This is a leading question in the New York Times a little while ago (just coming to this now that I’ve finished grading).

The contemporary U.S. economy, Mr. Rieder argued in his note to clients, is less vulnerable to the boom-and-bust cycles of yesteryear — primarily because its thriving consumers are service-oriented and less dependent than ever on factories or farms. Consumer spending accounts for about 70 percent of the economy.

In some ways, it is indisputable that the business cycle is less pronounced when considering the properties of real GDP time series.

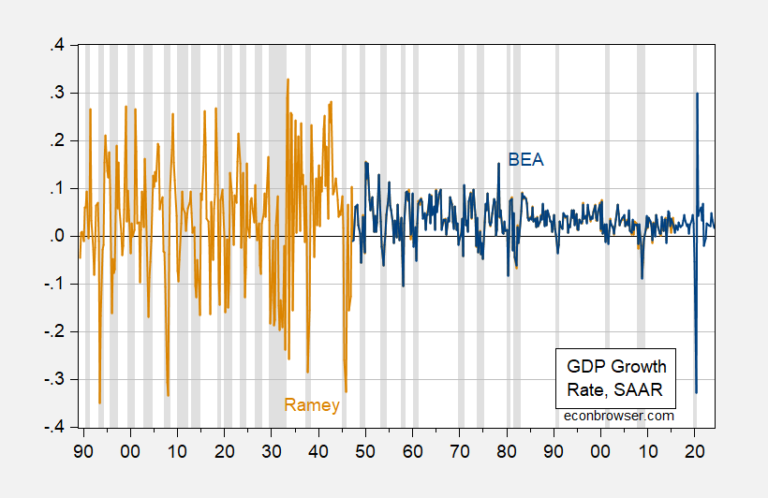

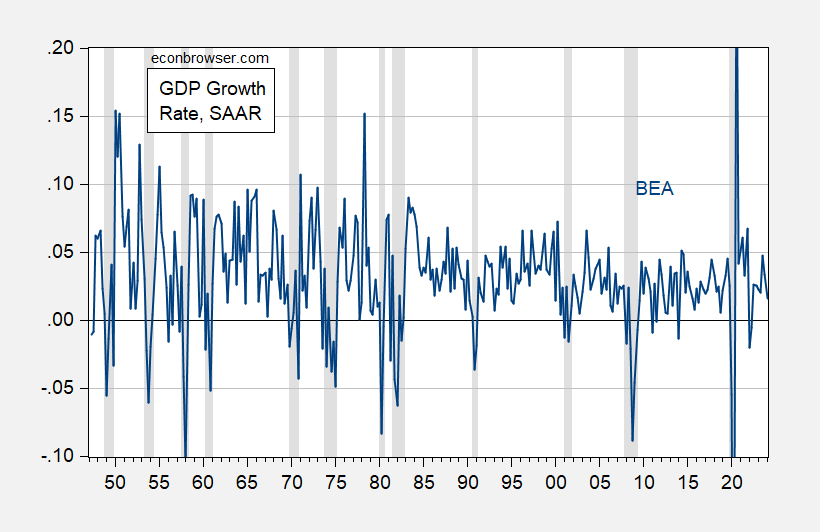

Figure 1: Quarter-over-quarter annualized GDP growth rate of BEA (blue) and Ramey (tan), calculated in logarithmic differences. The NBER has defined the peak to trough dates of the recession in gray. Source: BEA, RameyNBER and author’s calculations.

Even for the sample constituted by the BEA, we obtain the following table: GDP volatility is generally decreasing.

