da-kuk

Japan’s private sector returned to growth early in the second half of 2024. The rate of expansion was solid, although mainly driven by a booming services sector, while manufacturing output contracted slightly in July.

Meanwhile, the theme Rising inflationary pressures persisted in July, with both input cost and output price inflation rates rising, although with variations across sectors.

The intensification of cost pressures provides another reason for the Bank of Japan to further normalize monetary policy, although the cooling of business confidence in July and unbalanced production conditions add uncertainty to the outlook for interest rates.

Japan’s flash PMI signals solid growth

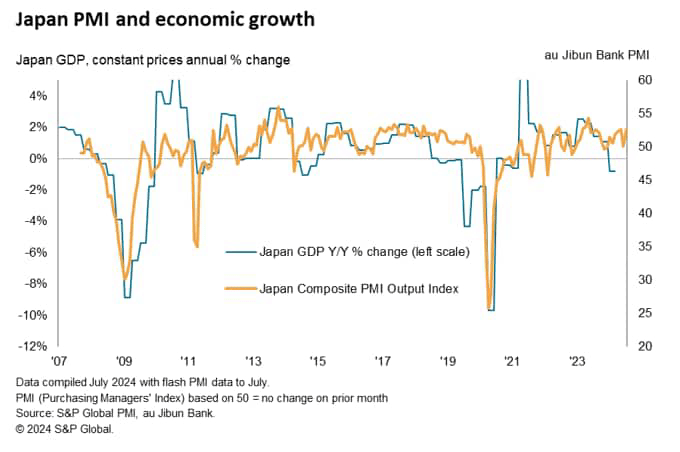

The Japanese Flash Composite PMI from Australian investment bank Jibun Bank, compiled by S&P Global, rose to 52.6 in July from 49.7 in June. Moving above the neutral mark of 50.0, the flash index, based on about 85-90% of responses to typical monthly PMI surveys indicate that Japanese private sector conditions have improved again after a brief deterioration in June.

Moreover, the growth rate was solid and the fastest in 14 months, matching both August 2023 and May 2024. Overall, the latest composite output reading – covering both manufacturing and services – is historically consistent with GDP growing at an annual rate of just over 1% at the start of the third quarter.

Services activity increases as manufacturing output declines

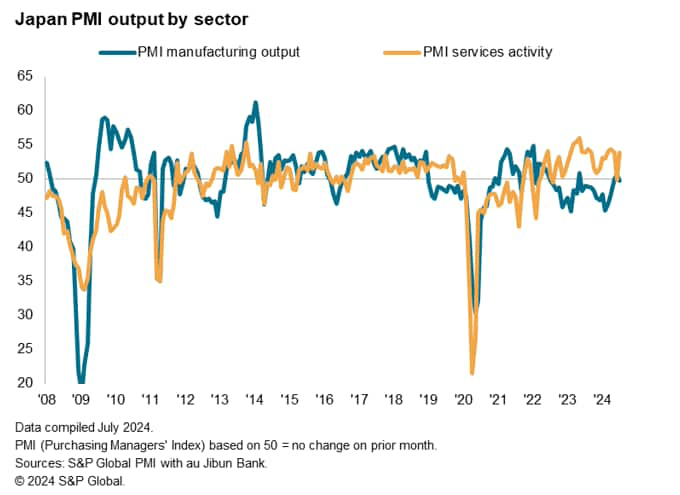

A reversal in sector performance was observed again in July, this time with services returning to the lead in growth while manufacturing output declined.

Services activity grew at its fastest pace since April, supported by a solid expansion of new services activity amid improving demand. More importantly, increased hiring of full-time and part-time staff allowed service providers to better meet orders, facilitating the latest surge in activity.

The level of ongoing activity nevertheless accumulated at the fastest pace since March, despite the solid rise in employment levels, and is therefore indicative of a further increase in services activity in the months ahead.

In contrast, manufacturing output declined in July after registering its first expansion in 13 months in June. Although the pace of output contraction was only marginal, sharp reductions in new orders and the level of backlogs of work point to a further slowdown in the goods-producing sector.

Japanese automakers have frequently reported a decline in new orders, due to weak domestic and foreign demand, and have often pointed to weakness in the auto sector. Although Japanese automakers have continued to increase their workforce, the sharp reduction in purchases and the reluctance to hold additional inputs and raw materials indicate a decline in optimism about future production.

