I have only started writing about this Trump policy proposal: “Trump trade advisers plot dollar devaluation” . I was baffled by how Trump’s masterminds were actually going to force a weakening of the dollar: sterilized intervention, lowering interest rates in the United States, or forcing foreign countries to re-peg their currencies to stronger values . They all seem problematic.

Sterilized procedure: There is not much evidence that this works, on a widespread basis, for countries with open capital markets (see Poppers, 2022 for an investigation).

Lower interest rates in the United States: Well, if the United States could lower its interest rates while forcing other countries to raise theirs, it would (absent any financial market turmoil that this might cause) result in a depreciation of the dollar . If, in addition, by lowering US interest rates, financial market participants could be convinced that inflation would accelerate, then most standard monetary models of the exchange rate would predict a depreciation of the dollar in the short term.

My estimates for an ad hoc model 2005-2023 give:

r = -5.61 + 2(aa*) + 9.6I – 9.7I* – 0.81π + 1.51π* + 0.003VIX

Adj-R2 = 0.88, SER = 0.031, DW = 0.60, N =76. Coefficients in Bold indicate significance at 10% msl using HAC robust standard errors.

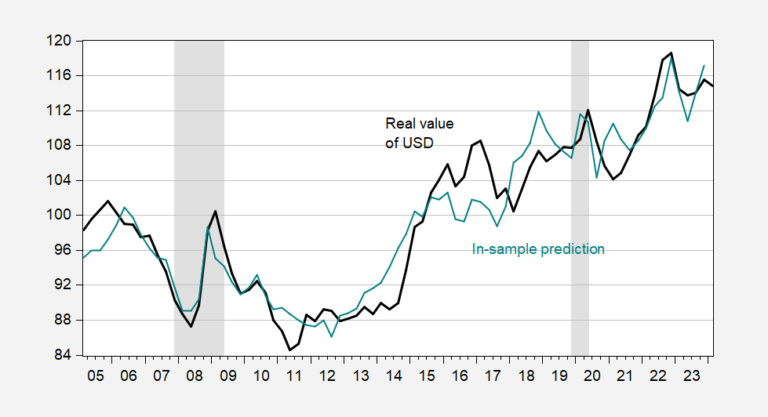

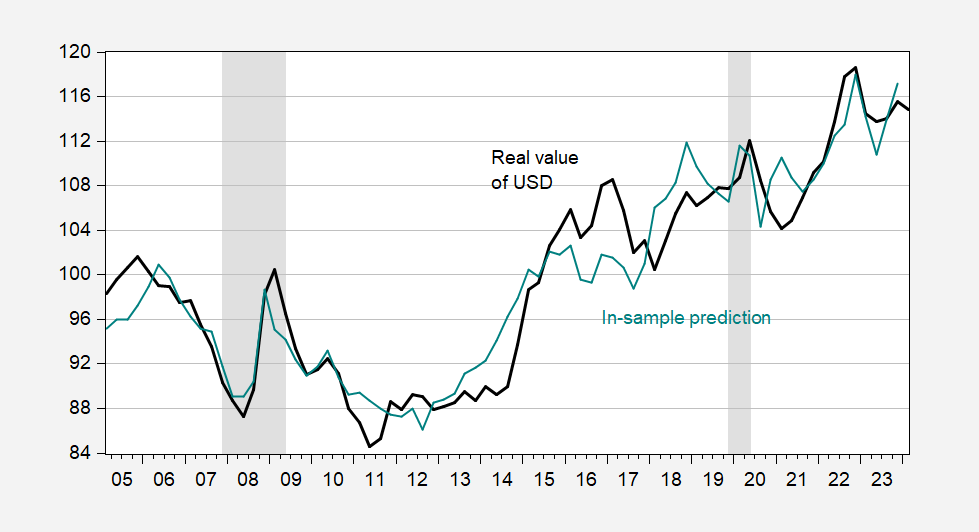

Or r is the log of the dollar weighted by real trade, Yes is the GDP, I is the 10-year yield, π represents year-on-year CPI inflation, and * denotes the rest of the advanced economies. The adjustment is shown in Figure 1:

Figure 1: Weighted real value of the US dollar (bold black), within-sample prediction (teal). The NBER has defined the peak to trough dates of the recession in gray. Source: Federal Reserve via FRED, NBER and author’s calculations.

