recession, stock market decline and housing market decline. From December 19 (Newport Beach Independent):

- Economic slowdown: The United States is likely to enter a recession as consumers expect to exhaust their savings, leading to a single quarter of potentially positive GDP in 2024.

- Downsizing and Unemployment: Anticipated corporate downsizing could push unemployment rates higher, although they are expected to remain below 5%.

- Federal Reserve Policy: The Fed could raise interest rates by another 25 basis points, but it will likely begin cutting them in mid-to-late 2024, with reductions no more than 75 basis points, unless before a global crisis occurs.

- Stock Market and Bond Market: The stock market is expected to experience a 15% sell-off over the next six months, followed by a moderate recovery as rate cuts begin. The bond market, after three consecutive years of decline, is expected to experience positive growth in 2024.

- Housing market: Housing prices could fall by as much as 10%, but limited inventory should provide some resilience.

- Commercial Real Estate: CRE values are expected to continue to decline, with multifamily properties potentially underperforming after a decade of strong performance.

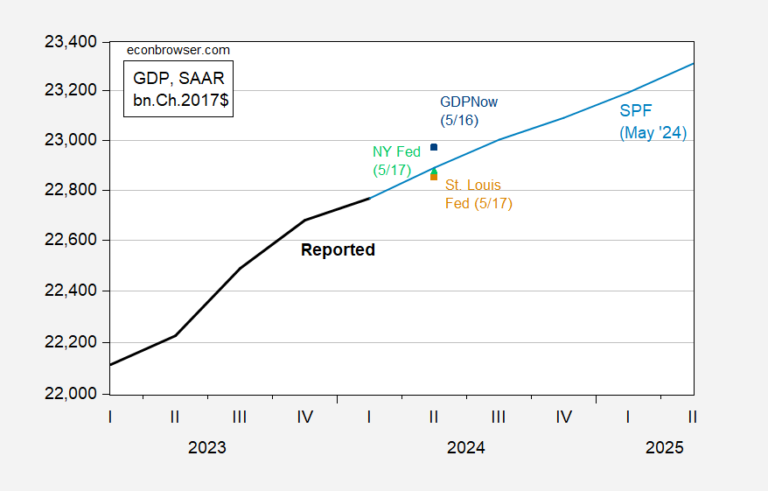

As I noted yesterday, the median survey of professional forecasters predicts no quarters of negative growth, and nowcasts call for positive growth in the second quarter.

Figure 1: GDP (bold black), May SPF median (light blue), GDPNow 5/16 (blue square), New York Fed nowcast 5/17 (green triangle), St. Fed nowcast Louis from 05/17 (beige square), all in billions of Ch.2017$, SAAR. Source: Avance BEA 2024T1, Philadelphia FedAtlanta Fed, New York Fed, St. Louis Fed via FRED and author’s calculations.

It therefore seems unlikely that the first prediction will come true correctly.

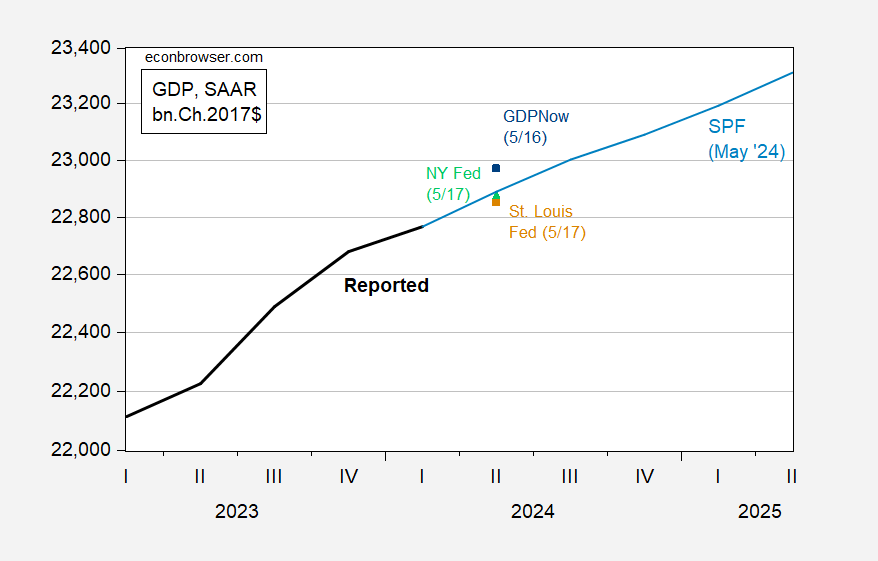

Regarding unemployment, the SPF forecasts an increase in unemployment, but far less than 5%.

Figure 2: Unemployment rate (bold black) and median SPF forecast for May (light blue), both in %. Source: BLS, Philadelphia Fed.

