D.Lentz

By Ewa Manthey

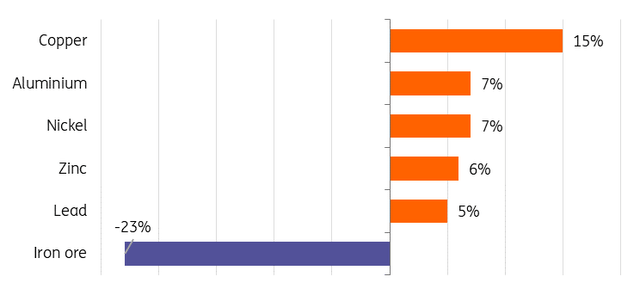

% performance of metals since the beginning of the year

Source: LME, SGX, ING Research

Aluminum rallies in May

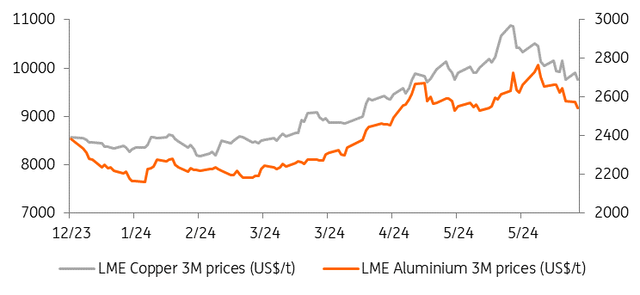

Aluminum prices on the London Metal Exchange reached their highest level in two years at the end of May. The increase was mainly due to the return of investments to raw materials after the surge in copper prices.

Copper and aluminum reach new highs in May

Increased investment drives aluminum up

After Rio Tinto (RIO) declared force majeure on alumina shipments from its Queensland refineries due to shortages of gas to fuel its operations, supply risks helped drive up the price of aluminum. Force majeure will only affect the supply of third-party exports, and the supply of Rio’s own smelters will not be affected. The reductions have raised concerns about their impact on aluminum supplies; However, we do I don’t believe that is the case.

Since then, the price of aluminum has fallen about 9% due to concerns about high global inventories, profit-taking by investment funds and weak Chinese demand. Meanwhile, copper is down about 10% from its all-time high set last month.

Despite the rally in May, we believe aluminum fundamentals have not changed significantly and prices are now vulnerable to a further downward correction. The supply and demand outlook remains fairly balanced for 2024, while investor interest fades.

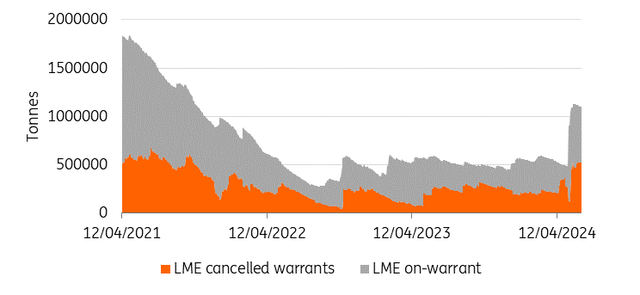

LME shares hit highest level since October 2021

LME aluminum stocks saw their biggest daily inflow in early May, driven by deliveries to Malaysian warehouses. By the end of May, total aluminum inventories were up 128% for the month.

Following these large deliveries – which would come from the Trafigura group – the waiting time to take delivery of aluminum on the LME increased from zero to more than five months. The latest data from the bourse shows a waiting time of 159 days for the delivery of aluminum to warehouses in Port Klang in Malaysia at the end of May. This is the longest queue reported in the LME system since June 2021, when there was a waiting time of 168 days.

Russian share of LME aluminum declines

Russia’s aluminum share on the LME plunged last month. The Russian metal accounted for less than half (42%) of the aluminum stored in LME warehouses in May. This figure is down from almost 90% a month earlier, the latest LME data shows.

The volume of Russian aluminum in LME warehouses increased to 246,950 tonnes, from 116,325 tonnes. Despite this sharp increase, the volume as a proportion of total stock fell following a significant influx of metals of Indian origin. Indian material volumes increased from 12,275 tonnes to 293,325 tonnes, with Indian metal’s share on the LME increasing from 9% in April to 50% last month. This follows large deliveries to Port Klang last month.

The LME banned the delivery of newly produced Russian metal in April following American and British sanctions.

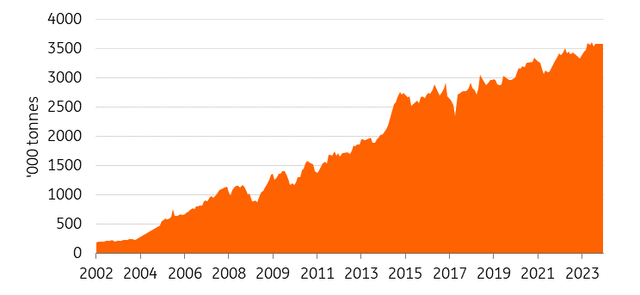

Chinese aluminum production increases

China’s production is expected to increase in the coming months, mainly due to the steady recovery of electricity supply in Yunnan, with remaining unused capacity continuing to slowly resume production. We expect China’s primary aluminum production to increase by around 2% in 2024 to around 42 million tonnes.

