NoDerog/E+ via Getty Images

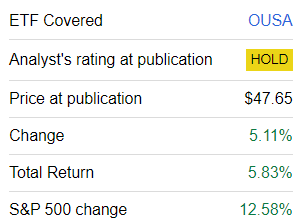

Continuing my series of updates on dividend-focused exchange-traded funds, today I’d like to re-evaluate the O’Shares US Quality Dividend ALPS ETF (BATS:WHERE). This vehicle initially caught my attention in June 2021, when I wrote the neutral-toned article, mainly influenced by its good but not excellent returns as well as its too-low dividend yield. My most recent analysis was present in February of this year, when I addressed three key questions:

- its inability to keep pace with the market,

- its unattractive dividend yield (a perennial concern), which then stood at 1.76% (1.66% at the time of writing),

- and its somewhat heavy expense ratio of 48bp.

All of these elements combined offset the fact that OUSA was able to calibrate high-quality equity mixes with robust cash flows, moderate leverage and decent yields on capital.

Today’s note is meant to discuss OUSA’s recent lackluster performance, paying particular attention to detractors and contributors, and offer an assessment of the changes in its mix of factors to explain why this vehicle remains a Hold.

What is OUSA’s strategy?

Of fact sheetwe know that OUSA’s current underlying index, the O’Shares US Quality Dividend Index, has only been in place since June 2020, while the fund itself was launched in July 2015. And while there was some methodological overlap between it and the FTSE USA Qual/Vol/Yield Factor 5% Capped Index, which it discontinued, I prefer to ignore OUSA’s performance prior to June 2020.

As mentioned in the summary prospectus:

The Underlying Index is constructed using a proprietary rules-based methodology designed to select equity securities from the S-Network US Equity Large-Cap 500 Index that are exposed to the following four factors: 1) quality, 2) low volatility, 3) dividend yield and 4) dividend quality.

Investors looking for a dividend instrument for greater diversification should pay attention to the fact that the O’Shares index and, therefore, the OUSA ignore sectors such as energy, materials and real estate. I think it is worth repeating my view from July 2022 article. The general idea here is that eliminating capital-intensive sectors that are closely tied to the economic cycle is more beneficial for risk-adjusted returns and for capturing downsides (lower exposure to cyclicals should mean less sensitivity to market declines) over the long term. However, OUSA investors also risk missing out on some of the tactical advantages that these sectors can offer in a favorable environment, i.e. when the price of WTI rises, boosting oil companies’ cash flows, or when monetary conditions become looser, allowing real estate companies to take advantage.

OUSA Returns: Comments on Performance Attribution

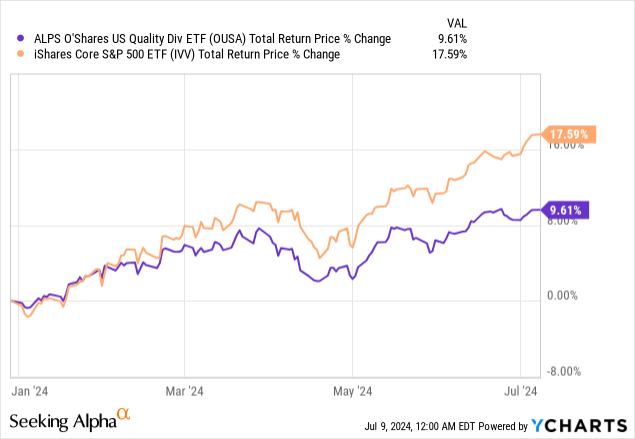

Since my February article, OUSA has disappointed again, significantly underperforming the S&P 500.

Looking for Alpha

With January included, juxtaposed with the return of the iShares Core S&P 500 ETF (IVV), its result is not attractive either.

This is certainly not a growth portfolio by any means (the weighted average growth rate of future earnings was just 5.6% in February, according to my calculations), so its failure to benefit from the long-term rise in stocks is explicable.

Digging a little deeper, I should note that OUSA’s holdings have not changed since the last coverage, which makes the performance attribution process much easier. The first fact to mention is that 52 out of 100 stocks (45.3% weight as of July 8) have seen their price decline (median was -7.2%). The five companies below had the worst performances over the period from February 2 to July 8:

| Symbol | Weight | Sector | % decline |

| Nike (NKE) | 0.68% | Consumer Discretionary Goods | -27.5% |

| Brown-Forman (BF.B) | 0.06% | Consumer staples | -26.0% |

| Starbucks (SBUX) | 0.70% | Consumer Discretionary Goods | -19.8% |

| Accenture (ACN) | 1.40% | Computer science | -19.7% |

| Bristol-Myers Squibb Company (BMY) | 0.43% | Health care | -17.9% |

Created using data from Seeking Alpha and the fund

Stocks that advanced had a median return of 13.6%, but they failed to offset lagging stocks. I’ve compiled the top performers below:

| Symbol | Weight | Sector | % price yield |

| QUALCOMM (QCOM) | 1.44% | Computer science | 46.7% |

| Broadcom (AVGO) | 4.89% | Computer science | 42.6% |

| Eli Lilly (Love) | 3.99% | Health care | 37.5% |

| Garmin (GRMN) | 0.20% | Consumer Discretionary Goods | 34.1% |

| Amphenol (APH) | 0.52% | Computer science | 31.4% |

Created using data from Seeking Alpha and the fund

Incidentally, in the previous note, I mentioned that it was probably OUSA’s insufficient exposure to growth that prevented it from demonstrating larger gains. This time, the problem is the same. The argument I would like to make to corroborate this is that stocks that generated negative returns over the period in question saw their median growth rate of future earnings decline, meaning that experts became more skeptical about their prospects.

