Travel Ink/DigitalVision via Getty Images

Ever since I discovered the midstream/pipeline sector, I have been drawn to this sector. Companies in this sector tend to offer many benefits. Even though they are generally very indebted on their account, books, they generate huge amounts of money. They grow steadily and are financially predictable. They also pay out a lot of that cash, while trading at rather cheap multiples. While not my favorite in this area, one player that certainly deserves attention is Enterprise Product Partners (NYSE:EPD).

For those unfamiliar, Enterprise Products Partners is a giant in the energy transportation and storage market. The company has more than 50,000 miles of pipeline and is responsible for transporting NGLs, crude oil, natural gas, petrochemicals and a wide range of refined products. It contains more than 300 million barrels of liquid storage capacity, 20 deepwater docks, 42 natural gas processing drains, 26 fractionators and countless additional assets. Although the company focuses largely on areas around the Gulf of Mexico, with most of its assets spread between Texas and Louisiana, it has a network that spans several other states, including up ‘At New York.

The last article that I wrote about the company was published in February of this year. In this article, I warned investors not to “let this cash cow slip away.” The company was yielding 7.73% and trading at attractive levels. This led me to reiterate the “buy” rating I had on the stock at the time. And since then, everything has been going pretty well. The shares generated an 11.1% gain for investors. This dwarfs the 3.9% increase seen by the S&P 500 over the same period. You would think that, given this rise, the shares might finally be worth their fair share. But I would say that there is still room for further upside.

Another solid opportunity

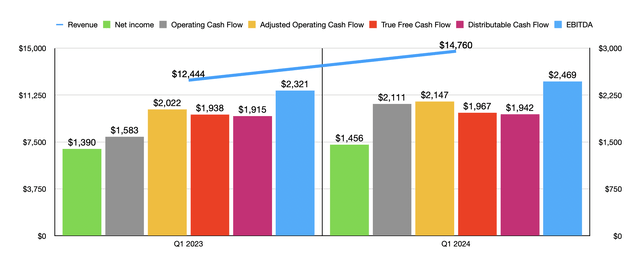

Since my last article on Enterprise Products Partners earlier this year, only a little additional data has been released about the company. This data covers the first quarter of fiscal year 2024. While not entirely irrelevant, I have long argued that revenue and net profit are not very important for these types of companies. Rather, it is the cash flow that counts. But for the sake of completeness, it would not be amiss to briefly discuss these two measures.

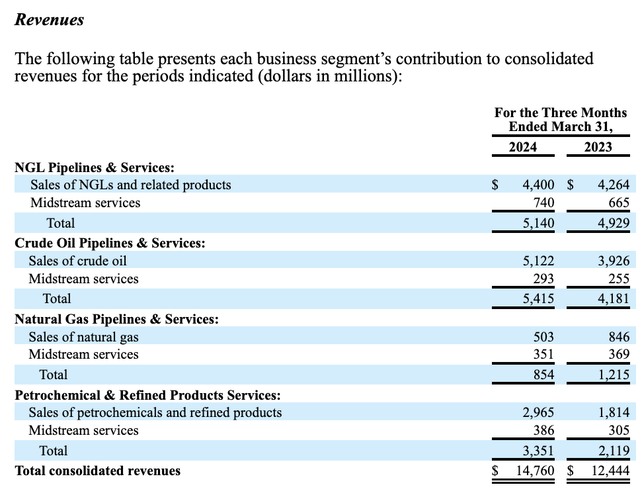

During the first quarter of 2024, the company’s revenue amounted to $14.76 billion. This represents an increase of 18.6% from the $12.44 billion generated a year earlier. Three of the company’s four segments contributed to this increase. The only exception was the Gas Pipelines and Services sector, whose revenues fell from $1.22 billion to just $854 million. This decline is largely explained by a drop in natural gas sales. This is despite the fact that the volume of natural gas transported increased from 18,023 Bbtus per day to 18,615 BBtus per day thanks to a larger network and higher demand for natural gas. However, lower average selling prices for this product decreased revenue by $343 million.

