Klaus Vedfelt

The GRAB investment thesis remains expensive for so long that its profits are minimal

Grab Holdings Limited (NASDAQ:TO INPUT) is the Uber (UBER) equivalent of the Super App platform in the Southeast Asia region, with the last sell your business in March 2019, after months of unsustainable price wars and cash burn.

Combined with UBER’s departure from key markets such as China in 2016 And Russia in 2017it is obvious that the “hyperlocal approach” and marketing know-how have been essential to GRAB’s success in the Southeast Asia region.

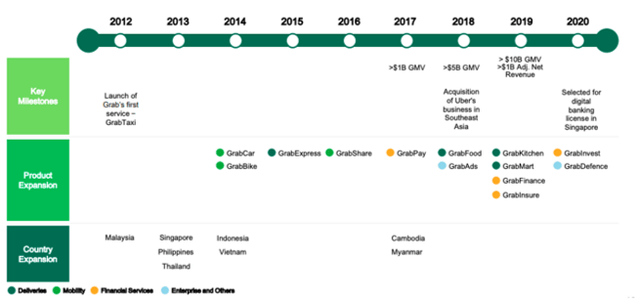

GRAB’s well-diversified offerings

Much of the success can perhaps also be attributed to GRAB’s well-diversified offerings in mobility, logistics delivery, food/grocery, fintech services and advertising, further illustrating why its consumers have been very loyal so far.

And this also led to SaaS the company’s excellent first quarter 2024 earnings call, with overall revenues of $653 million (Online QoQ/ +24.3% YoY) and adjusted EBITDA of $62 million (+77.1% Q/Q/+192.53% YoY), implying an increase in adjusted EBITDA margins of 9.4 % (+4.1 points Q/Q/ +22.1% YoY).

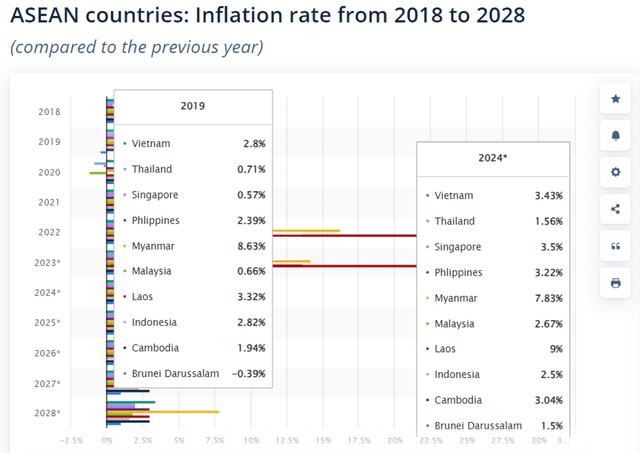

Inflation levels of Southeast Asian countries

Most of GRAB’s tailwinds are attributed to on-demand gross merchandise volume (GMV) growth of $4.24 billion (+2.9% QoQ/+17.7% YoY), thereby increasing the number of monthly transacting users (MTU) on demand by 34.4 million (-3.3M QoQ/ +5.5M YoY), and a stable on-demand GMV per MTU at $123 (-14.5% QoQ/-1.6% YoY).

This is indeed an impressive feat, despite the high inflationary pressure observed in the region compared to 2019 levels.

GRAB’s favorable financial results are naturally attributed to expanding advertising opportunities, GrabAds, with management releasing detailed figures for the first time.

Shipping advertising revenue of $37 million and Shipping advertising adjusted EBITDA of $24 million in the most recent quarter imply rich adjusted EBITDA margins of 64.8%, naturally illustrating the accretive nature of results of advertising activity.

We believe the segment’s growth prospects will remain promising, given the acceleration in growth seen in total number of active advertisers to 119,000 (+46% over one year) and average advertiser spending multiplied by 1.5 over one year.

This adds to the strong growth seen in GRAB’s Mobility segment, with revenues of $247 million (+4.2% qoq/+27.3% yoy) and adjusted EBITDA of $138 million. (-24.1% QoQ/+42.2% YoY), suggesting expansion Adj EBITDA margins of 55.8% (-20.9 points Q/Q/ +5.8 YoY ).

Mobility is indeed an important segment for investors to watch, as it represents the lion’s share of the Super App’s bottom line so far, shipping with revenue of $350 million (+9 % qoq/+19% yoy) and adjusted EBITDA of $42 million (-56.2% qoq/+321% yoy).

