aristotoo

By Christopher Gannatti, CFA and Aneeka Gupta

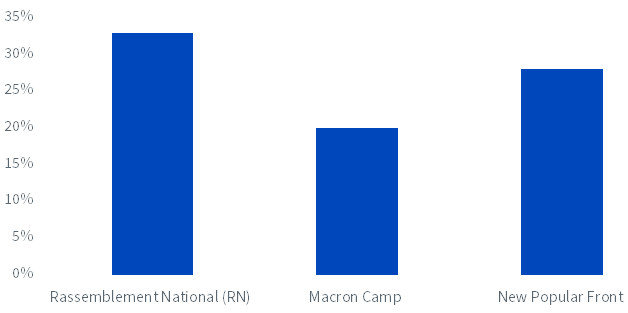

Marine Le Pen’s National Rally (RN) and her allies dominated the first round of voting on Sunday, taking 33.2% of the vote. The New Popular Front, made up of left-wing parties, won 28%, while parties supporting President Macron won 20.8% of the vote. The turnout was high, at 67%.1 Although Macron’s presidency is not formally at stake – and he has said he has no intention of resigning – Sunday’s result indicates that he is likely to either have to share governing responsibilities with Le Pen’s group or manage a parliament that is fundamentally deadlocked.

Figure 1: Share of votes in the first round of the French legislative elections

Source: Le Monde, WisdomTree as of July 1, 2024.

Macron’s camp and the Left Alliance see greater coordination

The Macron camp and the left alliance have announced that they will withdraw their candidates if the candidates of the other camp obtain better results in the first round. The cooperation that is emerging between the Macron camp and the New Popular Front reduces the RN’s chances of winning an absolute majority of seats in Parliament.

In a sign that Macron’s team is seeking alliances with the left, the prime minister decided late Sunday to suspend implementation of an unpopular unemployment insurance reform. The government had said the measures would encourage people to work by reducing the generosity of welfare, but opposition parties have widely criticized the move at a time of rising unemployment.2.

France under pressure over budget deficit

France’s deficit stood at -5.5% of gross domestic product (GDP) in 2023 (exceeding the bloc’s 3% deficit threshold) and is expected to narrow slightly this year to -5.3% and close to 5%.3 The launch by the European Commission (EC) of the Excessive Deficit Procedure (EDP) against Belgium, France, Italy, Hungary and Malta puts debt sustainability back on the radar.4 Despite France’s high investment needs and weak growth, the era of unlimited fiscal stimulus is over.

Both the far-right and left coalitions have quite expansionary fiscal policies in mind. Calling early elections was a risky bet for Macron’s party, but it comes at a time when French debt sustainability is under severe strain. With Macron’s government already grappling with fiscal consolidation, campaign promises from both the far-right and far-left French political parties threaten to blow up an already bloated government budget, drive up French interest rates, and strain France’s relationship with the European Union. Macron is playing to his strengths. We believe the early elections will be a rude awakening for voters to the consequences of capitulating to parties whose campaigns have abandoned any pretense of fiscal discipline.

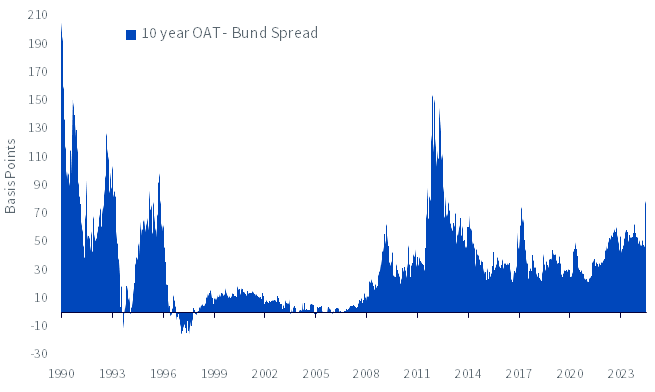

French Elections Cause Huge Market Upheavals

The run-up to the French snap election has already seen a widening of bond yield spreads, with the yield on France’s 10-year Treasury Bonds (OATs) relative to 10-year German Bunds rising by almost 20 basis points to a yearly high.5 The first round results have sparked a positive reaction in the euro, mainly due to the markets’ relief at the RN’s slim chances of winning an absolute majority of seats in Parliament. However, budgetary concerns, as well as uncertainty surrounding the outcome of the second round, remain an unattractive proposition for the euro.