| Band | Median income at term (February 3) | Median income at term (July 9) |

| Stocks that won | 5.35% | 5.42% |

| Stocks down | 4.91% | 3.57% |

Calculated using Seeking Alpha and fund data

Sector-wise, communications, healthcare and consumer staples were the biggest detractors, while IT contributed significantly, as the sector benefited from a supportive environment driven by expectations of lower interest rates and the AI adoption narrative.

| Sector | Average price performance |

| Communication services | -9.3% |

| Consumer Discretionary Goods | -1.0% |

| Consumer staples | 4.3% |

| Finances | 0.9% |

| Health care | -2.2% |

| Industrialists | 1.3% |

| Computer science | 14.2% |

| Utilities | 26.1% |

Calculated using Seeking Alpha and fund data

Speaking of utilities, although their average performance has been excellent, it is worth noting that there are only two stocks from this sector in the OUSA portfolio, with a weighting of 2.24%. Their contribution has therefore been minor.

| Action | Weight | Sector | % back |

| Incorporated Public Service Group (ANKLE) | 0.44% | Utilities | 28.2% |

| NextEra Energy (BORN) | 1.80% | Utilities | 24.0% |

Calculated using Seeking Alpha and fund data

Overall, since the index change, OUSA has not only underperformed the market represented by IVV, but also some peers in the dividend ETF universe, notably the Schwab US Dividend Equity ETF (SCHD), the Global X S&P 500 Quality Dividend ETF (QDIV) and the WisdomTree US Quality Dividend Growth Fund (DGRW).

| Metric | WHERE | IVV | SCHD | QDIV | DGRW |

| Starting balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Final sale | $16,159 | $19,126 | $17,171 | $17,501 | $18,832 |

| TCCA | 12.47% | 17.21% | 14.16% | 14.69% | 16.77% |

| Standard deviation | 14.88% | 17.10% | 15.98% | 16.53% | 15.19% |

| Best year | 23.74% | 28.76% | 29.87% | 28.99% | 24.35% |

| The worst year | -9.33% | -18.16% | -3.23% | -0.50% | -6.34% |

| Maximum draw | -19.40% | -23.93% | -15.68% | -16.50% | -16.85% |

| Sharpe ratio | 0.71 | 0.88 | 0.76 | 0.77 | 0.95 |

| Sortino Report | 1.19 | 1.45 | 1.41 | 1.33 | 1.71 |

| Capture on the rise | 79.31% | 101.7% | 75.91% | 75.4% | 88.31% |

| Downward capture | 86.02% | 98.18% | 73.12% | 69.88% | 80.65% |

Data from Portfolio Visualizer. The period is from June 2020 to June 2024

OUSA Factor Mix: Quality Dominates at the Expense of Growth and Value

The OUSA portfolio as of July 8 is similar to that of February, as the index is only reconstituted once a year in September. However, the weightings of the stocks have changed due to their outperformance or underperformance, so it is necessary to reassess the factor exposures.

Value and dividends

OUSA’s weighted average market cap rose to $668.3 billion from $540.4 billion in the previous analysis. Despite such a massive WA market cap, it has an earnings yield of 4.1%, according to my calculations, which is slightly stronger than the S&P 500’s 3.65%. At the same time, the share of holdings with a Quantitative Rating of B- or higher is almost unchanged at 10.7% (10.6% in February).

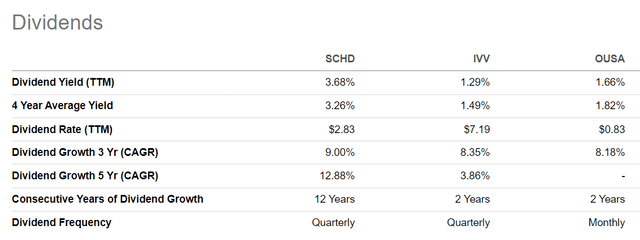

OUSA’s dividend yield has never been particularly attractive. At this point, the portfolio’s WA DY is around 2%, while the fund itself yields 1.66%. At the same time, SCHD investors get 3.68% and IVV investors 1.29%.

Growth

OUSA’s exposure to growth is clearly not spectacular. However, there has been a slight improvement in its allocation to stocks rated B- Quant Growth or better (32.9% in February versus 35.5% in July). Growth rates remain modest, however.

| Portfolio at | EPS before | Fwd Income |

| July | 8.3% | 6.4% |

| FEBRUARY | 7.0% | 5.6% |

Calculated using Seeking Alpha and fund data

Quality

On the quality side, OUSA has a decidedly strong portfolio. Most holdings are cash-rich, with the share of positive FCF companies at 89.1%. Second, capital efficiency is strong across the portfolio, as indicated by adjusted ROE of 23.7% (24.7% in February) and return on assets of 11.6% (12.3% in February), according to my calculations. ROE was calculated by removing negative and triple-digit outliers. Holdings with a quantitative profitability rating of B- or higher represent 95.4%, compared to 99.8% in February.

Low volatility

The lion’s share of OUSA’s net assets is allocated to low beta names, which is reflected in the weighted average figures, which have not changed at all:

| Coefficient | July | FEBRUARY |

| 24 month beta | 0.85 | 0.85 |

| 60 month beta | 0.87 | 0.87 |

Calculated using Seeking Alpha and fund data

Final thoughts: A grade upgrade is unnecessary

In conclusion, OUSA offers a high-quality portfolio with an EY higher than the S&P 500. However, its dividend yield is hardly attractive, its growth exposure is unspectacular, and its returns leave much to be desired (partly due to low volatility), especially assuming a 48 bps expense ratio. In other words, my Hold rating remains unchanged.