Nvidia Corp., the chipmaker at the center of an artificial intelligence boom, gave another bullish sales forecast, showing that spending on AI computing remains strong.

Second-quarter revenue will be about $28 billion, the company said Wednesday. Analysts on average expected $26.8 billion, according to data compiled by Bloomberg. Results for the fiscal first quarter, which ended in April, also beat forecasts.

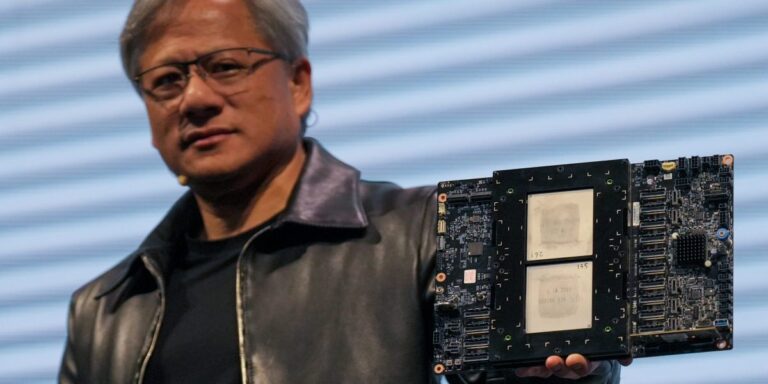

“The next industrial revolution has begun,” CEO Jensen Huang said in a statement, echoing one of his favorite themes. “AI will bring significant productivity gains to almost every industry and help businesses be more cost and energy efficient, while expanding revenue opportunities. »

This optimistic outlook reinforces Nvidia’s status as the biggest beneficiary of AI spending. The company’s so-called AI accelerators — chips that help data centers develop chatbots and other cutting-edge tools — have become a hot commodity over the past two years, driving up its sales . Nvidia’s market valuation has also skyrocketed, surpassing $2.3 trillion.

Shares rose about 4% in extended trading Wednesday. They had already gained 92% this year through the close, fueled by investors’ hopes that the company would continue to beat expectations.

The Santa Clara, Calif.-based company also announced a 10-for-1 stock split and increased its quarterly dividend by 150%, to 10 cents per share.

Nvidia, co-founded by Huang in 1993, began as a supplier of graphics cards to computer gamers. His recognition that the company’s chips were well suited to developing artificial intelligence software helped open up a new market and gave it an edge over competitors.

The release of OpenAI’s ChatGPT in 2022 then sparked a race among big tech companies to build their own AI infrastructure. This rush has made Nvidia’s H100 accelerators a must-have product. They sell for tens of thousands of dollars per chip and are often rare.

But much of this new revenue comes from a small handful of customers. A group of four companies — Amazon.com Inc., Metaplatforms Inc., Microsoft Corp. and Alphabet Inc. Google — are Nvidia’s biggest buyers and account for around 40% of sales. Huang, 61, is trying to expand his bets by producing comprehensive computers, software and services, aimed at helping more companies and government agencies deploy their own AI systems.

During the first fiscal quarter, Nvidia’s revenue more than tripled to $26 billion. Excluding certain items, earnings were $6.12 per share. Analysts had forecast revenue of about $24.7 billion and earnings of $5.65 per share.

Nvidia’s data center division – now by far its largest source of sales – generated $22.6 billion in revenue. Gaming chips brought in $2.6 billion. Analysts had set targets of $21 billion for the data center unit and $2.6 billion for gaming.

Nvidia stressed Wednesday that it wants to sell its technology to a broader market, beyond the giant cloud computing providers known as hyperscalers. Huang said AI is moving toward consumer internet companies, automakers and healthcare customers. Countries are also developing their own systems – a trend called Sovereign AI.

These opportunities “create multiple, multibillion-dollar verticals” beyond cloud service providers, he said.

Nonetheless, hyperscalers remained a key growth engine for Nvidia last quarter. They generated about 45% of the company’s data center revenue. This suggests that Nvidia is in the early stages of diversifying its business.

The company’s new chip platform, called Blackwell, is now in full production, Huang said. And this lays the foundation for generative AI capable of handling billions of parameters. “We are ready for our next wave of growth,” he said.