SweetBunFactory/iStock via Getty Images

GlobalFoundries Inc. (NASDAQ:GFS) is in a difficult situation because customers are destocking while the company is operating at 70% capacity. The company is also exposed to the risk of overbuilding its capacities. with a new smelter that will be paid for in part through awards awarded through the CHIPS Act and New York State’s Green Chips program. I believe GlobalFoundries will face growth challenges over the next couple of years as the macroeconomic environment deteriorates, leading to overcapacity coupled with reduced customer volumes. I rate GFS stock with a SELL recommendation with a price target of $42.24/share at 11.13x eFY25 EV/aEBITDA.

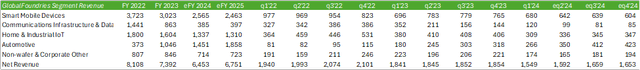

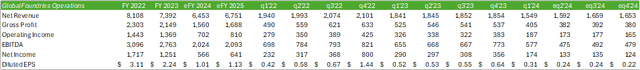

GlobalFoundries Operations

Many analysts have alluded to the fact that GlobalFoundries has taken its own initiatives in strengthening its capabilities. With 70% utilization and diversification across their entire global foundry footprint, this question comes into play as concerns arise about increased customer inventory levels. This has left GlobalFoundries with an increased level of days of inventory on its books, which may take the duration of FY24 to deplete. This has also raised some concerns regarding customer LTAs as GlobalFoundries has faced volume adjustments in various industry segments, which I believe could result in lower volumes in FY24. Management has noted that the company has $20 billion in long-term contracts for varying durations, depending on the product life cycle.

Management reported stronger growth in the smart wearable devices segment for eFY24 compared to semiconductor designers; although this is a relatively optimistic outlook given the relatively stable expectations for the segment throughout eFY24 by companies like Qualcomm (QCOM) or Micron technology (UM). Memory and storage chip maker Micro Technology It is suggested that eFY24 sales are likely to be replacement sales rather than sales growth, as consumers will not necessarily be looking to upgrade to the latest AI-enabled devices. The same goes for the next generation of AI-enabled PCs and workstations, for which Micron management anticipates a relatively stable market with limited interest in the next generation of devices. Even if smartphone sales volumes remained relatively stable, there could be upside potential as more content per device is sold on the latest generation of AI-enabled smartphones. Smart mobile devices represent 44% of total revenue and have been in steady decline over the past 5 quarters. Management expects the bottom to be approaching; However, I believe there are other factors at play that will keep devices flat throughout eFY24 and potentially into eFY25.

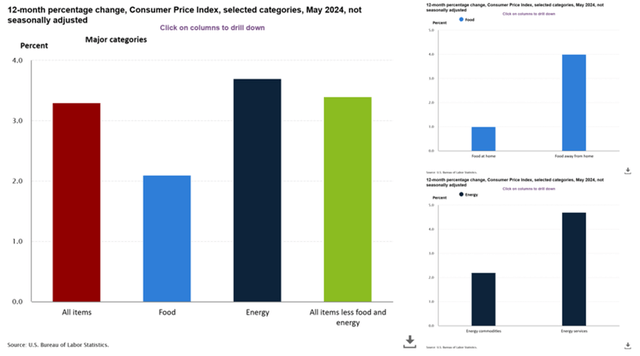

One of the biggest obstacles faced in this segment, as well as other segments, is customer inventory levels. Management indicated that customers were currently going through a destocking phase, which partly explains the drop in revenue. Despite inventory reductions, customers are also renegotiating their long-term sales agreements and reducing volumes, which may suggest that there are long-term effects that could cause sales to continue to decline. I believe that the high inflation rate will play a greater role in the decision-making process of end customers when it comes to upgrading their smart mobile devices. While replacements may be needed for lost or broken devices as well as those with higher incomes, I don’t foresee a mass migration to the latest generation of AI-enabled smartphones as consumers face a cost higher daily. of life.

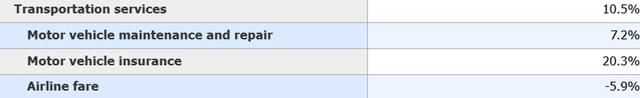

Looking at the automotive segment, I think there could be similar headwinds due to the higher cost of living. Additionally, insurance premiums have skyrocketed in the last year, which I believe is partly due to the higher costs required to insure an electric vehicle.

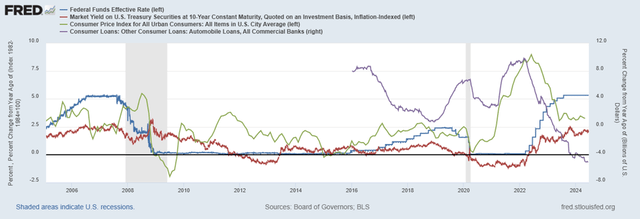

If you combine insurance premiums with the high cost of borrowing, purchasing a vehicle is more expensive overall.