These two segments balance well the cash burn reported by nascent yet profitable fintech companies, with revenues of $55 million (-1.7% Q/Q/+52.7% YoY) and adjusted EBITDA of -$28M (+65.4% Q/Q/+34.8% YoY), as the reduction in losses also signals the near end of its start-up phase.

Combined with healthy balance sheet net cash of $3.99 billion (-11.5% QoQ/-2.6% YoY), it appears that GRAB remains well capitalized to invest in its growth opportunities while achieving its first year of positive adjusted EBITDA margins of 9.5%. (+10.4 points over one year) during the 2024 financial year.

So, is GRAB Stock a Buy?sell or keep?

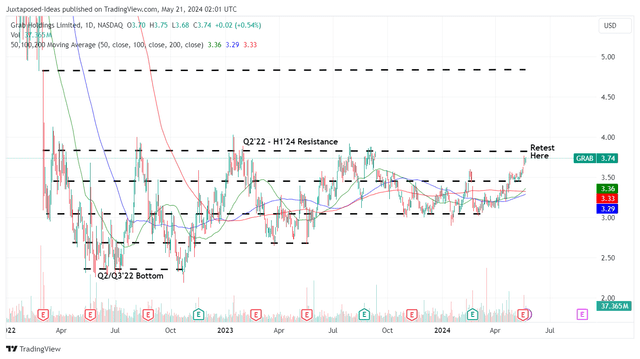

GRAB 2Y share price

For now, thanks to improving market confidence, the promising Q1 2024 results announcement and the raised forward guidance, GRAB has already seen an impressive recovery from the February 2024 low.

However, based on management’s raised fiscal 2024 guidance of adjusted EBITDA of $260 million at the midpoint (+1,281.8% YoY) and the latest share count of 3 .93 billion, we are looking at a disappointing adjusted EBITDA per share generation of $0.06 (+1,300% YoY). ).

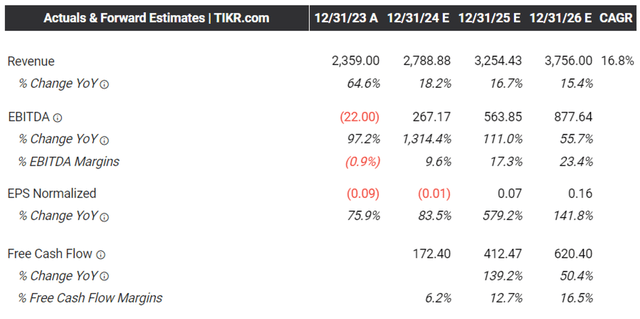

Based on a similar method of calculation on consensus estimates of FY2026 Adjusted EBITDA of $877.64 million, we are looking at Adjusted EBITDA per share of $0.22 – growing at a CAGR accelerated by +54.2%.

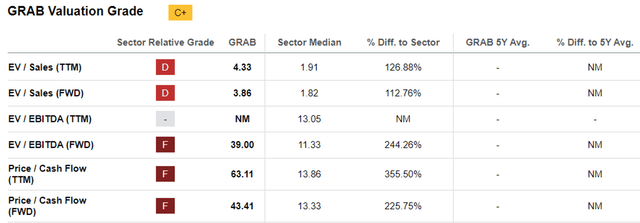

GRAB valuations

However, we don’t know if it makes sense to add it here.

Despite the supposed reversal in its cash burn, there is no denying that GRAB is still expensive with FWD EV/EBITDA valuations of 39x and FWD Price/Cash Flow valuations of 43.41x, compared to the one-year average of 22 .18x/52.10x and mains. median of 11.33x/13.33x, respectively.

Even when compared to its direct peers, like GoTo Gojek Tokopedia Tbk (GOTO-INDONESIA) at 52.90x/NA, the very profitable UBER at 22.49x/22.22x, and Lyft (LYFT) at 18.01x/36.18x, it is evident that GRAB is trading at a premium.

Forward-looking consensus estimates

This is especially true when GRAB’s consensus revenue/bottom line growth at a projected CAGR of +16.8%/+84.39 through FY2026 pales in comparison to that of GOTO at +4.9%/+124.3%, the constant profitability of UBER at +15.6%/+39.5%, and the constant profitability of LFYT at +15.6%/+39.7 %, respectively.

Combined with GRAB’s new near-term resistance test at $3.80, we’d rather continue to watch management’s execution and its stock move for a bit longer as it could likely continue trading sideways as it has since March 2022 as the stock slowly builds towards its near-term resistance level. premium valuations over the coming quarters.

Combined with its penny stock status, we prefer to conservatively rate GRAB stock as Hold (Neutral) here.