CIPhotos

Janux Therapeutics, Inc. (NASDAQ:JANX) is a clinical-stage biopharmaceutical company generating novel immunotherapies to modulate T cells to fight cancer. The Company’s platforms design novel drug candidates that overcome the limitations of current T cell engagers (TCEs) for solid tumor treatments. Today, Janux The pipeline includes JANX007, which targets prostate-specific membrane antigen (PSMA) for metastatic castration-resistant prostate cancer (mCRPC), and JANX008, which targets epidermal growth factor receptor (EGFR) for several solid tumors. Therefore, I consider JANX a “buy” for investors aware of the risks inherent in biotechnology and M&A.

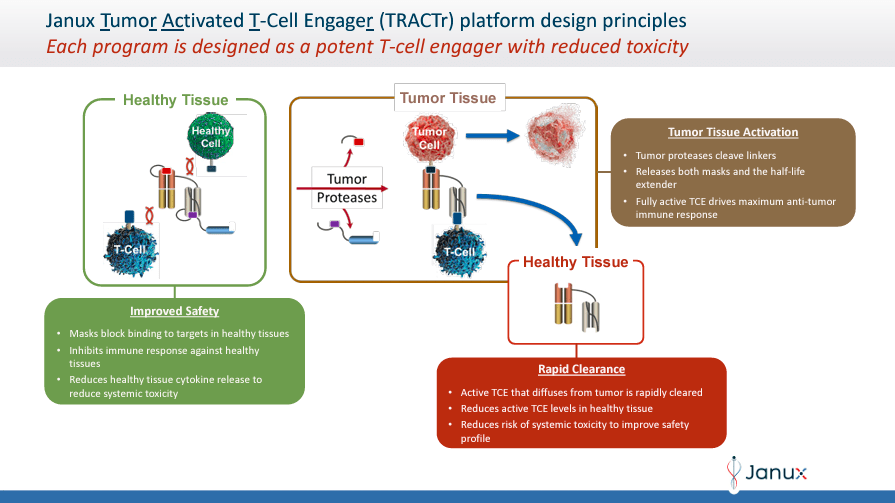

TRACTr: overview of the activity

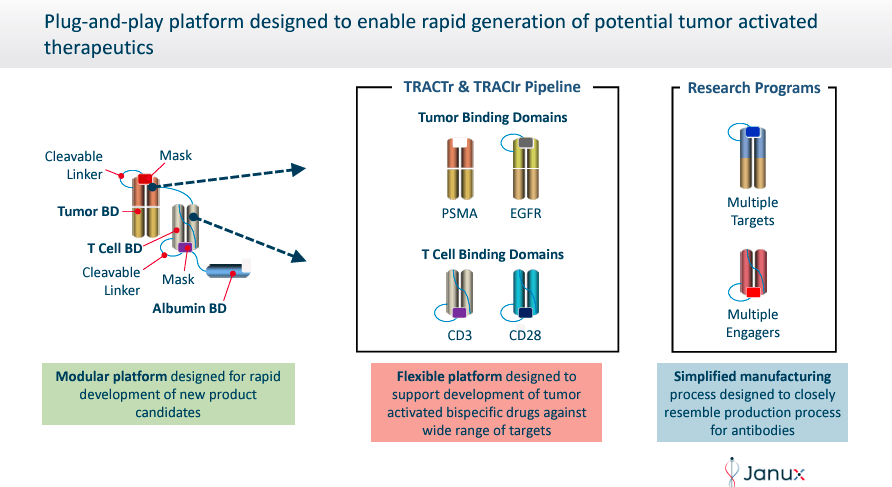

Janux Therapeutics was founded in 2025 and is headquartered in San Diego, California. JANX’s proprietary platforms, Tumor-Activated T Cell Engager (TRACTr) and Tumor-Activated Immunomodulator (TRACIr), are developing drug candidates designed to overcome the limitations of existing T cell-based tumor treatments. The TRACTr platform designs molecules that selectively activate T cells only in the tumor microenvironment. At the same time, the TRACIr system generates molecules targeting tumor antigens to improve the immune response with reduced side effects.

Source: Corporate Presentation. May 2024.

In addition, the company TRACTr platform selectively creates molecules that are activated in the presence of tumor-specific proteases in the cancer microenvironment and remain inactive in healthy tissues. THE TRACIr platform creates tumor-activated immunomodulators that utilize a tumor antigen-binding domain linked to a T-cell co-stimulatory CD28 binding domain. This design ensures that JANX’s mechanism of action specifically targets cancer cells, enhancing thus the immune response while reducing side effects.

