William_Potter

Charlie Munger once exalted the virtues of an initial savings of $100,000 as a key first step towards achieving long-term financial independence. The reasons for this are numerous and include the fact that reaching a $100,000 nest egg requires a lot of discipline and focus. As This is generally the case with any achievement, who you become in the process of achieving that goal is often far more valuable and important to your long-term success than the achievement itself.

Plus, once you’ve accumulated $100,000 in investments, you have a substantial passive income snowball that will start earning you a significant amount of money without you having to do any additional work. For example, if you earn a roughly average annualized stock market return on this nest egg, you’ll earn about $10,000 a year. In a short time, this will quickly snowball to $1,000 or more per month in passive income, which can be quite significant for families living on a typical salary. Additionally, it can provide a significant psychological boost, as having a six-figure savings working for you and seeing a significant amount of passive income coming in each month can do wonders for your confidence and also free you up to take additional risks in order to potentially accelerate capitalization. process.

With that in mind, this article will explain how to deploy that $100,000 using a simple portfolio combining the power of diversified ETFs with high-quality, high-yielding stocks to generate substantial passive income while also seeking total return long-term compound. As part of the process of building a powerful passive income snowball, the five funds I would consider investing in for a relatively simple but well-diversified portfolio are:

#1. Schwab US Dividend Stock ETF (SCHD)

This fund provides well-diversified exposure to high-quality dividend growth stocks at a very low expense ratio of 0.06%. It has a strong track record of generating total return and an impressive track record of long-term dividend growth. SCHD offers a current dividend yield of almost 3.5% and diversification across more than 100 positions, well distributed across major sectors like financials, healthcare, consumer goods, industrials and even a small technology exposure .

#2. JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

While this fund charges a higher expense ratio of 0.35%, it makes up for that by offering outsized exposure to ultra-large-cap technology stocks along with a de facto covered call strategy that generates monthly cash flows very lucrative. The ETF pays a 12-month dividend yield of 8.8% while providing investors with approximately 50% exposure to technology and 15.79% to the communications sector, both underweight in the portfolio of SCHD. This includes major stocks such as Microsoft, Apple, Nvidia, Amazon, Alphabet, Meta, Broadcom, Advanced Micro Devices, Tesla and Netflix.

Although the diversification offered by these two ETFs is significant, they still lack exposure to fixed income and real estate and have very little exposure to utilities and infrastructure stocks. Therefore, the other three funds I would invest in are:

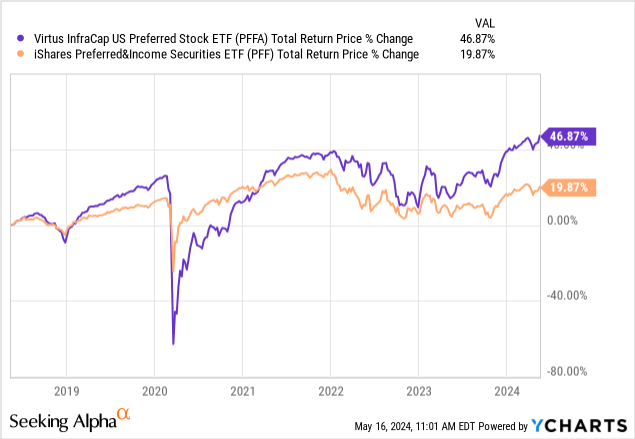

#3. InfraCap US Preferred Stock ETF (PFA)

This fund provides diversified exposure to the preferred infrastructure sector by employing a strategic level of leverage and an actively managed portfolio strategy that has outperformed the broader preferred sector (PFF) by more than two to one since its creation.

Additionally, it offers a very attractive dividend yield of 9.5%.

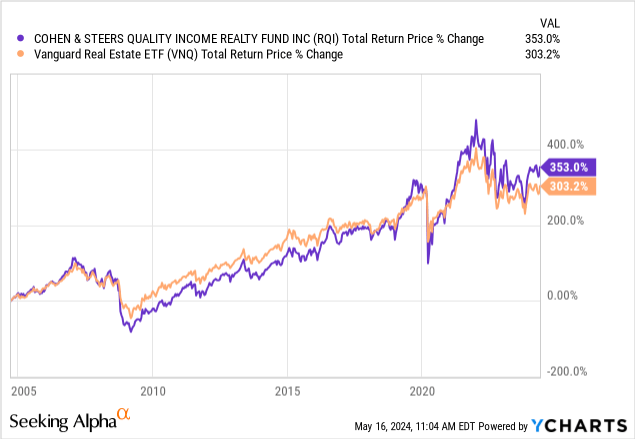

#4. Cohen & Steers Quality Income Real Estate Fund (IQR)

This fund provides diversified exposure to the real estate sector while employing an actively managed strategy that has generated long-term outperformance versus the broader REIT space (VNQ):

It also brings a dividend yield of 8.25% which is paid monthly and has been sustained through thick and thin, including the COVID-19 crash.

