plans. The remaining dilution at this point is only about 5%.

NPV model provided

We can jump straight to the NPV model which is the gist of the case and helps us understand the VE of the Waterberg project.

Of course, this is an area quite rich in PGM resources, i.e. platinum, palladium, rhodium and others which are essential for use in catalytic converters used to limit car emissions. Most of these minerals, with the exception of platinum, contain more than 70-80% of their end markets only in catalytic converters. Platinum is more like 40%. Gold, nickel and copper also come from the mine as co-products.

These automotive end markets are theoretically in decline as electric vehicles are expected to take over. We are less sure than many of these facts, but this is also the reason why Amplats was somewhat snubbed in Anglo American’s bid. This is also the reason why Anglo American is interested in the split of Amplats, offer aside. Nonetheless, we consider clear precedent that these assets are not sought as part of the business case.

The independent technical study has all the information an investor would need to build a model. In fact, they built the model themselves, so we will use the results to draw conclusions. These are DCF models, therefore extremely sensitive to inputs. Any analysis is therefore quite provisional, which is normal in any case for a company in the development phase. What you need to know is that the study was finalized in 2019. Therefore, the data reflects 2019 assumptions regarding costs, raw material prices, as well as discount rates, which matter among the most important elements.

They made two assumptions regarding commodity prices in their NPV model, which we need to obtain an NPV figure. They took spot prices from that date and another scenario based on rolling averages. We’ll compare the assumptions then with today’s spot prices to get an idea of how wrong their NPV calculations were. Also note that the ZAR/USD exchange rate is also different.

After-tax net present value of R5.62 billion (US$333 million) at a discount rate of 8% (three-year average price US$931 per ounce of Pt, US$1,055 per ounce of Pd, US$1,930 per ounce of Rh, US$1,318 oz Au, US$2.87 per pound of Cu and US$5.56 per pound of Ni, US$/South African Rand (ZAR) 15.95). • After-tax NPV of R14.7 billion (US$982 million) at a discount rate of 8% (September 4, 2019 spot price – US$980 per ounce of Pt, US$1,546 per ounce of Pd, US$5,036 per ounce of Rh, US$1,548 per ounce of Au, US$2.56 per pound of Cu and $8.10 US per pound of Ni, US$15.00/ZAR). • After-tax internal rate of return (IRR) of 13.3% (three-year average price). • After-tax IRR of 20.7% (Spot Price of September 4, 2019).