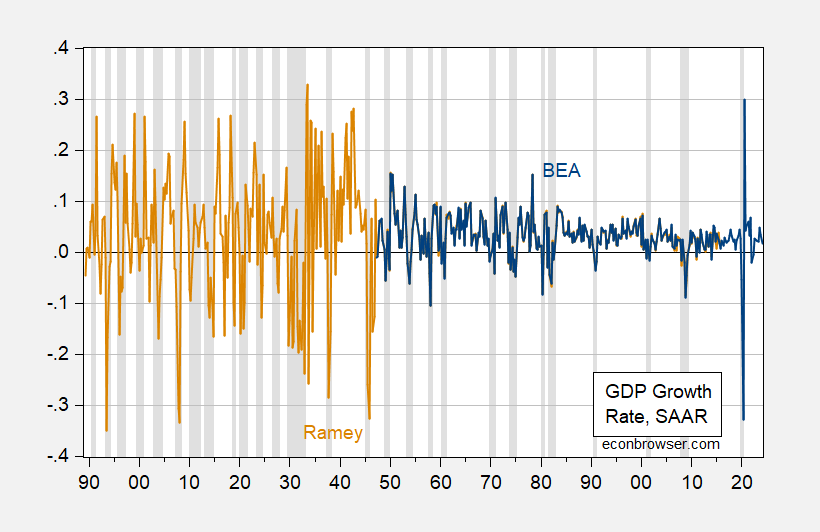

Figure 2: BEA quarter-over-quarter annualized GDP growth rate (blue), calculated in logarithmic differences. The NBER has defined the peak to trough dates of the recession in gray. Source: BEA, NBER and author’s calculations.

Aside from the pandemic-related recession, GDP volatility has been much less. The length of extensions determined by the NBER has also increased. This change has been apparent for a long time and has prompted Bernanke coined the term “The Great Moderation”.

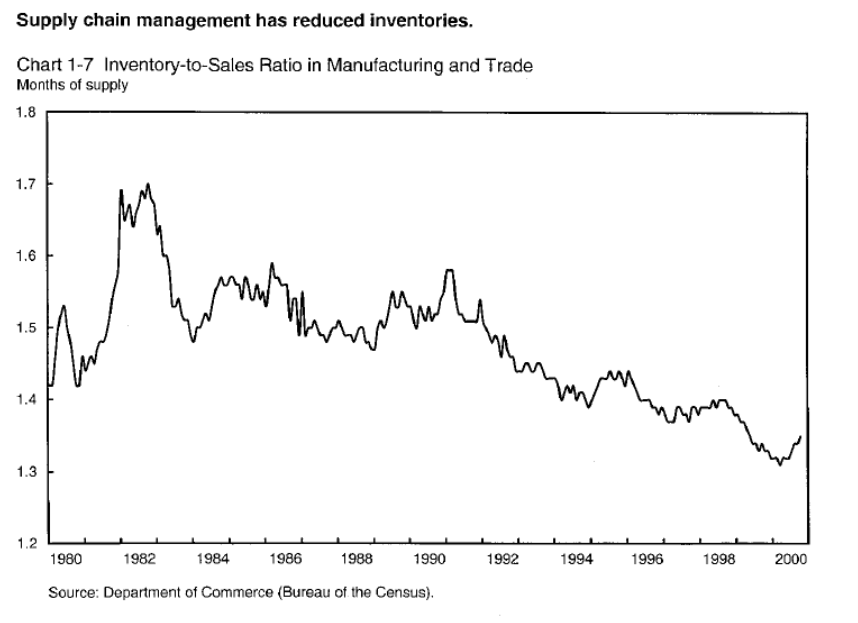

This discussion reminds me of discussions at the beginning of this century about how new information technologies would improve inventory management (Economic Report of the President, 2001):

New information technologies have also changed the nature of relationships between companies and their suppliers. Procurement practices have changed dramatically, as companies are now linked to their suppliers through Internet-based business-to-business marketplaces. This capability allows companies to streamline procurement activities, reduce transaction costs, improve supplier relationship management, and even engage in collaborative product design. “Just-in-time” delivery, facilitated by a more efficient transportation network comprising both ground and air infrastructure, has been instrumental in allowing businesses to reduce inventory and costs while continuing to provide essential services to producers and consumers.

