S. Ren at Bloomberg: “The situation is flattening out, raising concerns about an ‘asset famine’ and a prolonged recession.”

Whatever the reason, an inverted yield curve gets a bad rap. Normally, longer-dated securities offer higher rates to compensate lenders for locking up their money for an extended period of time. When these yields are close to or below the shortest yields, it indicates that investors are pessimistic about an economy’s growth prospects. In the United States, an inversion was a reliable predictor of recessionsat least before the pandemic.

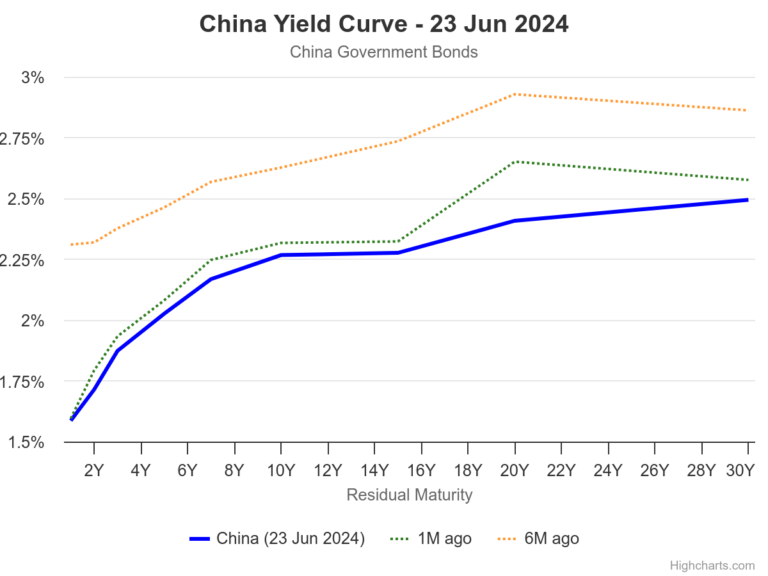

Here is a picture of the Chinese yield curve as of today:

Source: WorldGovernmentBonds.com.

There is no inversion for maturities 1 year to 30 years. On the other hand, the 10 year-3 month spread is reversed.

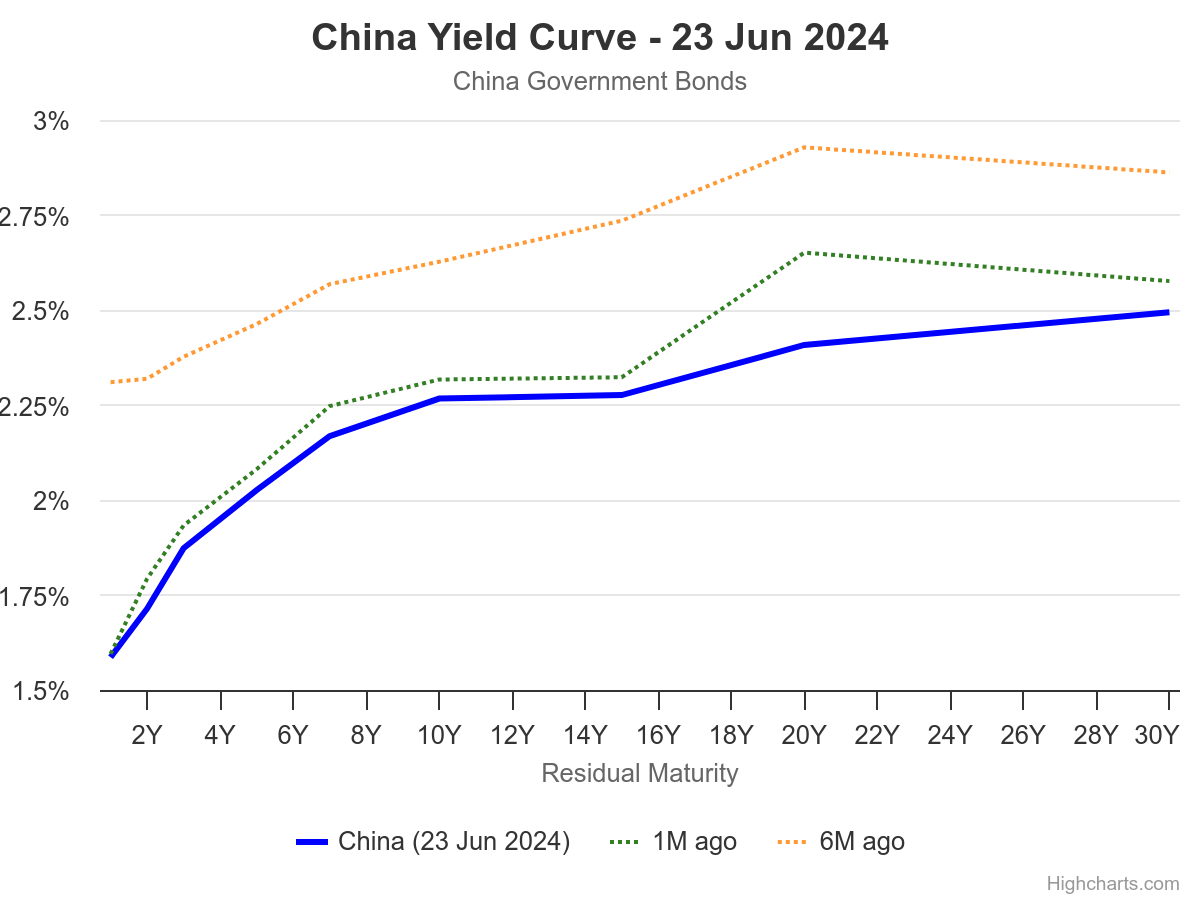

Figure 1: Annual growth of Chinese industrial production (black scale, left) and 10-year gap over 3 months (blue scale, right). ECRI has defined the peak to trough dates of the recession in gray. Source: OECD and author’s calculations.