Figure 2: The premium that France pays compared to Germany to issue debt

Source: Bloomberg, WisdomTree from January 2, 1990 to July 1, 2024.

French stocks fell 5.3%6 French:Frenchfollowing the announcement of early elections in France, compared to a 2.1% decline for the broader European EuroStoxx 600 index. However, only 15% of corporate sales are exposed to the domestic market with the French benchmark CAC 40 index. This is a very global market from a revenue perspective. Many international companies are based in France and are not particularly exposed to the domestic environment in terms of revenue. As a result, we have seen specific sectors being hit hard, particularly domestically exposed names in the financials, infrastructure, utilities and defence sectors.

Domestically, banks have been hit hard as they hold a high amount of debt and are likely to suffer from higher borrowing costs. Risk premiums on the French bank have increased due to a proposed windfall tax and capital gains tax on dividends. Infrastructure stocks have also come under pressure as the government may force these companies to lower their retail prices. Utilities have come under pressure due to government intervention to force lower retail prices. Defence stocks have performed well in Europe over the past two years, due to increased spending following Russia’s invasion of Ukraine, but there are concerns that the far-right party is less concerned about foreign intervention and more focused on domestic security. With increased uncertainty around domestically oriented stocks, shifting to profitable and growing European exporters could be a prudent alternative.

The orientation towards eurozone exports, which bring dividends

On July 2, 2012, WisdomTree launched its Europe Hedged Equity Index. The two main ideas behind the methodology are:

- Each constituent must derive more than 50% of his income from out Europe. This means that the focus is on global companies based in Europe. If we view the French election as a more local market shock, it may be that global companies generate stock returns that are highly correlated to those of more locally focused companies, but then over time, fundamentals respond more to global than local conditions. It is possible that more localized shocks create attractive opportunities for truly global companies.

- The returns of the WisdomTree Europe Hedged Equity Index do not take into account currency returns and focus solely on equities. If the US dollar appreciates against the euro, this impact is mitigated. Similarly, if the euro appreciates against the dollar, this impact is also mitigated. It is possible that localized shocks, such as a surprising result in the French elections, could cause the euro to depreciate against the US dollar, which could be mitigated by such a currency hedging strategy.

WisdomTree has a well-known strategy, the WisdomTree Hedged European Equity Fund (HEDJ), designed to track the WisdomTree Europe Hedged Equity Index before fees and expenses. Localized surprises in Europe could create notable entry points into global companies that are located in Europe.

1The World, as of 06/30/24

2Adghirni et al. “Macron and French Left Rivals Rush to Halt Le Pen’s Momentum.” Bloomberg, accessed via Yahoo Finance. July 1, 2024.

3European Commission, 12/31/23

4Euractiv, 19/06/24

5Bloomberg, as of 06/28/24

6Bloomberg, CAC 40 index, 06/10/2024-06/28/2024

Christopher Gannatti, CFA, Global Director of Research

Christopher Gannatti joined WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January 2014, he was promoted to Associate Director of Research, where he was responsible for leading various groups of analysts and strategists within WisdomTree’s broader research team. In February 2018, Christopher was promoted to Head of Research, Europe, where he was based in WisdomTree’s London office and was responsible for all of WisdomTree’s research efforts in the European market, as well as supporting the UCIT platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for many of the investment strategy communications globally, particularly in the thematic equities space. Christopher comes to WisdomTree from Lord Abbett, where he worked for four and a half years as a regional consultant. He received his MBA in Quantitative Finance, Accounting and Economics from New York University’s Stern School of Business in 2010, and his BA in Economics from Colgate University in 2006. Christopher holds the Chartered Financial Analyst designation.

Aneeka Gupta, Director of Macroeconomic Research

Aneeka Gupta is the Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity and Commodity Strategist at the firm. Aneeka has 17 years of experience as a research analyst across a wide range of asset classes. In her current role, she is responsible for conducting analysis for all internal equity, commodity and macro publications and assisting the sales team in answering client product and market queries.

Prior to joining WisdomTree, Aneeka started her career as an Equity Analyst at Bear Stearns International Ltd in London. She also worked as an Equity Trader at Sunrise Brokers on the US and Pan-European exchanges. Prior to that, she worked as a Sales Manager for Equity Derivatives at Mashreq Bank in Dubai.

Aneeka holds a Masters degree in Mathematics from the University of Oxford and a Bachelors degree in Mathematics from the University of Delhi, India. She is also a CFA charterholder.