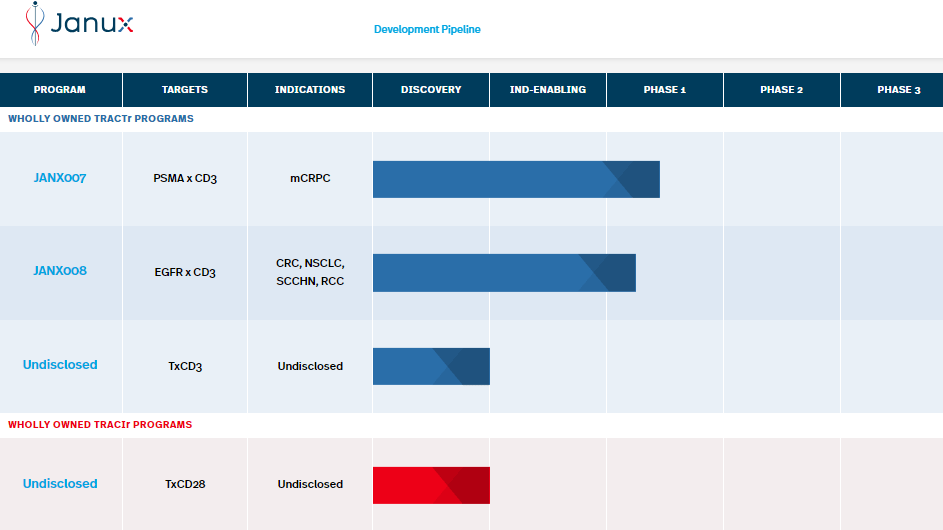

Source: Janux Therapeutics website.

JANX pipeline includes two programs: JANX007 and JANX008. JANX007 is a bispecific molecule studied in Phase 1 clinical trials. The drug is the Company’s lead tumor-activated T-cell engaging (TRACTr) agent, which targets prostate-specific membrane antigen (PSMA). It is indicated in metastatic castration-resistant prostate cancer (mCRPC).

On the other hand, JANX008 is also a TRACTr targeting epidermal growth factor receptor (EGFR) in phase 1. However, JANX008 is indicated for multiple solid tumors, such as colorectal cancer (CRC), squamous cell carcinoma of the head and neck cancer (SCCHN), non-small cell lung cancer (NSCLC), and renal cell carcinoma (RCC).

Cancer Treatment Results Propel Janux Therapeutics

Most recently, on February 26, 2024, JANX announced positive Safety and efficacy results of JANX007 in heavily pretreated patients with advanced mCRPC. The results suggest that JANX007 may be the best treatment for mCRPC due to its efficacy and safety profile. In patients receiving a starting dose of 0.2 mg or more, 83% (5 of 6) achieved a 50% reduction in prostate-specific antigen (PSA) levels.

This indicator, called (PSA50), is a well-known biomarker for disease monitoring because high PSA levels are linked to the presence of prostate cancer. Additionally, another result showed that with a first dose of 0.1 mg or more, 56% of patients (10 out of 18) achieved a reduction in PSA50. The safety profile showed no cytokine release syndrome (CRS) above grade 2. Therefore, there was no exaggerated immune response that could be harmful. This corroborates that JANX007 had a satisfactory safety profile and paved the way for phase 2 and 3 trials. It also shows that its effects are dose-dependent, which often suggests that the drug’s mechanism of action is working.

Additionally, JANX noted its first JANX008 data results showed differentiated safety and promising efficacy in heavily pretreated patients with various solid tumors. A subject with NSCLC, a difficult-to-treat aggressive lung cancer, achieved a Response Evaluation Criteria in Solid Tumors (RECIST) partial response (PR) maintained for 18 weeks with a 100% reduction. of the primary lung tumor (i.e. the tumor has disappeared).

Source: Corporate presentation. May 2024.

In fact, JANX’s drug successfully eliminated liver metastases without serious adverse events (SAEs) or dose-limiting toxicities (DLTs). Additionally, JANX executives indicated that they expected a update on JANX007 data in 2H2024. As for JANX008, we should receive another update by 2025. The company is also running additional TRACTr and TRACIr preclinical programs for future studies. In my opinion, this is quite astonishing, and is probably the reason why the company is now valued in the billions, as the drug was effective and well tolerated. So overall, I would say that its pipeline is progressing very promisingly for effective cancer therapies.