If this set of correlations holds into the future, then a one percentage point reduction in the 10-year Treasury yield compared to abroad this would reduce the real value of the dollar by almost 10 percent. Is this possible in practice? It’s hard to say ; after all, long-term rates are correlated, and long-term rates in other advanced economies tend to move.

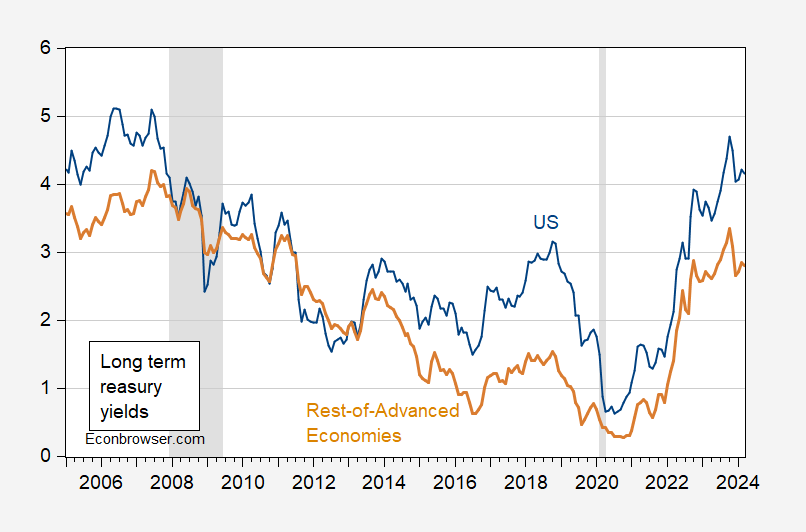

Figure 2: Ten-year US Treasury yield (blue), long-term (5-10 year) government bond yields of the rest of the advanced economies (tan), both in %. The NBER has defined the peak to trough dates of the recession in gray. Source: Trésor via FRED, DGEI of the Dallas Fedand NBER.

Over this sample period, each percentage point change in the U.S. Treasury yield is associated with about a 0.6 percentage point change in the yields of the rest of the advanced economies.

Of course, if interest rates were to be reduced in the United States, U.S. GDP would likely grow faster than otherwise, thus slightly offsetting the (already diminished) effect of interest rates. If the United States were to use heavy-handed methods to gain “cooperation” from other countries, the VIX would likely rise (as it often did under Trump, especially during the trade war). Of course, the U.S. Treasury alone cannot control the yield of Treasury bonds in a market economy. Compliance from the Fed would therefore be necessary (which could explain why Trump’s brain trust is so important). thinking about how to make the Fed’s decision-making process more malleable).

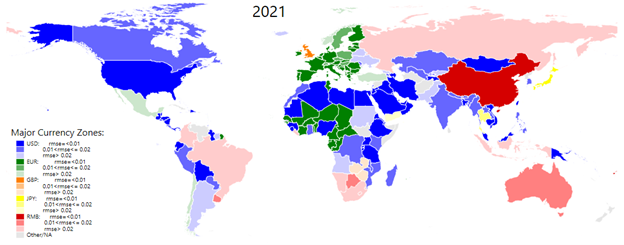

Force other countries to reevaluate: The nominal value of the US dollar depends on the policies of the countries linked to the dollar. Ito and Kawai identify currency zones as those linked to their respective currencies. From 2021:

Figure 3: The evolution of the main monetary zones. Source: Compiled by the authors from their estimates. Source: Ito (2024).

