More articles on dollar dominance, for example in Foreign policy, Wells Fargoagainst. BitcoinNews. But most of the discussions are about the use of the dollar as a medium of exchange, etc. (use of SWIFT, invoicing). Here are some recent trends regarding the size of reserves.

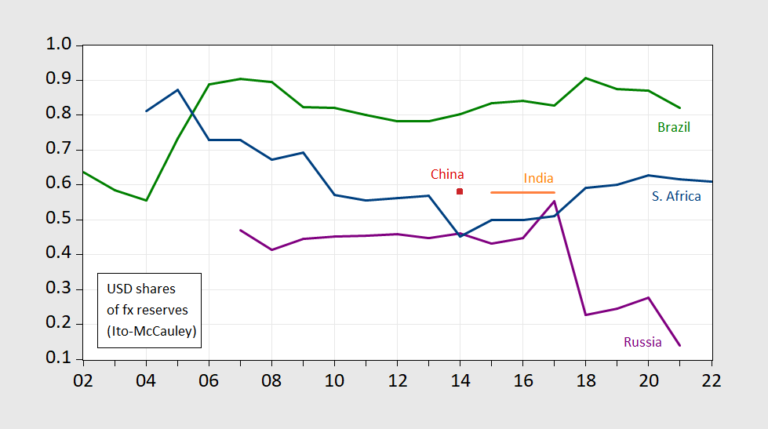

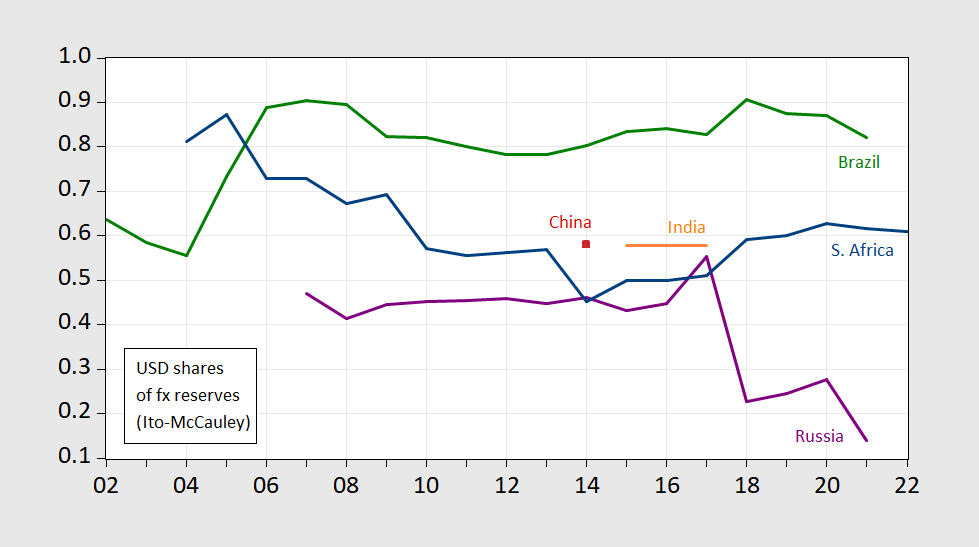

Here are some images of the main reserve currencies held by the BRICS.

Figure 1: Share of foreign currency assets in USD, by central bank. Source: Ito-McCauley Database,.

Next, shares held in EUR; note the change in scale.

Figure 2: Share of foreign currency assets in EUR, by central bank. Source: Ito-McCauley Database,.