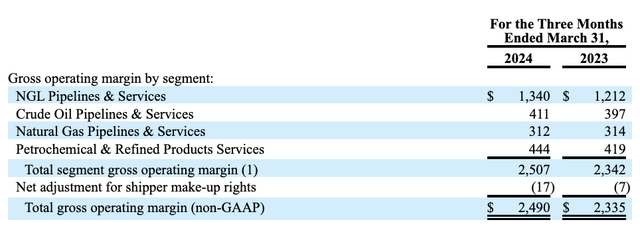

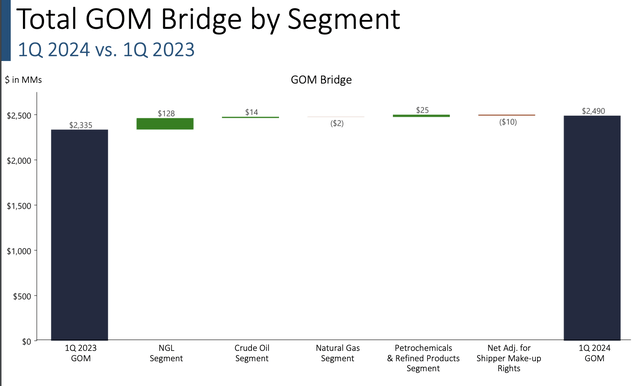

As you can see in the image above, the company’s other three operating segments saw fairly substantial year-over-year revenue increases. This can actually be attributed to higher sales volumes which more than offset a slight decline in average selling prices. Collectively, revenues from intermediary services have also increased. The increase in sales led to an increase in the company’s gross operating margin from $2.34 billion to $2.49 billion. Most of this improvement came from the company’s NGL Pipelines & Services segment, with an increase from $1.21 billion to $1.34 billion. This is largely attributable to higher average sales margins, higher average processing margins, increased paid natural gas processing volumes, increased export volumes, increased transportation costs associated with certain pipelines such as its Eastern ethane pipelines, additional storage revenues and increased fractionation. volumes which resulted in increased sales of ancillary services.

Enterprise Product Partners Enterprise Product Partners

These increases helped net profits increase from $1.39 billion to $1.46 billion. But more importantly, other profitability indicators also increased. Operating cash flow, for example, increased from $1.58 billion to $2.11 billion. If we take into account changes in working capital, we get a more modest increase, from $2.02 billion to $2.15 billion. When I look at this space, I also like to look at what I call “true free cash flow.” This essentially takes the adjusted operating cash flow and removes maintenance capital expenditures from it. This avoids punishing the company from a valuation perspective for its growth-oriented initiatives. True free cash flow fell from $1.94 billion in the first quarter of 2023 to $1.97 billion in the same period this year. DCF, or distributable cash flow, increased from $1.92 billion to $1.94 billion. And finally, the company’s EBITDA increased from $2.32 billion to $2.47 billion.

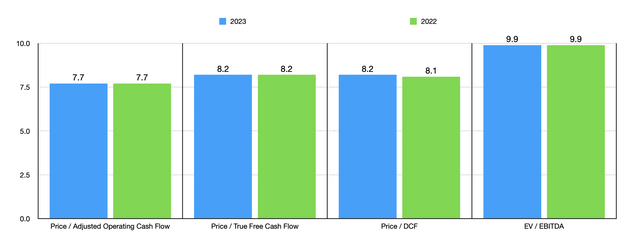

Valuing a company like Enterprise Products Partners is not that difficult. Taking a few of these measurements, I then created the chart above. We see that, from 2022 to 2023, the company’s prices have remained almost identical. I then compared the company to five similar companies, as shown in the table below. I did this using two of the four metrics. The first, price to adjusted operating cash flow multiple, found that three of the five companies were cheaper than Enterprise Products Partners. But when we use the EV/EBITDA approach, that number drops to just one in five.

| Business | Price/Operating Cash Flow | EV / EBITDA |

| Enterprise Product Partners | 7.7 | 9.9 |

| TC Energy (TRP) | 7.4 | 13.5 |

| Kinder MorganKMI) | 6.7 | 11.6 |

| The Williams Companies (WMB) | 8.6 | 10.4 |

| Enbridge (IN B) | 7.9 | 12.8 |

| Energy transfer (AND) | 5.2 | 8.7 |

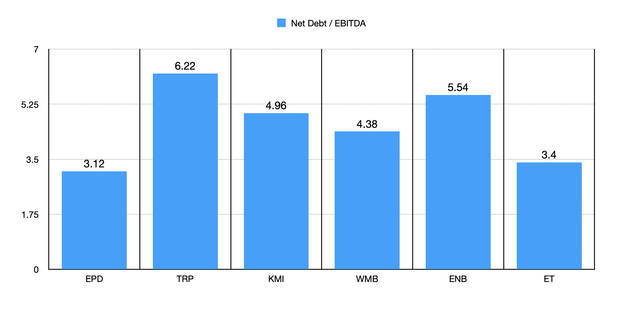

Part of this pricing disparity can be attributed to the low leverage available to Enterprise Products Partners. As you can see in the chart below, our candidate has a net leverage ratio of 3.12. This is actually the lowest of the six companies we study throughout this article. The next closest is my favorite, Energy Transfer, which has a net leverage ratio of 3.40. All other players have values between 4.38 and 6.22. I would argue that such a disparity probably warrants a premium for companies like Enterprise Products Partners and Energy Transfer because it means risk is reduced.