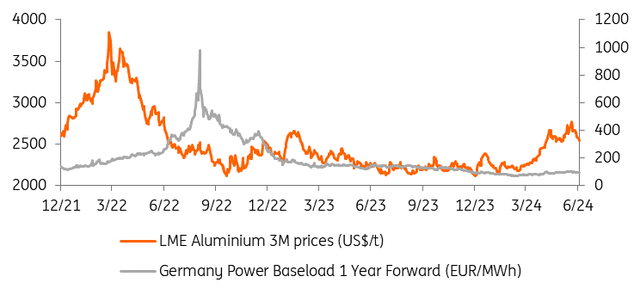

High aluminum prices and low energy costs could lead to more restarts in Europe

Source: LME, Refinitiv, ING Research

In Europe, smelter margins are healthy amid high aluminum prices and lower energy costs, and could lead to more announcements of restarts, which would be bearish for aluminum prices. The European aluminum sector has been one of the sectors most affected by the energy crisis. This metal is one of the most energy-intensive metals to produce. More than a million tonnes per year were taken offline during the energy crisis, but we are starting to see restart announcements as electricity prices have fallen sharply from the highs seen during the crisis. In the first quarter, a restart began at the Trimet foundry in Saint-Jean, France, and further announcements are likely throughout the year.

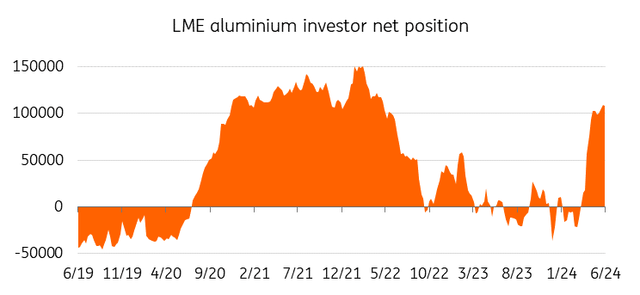

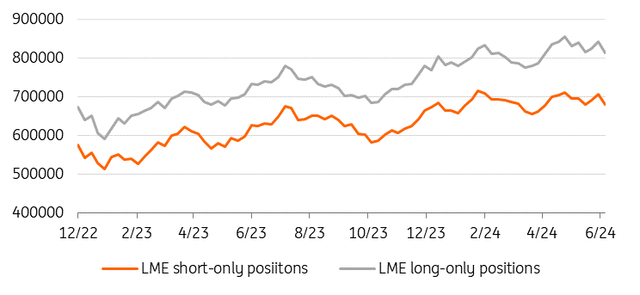

Speculators reduce their net bullish bets

Speculators reduced their bullish bets on aluminum on the LME by 3,670 net long positions to 133,439, weekly futures and options trading data showed. The net long position was the least bullish in more than two months.

LME net bullish bets fall to two-month low

The Fed’s caution could be a brake

US monetary policy will also play an important role in determining the direction of aluminum prices. High rates and a strengthening dollar have weighed on industrial metals over the past two years.

Our American economist believes that under the right conditions – that is, more evidence of easing inflationary pressures, a slowing labor market, and a slowdown in consumer spending – the Fed will seek to move its monetary policy from “restrictive” to “slightly less restrictive” by lowering its rates by 25 basis points at its September FOMC meeting.

However, if US rates remain high for longer, it would lead to a stronger US dollar and weakening investor confidence, resulting in lower aluminum prices.

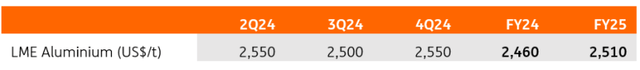

Aluminum could experience more disadvantages

We have revised our LME aluminum price forecast slightly upwards to reflect the investor-led rise to a new two-year high in recent weeks. We now expect an average of $2,550/t in the second quarter, compared to $2,500/t previously.

However, we then expect prices to decline over the coming months to an average of $2,500/t in the third quarter, as the recent rise is mainly due to investment money and there is now a likelihood additional profit taking.

Subsequently, we see prices rising again in the latter part of the third quarter as demand begins to improve, averaging $2,550/t in the fourth quarter. The second half of the year should also be the starting point for Fed rate cuts. There is, however, a risk that demand will weaken further if high inflation keeps interest rates high. We forecast average prices of $2,460/t in 2024.

ING forecasts

Content Disclaimer

This publication has been prepared by ING for information purposes only, regardless of the user’s means, financial situation or investment objectives. The information does not constitute an investment recommendation, nor does it constitute investment, legal or tax advice, or an offer or solicitation to buy or sell any financial instrument. Learn more