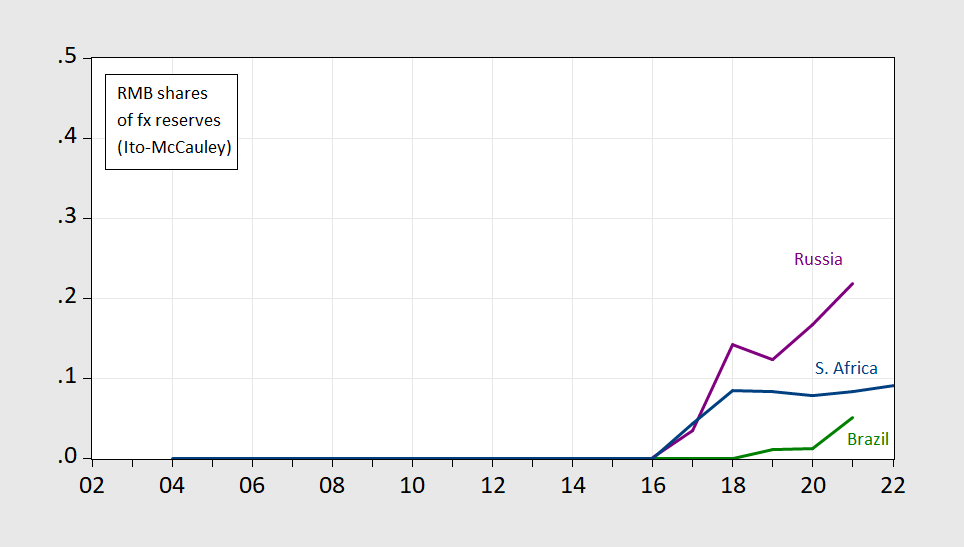

US dollar reserves have fallen sharply only in Russia. What about RMB? We have little information on this.

Figure 3: Share of foreign currency assets in RMB, by central bank. Source: Ito-McCauley Database,.

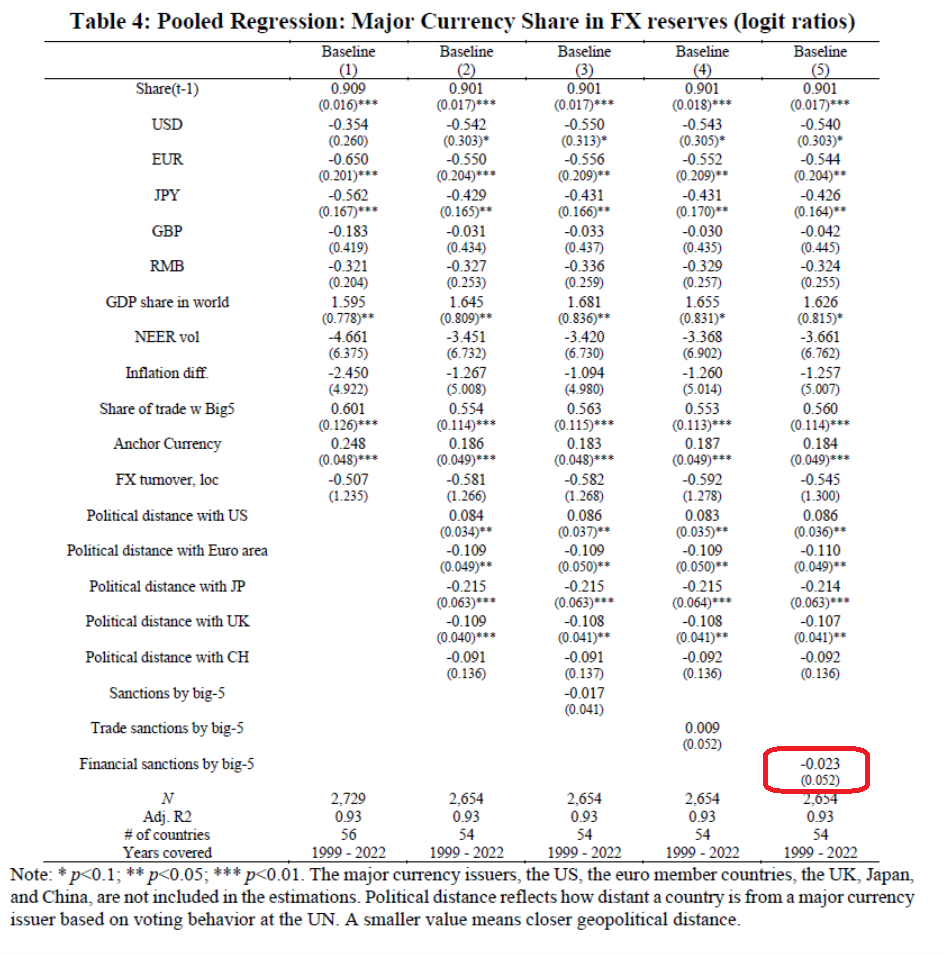

Will the implementation of sanctions lead to a reduction in dollar reserves? Unfortunately, we do not have data for the period after the expanded invasion of Ukraine, but we do have estimates covering the period up to 2021.

