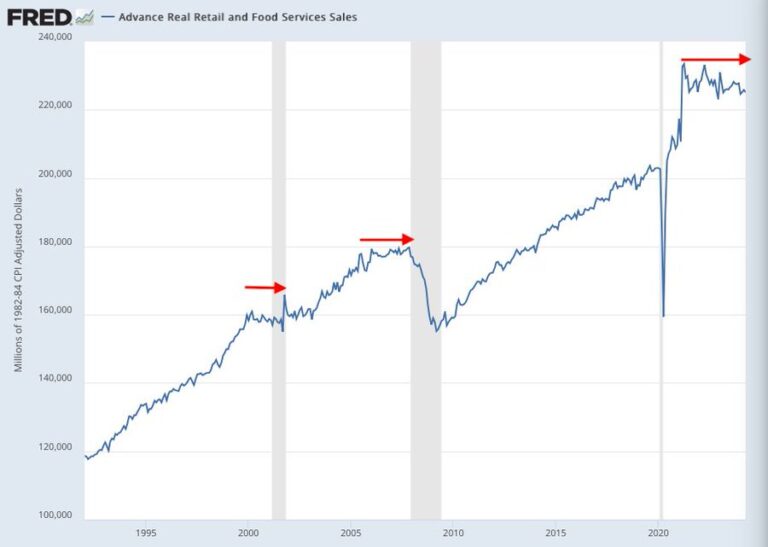

Out of curiosity, I’m scouring the web to see who is still saying a recession is coming (with an open mind). This Tweeter suggests that retail sales are the indicator of the day:

Source: Alex Joosten (2024).

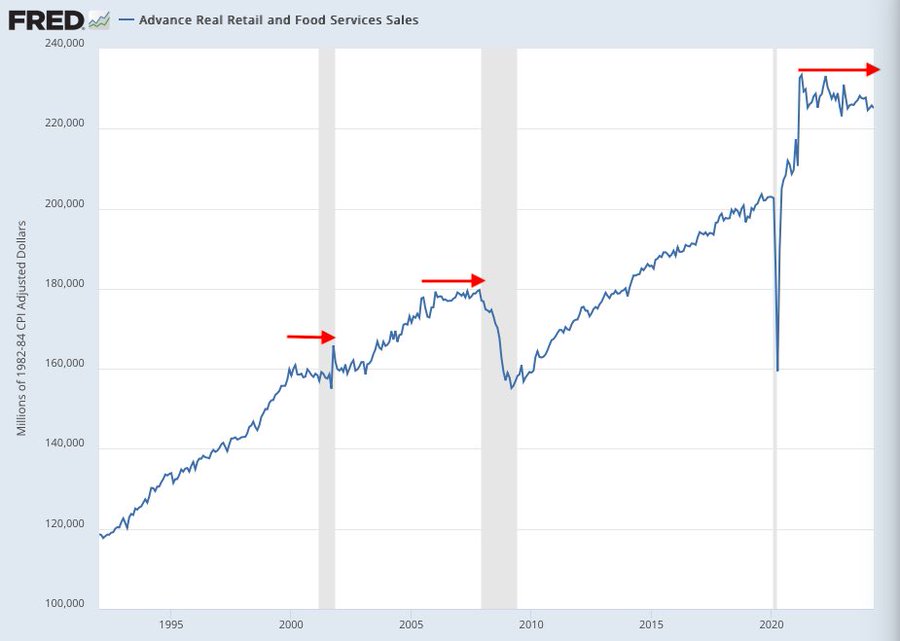

Quite convincing, for the last 3 recessions. However, the post-pandemic boom in retail consumption and spending is quite remarkable. So I thought it might be useful to consider a longer period of data, using inflation-adjusted retail sales. This is the photo I got, for 1947-2024M04.

