alfexe/iStock via Getty Images

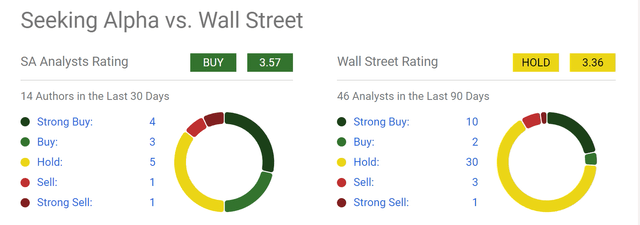

Intel stock is not liked by Wall Street

Readers familiar with my writings know that we have argued against Wall Street’s view of Intel Corporation (NASDAQ:INTC) in the last year or So, as the chart below illustrates, Wall Street sentiment on the stock is lukewarm at best. Overall, Wall Street analysts have given the stock a “Hold” rating, with 30 out of 46 analysts giving it that rating over the past 90 days. There are some differences among analysts, however. A total of 10 analysts have given it a “Strong Buy” rating, and 4 analysts have given it a “Sell” or “Strong Sell” rating.

I, on the other hand, am optimistic about the title. As I explained in my recent articleMy opinion is that:

…the recent price The corrections reflect the short-term market reaction and present a buying opportunity for investors with a 3-5 year investment horizon. Analysts expect EPS to grow at a CAGR of over 20% over the next few years and we view such a growth curve as highly plausible thanks to a series of catalysts.

My argument in this article was based on a series of catalysts, the three main ones being ““The Biden administration’s recent $8.5 billion grant, secular demand for semiconductors and the potential for margin expansion.”

In this article, I want to reiterate our optimistic view by focusing the discussion on its foundry business. The goal is to explore this aspect in more depth and show A) why this INTC’s investment over 3-5 years, and B) why the market reaction to its quarterly progress (or lack thereof) is overblown and misplaced.

Intel Stock: The Situation of Foundries

INTC stock prices have been up and down lately. The stock prices have become too sensitive to news about its smelter and so detached from the fundamentals of the company in my opinion. For example, the main reason for the sharp decline in price over the last 2-3 months (more on that later) has been the recent drop in INTC stock prices. disclosure regarding its foundry business. The disclosure reported a larger-than-expected loss. Specifically,

“The Foundry business reported an operating loss of $7 billion on revenue of $18.9 billion for its Foundry business in 2023, higher than the loss of $5.2 billion recorded in 2022 on revenue of $27.5 billion.”

I know that the foundry business will be a long-term investment for INTC from the beginning, and that there will be bumps along the way. For a company of this scale, delays in building new plants (manufacturing plants) and financial losses in their current foundry business are inevitable and don’t bother me too much. The reasons for my optimistic view involve a bit of technical training and some engineering details (incidentally, I have a pretty good technical background from graduate school and enjoy understanding technical/engineering problems). For those of you who share a similar interest/passion, I’d like to refer you to a recent article titled Understanding Intel’s Foundry Situation. The author did an impressive job on the engineering side and went into much more depth on the technical aspects than I would ever dare to do in my public articles.

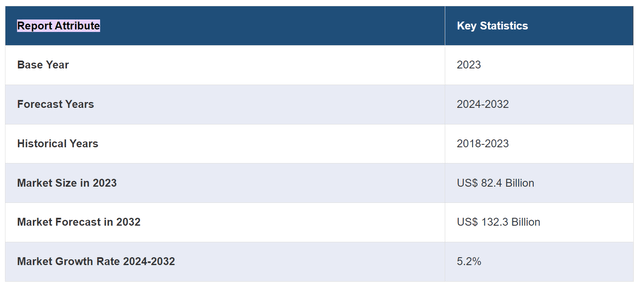

As detailed in my previous article, I see a good chance that Intel Foundry will benefit from margin expansion (say around 40% non-GAAP gross margins and 30% non-GAAP operating margins over the next 3-5 years) and reach a breakeven point. Intel Projects foundry business to attract external customers with revenues exceeding $15 billion by around 2030 and become the world’s second-largest foundry by then (after Taiwan Semiconductor (TSM), TSMC). Of course, INTC will be far behind even if this goal is achieved. Moreover, as many bears have already pointed out, INTC’s manufacturing technology will lag far behind TSMC’s and therefore will not be able to compete for the most lucrative contracts. However, I believe that A) global demand for manufacturing capacity will increase secularly at a healthy pace (see data provided by IMARC (below) and B) demand will grow in various application segments and not just in the most advanced chips requiring the most advanced manufacturing technologies.

