Alexandros Michailidis/iStock Editorial via Getty Images

Introduction

I kept an eye on Forvia (OTCPK:FURCF) (OTC:FAURY) for several years now, as the supplier of spare parts for the automotive sector has worked hard to expand its product offering and increase its margins. I wasn’t a big fan of the acquisition of Hella, a German manufacturer of electronic components and lighting for cars, but Forvia has already generated €190 million in annual cost synergies in 2023 and expects to so that the total benefits of the synergy amount to around 350 million euros by the end of 2025. This would be pretty good considering that the total amount of the acquisition was less than 7 billion euros.

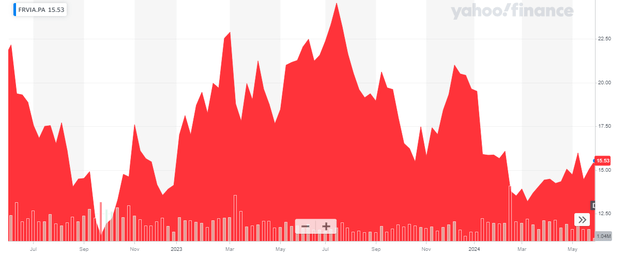

Yahoo finance

Forvia is listed primarily in France, where it is listed on Euronext Paris with FRVIA as its ticker symbol. THE average daily volume is approximately 1.1 million shares per dayand that makes the most liquid quote. Since the company reports its financial results in Euros, I will use Euro as the base currency throughout this. The current number of shares is around 197.1 million, giving a market capitalization of just under €2.96 billion, taking into account the dividend of €0.50.

A look back at the good results for 2023

As the company does not release detailed financial results on a quarterly basis and the quarterly transaction updates do not contain as much information as the more detailed financial results, I wanted to revisit Forvia’s 2023 results because those -these will be. provide the springboard to continue growing in 2024 and achieve its goals for 2025, which I will discuss later in this article.

In 2023, Forvia was able to increase its turnover by around 14% to more than 27 billion euros while its operating profit increased by more than 35% thanks to higher revenues and a fairly substantial margin expansion (operating margin increased from 4.3% to 5.3 %).

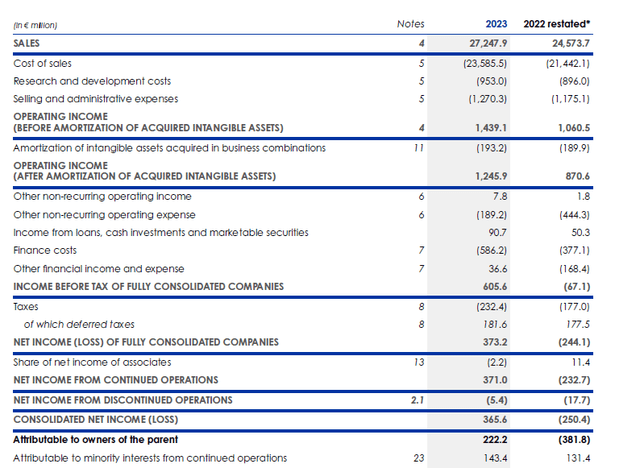

As you can see below, the operating profit after amortization expenses related to intangible assets obtained by merger and acquisition amounts to approximately 1.25 billion euros. Other non-recurring operating expenses decreased significantly, but unfortunately financial expenses increased, which is not really a surprise given the evolution of interest rates on the financial markets.

Forvia Investor Relations

Despite higher financial charges, the company still recorded a very substantial increase in its pre-tax profit, mainly due to Forvia’s ability to integrate the acquisition of Hella into its existing business model. After deducting the total tax bill of approximately 232 million euros, the net result amounts to 371 million euros before taking into account the loss of 5.4 million euros linked to discontinued operations. Net income from continuing operations amounts to EUR 365.6 million, of which EUR 222.2 million is attributable to Forvia’s ordinary shareholders (compared to a loss of EUR 382 million during the 2022 financial year). This means that the EPS for the financial year 2023 was approximately EUR 1.13, while the EPS from continuing operations was EUR 1.15.

As Forvia added a significant amount of debt to its balance sheet when it acquired Hella, the company’s cash flow performance remains very important to reducing debt, and more importantly, to reducing interest expense. .