#5. Cohen & Steers Infrastructure Fund (UTF)

This fund provides broadly diversified exposure to the utilities and infrastructure sectors, paying dividends monthly with an attractive 8% yield. It includes stakes in tower infrastructures (AMT), electric (SO) (BORN) and energy infrastructure (TRP) spaces, among others.

Now that the portfolio is better balanced and offers a higher return, the key elements missing are exposure to the midstream sector (AMLP) and business development companies (BDC) (BIZD), two of the best sectors for generating sustainable high-income returns over the long term. My choices for these sectors are:

Midstream Stocks

I would choose three middle stocks: Enterprise Products Partners (EPD), Energy transfer (AND), and Enbridge (IN B). While you can potentially find better values in this sector, these three sectors offer high, sustainable returns over the long term and are likely to continue to grow at a rate that matches or exceeds inflation.

EPD leads the industry with an A- credit rating from S&P, a very low leverage ratio of 3.0 times, a distribution yield of over 7%, and a growth rate of approximately 5% per year. It has an attractive growth pipeline and a well-diversified portfolio that provides stability, generating returns on invested capital of 10% or more in various market environments.

Despite the recent rapid rise in ET’s unit price over the past few years, it still offers a distribution yield of around 8%, covered approximately 1.9 times by distributable cash flow. Its leverage ratio continues to decline and it recently repurchased the vast majority of its outstanding preferred shares, strengthening its balance sheet and distribution coverage. It is also advancing several growth projects and has increased its distribution at an annualized rate of more than 3%.

Finally, ENB has a strong balance sheet with a BBB+ credit rating. Additionally, its cash flows are among the most stable in the entire midstream industry, with over 95% coming from investment-grade counterparties and approximately 98% from long-term contracted or regulated assets. Its recent large utility acquisitions from Dominion Energy (D) have made it a major player in the natural gas utility sector, significantly boosting its conservative profile. It expects its EBITDA to grow around an annualized rate of 5% in the long term and its distribution to grow at an annualized rate of 3 to 5%, with a dividend yield above 7%.

BDC Shares

The three BDC stocks I would buy for attractive, sustainable long-term dividends with further growth potential are Ares Capital (ARCC), Main Street Capital (MAIN), and Blackstone Guaranteed Loans (BXSL).

ARCC has a fairly conservative dividend coverage ratio compared to most BDCs, which is further bolstered by its large and growing revenues. Its 9%-plus dividend yield is supported by an investment-grade balance sheet and strong underwriting performance from its external manager Ares Management (ARE), and a long-term track record of market-crushing overall returns, despite the blow from the Great Financial Crisis and the COVID outbreak.

MAIN has an even more impressive long-term total return history and has proven to be one of the best dividend growth stocks in the BDC sector. It offers a current dividend yield of almost 6%, often supplemented by generous special dividends. Being managed internally, it has lower management costs than many externally managed peers, and it also has lucrative asset management and equity investment arms that generate significant net asset value growth on the long term.

Last but not least, BXSL is managed by the world’s largest alternative asset manager, Blackstone (B.X.). BXSL invests almost its entire portfolio in senior secured loans, which allows it to benefit from a more conservative stance compared to many peers. Combined with its investment-grade balance sheet and very strong performance since IPO, BXSL’s attractive 10%-plus dividend yield likely makes it the best risk-adjusted dividend in the entire BDC sector.

Here is the complete portfolio allocation example:

| Tickers | Amount | % | Yield |

| SCHD | $25,000.00 | 25.00% | 3.40% |

| JEPQ | $25,000.00 | 25.00% | 8.82% |

| PFA | $12,500.00 | 12.50% | 9.50% |

| IQR | $10,000.00 | 10.00% | 8.25% |

| UTF | $7,500.00 | 7.50% | 7.88% |

| EPD | $5,000.00 | 5.00% | 7.14% |

| AND | $2,500.00 | 2.50% | 7.99% |

| IN B | $5,000.00 | 5.00% | 7.17% |

| ARCC | $2,500.00 | 2.50% | 9.07% |

| MAIN | $2,500.00 | 2.50% | 5.84% |

| BXSL | $2,500.00 | 2.50% | 10.07% |

| Total | $100,000.00 | 100.00% | 7.20% |

Takeaways for investors

By intelligently combining ETF diversification with certain strategic allocations to high-quality, high-yielding blue chips in sectors lacking in circulating funds, investors can benefit from a well-diversified high-yielding portfolio that is expected to continue to grow in value. distributions over the long term while requiring very little management. This allows a retiree to relax and enjoy their golden years. Of course, this portfolio is only a thought experiment, and investors should do their due diligence, including speaking with their personal financial advisor or financial planner before employing this or any other strategy. But we hope these ideas give you some food for thought as you think about building your own income portfolio.