On-chain data shows that the percentage of Bitcoin miners’ revenue coming from fees has exploded recently. Here’s what’s behind this strong growth.

Bitcoin Runes Caused Sudden Disruption to Miners’ Income

A few days ago, the much awaited fourth halving, a periodic event occurring approximately every four years in which the block rewards miners receive for solving blocks are permanently cut in half, has finally taken place on the Bitcoin network. Although this is a major event for the cryptocurrency, another observed development occurred simultaneously on the network. This was the release of Runes, a new protocol for minting fungible tokens on the network.

The Runes protocol was developed by none other than the creator of the revolutionary Ordinals protocol, Casey Rodarmor. The Ordinals protocol was released in early 2023 and offered a way to “write” data directly onto a satoshi (sat), the smallest unit of Bitcoin.

Thanks to this protocol, various applications have become possible on the network, including non-fungible tokens (NFT). These applications quickly gained popularity among users and became mainstays of the network. With the launch of Runes, there is now a sort of sequel to this legendary protocol.

How are Runes different from the “inscriptions” produced by the Ordinals protocol? As Rodarmor said: »Ordinal theory textbook“, he said, “while each inscription is unique, each unit of a rune is the same. These are interchangeable tokens, suitable for various purposes. Thus, Runes create the opposite of NFTs: fungible tokens.

However, the fungible token feature is not really new to Bitcoin, as the popular BRC-20 token standard already exists. So why all the hype behind Runes? The reason is that the latter is much simpler and more efficient than other standards.

BRC-20 tokens use a roundabout way to list fungible tokens, leveraging the Ordinals protocol and operating on an account-based system similar to Ethereum. Their complexity means they require 3 transactions for a transfer to be completed.

Runes, on the other hand, use a UTXO (Unspent Transaction Output) system (similar to how Bitcoin itself works) and are entirely present on-chain. This means they are easily accessible in block explorers. Additionally, unlike BRC-20 tokens, they only require a single transaction.

Since their inception, Ordinals-related applications have made waves on the network and during peak periods, they have even caused temporary but drastic effects on the cryptocurrency economy in terms of one particular measure: the transaction fees.

These applications naturally influence traffic on the blockchain and when demand is high, this traffic can even exceed all other uses of cryptocurrency.

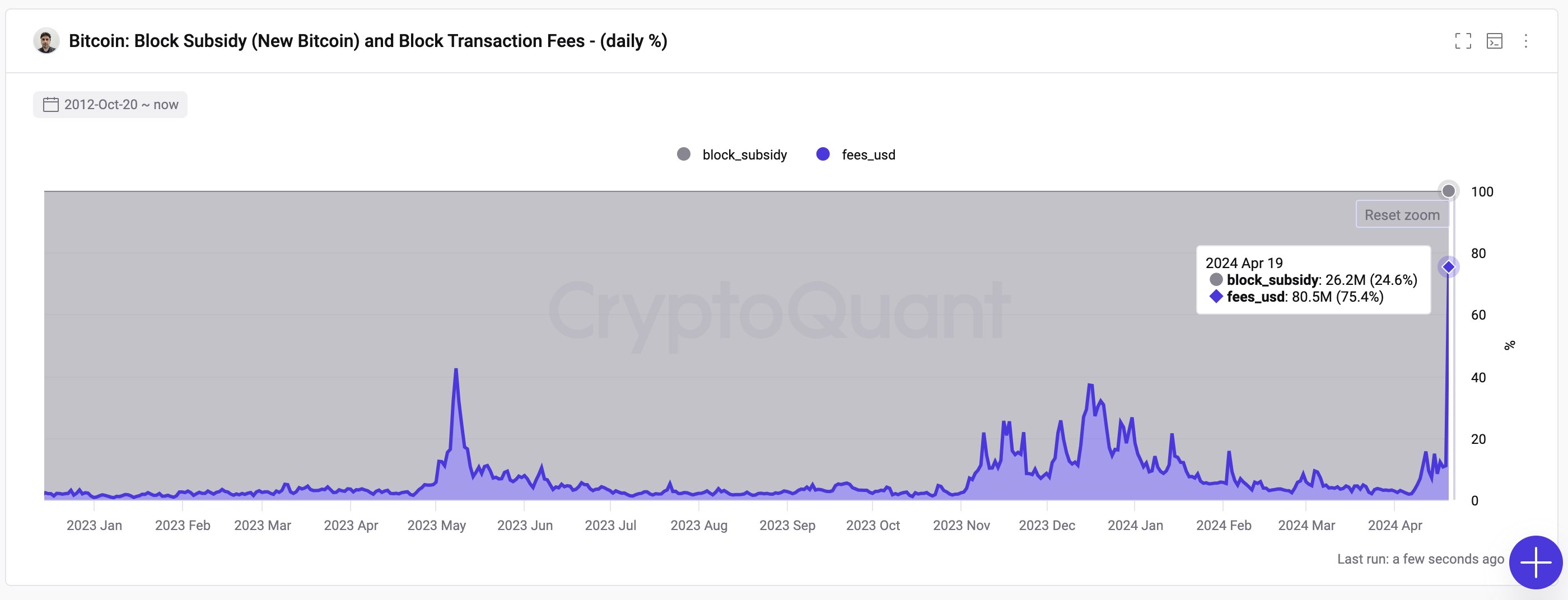

Runes appears to have followed suit, as transaction fees on the network have also increased since their introduction. As Julio Moreno, head of research at CryptoQuant, pointed out yesterday in an jobminer revenue from transfer fees increased by up to 75% alongside the launch of Runes.

The value of the metric seems to have been quite high in recent days | Source: @jjcmoreno on X

From the chart, it is visible that miners made a record total revenue of $107 million that day, of which $80.5 million came from transaction fees alone.

Historically, fees have been much less relevant to miner revenue than block rewards, but recent applications on the network have caused at least temporary fluctuations where fees have reached notable levels.

With the latest halving, block rewards have been significantly reduced again, meaning that the main source of income for these miners has been reduced.

As halvings continue in the future and these rewards decline even further, miners are expected to become increasingly dependent on transaction fees to survive.

Ordinals and Runes may provide a glimpse of a future where such applications dominate the Bitcoin network and inflate fees enough for it to serve as the primary source of income for miners.

BTC Price

Bitcoin had fallen below the $60,000 level before the halving, but since that low, the price has rebounded towards $65,900.

Looks like the price of the asset has been heading up recently | Source: BTCUSD on TradingView

Featured image by Brian Wangenheim on Unsplash.com, CryptoQuant.com, chart from TradingView.com