alexei_tm/iStock via Getty Images

Investment Overview

Therapeutic gyre (NASDAQ:GYRE) is a low-key biotech company that gained its Nasdaq listing in October last year through a merger between Catalyst Biosciences and GNI Group – according to a Press release:

Catalyst received shareholder approval for all proposals necessary to consummate the business combination at a special meeting of shareholders held on August 29, 2023. Catalyst effected a name change and consolidation of common stock of Catalyst immediately prior to the closing of the business combination.

The combined company will operate under the name “Gyre Therapeutics, Inc.” (“Gyre”). As a result of the business combination, Beijing Continent Pharmaceuticals Co., Ltd. became a majority-owned subsidiary of Gyre.

Catalyst was a company developing drugs targeting hemophilia, which I had High hopes in 2020, but which had been forced to sell its hemophilia programs at South Korean company GC Biopharma, and additional complementary programs at Boston-based Pharma Vertex (VRTX). As such, the company was little more than a shell, and Gyre CEO Charles Wu, Ph.D, said of the merger:

Now that Gyre has launched on Nasdaq, we will be able to more efficiently conduct clinical research and development of our promising pipeline of product candidates in the United States. We are optimistic that our research and development efforts can bring new medicines to patients suffering from organ fibrosis and inflammatory diseases for which no approved treatments are currently available.

In its 2023 annual report / 10K submissionGyre is called:

a financially viable pharmaceutical company with a history of financial success that develops and commercializes small molecule anti-inflammatory and antifibrotic drugs targeting organ diseases, with a specific focus on organ fibrosis.

The company successfully developed pirfinedone, “a small molecule drug that inhibits the synthesis of TGF-ß1, TNF-α and other modulators of fibrosis and inflammation”, obtaining approval, under the Etuary brand, in the indication of idiopathic pulmonary fibrosis (“IPF”), in the United States, the European Union, Japan and the People’s Republic of China. Gyre claims that sales of Etuary have reached 112 .3 million dollars last year.

In the United States and China, Gyre is focused on commercializing a structural derivative of pirfenidone, F351, or Hydronidone, and in the United States it is “prioritizing F351 for the treatment of hepatic fibrosis in due to the large potential addressable market and the significant number of unsatisfied products.” need”.

Apparently, Catalyst entered into a business combination agreement with GNI USA, GNI Japan and GNI Hong Kong in December 2022, and subsequently “acquired an indirect majority stake in Beijing Continent Pharmaceuticals.” The structure of the different interested parties and stakeholders is complex, but according to a Gyre investor presentationGNI Japan owns 100% of GNI USA, which owns 85% of Gyre Therapeutics, which owns 70% of Beijing Continent.

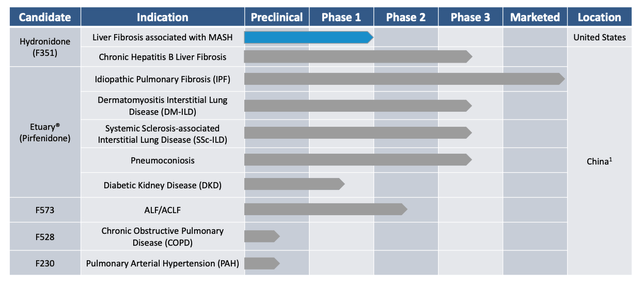

The current pipeline is as follows:

Gyre therapeutic pipeline (investor presentation)

Hydronidone – Building on positive phase 2 data in China, challenging Rezdiffra?

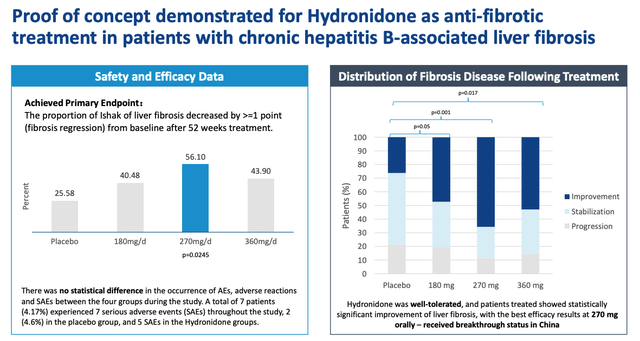

In China, Gyre conducted a Phase 2b study of hydronidone in patients with hepatitis B-associated chronic liver fibrosis, which met its primary endpoint of “Proportion of Hepatic Fibrosis Ishak Scores which decreased >=1 after treatment compared to pre-treatment. “.

The Ishak scale, which ranges from 0 to 6, is similar to the Batts-Ludwig scale more commonly used in the United States, which ranges from 0 to 4, as follows:

- 0: a lack of fibrosis

- 1: portal fibrosis

- 2: rare portal-to-portal septa

- 3: fibrous septa

- 4: definite or probable cirrhosis

Stages 0 to 3 represent liver fibrosis, while any level 3 or higher is classified as cirrhosis – a buildup of scar tissue in the liver that can lead to serious complications over time.

Results of the P2 study – China (presentation)

As we can see above, Gyre believes it has established a proof of concept (“PoC”) for hydronidone, which met its primary endpoint in the Phase 2 study, showing the best results at a dose of 270 mg/d and, above all, with a safety profile, and using oral administration. A phase 3 study has now been launched in China, involving 248 patients and with data expected this year – a potentially important catalyst for potential investors to watch.