As the IMAR report points out (emphasis added):

The global semiconductor foundry market size reached US$82.4 billion in 2023. Looking forward, IMARC Group expects the market to reach US$132.3 billion by 2032, exhibiting a growth rate (CAGR) of 5.2% during 2024-2032. The market is experiencing steady growth, driven by the increasing demand for advanced electronics. in various sectors including consumer electronics, automotive and telecommunications, the increasing shift to electric and autonomous vehicles, as well as the growing adoption of AI and machine learning.

Ultimately, I see strong demand for INTC’s manufacturing capabilities in the coming years, even if they aren’t the most advanced. Finally, adding $15 billion in incremental revenue is already significant, especially considering INTC’s compressed valuation metrics today. INTC trades at a P/S ratio of 2.6x at the time of writing, compared to TSM’s 11.5x P/S on a TTM basis.

Other risks and final thoughts

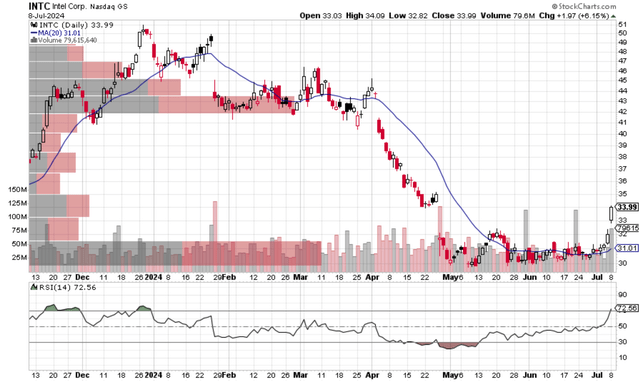

Another near-term bullish element is the stock’s recent trading pattern, as shown below. You can also see how oversold the stock was in April after the release of its smelting business update. Specifically, the top panel of the chart shows INTC stock’s price and volume information along with its 20-day moving average. The bottom panel shows the Relative Strength Index (“RSI”). I see several classic signs that INTC stock is headed higher in the near term.

First, the price has just crossed above the 20-day moving average. The current price of $33.99 is well above the 20-day moving average of $31. Second, the strong price gains of the last few days have also been accompanied by an increase in trading volume, a classic combination that indicates an uptrend. Finally, its RSI has moved out of oversold territory. The RSI is currently at 72.56. An RSI reading of 70 or above is generally considered to be in “bullish territory.” Also note that the RSI itself has been trending upward since July, suggesting that selling pressure has subsided and buying pressure is increasing.

In terms of downside risks, apart from execution challenges in its foundry business, INTC also faces a few other risks. The ongoing global trade tension (particularly between the US and China) and the potential for an economic slowdown are some of the key macro risks facing INTC and its chip peers. On the emerging artificial intelligence (AI) front, competition is only going to intensify, not with heavyweights like Nvidia (NVDA) and advanced microdevices (AMD) but also with new entrants. Many non-chip tech companies (like Apple, Google, etc.) have recently started investing in their own AI chips. Finally, INTC derives a large portion of its revenue from the PC segment. Growth in this segment may be limited as PCs reach saturation and other alternative computing devices (mobile, cloud, etc.) become more common.

Overall, given all of these uncertainties, I think it’s fair to say that Intel Corporation is currently in a state of flux. It’s certainly a high-risk investment that I wouldn’t recommend to more conservative investors. However, I believe it has the financial wherewithal and technical expertise to turn things around. In particular, its foundry business is a long-term investment, and the market’s overreaction to short-term setbacks only creates excellent buying opportunities for long-term investors.