Simonapilolla/iStock via Getty Images

Genesco’s 1Q25 results didn’t beat expectations, with revenue down in absolute terms but not much in comparison and margins protected by store closures. The company’s seasonally weak quarter is relatively insignificant compared to the second half, and management has provided strategic guidance for this period as it attempts to move away from brands like Vans and Converse.

This article is about Genesco (New York stock market :GCO) 1T25 results And earnings conference call. I started covering Genesco in March 2024 with a Socket Despite some positives for the company, namely long-term management, a relatively niche position and a low multiple of pre-pandemic earnings, I considered the stock not opportunistic, given the consumer challenges and the lack of balance sheet strength.

Since then, the company’s shares have remained stable and I see no significant fundamental improvement. I’m waiting for it The stock’s second and third quarters are expected to be volatile as the company tests a new assortment strategy across its flagship channels. For this reason, I maintain my Hold rating.

Stable or declining results in the first quarter of 2025

The company’s financial year began with negative or even stable results.

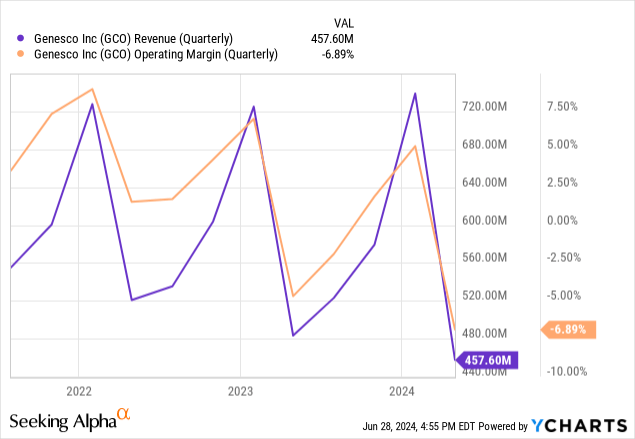

Revenue was down 5%, with Journeys down 5%, Schuh down 7%, J&M down 3%, and GBG down 5%. The company also reported that number for comparable sales, but the store footprint was down 5%, so I think the comparables are actually pretty flat.

Gross margins were broadly flat, which is understandable given that Genesco doesn’t record occupancy and labor in cost of goods sold. General and administrative expenses declined in absolute terms (thanks to store closures), but still generated 220 basis points, meaning operating losses increased $10 million year over year to $32 million.

It should be remembered that Q1 is a seasonally slow quarter for the business and as a B&M retailer with declining sales, operating losses are higher than what would be expected for subsequent quarters (particularly H2).

A risky bet for a turnaround in the second half of 2025

The company’s second quarter is stronger than the first quarter, and the company expects similar performance in terms of year-over-year comparable revenue decline. Margins should improve slightly year-on-year thanks to the second quarter benefiting from an additional week for the start of the school year this year, compared to 2Q24.

However, the company’s pivotal season is clearly 2H, which includes back-to-school and vacations. For this season, Genesco is preparing a strategic shift at its two flagship chains, Journeys and Schuh, which account for 80% of sales. Journeys brought in a new CEO earlier this year and replaced its chief merchandise and marketing officers (as noted on the call).

Both chains are known for catering to teens, especially girls, with fashion-oriented footwear. Customers can find more sneakers, streetwear-style shoes, and boots. The chain’s flagship brands are Vans and Converse. Athletic shoes (like Nike or Adidas for runners) are a less prominent element.

However, the company highlighted weak demand for Vans and Converse, which are grouped under the vulcanized footwear banner during the earnings call (they are called that to distinguish themselves from athletic shoes that are typically made with contact bonding techniques). Vans’ weakness is not surprising, as its parent company VF Corporation (VFC) recently published sales down 25% year-on-year for the brand. Nike (NKE) reported earnings this week, with Converse down 18%. The sector is clearly suffering.

For this reason, Genesco is trying to move away from these brands and adopt a different assortment. For example, New Arrivals Journey’s website section gives more space to New Balance (a casual sportswear brand) and Crocs than to Vans and Converse.

I think this pivot might be the right move, but it’s a dangerous one. The company risks losing its position as a fashion shoe retailer for teens and becoming just another athletic shoe retailer. Sure, the company doesn’t carry Nike or Hoka shoes for runners, and management can claim that New Balance is now fashionable, but it still seems like a dangerous move.

The new assortment will be rolled out for the start of the school year, starting at the end of the second quarter. This means that the second quarter will contain important information on the recovery potential for the very important second half of the year.

Revisiting valuation in a context of uncertainty

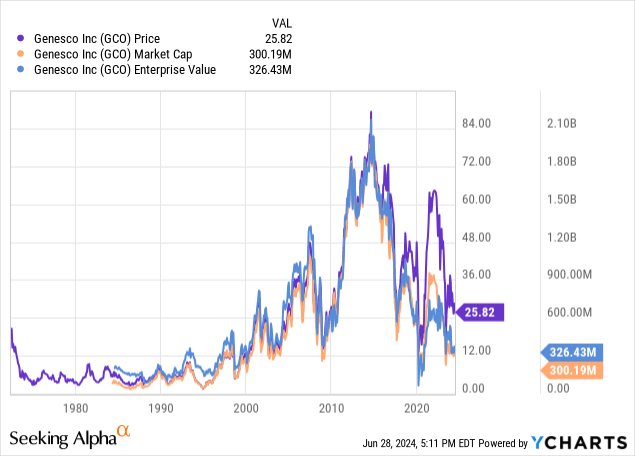

Today, Genesco has a market capitalization of $300 million and a share price near $26.

During the conference call, management reaffirmed its guidance for the year, with sales down 2-3% and margins stable at both the operating and gross levels. The result would be EPS of between $0.6 and $1.

A price close to $26 seems rather high compared to the above. However, I think the comparison is not fair for two reasons.

First, the company has significant operating leverage; a comparable revenue increase of 5% for the next fiscal year would mean the company could go from a current EBT loss of around $25 million on TTM to an EBT profit of $42 million.

Second, the company’s forecasts aren’t much help when it plans to make a significant lineup change in the second half of the year. Despite management’s best intentions, it is difficult to predict how customers will react to this change. Being the most important time of the year, if the line is well received, Genesco will likely post much better numbers for fiscal 2025, while they will be worse if the line is a failure.

In this uncertain scenario, I would compare the data to the results needed to justify the current price. First, the consumer does not appear to be in a better position than they were a few quarters ago. Second, the company is undergoing a significant assortment transition that is risky. Third, the company’s balance sheet has averaged less than $30 million in cash over the past few quarters. Debt is not high ($60 million currently), but it means the company has no cushion to survive a prolonged economic downturn or an assortment mismatch that requires liquidation sales.

Given these relatively gloomy numbers, the stock needs the company to deliver a good second half of the year. Otherwise, the company will continue to post losses for the 2025 financial year. In addition, it will face an inventory problem related to the new assortment. This means, in my opinion, that the stock is already discounting at least part of the positive scenario and offers little protection against negative scenarios.

For this reason, I continue to believe the stock is a valuable hold. For 2Q25, I will pay a lot of attention to the comments on the evolution of the new assortment at the start of the school year.