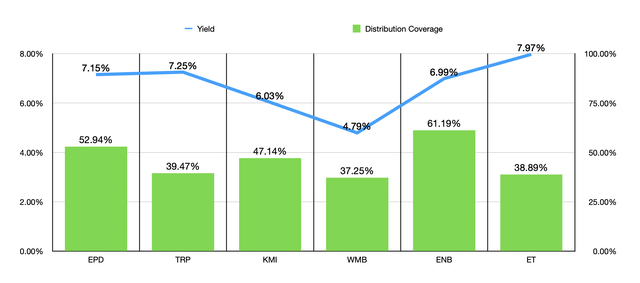

There are a few other important metrics we can use to assess the quality of these companies. The two I have in mind can be seen in the table below. The first concerns the yield, that is to say the amount that investors receive each year in distribution by purchasing the shares of said companies at current prices. This does not imply any change in distribution policy. Three of the five companies have a lower yield than Enterprise Products Partners’ 7.15%, with the other two having higher yields.

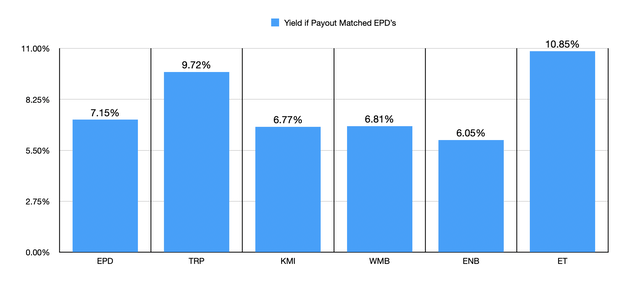

The other metric is the payout ratio, which looks at how much of adjusted operating cash flow is paid out for common distributions. At 52.94%, Enterprise Products Partners is near the high end of the spectrum, with only one of the five companies I compared it to above it. This means other companies could increase their payments if they wanted. However, as the following chart shows, even if the companies could all pay out the same percentage of their cash flow without seeing a change in their stock prices in response to this change, only two of the five companies would manage to achieve returns. higher. than what Enterprise Products Partners offers. These would be TC Energy at 9.72% and Energy Transfer at 10.85%.

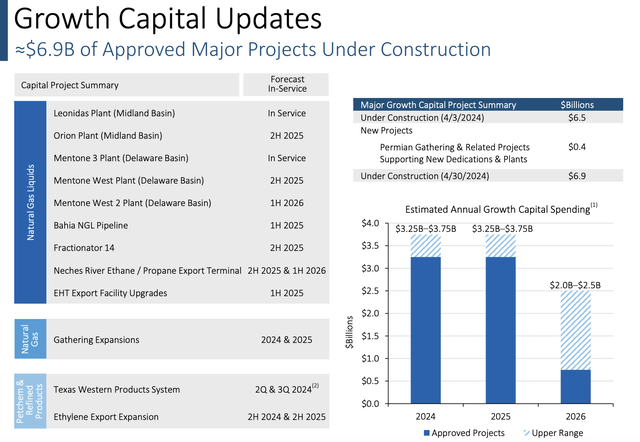

Beyond the valuation and health of companies, it is also useful to look at the long-term situation. Currently, Enterprise Products Partners’ management team has made it clear that they have major projects approved worth $6.9 billion and currently under construction. As much as $3.75 billion could be spent on these growth initiatives this year alone. Up to $3.75 billion more is planned for next year, followed by $2.5 billion in 2026. In the long term, these initiatives should help the company grow even further. This can only be a good thing, provided that leverage does not change much from its current level. The good news is that, given the cash flow the company generates, this shouldn’t be a problem.

Take away

In my opinion, Enterprise Products Partners is a really solid company with a great future. For someone looking for a high-yielding cash cow with long-term stability, this is definitely an opportunity to keep in mind. He’s not the cheapest player in the business, and he probably shouldn’t be the cheapest either. Leverage is low and growth initiatives are expected to increase long-term profitability. But for those who are simply looking for a quality company that should do well, a “buy” rating should make a lot of sense.