On-chain data shows that Ethereum transaction fees are now at their lowest level since October 2023. Here’s what this could mean for the cryptocurrency.

Ethereum transfer fees recently dropped to a low of $1.12

According to data from the on-chain analytics company FeelingTHE average price on the Ethereum network has recently fallen to low levels. Here, fees naturally refer to the amount each sender must attach to their transactions as compensation for the blockchain to process their transfer.

The fees an investor may need to charge to make the transfer happen quickly depend on network conditions at the time. During busy periods, there may be high competition to complete transactions quickly, so users in a hurry may have to pay sufficiently high fees to avoid this traffic.

As a result, average fees tend to be high while these congestion periods last. Likewise, in periods of low activity, users can get by by paying only a small amount. Because of this relationship, average fees can provide insight into the current demand among users for using the Ethereum network.

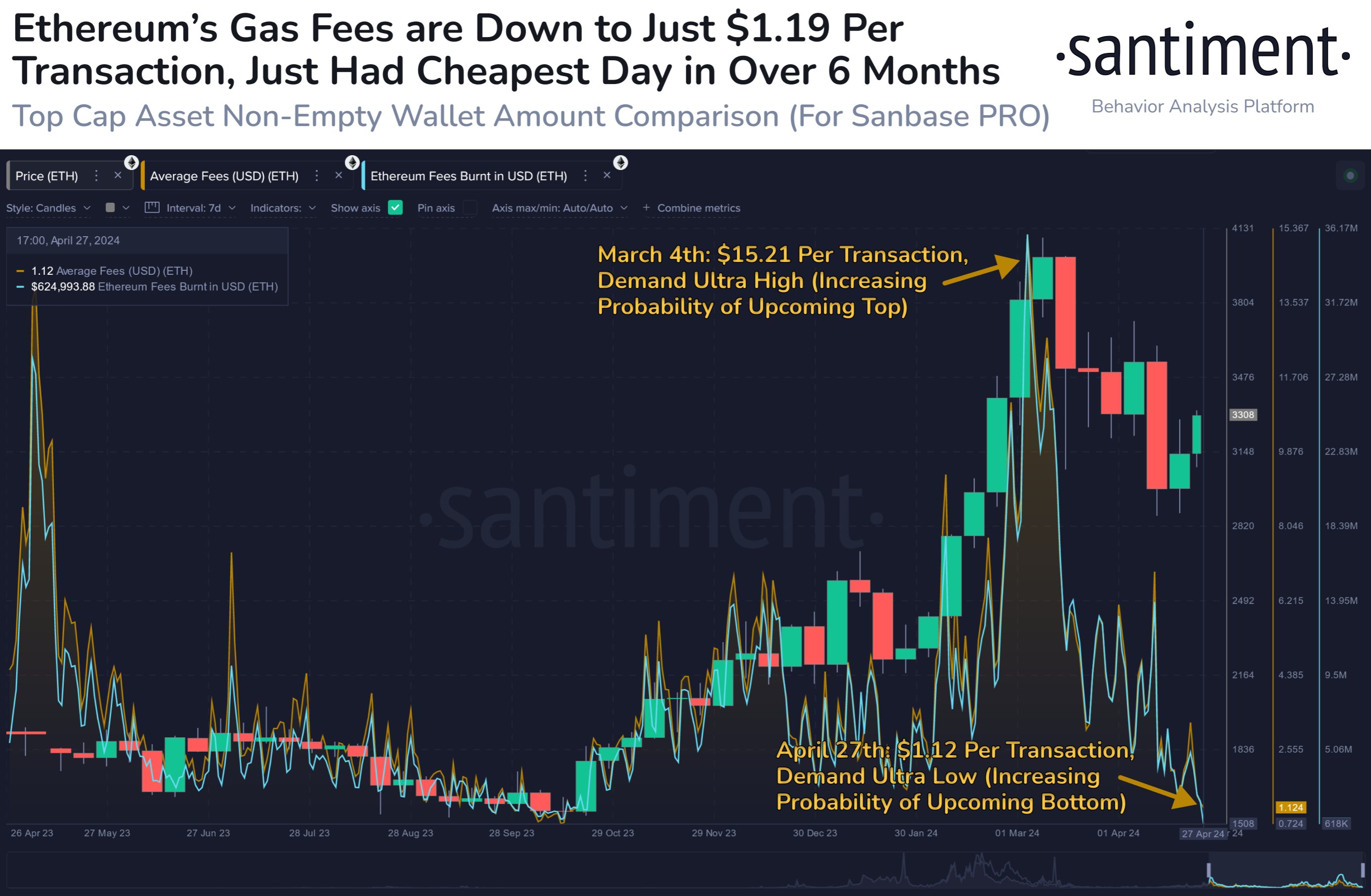

The chart below shows the evolution of average fees on the Ethereum blockchain over the past year:

The value of the metric seems to have been going down in recent days | Source: Santiment on X

As the chart shows, Ethereum’s average fees have seen an increase alongside the rally this year and reached a high of $15.21 last month. Interestingly, this spike in fees occurred near the peak of the price of the asset itself.

“Traders historically move between sentimental cycles of feeling crypto is going ‘to the moon’ or feeling ‘it’s dead,’ which can be observed through transaction fees,” notes the analytics firm .

Historically, the market has tended to move against the expectations of the majority, which is why periods of high fees, where FOMO comes into play, tend to lead to peaks in prices. As such, the trend observed last month would be consistent with what has been observed in the past.

From the chart, it is visible that Ethereum fees observed a decline alongside the price after this peak. Recently, the metric has continued this cooldown, now falling to a low of just $1.12.

This is the cheapest network since October last year. Just as high fees can lead to highs, low demand can lead to down for cryptocurrency.

“While markets have mostly pulled back over the past 6 weeks, the lack of demand and strain on the network could help turn around ETH and related altcoins sooner than many think,” says Santiment.

ETH Price

Ethereum had recovered as high as $3,350 yesterday, but the asset appears to have already retraced that rise, as it has now fallen to just $3,170.

Looks like the price of the coin has gone through a rollercoaster over the past couple of days | Source: ETHUSD on TradingView

Featured image of Kanchanara on Unsplash.com, Santiment.net, chart from TradingView.com