Chinn and Ferrara (2024) examine the predictability of Chinese recessions and industrial production growth. In the first case, no result can be obtained, given the rarity of recessions during periods when long-term interest rates are available (or relevant, given financial repression). For the annual growth of industrial production, we obtain:

growth = 0.095 + 1.66 × propagated

Adj-R2 = 0.26, NObs = 131, Sample = 2007M07-2018M12 (growth until 2019M12). Bold indicates significance at 10% msl using HAC robust standard errors.

Although there is a statistically significant positive association between the gap and growth, it is not a major explanatory factor. This is perhaps not surprising as the long-term government bond market in China is not very liquid. Long-term bond yield is strongly related to expected future short rates (i.e., the expectations assumption of the term structure) if the marked long term is liquid.

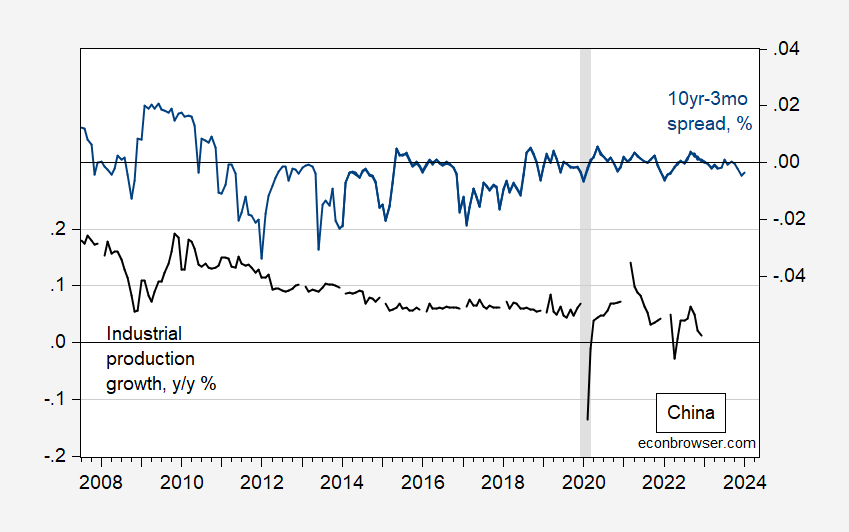

Adding additional financial factors – particularly the debt service ratio and foreign forward spread – increases the adjusted R2 at around 0.77.

growth = 0.237 + 0.32 × propagated – 0.98 ×dsr + 1.44 × propagated*

Adj-R2 = 0.77, NObs = 131, Sample = 2007M07-2018M12 (growth until 2019M12). Bold indicates significance at 10% msl using HAC robust standard errors.

Although the gap remains marginally significant, in terms of standardized coefficients, the debt service ratio and the foreign forward spread have more impact (respectively 7 and 3 times more than the forward spread).

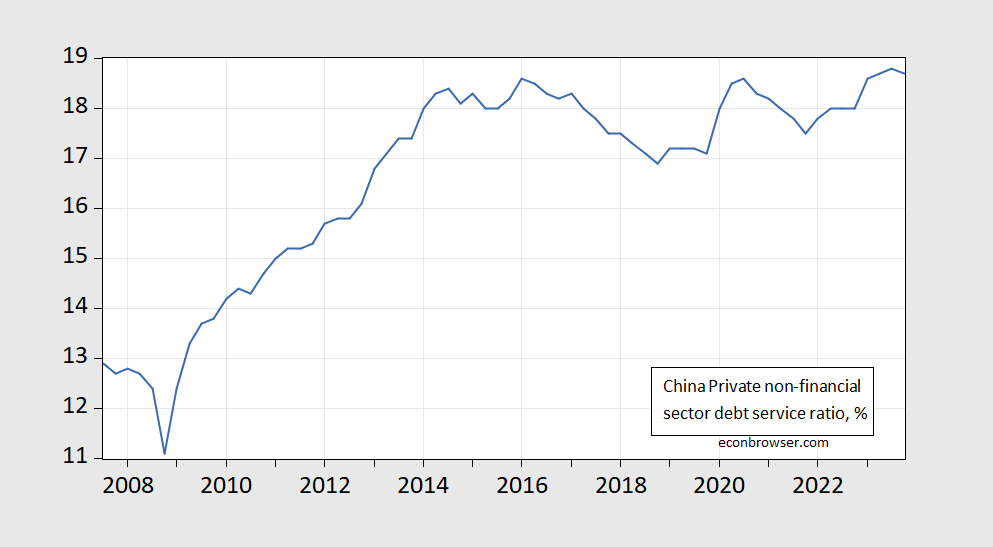

Here is the BIS series on the debt service ratio of the non-financial private sector, until 2023.

Figure 2: Debt service ratio of China’s non-financial private sector, %. Source: BIS.

To spot signs of an impending recession – or recession – look at other indicators.

Previous article on China, here.