On-chain data shows that Ethereum exchange net flows have been very positive recently, a sign that selling could be taking place in the market.

Ethereum Exchange Net Flows Spiked Recently

In a new job On X, Julio Moreno, Head of Research at CryptoQuant, discussed the latest Ethereum exchange net flow trend. THE “net exchange flow” here refers to an on-chain metric that keeps track of the net amount of ETH entering or leaving the wallets of all centralized exchanges.

When the value of this metric is positive, it means that these platforms are currently receiving a net number of coins. Since one of the main reasons holders may deposit coins on exchanges is for selling purposes, this trend can potentially have bearish consequences on the price of the asset.

On the other hand, the negative reading of the indicator implies that wallets associated with exchanges are currently observing net withdrawals. Investors could withdraw their coins from the custody of these central entities to hold them for the long term, so such a trend could prove bullish for the cryptocurrency.

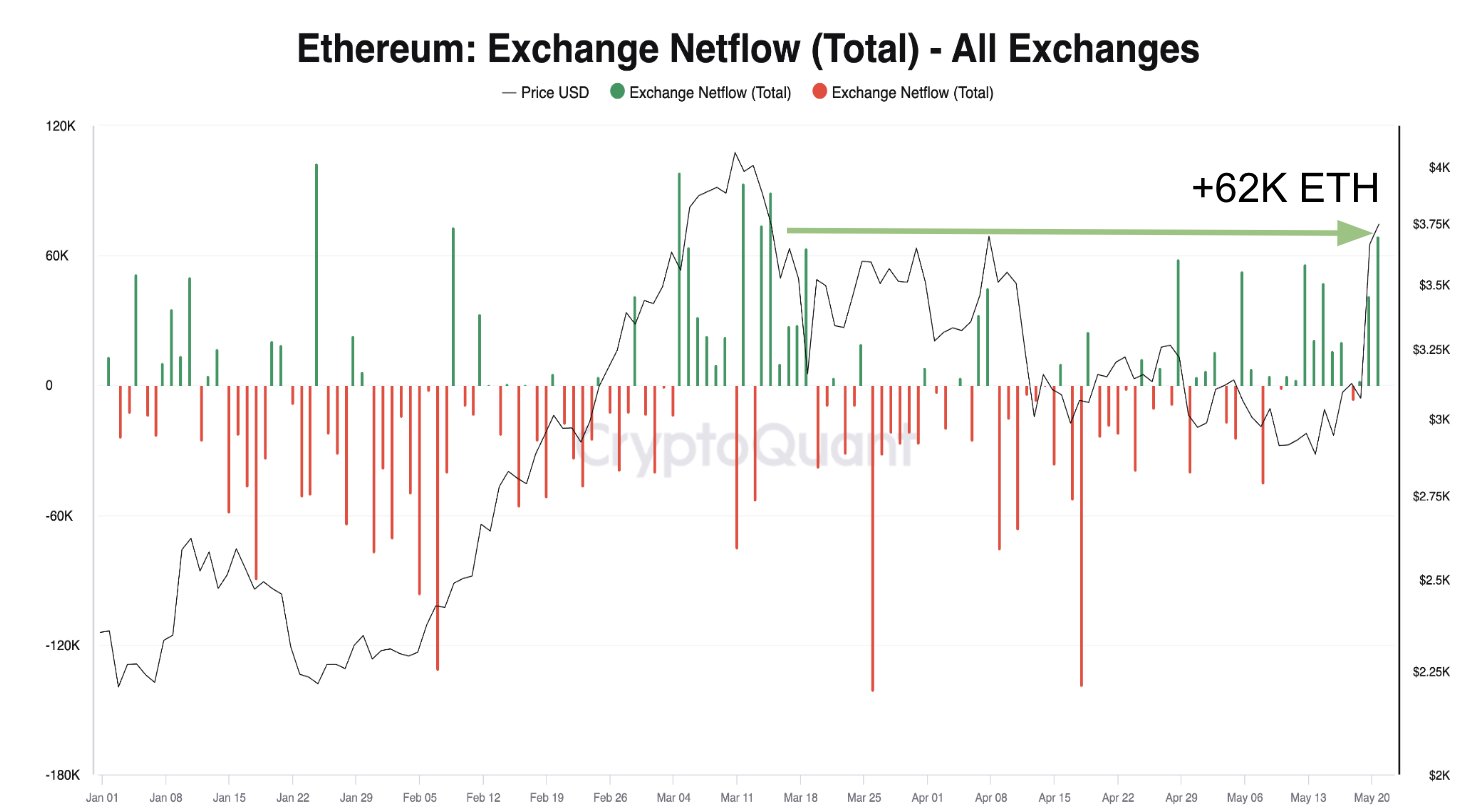

Now here is a chart that shows the Ethereum exchange net flow trend over the past few months:

The value of the metric appears to have been quite high in recent days | Source: @jjcmoreno on X

The chart above shows that the Ethereum exchange’s net flow has seen significant positive spikes recently. These net deposits were of a magnitude seen only in March. According to Moreno, these deposits were mainly directed to Binance and Bybit.

As mentioned previously, net FX inflows can indicate that sales are taking place in the market, although this does not necessarily have to be the case. Sometimes large deposits use one of the other services offered by these platforms, such as derivatives contracts.

Regardless, volatility tends to increase following large deposits. The chart shows that the peak of the March rally saw the indicator take high values as investors participated in profit taking.

Recently, Ethereum has seen a strong rise, fueled by positive news regarding the spot exchange-traded funds (ETFs). Given this rebound, it is possible that profit-taking is once again the objective behind the positive net flows.

However, so far ETH has managed to avoid this potential sell-off as its price has remained relatively high. However, it is uncertain how long demand can continue to absorb potential selling pressure if deposits continue to flow into these platforms in the coming days.

ETH Price

Ethereum started to rise over the past day as its price crossed the $3,950 mark. The rise only lasted briefly, however, as the asset fell back below the $3,800 level.

Looks like the price of the asset has observed a surge over the last few days | Source: ETHUSD on TradingView

Featured image of Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com