Most economists expected a recession in 2023. That prediction didn’t even come close: indeed, 2023 was a boom year. I have already discussed an implication of this fact; economists are bad at predicting the business cycle and shouldn’t even try.

There is another lesson to be learned from the non-recession of 2023; Don’t put too much emphasis on statistical models that may seem reliable at first glance. Readers of this blog know that I often reject claims that the “yield curve” is an infallible indicator of turning points in the economic cycle.

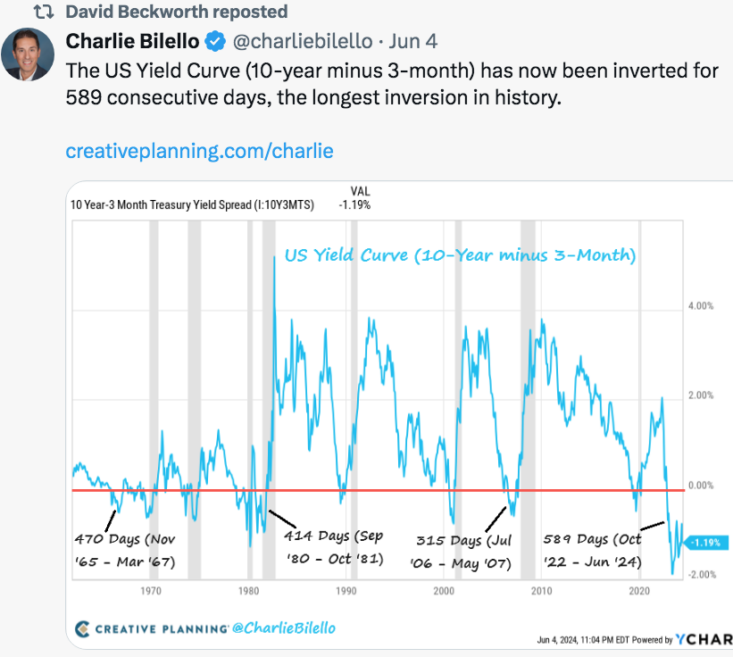

David Beckworth recently directed me to a tweet showing that the yield curve has now been inverted for 589 days. Forecasters often say that a recession is inevitable within 12 months of a yield curve inversion. This is not the case:

I think an inverted yield curve provides useful information. This can be seen as an indicator that investors are likely expecting NGDP growth to slow down in the future. But it’s not perfect.

I recently published an article on the “bad reasoning” regarding the hypothesis of a laboratory leak for Covid. Recession forecasting is another example of poor reasoning. Yield curve inversions tend to occur quite late in a business cycle. And America tends to experience recessions every five years on average. Combining these two facts, it is not surprising that recessions often occur within 12 months of a yield curve inversion. But not always.

Human beings are very good at noticing statistical patterns. We are always looking for patterns that help us better navigate the world around us. And templates are actually often very useful. Yield curve inversion is often a definite precursor to recessions. But I also find that people become overconfident in these models, assuming that just because a model has worked in the past, it will continue to hold true.

The Fed always tries to prevent recessions. If a truly foolproof indicator of recession were to be established, the Fed would respond by adjusting monetary policy in such a way as to make recession less likely. For this reason, it is unlikely that we will ever have a reliable technique for predicting recessions.

PS. The yield curve actually predicted the 2020 Covid recession, but I suspect it was just “dumb luck”.