Year-over-year changes in consumer vehicle loans could shed light on the fact that consumers are delaying the purchase of their next vehicle as loans mature. It could also indicate lower vehicle sales volumes, higher down payments or consumers choosing to purchase cheaper models. Regardless, I think this indicates some degree of decline for automotive chips, as less expensive models may not require the same amount of chips as more sophisticated models.

Home and industrial IoT could face the same fate as appliances and automobiles, as consumers’ discretionary spending is balanced by a higher daily cost of living.

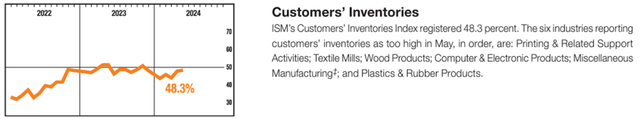

Inventories appear to be contracting at a slower rate, which may be a good sign for GlobalFoundries. Despite this slowdown, new orders for computers and electronic products also remain in contraction territory, indicating the challenge could be more serious.

Orders have started to rebound, but inventory levels remain high enough to have no impact on our supplier orders. It will still be a solid few months before supplier orders are reactivated or increased.

ISM-PMI: (Computers and electronic products).

It’s also a sign that a rebound could be on the horizon if stocks continue to fall. While this may broadly be the case, the challenge still remains whether GlobalFoundries LTAs are entered into on a volume basis. These contract modifications are either linked to short-term difficulties for customers or to long-term forecasts of a reduction in necessary volumes. That could very well put GlobalFoundries in a difficult position as the company invests in its new foundry, paid for in part by a $1.5 billion award under the CHIPS Act and an additional $600 million proposed by New York State under the Green Chips program. Since GlobalFoundries is operating at 70% capacity, the company risks building excess capacity and risking economies of scale.

The management mentioned in their Call on 1st quarter 2024 results that the company diversifies its foundries to localize chip production across regional verticals. I found this fascinating, as it could create marginal hurdles for the company as each foundry will no longer specialize in a series of chips but rather spread its talent across multiple nodes to ensure regional capacity. While I believe this will reduce supply chain risk, I also expect that this method of operation may add marginal risk to operations as additional machinery may be required to produce different nodes of semiconductors.

Given the broader theme of inventory destocking occurring across various verticals for GlobalFoundries, I expect a slight decline in revenue coupled with a slight contraction in margin throughout FY24 and exercise 25. The ISM-PMI manufacturing index reported for May that delays for computer and electronic products remained declining, adding pressure on future production even as inventories are reduced. Essentially, I expect a tough FY24-25 for GlobalFoundries given the macroeconomic outlook.

Despite this negative outlook, there could be some positives for the company, particularly in the automotive industry. As new vehicles become more sophisticated, more chips will be needed. Even in a stagnant new vehicle sales environment, more content per vehicle can be a growth factor for GlobalFoundries. I also expect datacom to rebound towards the end of FY24 or early FY25 as network infrastructure will require higher pricing to meet the needs of AI infrastructure. This could provide a tailwind for GlobalFoundries in its communications segment.

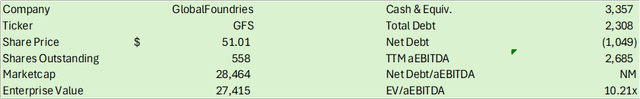

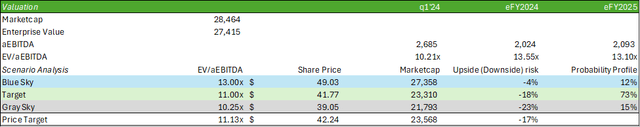

Valuation and shareholder value

GFS is currently trading at 10.21x EV/aEBITDA, the lower end of its historical range. Given my financial forecast for the company, I expect the stock price to fall further into the historical trading range. Given the headwinds encountered in most segments, I offer GFS stock a SELL recommendation with a price target of $42.24/share at 11.13x eFY25 EV/aEBITDA. This valuation was obtained using a probability profile of risk scenarios based on historical trading multiples.

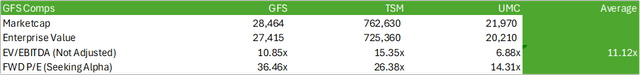

Comparing GFS to its peers, the stock is trading significantly higher than its closest competitor, United Microelectronics Corp.UMC), considering market capitalization. Using an average of Taiwan Semiconductor (TSM) and UMC, we can arrive at a similar trading multiple, as shown in my independent valuation chart above.

GlobalFoundries shares are mainly concentrated in Mubadala Investment Company, with a stake of 95.84%. GlobalFoundries recently announced a $950 million secondary offering of shares will be sold by Mubadala with an option to put more than $112.5 million worth of shares on May 22, 2024. This shelf offering includes a share repurchase of $200 million of those shares, which is expected limit the dilution resulting from the secondary offering.