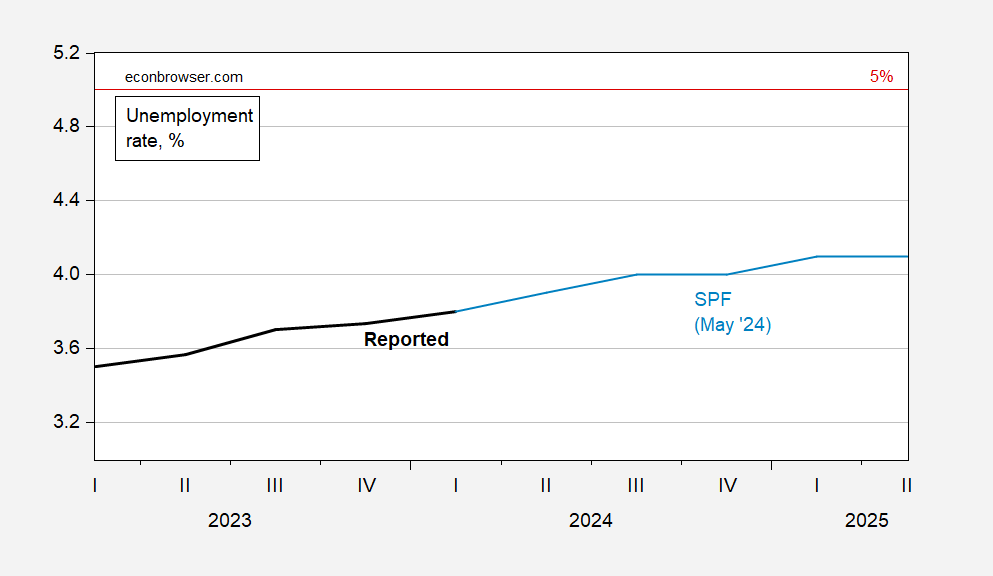

What about the 15% sale? We do not know exactly what this 15% corresponds to; I assume this is the December 2023 level. Here is the S&P500 plot and what the S&P500 needs to be in June to match Hovde’s prediction.

Figure 3: S&P500 (bold black) and Hovde prediction (red square). The May observation runs until May 16. Source: FRED, and author’s calculations.

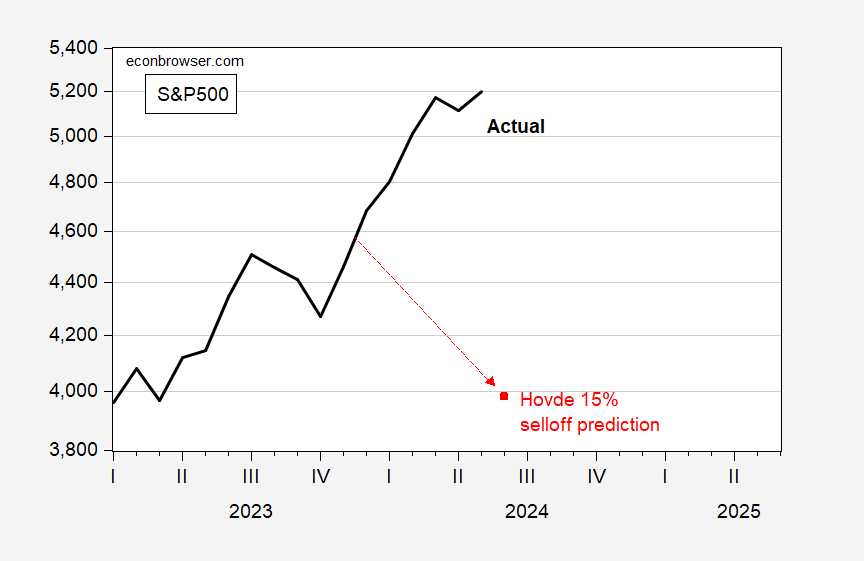

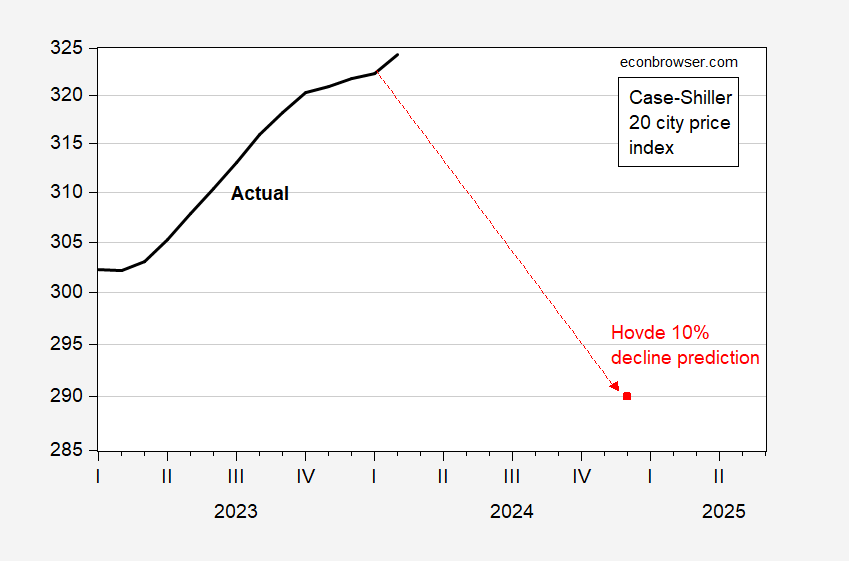

Finally, what about the real estate market? The 10% price drop is for 2024, so I assume the 10% drop is below the December level.

Figure 4: S&P Case Shiller 20 City Housing Price Index, sa (bold black) and Hovde prediction (red square). Source: FRED and author’s calculations.