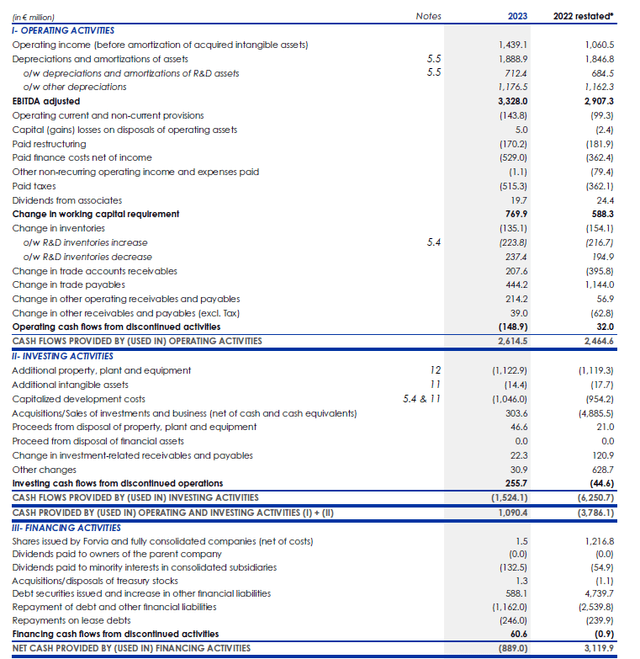

Total Reported operating cash flow amounts to €2.61 billion.but this included a contribution of 770 million euros from changes in working capital, but on the other hand it also took into account a cash tax bill of 515 million euros, although the account of result indicates that only €232 million in taxes were due based on the 2023 result (with the majority of these taxes as deferred taxes).

Forvia Investor Relations

On the other hand, I still have to deduct the 133 MEUR in payments to minority interests and the 246 MEUR in rent. This translates to an adjusted operating cash flow of approximately €1.75 billion.

Total investments were around €2.2 billion (including €1.05 billion of capitalized development costs), meaning Forvia had negative free cash flow in 2023.

That being said, keep in mind that this involves a very significant growth investment. The total amount of depreciation and amortization expenses amounts to just under €1.9 billion per year, while Forvia spent €2.43 billion on capital expenditure and rents.

The trend will continue in 2024

These investments are expected to help the company continue its growth trajectory and the order book continues to grow. In the first quarter of 2024, Forvia added 6.5 billion euros of orders to its order book, representing an increase of around 1 billion euros compared to a year ago, thanks to the very good performance in Asia where BYD is an important customer of Forvia.

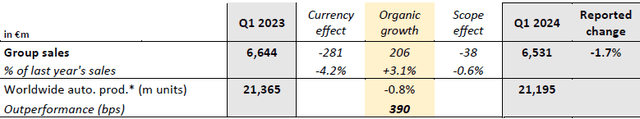

And although the company reported a revenue decline of 1.7% in the first quarter of this year, the image below shows that this is mainly linked to currency changes, with organic revenue growth amounting to around €206 million.

Forvia Investor Relations

Forvia reiterated its forecast for this year. It wants to achieve a total turnover of around 28 billion euros, while its operating margin should jump again at 5.6-6.4% of turnover. The midpoint of 6% would represent an additional 70 basis point increase from the 5.3 operating margin recorded in fiscal 2023. This, combined with another increase in revenue, would increase operating income by 240 million euros to 1.68 billion euros (before amortization of intangible assets of acquisitions). The additional profit would be highly accretive to Forvia’s pre-tax profit performance and could potentially increase net profit attributable to Forvia shareholders by 50%. Another important element is Forvia’s hope to reduce the debt ratio to less than 1.9 times EBITDA by the end of this year.

The company also has confirmed its forecasts for 2025, which was released some time ago. Forvia wants to increase its turnover to 30 billion euros and generate an operating margin of 7% of turnover. An operating margin increase of 6% to 7% in one year would be a great achievement, but it probably also indicates that I may be a little too conservative in using the midpoint of the 2024 forecast as a base case. Or, another explanation could be a delay in reaching the 7% operating margin.

Regardless, if Forvia hits its own targets, its implied operating profit would rise to €2.1 billion, an increase of almost 50% from the 2023 level. And that will likely more than double the net profit attributable to ordinary shareholders of Forvia, and I think that Forvia has a chance of reporting EPS above 2.5 EUR per share in 2025.

Investment thesis

The last few years have been difficult for Forvia and the massive acquisition of Hella increased its debt levels, just as interest rates began to rise. However, we definitely saw a turnaround in 2023, as its operating margin increased significantly, and based on the guidance for 2024 and 2025, the operating margin (and operating profit) will continue to increase. The main risk of this investment thesis would obviously be a slowdown in car sales and demand for Forvia products.

I’ve been relatively positive on Forvia for a while now and so far the stock price hasn’t really met any of my expectations. But as explained above, if the 2025 targets are met, EPS could exceed 2.5 EUR, which makes the current share price of around 15 EUR per share rather attractive.

I currently have no position in Forvia, but I might try to re-enter a long position. I can also write puts on Forvia (in a combination of out-of-the-money and in-the-money puts).

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.