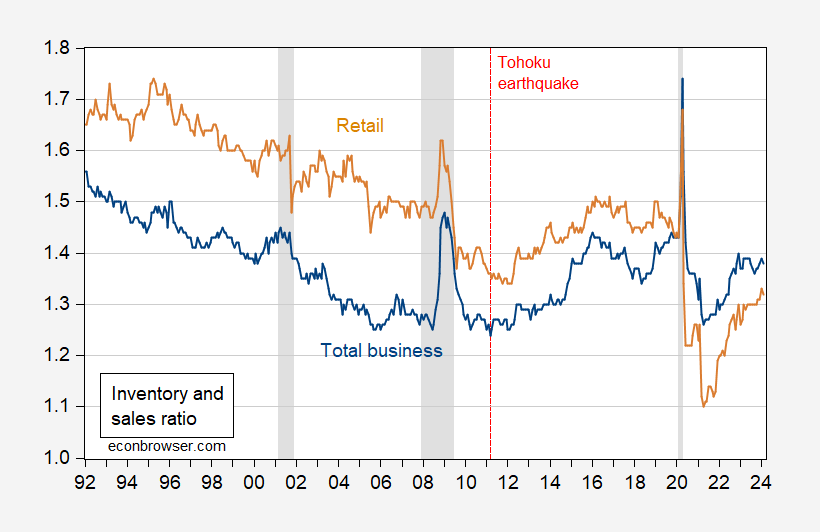

I don’t have access to the same series, but here is the inventory-to-sales ratio for the entire business and for retail, with a sample extending through Q4 2023.

Figure 3: Inventory-to-sales ratio for total activity (blue), for retail (tan). The NBER has defined the peak to trough dates of the recession in gray. Source: Census via FRED.

Inventory ratios continued to decline after 2000, until 2008, a year interrupted by the Great Recession. They start to increase again after the Tohoku earthquake in Japan, which highlighted the dangers of remote supply chains.

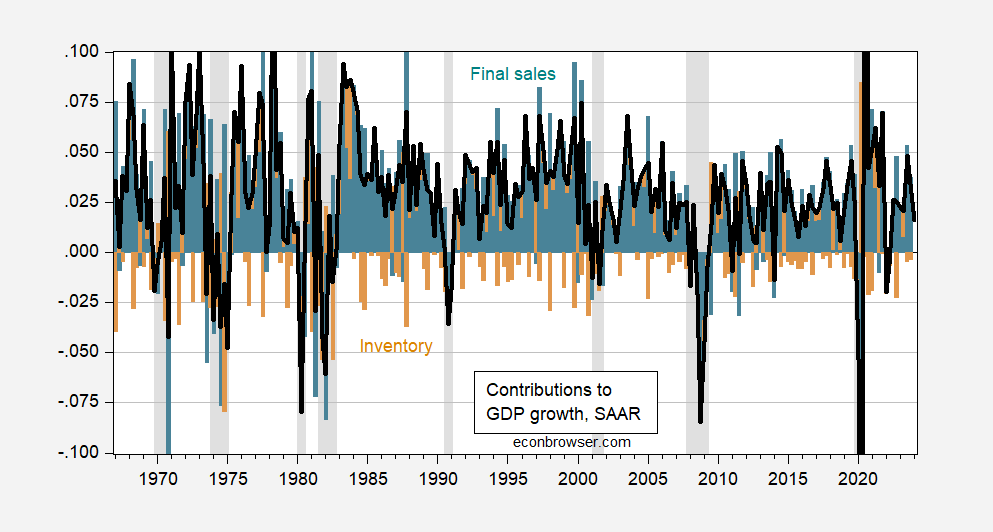

What appears to be true is that the relative contribution of inventory changes to overall GDP growth has declined over time.

Figure 4: Annualized GDP growth rate q/q (black line), contribution from final sales (teal bar), contribution from inventory changes (beige bar). The NBER has defined the peak to trough dates of the recession in gray. Source: BEA.

So to some extent the story we tell in the macro introduction, that the Keynesian crossover imbalance is eliminated by stock decumulation or accumulation via production changes, is less relevant than in the past . Whether this remains true depends on the extent of reshoring, or “friendshoring,” as countries and companies try to protect supply chains from shocks.

However, as noted in the New York Times article, other shocks – demand and supply – remain, including financial crises (2007-09), debt crises (2009-12) or pandemics (2020). . For me, the economic cycle remains, even if certain modes of propagation have perhaps become less relevant.