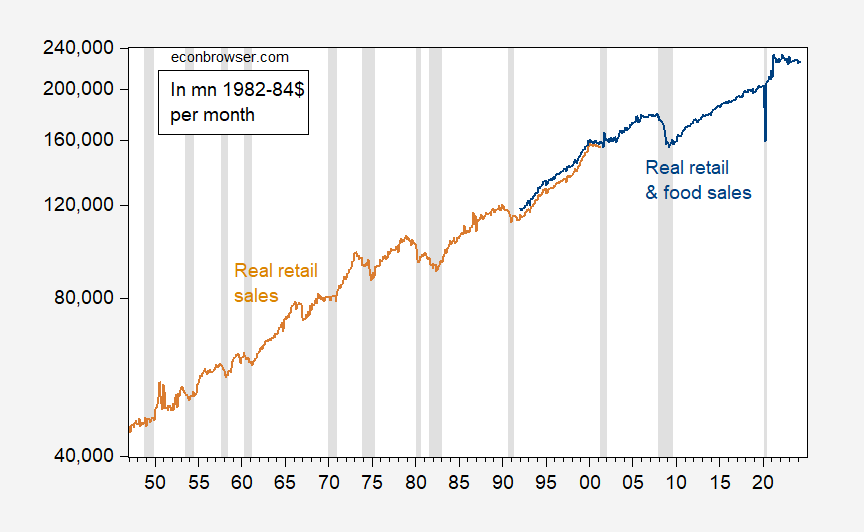

Figure 1: Actual retail sales (FRED RSALES series) (beige) and actual retail and food service sales (FRED RSAFS series) (blue), in millions from 1982 to $84, deflated using the FRED CPIAUCSL series. The NBER has defined the peak to trough dates of the recession in gray. Source: FRED, NBER.

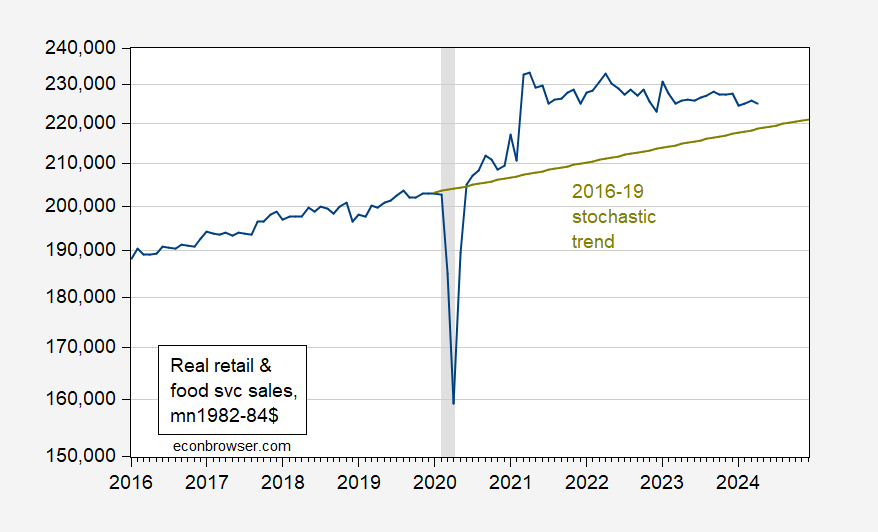

It is certainly true that retail sales stagnate and even decline in some cases before a recession (as defined by the NBER). In contrast, in each of the previous cases, retail sales deviated from a pre-recession trend. Is this true in this case? Without knowing whether an incipient recession is upon us, I cannot answer this question. However, I can assess whether retail and food sales, deflated by CPI, deviated from the (stochastic) trend of 2016-2019.

Figure 2: Actual retail and food service sales (FRED RSAFS series) (blue), in millions of dollars from 1982 to $84, deflated using the FRED CPIAUCSL series. The NBER has defined the peak to trough dates of the recession in gray. Source: FRED, NBER.

So from a metric perspective we should be concerned. By another (deviation from trend), maybe not.