In the United States, Gyre targets the MASH/NASH market. NASH used to be short for nonalcoholic steatohepatitis, but today the disease is called metabolism-associated steatohepatitis (“MASH”). In his investor presentation, Gyre calls MASH a “global market with no approved therapy,” although that is no longer true.

In March of this year, the FDA approved Madrigal Pharmaceuticals’ (MDGL) Rezdiffra for “treatment of adults with non-cirrhotic NASH with moderate to advanced hepatic fibrosis (consistent with fibrosis stages F2 to F3)” – a historic first approval for any drug in the NASH/MASH indication.

Analysts have speculated that Rezdiffra could generate peak revenues of around $5 billion per year. Gyre is therefore right to point out that there is a very large market for successful MASH therapy, although his estimate of a market in excess of $108 billion by 2030 seems extremely optimistic. Me.

Still, there are at least a few reasons why investors might be excited about hydronidone’s potential.

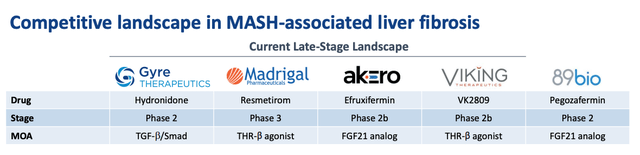

MASH – competitive landscape (presentation)

As we can see above, Gyre has correctly identified most of its rivals in the MASH space – Madrigal’s Resmetirom is now approved, while Viking Therapeutics’ candidate – which has the same mechanism of action (” MoA”) than Resmetirom, being a thyroid hormone receptor. -beta-agonist – was almost forgotten due to a second Viking candidate, VK2735, a potentially best-in-class dual GLP-1/GIP receptor agonist. weight loss datatriggering a massive surge in the stock price.

Meanwhile, Akero Therapeutics (AKRO) and 89Bio (ETNB) continue to advance their FGF21 analogue drugs, efruxifermin and pegozafermin, in pivotal studies, generating reasonably positive results, although the FDA approval criteria for NASH are strict: improvement of at least 1 stage of fibrosis without worsening of NASH, or improvement of NASH. resolution without worsening of fibrosis, or both.

The high bar for approval has seen several companies’ hopes of securing approval dashed over the past twenty years or more, and it is worth noting that one approval, for Madrigal’s Rezdiffra, does not necessarily open the floodgates. Additionally, there are other red flags currently flying in this space.

We still don’t know if doctors will prescribe Rezdiffra en masse, as many may think that a lifestyle change, i.e. more exercise, can be an equally effective remedy for MASH as a daily oral pill. Thus, the market opportunities at play may not meet market expectations.

Likewise, the rise of GLP-1 agonist drugs, with their miraculous weight loss properties, is expected to impact the MASH market, either via these drugs – that of Novo Nordisk (NVO) Wegovy, or Eli Lilly (THERE IS) Zepbound, for example, to gain approval in MASH, or because more patients are being diagnosed with obesity and fewer patients in NASH.

Gyre’s Verdict: A Latecomer to the MASH Dash May Have an Approved Drug — and May Be Worth Adding to Your Watchlist

Gyre stock has certainly performed well since its debut on the Nasdaq last year: on a 6-month basis, shares increased in value by 225% and reached highs >$25 in December of last year and in February of this year.

Gyre’s current market cap of $1.42 billion is higher than 89Bio’s $941 million, about the same as Akero, and significantly lower than Madrigal’s $5.1 billion dollars, and Viking, 7.64 billion dollars. The fact that Viking stock has reached +>500% over the past six months provides compelling evidence that the market’s focus has shifted from MASH drugs to weight loss drugs, but that does not necessarily mean that a approval in MASH would not constitute a compelling advantage. catalyst for 89Bio, Akero, or even Gyre.

Gyre already has an approved drug that brings in more than $110 million a year, although the company was far from profitable in 2023, making a net loss of ($67 million), compared to a profit of $9 million. the previous year. Gyre spent just $14 million on R&D in 2023, results show Press release. The cash position was $33.5 million.

In short, Gyre, to me, represents an opportunistic, as opposed to risk-free, investment opportunity. The company rightly notes that there is a significant market opportunity for an effective MASH drug, although that market is likely nowhere near as large as management claims.

Grye introduces a differentiated drug to the market, somewhat threatened by the approval obtained for pirfinedone, its commercial success and the data from the Chinese study. None of these factors guarantee that hydronidone will be approved, but they provide at least some encouragement.

A final point to consider is simply whether, by the time hydronidone becomes commercially available in the United States, assuming that it does, there will be a demand for another drug with an antifibrotic mechanism of action. pleiotropic – there may be two or three of these drugs. on the market by 2027, Gyre’s first drug could likely hit the market, in my opinion, along with several other alternative therapies.

In a way, this opportunity reminds me of the one presented by Phathom Pharmaceuticals (PHAT) a few years ago, Phathom was trying to introduce to the U.S. market a type of acid reflux medication that was popular in Japan and doing more than $700 million in sales annually in the country. Ultimately, the company got approval for the US market, but only after a long period of consideration, and the market opportunities are uncertain: is there anyone unhappy with the options current treatment options?

Phathom’s share price is down >50% over 5 years, but +22% over 12 months, as the company finally begins to launch commercially in the US.

As such, when it comes to Gyre, I will recommend the company “hold”, but what I really mean is “hold”. I suspect the long and winding road to US approval will extract much of the value from Gyre’s stock price today, but approval could be possible later, and when that approval begins to crystallize, it will be the time to consider buying – not today.