Source: Chinn, Frankel and Ito (JIMF2024).

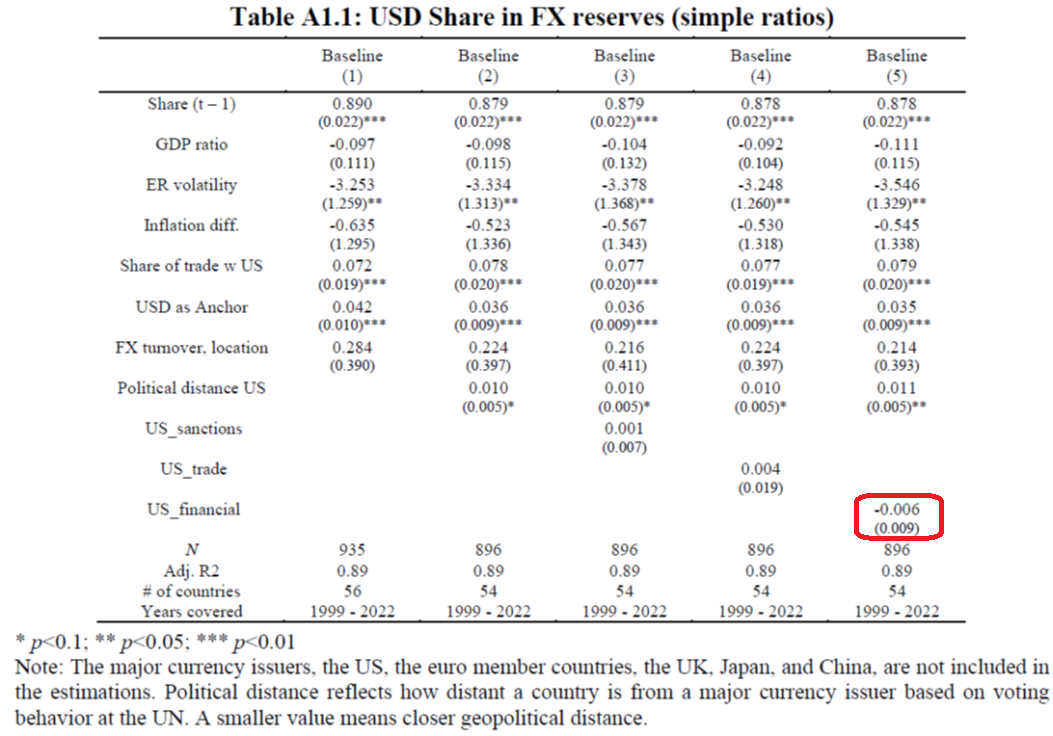

Note that the estimated coefficient is not statistically significant. It is also nonlinear, so a bit difficult to interpret. Table A1.1 in the paper presents estimates from a linear regression of stocks on USD holdings (only), so the coefficient estimate is easier to interpret.

Source: Chinn, Frankel and Ito (JIMF2024).

The point estimate is very small (and not Taken literally, with an autoregressive coefficient of 0.88, the long term The impact is 0.05, meaning that if the United States imposes financial sanctions on a country, that country’s central bank will hold on average 5 percentage points fewer U.S. dollars. But the 95% confidence interval encompasses a 6 percentage point interval. increase in dollar shares.

Therefore, arguments that the use of financial sanctions would erode dollar dominance are not empirically verified so far (perhaps with data up to 2023 we would find something different).