Service providers retain pricing power amid continued cost increases

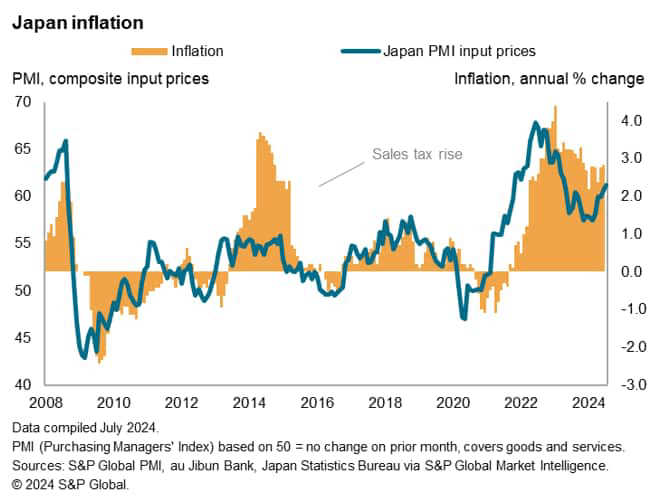

At the same time, cost pressures increased in line with the general increase in economic activity in July. Average input prices, measured in the manufacturing and services sectors, rose at the fastest pace since April 2023 due to the weaker yen. This led private sector companies to raise their selling prices at a faster pace in July.

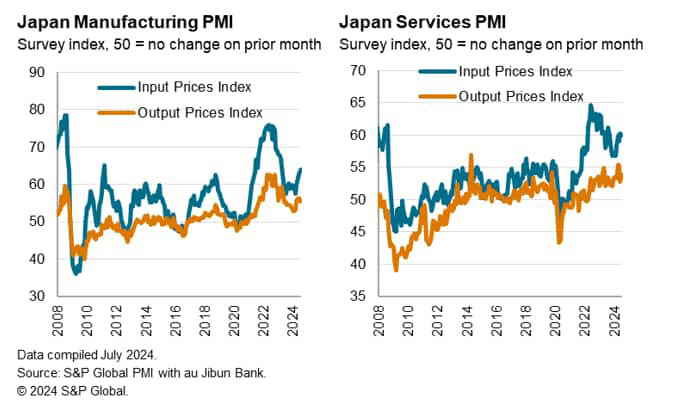

That said, a closer look at pricing trends by sector reveals divergences in pricing power. While Japanese manufacturers experienced the highest input cost inflation in 15 months, the rate of producer price inflation slowed to a four-month low as producers sought to set more competitive prices to support sales.

In contrast, Japanese service providers raised their selling prices at an accelerated pace in July, even though input costs rose at a slightly slower pace than in June. This gap in pricing power reflects differences in demand conditions between the two sectors.

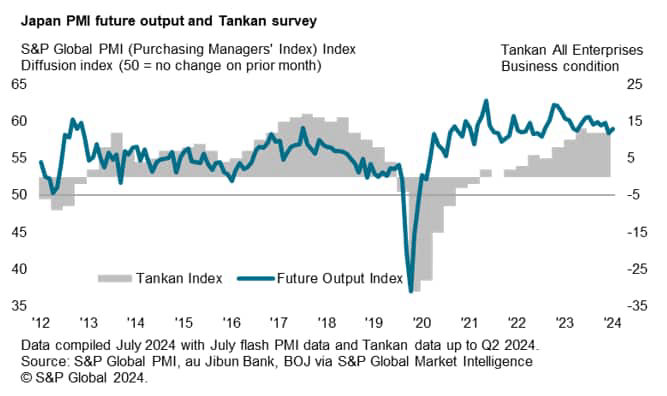

The PMI of future production also revealed divergences in sentiment. The overall level of confidence fell to a nine-month low, due to a decline in optimism in the manufacturing sector. Concerns among goods producers focused mainly on slowing demand and an uncertain global growth outlook. Services firms, on the other hand, posted their highest level of optimism since May.

The latest flash PMI figures thus illustrate the Bank of Japan’s dilemma over whether to raise rates at its next policy meeting. On the one hand, the sustained increase in inflationary pressures, attributed in part to the weak domestic currency, strengthens the case for a rate hike.

In contrast, more detailed sectoral PMI data revealed an imbalance in economic conditions by sector when looking under the hood, with the slowdown in manufacturing being a concern.

Editor’s Note: The summary bullet points in this article were selected by Seeking Alpha editors.