Stantec 2019 technical study

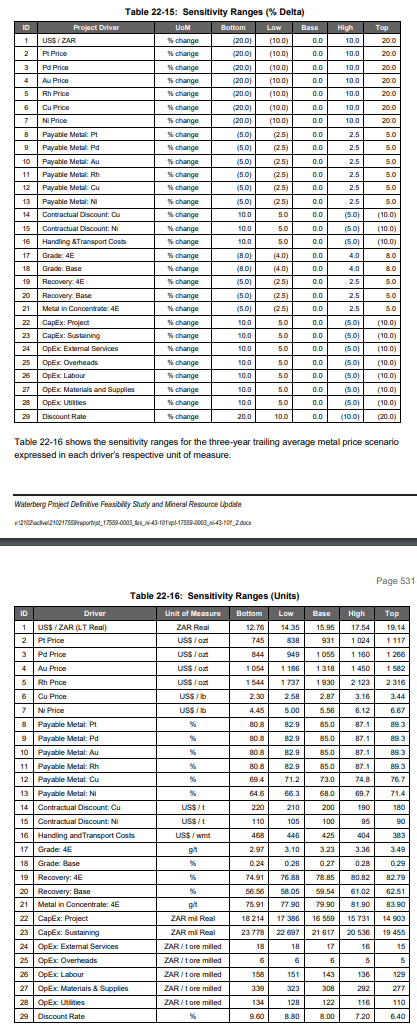

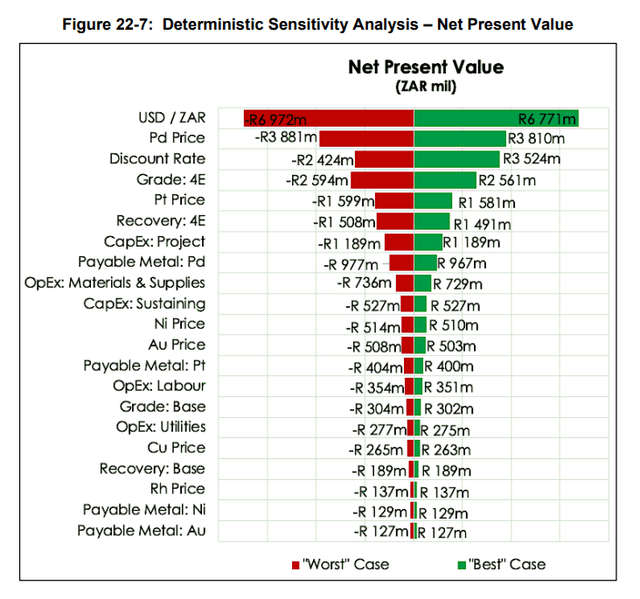

Sensitivity analysis gets us where we need to go. Below are the ranges they used.

Entries and scenarios (technical analysis 2019)

We will compare to the rolling average hypothesis. Below shows the sensitivity to different factors. PD Prices are down from that time, by around 12% compared to assumed values. Platinum is up 5%. Gold almost doubled. Nickel is up about 50%. Platinum and palladium are the most important for sensitivity analysis.

The other important factor is the discount rate. A more recent gold project just used a rate of 5%. A country risk premium for South Africa it could be around 4.4%. In the analysis used here, a discount rate of 8% was used. In the new rate environment, something like 9.4% would be more appropriate, equal to 4.4% + 5%, and close to the worst-case scenario of 9.6%, which is the discount rate we would want to use for the project. This represents an increase of approximately 20% compared to previous assumptions. Finally, the US$/ZAR rate is around the “high” case provided by PLG.

Starting from 5.62 billion ZAR, we roughly have an effect of -1.4 billion ZAR due to the new reality of palladium. Evaluate the total impact of -2.42 billion ZAR compared to the worst case scenario. Nickel and gold could have a positive effect of around 3.5 billion, although they were expected to be more marginal, particularly due to their respective increases. Copper which also almost doubled could represent, generously, a ZAR 1 billion effect on NPV. The problem is with things like project CAPEX and sustaining CAPEX, both of which are likely higher with inflation accelerating. Then there are OPEX items like utilities, labor, and materials. These are all areas that the model is sensitive to. While there may even be a net positive effect of commodities, net inflation since 2019 means perhaps worst case scenarios for CAPEX and OPEX as it relates to the NPV model provided. We believe this is perhaps a net effect of -3 billion ZAR from CAPEX and OPEX when taking into account the full effects of global inflation. Next, the ZAR depreciation was nice for the model since all commodities are denominated in USD, which is approximately +3.2 billion additional ZAR. The net effect is almost ZAR 1 billion higher than the figure provided, including inflation, and based on what has happened since. In USD, which corresponds to the PLG denomination, the NPV is rather $310 million, a slight decrease in dollar terms.

Sensitivity analysis (2019 technical study)

Conclusion

Even though this was a rough analysis, a fair multiple is around a 0.6-0.3x for assets in the development phase. 1x is closer to the price at which already operational mines could trade. Since Waterberg is a JV, there isn’t enough debt to manage either, it looks like the P/NAV here is closer to 1x.

Ultimately, this is a sensible model since it is a DCF, although there is a clear margin to say that the project will likely be NPV positive, which is good enough to create value for shareholders. We might even have been able to be generous, depending on the evolution of raw material prices. We’ve always liked the hydrogen aspect, but when it comes to supply reduction at Amplats, we’re just not sure about the trading dynamics for the stock or for the commodities, which could decline over time. time.

There is the question of Lion Battery Technologies, which is their other business. This presence is why we would say that PLG’s valuation seems a little fairer. Lion is jointly controlled by Amplats. The book value is only several million dollars from contributions to accelerate investments in lithium battery technology using palladium and platinum. Some data supports that batteries using Lion’s patents degrade more slowly. All of this probably has some value, but we just don’t know what, so it’s a tampering factor, but it might be enough to bring PLG to an unattractive fair value.