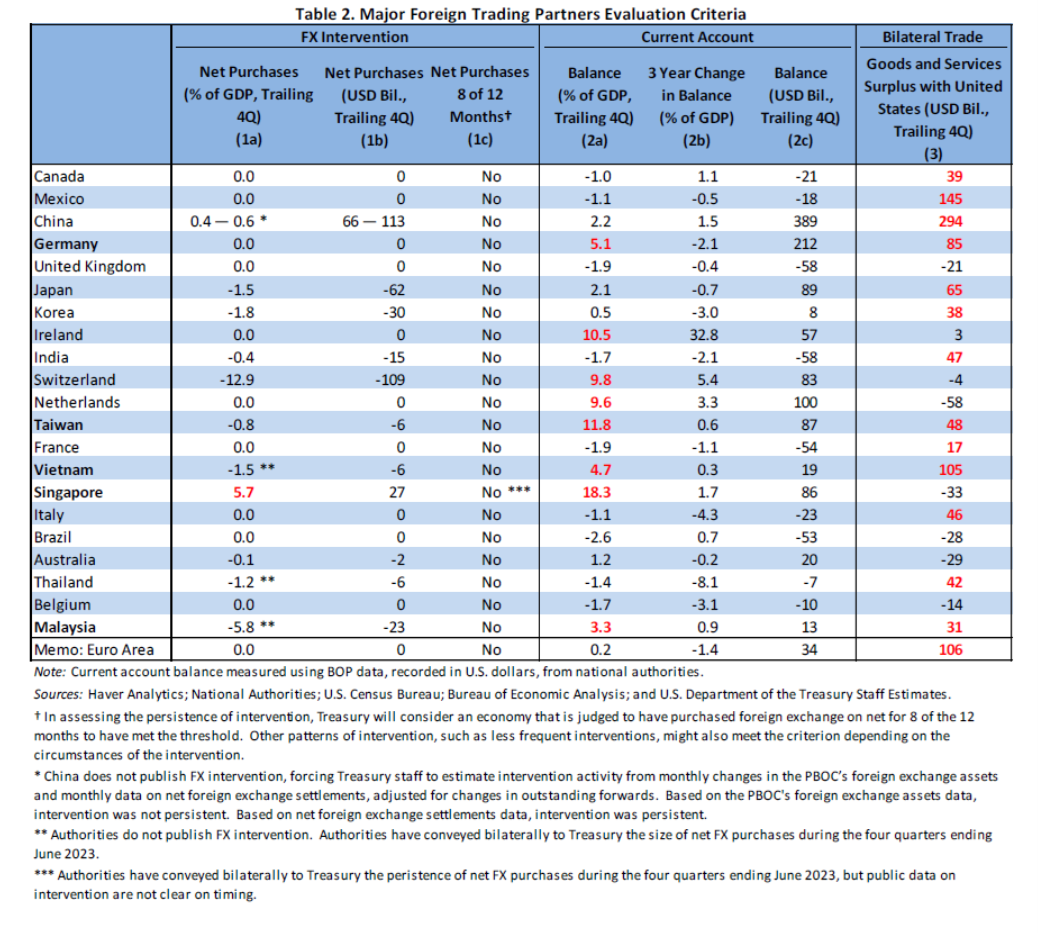

Among the countries identified as being part of the dollar zone, not all, or almost all, are linked to the dollar. But those who do, the United States might convince to re-evaluate. How big is the effect? Adler, Lisack and Mano (Emerging Markets Review, 2022) find that each percentage point of GDP reduction in foreign exchange interventions results in an appreciation of the bilateral real exchange rate of 1.4 to 1.7 percentage points. There is some wonder if China has returned to a dollar peg from 2024, but we can examine the extent to which strong US dollar appreciation is possible by looking at the scale of intervention currently underway. The latest foreign exchange report from the US Treasury, from November 2023, presents some statistics.

Source: US Treasury (November 2023).

Singapore intervenes substantially (as a share of GDP), but weighs only 1.9% in the trade-weighted dollar (American Fed in the broad sense). China has a greater weight, 13.4% (1). If China were to reduce its intervention by 1 point of GDP (while it was estimated between 0.4 and 0.6 points by the Treasury), then the RMB would appreciate by 1.4 to 1.7%. The direct impact on the trade-weighted dollar would then be 0.23 ppts to 0.28 ppts (!). To the extent that some countries peg their currencies to the yuan, then the effect could be slightly greater. However, in the end, it seems like it takes a lot of work to get a small change in the value of the dollar.

A more in-depth assessment of the desirability of this political initiative, in Rampell (WaPo)as well as Horan (National review).