It’s worth it: valuation analysis

From a valuation perspective, JANX trades at a market cap of $2.1 billion. This is important because the company still has no product revenue, only collaboration revenue from its research agreement with Merck (MRK). This deal hinted at the value of JANX with its TRACTr technology, since MRK also wants to use it to develop its own T cell-activating drugs. I suspect there could be more collaborations like these, as development new, safe and innovative T-cell engagers is precisely revolutionary. So, despite JANX’s promising results on its internal drug portfolio (i.e. JANX007 and JANX008), its platform sets JANX apart.

Also note on April 10, 2024, the JANX share price increased by 12% Due to the potential interest in buying their products from large pharmaceutical companies, who want to expand their portfolio. Naturally, we have few details about these potential M&A deals, and there’s no way they’ll come to fruition, but I suspect they make sense. In my opinion, it would make sense for JANX’s platform to be as efficient and versatile for producing new drug candidates as the MRK deal suggests. Regardless of the outcome, the attention from big pharma underscores the value and potential impact of JANX’s TRACT technology.

Source: Alpha Research.

On the other hand, much of JANX’s value today appears tied to such M&A speculation. It nevertheless remains true that JANX has substantial financial resources. His last balance sheet The report showed $212.8 million in cash and equivalents and $439.0 million in short-term investments. So, adding these two together, JANX essentially has $651.8 million in short-term available liquidity. It also has no financial debt, just $33.2 million in total liabilities, most of it coming from operating lease obligations.

JANX’s cash burn is also somewhat moderate relative to its available funds. By adding its CFO and Net CAPEX, I estimate its last quarterly cash flow the burn was $15.0 million. This implies an annual cash burn of $60.0 million, which suggests a long cash flow period of approximately 10.9 years. This means that the company has more than enough resources to fund its research for the foreseeable future, even if it is still mostly in phase 1.

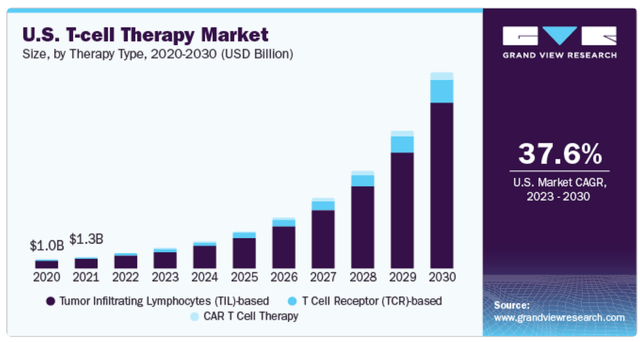

JANX’s T cell activators are part of the broader T cell therapy market. (Source: GrandViewResearch.)

Additionally, its most recent book value was $655.8 million, implying a P/B of 3.2. For reference, this is Median industry P/B the multiple is 2.36. Thus, JANX trades at a slight premium to its peers. Still, it’s worth considering that its underlying intellectual property appears potentially very valuable, so I think its valuation is reasonable overall. Therefore, JANX seems a reasonable “buy” for investors who want to bet on this potentially disruptive platform and technology. It also has promising drug candidates in phase 1, the results of which pave the way for other short-term trials. As T-cell activators are part of the broader T-cell therapy market, there is considerable potential for JANX’s intellectual property if successful.

Investment Cautions: Risk Analysis

However, I must emphasize that the main risk of my “buy” thesis is that JANX’s platform is disappointing. As I noted previously, much of its current valuation is likely due to its speculative appeal to other pharmaceutical giants. If further clinical trials of JANX007 and JANX008 suggest that the company’s technology is not as viable as it appears today, then the stock would likely suffer as a result.

Source: TradingView.

Additionally, it is important to consider the potential stock price implications if ongoing M&A rumors are refuted or dismissed altogether. Yet, as a standalone company, I believe JANX’s vast resources and platform position it well to generate shareholder value over the long term. After all, JANX’s promising clinical trial results on these drug candidates have demonstrated their effectiveness and safety, attracting the attention of major pharmaceutical companies and demonstrating the important role JANX will play in advancing cancer treatments.

Buy: Conclusion

Overall, JANX has a potentially revolutionary platform with its TRACTr technology. Two promising drug candidates are progressing well through the FDA regulatory process, and phase ⅔ is expected to begin within a year or two. In my opinion, JANX’s balance sheet is also quite strong, with a long cash reserve of over ten years. Finally, recent M&A rumors also add to its potential, as a buyout would likely bring significant value to shareholders. So, despite the uncertainty inherent in JANX’s technology, I believe its investment equation is ultimately favorable. Therefore, I view JANX as a “buy” for investors looking to gain exposure to oncology biotech.